For us the Net National Savings Rate is the best alternative indictator to GDP growth. It is positively correlated with the change in wealth, with the establishment of future productive capacity, the price of government bonds and currency valuations. But today GDP growth is often negatively correlated to the Net Savings Rate. Hence GDP is often a less useful measure.

Read More »

Tag Archive: GDP growth

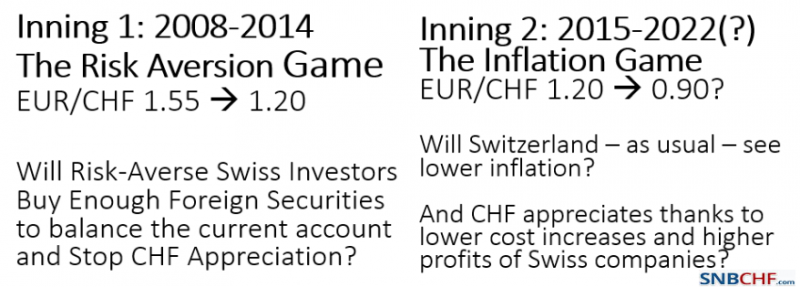

The two phases of CHF appreciation… and what is in between

We show the two phases or "two innings" of Swiss franc appreciation: The risk aversion phase and the high inflation phase.

With the weakening of emerging markets and the strengthening of the United States in 2013/2014, the Swiss National Bank (SNB) had won the first battle in the war against financial market, the "risk aversion game", the first inning in two-part match. Risk aversion is lower because the United States recovered with weaker oil...

Read More »

Read More »

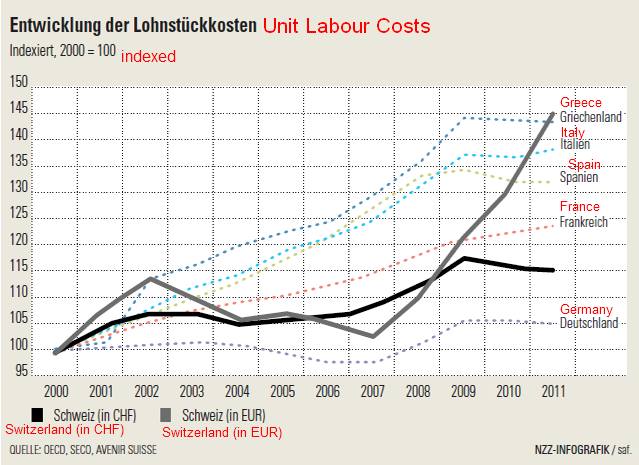

(5.3) FX Theory: Penn Effect and Balassa Samuelson Effect

George Dorgan extends the previous discussion on trade surplus countries. Now he explains the Penn and the Balassa-Samuelson Effect. He applies these principles to Germany, to Greece and to Switzerland.

Read More »

Read More »

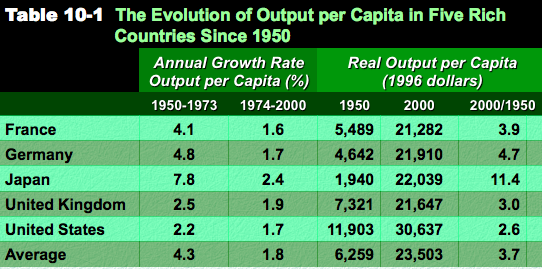

Financial Cycles History: 1945-1966: Bretton Woods, strong growth in Europe

The Bretton Woods time from 1945 to 1966 was a period of strong growth, especially in country like Germany, France, Italy and Japan.

Read More »

Read More »

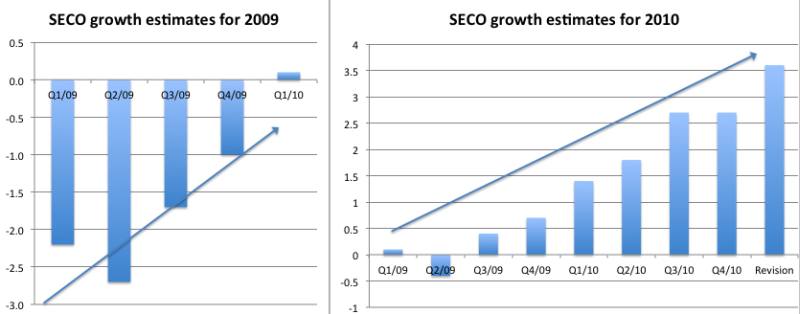

History of Wrong Forecasts by Swiss and Fed Economists: Update September 2013

Or how to talk down and how to talk up an economy with wrong forecasts American and Swiss mentalities are very different, the Americans have the tendency not to care about the future a lot, the Swiss, however, do things only after careful consideration of potential risks. This tendency can be proven economically with … Continue reading...

Read More »

Read More »

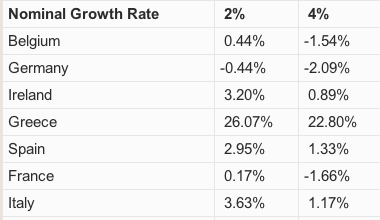

Which Primary Surpluses are needed for EU Members?

Primary surplus is the difference between government revenues and expenditures excl interest. Debt is reduced if rel. primary surplus is higher than debt multiplied by interest minus GDP growth.

Read More »

Read More »