Tag Archive: Featured

22. Vermögenskonvent des Elite Report in Salzburg

Beim 22. Vermögenskonvent des Elite Report wurden im November in Salzburg die besten Vermögensverwalter und Family Offices im deutschsprachigen Raum ausgezeichnet. Eindrücke aus der Stadt und von der Verleihung werden abgelöst vom Interview mit Christan Janas, Mitglied der erweiterten Geschäftsleitung und Leiter Vermögensverwaltung, der zusammen mit Vorstandsmitglied Thorsten Schrieber die Auszeichnung entgegennahm.

Read More »

Read More »

Wahnsinn was in Thüringen passiert!!!

In Thüringen geht's jetzt richtig run! Exklusiv-Recherche von Apollo News über den Thüringer Verfassungsschutz!

Read More »

Read More »

Gold Technical Analysis – Eyes on the US CPI report

#gold #xauusd #technicalanalysis In this video you will learn about the latest fundamental developments for Gold. You will also find technical analysis across different timeframes for a better overall outlook on the market.

Read More »

Read More »

The World at War—An Essential New Book from Ralph Raico

This article is the foreword to The World at War by Ralph Raico, edited and annotated by Edward Fuller. Buy the book at the Mises store. The twentieth century was a century of war, which means it was also a century of tragedy. The full extent of this tragedy, however, is often hidden by the popular narratives of the world wars that continue to be pushed in the West, especially among Americans. But many aspects of the tragedy are also taught far and...

Read More »

Read More »

Die lebenswertesten Städte in Deutschland

Wir präsentieren: Die lebenswertesten Städte Deutschlands. Wo es sich am besten leben lässt und nach welchen Kriterien ausgewählt wurde, das erfährst Du hier.

#Finanztip

Read More »

Read More »

The Rich Don’t Work for Money, Here’s What School Won’t Teach You About Money

Join Robert Kiyosaki as he shares powerful life lessons from his journey to success through financial education. This motivational talk explores essential financial literacy concepts that shaped his path from struggling student to successful author. Discover practical business ideas and insights about investing that can help shape your financial future.

Key Takeaways:

Why "living debt-free" is the biggest lie you're told.

How the U.S....

Read More »

Read More »

BRICS greift westliche Rohstoffbörsen an

Florian Günther ist der Kopf hinter Investorenausbildung.de. Er ist studierter Bankkaufmann und hilft Menschen auf der Ausbildungsplattform Investorenausbildung durch handfeste Regeln die richtige Aktienauswahl zu treffen und daraus monatliche Einnahmen zu generieren. Und das in jeder Marktphase!

▬ Inhalt ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

"China hortet Rohstoffe, während die BRICS eigene Börsen aufbauen." - Jürgen Wechsler

Read More »

Read More »

EL YUAN CHINO SE DERRUMBA MIENTRAS EL DÓLAR SE DISPARA

El yuan chino cae al nivel más bajo en un año frente al dólar tras la victoria de Trump.

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!...

Read More »

Read More »

Minimum Wage Laws Can’t Repeal the Laws of Economics

On April 1, 2024 California bill AB 1228 went into effect, raising the minimum wage to $20 an hour for fast food restaurant workers. The media pundits largely celebrated the bill’s boldness. Economists and industry insiders largely complained it would raise prices, lower employment, and maybe even radically diminish a convenient and beloved fixture in American society.A new study from the Institute for Research on Labor and Employment at UC...

Read More »

Read More »

Alice Weidel lässt es knallen vor der Presse!

Alice Weidel wurde offiziell als Kanzlerkandidatin bestätigt!

Meine Depot-Empfehlung: https://link.aktienmitkopf.de/Depot *

Auf der Freedom 24-Plattform findest Du:

- Bis zu 1.000.000 Aktien, ETFs, Aktienoptionen und andere Finanzinstrumente!

- Depot kostenlos eröffnen: https://link.aktienmitkopf.de/Depot *

Bildrechte:

? Mein Buch! Der Rationale Kapitalist ►►http://amzn.to/2kludNT *

?JETZT auch als Hörbuch bei Audible ►► https://goo.gl/iWvTRR *...

Read More »

Read More »

Hast du schon eine virtuelle Debitkarte?

Debitkarte oder Kreditkarte? ? Die Unterschiede und wie du versteckte Gebühren vermeidest ✅

Read More »

Read More »

So entwickeln sich Bitcoin, Litecoin & Co am Nachmittag am Kryptomarkt

Der <a href="/devisen/bitcoin-dollar-kurs">Bitcoin</a>-Kurs wertet am Sonntagnachmittag um 0,22 Prozent auf 100.021,05 US-Dollar auf. Am Vortag stand <a href="/devisen/bitcoin-dollar-kurs">Bitcoin</a> bei 99.805,31 US-Dollar.<!-- sh_cad_1 -->Währenddessen wird <a href="/devisen/bitcoin-cash-dollar-kurs">Bitcoin Cash</a> bei 619,99 US-Dollar...

Read More »

Read More »

Understanding the Impact of Interest Rates on Inflation and the Economy

Inflation concerns are rising, impacting interest rates and the economy. Debt levels are crucial. Keep an eye on the housing market trends! ? #economy #inflation #debtlevels

Watch the entire show here: https://cstu.io/a9c64c

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Total Eskalation in Syrien! Das passiert gerade!

Haftungsausschluss: Anlagen in Wertpapieren und anderen Finanzinstrumenten bergen immer das Risiko des Verlustes Ihres Kapitals.

Prognosen und frühere Wertentwicklungen sind keine verlässlichen Indikatoren für die künftige Wertentwicklung.

Read More »

Read More »

US Announces Nearly $1 Billion in New Military Aid for Ukraine | World News | WION

The United States on Saturday announced a nearly $1 billion security assistance package for Ukraine as Washington races to provide aid to Kyiv before President-elect Donald Trump takes office. Watch for more details!

Read More »

Read More »

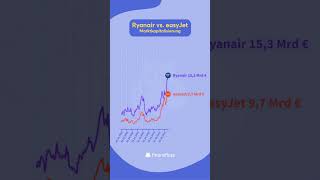

Ryanair vs. easyJet #marketcap

Ryanair vs. easyJet ? #marketcap

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung zu übernehmen...

Read More »

Read More »

‘In 30 Jahren alles kaputtgemacht!’ – Logistikunternehmer Thomas Hansche über Deutschlands Abstieg

Sicher dir jetzt deinen kostenlosen Vermögenscheck an und erfahre alles über die richtige Anlagestrategie in Zeiten der Multi-Krise: https://max-otte-fonds.de/vermoegenscheck/#formular

Logistik-Unternehmer Thomas Hansche nimmt im Gespräch mit Florian Günther kein Blatt vor den Mund: Was läuft schief in der deutschen Wirtschaft? Warum verlieren wir unsere Wettbewerbsfähigkeit? Und gibt es noch Hoffnung für den Wirtschaftsstandort Deutschland? Ein...

Read More »

Read More »

EU Eklat: Rumänien hat “falsch” gewählt!

EU: Untersuchung! Rumänien hat falsch gewählt!

Meine Depot-Empfehlung: https://link.aktienmitkopf.de/Depot *

Auf der Freedom 24-Plattform findest Du:

- Bis zu 1.000.000 Aktien, ETFs, Aktienoptionen und andere Finanzinstrumente!

- Depot kostenlos eröffnen: https://link.aktienmitkopf.de/Depot *

Bildrechte:

? Mein Buch! Der Rationale Kapitalist ►►http://amzn.to/2kludNT *

?JETZT auch als Hörbuch bei Audible ►► https://goo.gl/iWvTRR *...

Read More »

Read More »

Vorabpauschale 2025: Das musst du VOR dem Jahreswechsel tun!

Vorabpauschale: Diese ETF-Steuer fällt im Januar an!

Kostenloses Depot eröffnen: ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=820&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *?

Vermögen tracken mit Finanzfluss Copilot: ►► https://www.finanzfluss.de/copilot/ ?

ℹ️ Weitere Infos zum Video:

Im Januar fällt eine ETF-Steuer, nämlich die Steuer auf die Vorabpauschale, an. Was es damit...

Read More »

Read More »