Tag Archive: Featured

Thanks to Our Fall Campaign Donors

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Warum dein Erbe in Gefahr ist – Denkfehler

Welche Fehler im Bezug auf Börse und Investments führen zu Verlusten? In diesem ersten Video einer Videoreihe zeige ich dir die ersten Fehler auf, welche einfach zu vermeiden sind.

Erlebe Jens Rabe LIVE auf der Bühne zum Börsen-Strategie-Tag:

https://www.jensrabe.de/BST24

Vereinbare jetzt dein kostenfreies Beratungsgespräch:

https://jensrabe.de/Q3Termin24

Tägliche Updates ab sofort auf:

https://aktienkannjeder.de

Schau auf meinem...

Read More »

Read More »

Das kostet Dich eine Dusche #shorts

Wie viel Geld gibst Du eigentlich fürs Duschen aus? Xenia rechnet Dir hier in einem Beispiel vor, wie viel Du pro Dusche zahlst.

#Finanztip

Read More »

Read More »

Fidschi (Fiji) – Touristenziel oder dritte Welt in der Südsee?

✘ Werbung:

Mein Buch Katastrophenzyklen ► https://amazon.de/dp/B0C2SG8JGH/

Kunden werben Tesla-Kunden ► http://ts.la/theresia5687

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

-

Fiji ist ein kleiner Inselstaat mit 1 Mio. Einwohnern in der #Südsee, der erst 1970 selbstständig wurde und von den Briten löste. Wir haben dort 2024 Urlaub gemacht und ich zeige hier #Urlaubsbilder und -videos.

Der Inselarchipel ist ein touristisches...

Read More »

Read More »

YOLANDA DÍAZ HACE EL RIDÍCULO EXPLICANDO LA COMPETENCIA MOTOS vs. BRONCANO

Pablo Motos bate récords con 'El Hormiguero' pese a la competencia de Broncano. Por suerte, Yolanda Díaz nos ofrece su profundo análisis sobre este fenómeno.

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon -...

Read More »

Read More »

Covid Czar Scandal Is Reminder of Boundless Idiocy and Hypocrisy of the Covid Regime

Remember when government officials sanctioned orgies but insisted it was too risky to permit children to attend classes to learn how to read?During the pandemic, New York City Covid Czar Jay Varma championed endless government restrictions and lockdowns to keep people safe. But, at the same time, he attended sex parties and a dance party, indulgences that made a mockery of everything he preached to New Yorkers. His hypocrisy was exposed this week...

Read More »

Read More »

Covid Tyrants Partied While Demanding Lockdowns for Everyone Else

Remember when government officials sanctioned orgies but insisted it was too risky to permit children to attend classes to learn how to read?During the pandemic, New York City Covid Czar Jay Varma championed endless government restrictions and lockdowns to keep people safe. But, at the same time, he attended sex parties and a dance party, indulgences that made a mockery of everything he preached to New Yorkers. His hypocrisy was exposed this week...

Read More »

Read More »

DAS wird Dir über Aktien verschwiegen (bewusst!)

Zu meinen Onlinekursen: https://thomas-anton-schuster.coachy.net/lp/finanzielle-unabhangigkeit

Vortrags- und Seminartermine, sowie kostenlose Anforderung des Aktienbewertungsblatts: https://aktienerfahren.de

Read More »

Read More »

Washington’s Ukraine Obsession is Going to Get Us All Killed!

Last week the world narrowly escaped likely nuclear destruction, as the Biden Administration considered Ukraine’s request to allow US missiles to strike deeply into Russian territory. Russian president Vladimir Putin warned, as the request was being considered, that because these missiles could not be launched without the active participation of the US military and NATO, Russia would consider itself in a state of war with both NATO and the US...

Read More »

Read More »

9-24-24 Who Benefits Most from the Latest Fed Rate Cut?

Oil prices conitnue to weaken in the face of optimism from analysts now forecasting an 18% gain in earnings in 2025. One of them is wrong. Lance and Jonathan discuss market clarity, Fed rate cuts, and the impact on the markets. Markets trade on the effective Fed rates; what's the sweet spot among market sectors when rates are coming down? Lance reviews Gold behaviors during rate cutting cycles; big surges in Gold lead to longer-term bases. Why the...

Read More »

Read More »

Eilmeldung: Fulminanter NDR Skandal!

Wahnsinn was beim NDR abgeht! Ein unfassbarer Skandal!

Mein Depot: https://link.aktienmitkopf.de/Depot *

Auf der Freedom 24-Plattform findest Du:

- Langfristige Sparpläne mit Zinssätzen bis zu 8,76 %!

- Rendite von 3,86 % in Euro und 5,31 % in Dollar bei täglicher Gutschrift der Zinsen!

- Bis zu 1.000.000 Aktien, ETFs, Aktienoptionen und andere Finanzinstrumente!

- Depot kostenlos eröffnen: https://link.aktienmitkopf.de/Depot *

Bildrechte:

?...

Read More »

Read More »

MILEI SACUDE WALL STREET CON UN DISCURSO HISTÓRICO

Milei, en un apasionante discurso en Wall Street, defiende la libertad y el equilibrio fiscal.

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!...

Read More »

Read More »

Shun while it lasted: never-Trumpers’ fading sway

A handful of Republican leaders have been denouncing Donald Trump since his first presidential campaign. Will the voices of those who remain be heeded (https://www.economist.com/united-states/2024/09/14/the-never-trump-movement-has-leaders-what-about-followers?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners) this time...

Read More »

Read More »

Does Technical Knowledge by Itself Drive Economic Growth?

Some have argued that new technological ideas, unlike material inputs and labor, are not in themselves scarce. Consequently, it is further argued that new ideas for more efficient processes and new products can make continuous economic growth possible. So-called experts, however, are of the view that in a fully competitive environment, firms are likely to be concerned that competitors are going to copy any innovations they introduce. Therefore, it...

Read More »

Read More »

China Goes Big, and Market (Initially) Gives it the Benefit of the Doubt

Overview: News of China's multifaceted support measures have bolstered risk appetites today. The dollar is mostly softer and only the yen and Swiss franc among the G10 currencies have been unable to find traction against the greenback. Most emerging market currencies are also trading with a firmer bias. China's measures include measures to support the stock and housing markets. The seven-day repo rate was cut by 20 bp (to 1.50%) and reserve...

Read More »

Read More »

Milei’s Political Game

“I’m the one who destroys the state from within.” “The state is a criminal organization.” “Taxation is theft.” “The state does everything wrong.” These are just a few of the many anti-statist (or anarcho-capitalist) lines uttered by Javier Milei, who—after breaking the barriers of respectable political discourse and becoming a congressman in 2021—won the presidency of Argentina in 2023.And while statism continues to advance or is protected when...

Read More »

Read More »

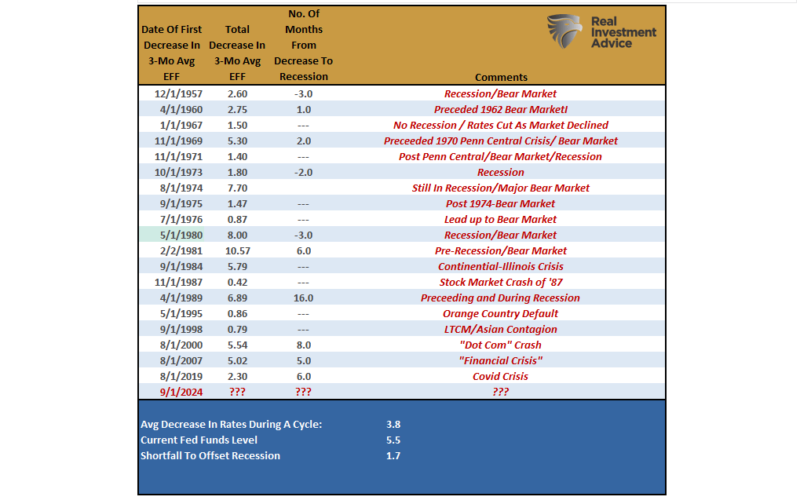

50 Basis Point Rate Cut – A Review And Outlook

Last week, the Federal Reserve made a significant move by cutting its overnight lending rate by 50 basis points. This marks the first rate cut since 2020, signaling the Fed is aggressively supporting the economy amid a backdrop of softening economic data. For investors, understanding how similar rate cuts have historically impacted markets and which sectors tend to benefit is key to navigating the months ahead.

In this post, we will explore the...

Read More »

Read More »

Was regt Euch so richtig auf? Saidi & Emil reagieren auf Eure Finanz-Ärgernisse

Irgendjemand hat die Preise erhöht? Schlechte Banking-Apps? Miserable Finanzbildung in der Schule? Es gibt genügend finanzielle Anlässe, die Grund zum Ärgern sind. Saidi und Emil schauen sich an, was Euch so richtig ärgert, kommentieren und erzählen von ihren eigenen Erlebnissen.

Hier nehmt Ihr teil: https://finanztip.typeform.com/to/ACbDhxwt?utm_source=youtube&utm_medium=videobeschreibung

Depot-Vergleich 2024: Die besten Broker &...

Read More »

Read More »