Tag Archive: Featured

EL MITO DE NO PODER AHORRAR EN ESPAÑA

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

Who Should Voters Trust on the Economy?

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

KI-Wettlauf: Wer erschafft den digitalen Supermensch?

▬ Kontakt ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

Vereinbare jetzt Dein kostenloses Beratungsgespräch??:

► https://go.investorenausbildung.de/3n29OKX

kostenloses Webinar ansehen???:

► https://go.investorenausbildung.de/3zRHbI0

Aktienanalyse auf Knopfdruck?:

► https://go.investorenausbildung.de/3zVtfwv

kostenloses Buch sichern?:

► https://go.investorenausbildung.de/3xJn7ow

▬ Über Mich ▬▬▬▬▬▬▬▬▬▬▬▬

Florian Günther ist der Kopf hinter Investorenausbildung.de. Er ist...

Read More »

Read More »

Sellers in the GBPUSD push to modest support and remains below the 100 day MA

The 100-day MA remains a key resistance target. Stay below is more bearish TODAY and going forward.

Read More »

Read More »

Die 3 besten Gold-Aktien!

► „Finfluencer des Jahres“ – bitte hier für mich voten! → http://www.zertifikateawards.de/umfrage?ref=erichsenlars

► Sichere Dir jetzt meinen Report „Warum steigt der DAX?“ – 100% gratis → https://www.lars-erichsen.de

► Hier kannst Du meinen Kanal abonnieren → https://www.youtube.com/erichsengeld?sub_confirmation=1

Heute halten wir es mal ganz einfach: Ich zeige Euch die aus meiner Sicht 3 interessantesten Gold-Aktien für all diejenigen, die...

Read More »

Read More »

Breaking: Bill Gates in Panik wegen Trump!

Bill Gates spendet heimlich 50 Millionen Dollar für Kamala Harris! Wovor hat er Angst?

Meine Depot-Empfehlung: https://link.aktienmitkopf.de/Depot *

Auf der Freedom 24-Plattform findest Du:

- Langfristige Sparpläne mit Zinssätzen bis zu 8,76 %!

- Rendite von 3,86 % in Euro und 5,31 % in Dollar bei täglicher Gutschrift der Zinsen!

- Bis zu 1.000.000 Aktien, ETFs, Aktienoptionen und andere Finanzinstrumente!

- Depot kostenlos eröffnen:...

Read More »

Read More »

Washington! We Have (a $35 Trillion) Problem!

Washington D.C. has a problem!

A $35.7 trillion problem.

And yet most people don't seem concerned about excessive government spending, massive budget deficits, and the growing national debt.

In this episode of the Money Metals' Midweek Memo, host Mike Maharrey explains why people should be concerned. He digs deep into the numbers and points out some signs that the ramifications of the government's borrow-and-spend addiction and the...

Read More »

Read More »

Krankenkasse wird für viele teurer. Was jetzt? | Geld ganz einfach

Krankenkassenvergleich 2024: Die besten Krankenkassen

HKK* ► https://www.finanztip.de/link/hkk-gkv-yt/yt_lMH1A6BWVhs

TK

Audi BKK* ► https://www.finanztip.de/link/audibkk-gkv-yt/yt_lMH1A6BWVhs

HEK

Energie-BKK* ► https://www.finanztip.de/link/energiebkk-gkv-yt/yt_lMH1A6BWVhs

Big direkt gesund* ► https://www.finanztip.de/link/bigdirekt-gkv-yt/yt_lMH1A6BWVhs

(Stand: 18.01.24)

? Jetzt Finanztip Unterstützer werden:...

Read More »

Read More »

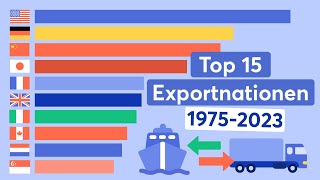

Top 15 Exportnationen 1975-2023

Die Top 15 Exportnationen nach Waren- & Dienstleistungsexporten

Kostenloses Depot eröffnen: ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=811&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *?

Vermögen tracken mit Finanzfluss Copilot: ►► https://www.finanzfluss.de/copilot/ ?

ℹ️ Weitere Infos zum Video:

Was sind eigentlich die größten Exportnationen der Welt? Wir haben...

Read More »

Read More »

Wie du dir ohne Kapital mit strategischen Beteiligungen ein Vermögen aufbaust! (Work for Equity)

? https://dealmakingtraining.de/geb-webinar-yt5 - Jetzt kostenlos zum Webinar am 24.10.2024 anmelden!

? Lerne, wie du dir mit strategischen Beteiligungen ein Vermögen aufbaust - auch ohne Eigenkapital!

In diesem Video zeigt dir Gerald Hörhan, wie du ohne eigenes Kapital an Unternehmensbeteiligungen oder Immobilienanteile kommen kannst – durch das sogenannte Work for Equity.

Er erklärt, wie du durch deine Arbeitsleistung oder spezifische...

Read More »

Read More »

Trusting Trump?

On October 17, 2024, Jonathan Newman appeared on Wake-Up Call with Bill Lundun to discuss Austrian economics, Donald Trump, and mainstream economists.The original episode is available at News Radio 1120 KPNW.Bill Lundun (BL): News Radio 1120 KPNW, thanks for being with us this morning. We have like two different things that we keep hearing when it comes to this particular election period. And it is that Americans overall trust Trump more on the...

Read More »

Read More »

AUDUSD reaches the 200 day key target and finds willing buyers. What next?

The 200-day moving average holds support, but the 50% midpoint is holding resistance as a battle begins

Read More »

Read More »

How to Use Taxes and Debt to Build Wealth – Robert Kiyosaki

In this episode of Rich Dad Radio Show, hosts Robert Kiyosaki and Kim Kiyosaki are joined by financial experts Tom Wheelwright and Jason Hartman to discuss the critical importance of tax strategies and smart investments in today’s unpredictable financial environment. If you’re serious about protecting and growing your wealth, this episode delivers actionable insights into leveraging tax incentives and making strategic investment decisions that...

Read More »

Read More »

KAMALA HARRIS TERMINA DE HUNDIRSE EN UNA ENTREVISTA CON FOX NEWS

Kamala Harris termina de hundirse en su entrevista con Fox News. Un desastre total.

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

#KamalaHarris...

Read More »

Read More »

Bank of Canada rate decision ahead. What technical levels are in play for the USDCAD?

The USDCAD is trading near a swing high resistance target just ahead of the BOC rate decision. Will it be a sell the fact and correct modestly lower or will the buyers (sellers of the CAD) continue the move higher toward August highs?

Read More »

Read More »

US Dollar rallies on Wednesday with US yields surging higher

The US Dollar rolls through markets and strengthens against most major G20 currencies.

US equities are falling further while markets calibrate the new normal for the Fed interest-rate outlook.

The US Dollar index adds even more gains to its October rally and trades in a crucial technical area.

The US Dollar (USD) speeds up its rally this Wednesday just ahead of the US Opening Bell, fueled by uncertainty ahead of the US presidential election and...

Read More »

Read More »

10-23-24 Technical Analysis Techniques

As promised, a show about that voodoo that we do!

(Actually, it's not voodoo, and Lance Roberts will explain why and how).

Markets sold off on Tuesday to break even. following six straight weeks of gains; still, markets have no fear of recession. Lance shares his personal strategy for Bonds (using his own money, not clients') When everyone is hating on Bonds is the time to buy. After the Election, the focus will return to Yields and Interest...

Read More »

Read More »