Tag Archive: Featured

Climate change could slash company profits by 7% by 2035, says WEF

7 percent less profit due to climate change

Keystone-SDA

Listen to the article

Listening the article

Toggle language selector...

Read More »

Read More »

Trump Election Sends NFIB Optimism Surging

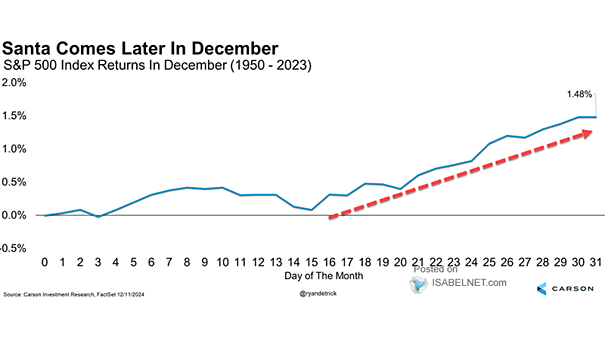

Inside This Week's Bull Bear Report First Comes The Fed, Then Santa Last week, we discussed that the risk to the markets was the annual portfolio rebalancing process. To wit: "With the year-end approaching, portfolio managers need to rebalance their holdings due to tax considerations, distributions, and annual reporting. For example, as of this writing, …

Read More »

Read More »

Nein, Mr. Gujer, Germany Should Not Raise its Debt Limit

The decayed and degraded state of German infrastructure has prompted Eric Gujer to publish an opinion piece in the Neue Zürcher Zeitung (NZZ) in which he advocates for a compromise between conservatives (increase the debt limit and thereby free up funds for renovations), progressives (reform social spending), and the government (reduce subsidies). Should Germany fail to manifest the collective willpower necessary to bring about such a political...

Read More »

Read More »

Welches Depot ist das Beste? #shorts

Welches Depot ist das Richtige für Dich? Wenn Du Dich das fragst, dann hat Saidi hier einen Tipp für Dich, wie Du das ganz einfach herausfinden kannst.

#Finanztip

Read More »

Read More »

Snowflake Silver Ornament

❄️ Snowflake Silver Ornaments! This 1/2 ounce of pure silver is both a precious metal investment, and a decorative keepsake for Christmas. ?Get yours before the holiday is over!

ORDER YOURS HERE: https://www.moneymetals.com/snowflake-silver-12-troy-ounce-999-pure/1809

#silver #christmas #ornament #money #metals #moneymetals

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★★FOLLOW...

Read More »

Read More »

Physical Gold & Silver Are Besting Mining Stocks… But Will This Continue?

Coming up don’t miss our interview with Jeff Clark – founder of TheGoldAdvisor.com (https://thegoldadvisor.com/) newsletter and a globally recognized authority on precious metals. Jeff and Mike Maharrey break down the incredibly difficult and time-consuming process of bringing a mine from the beginning stages all the way to becoming a producing entity and actually getting ounces out of the ground.

Read More »

Read More »

Neu: Finanztip Academy – Saidi zeigt Dir den Finanz-Masterplan

? Zur Finanztip Academy ► https://www.finanztip.de/academy/?utm_source=youtube&utm_medium=videobeschreibung&utm_campaign=5-WVKwJXmRM

Mit der neuen Academy von Finanztip stellst Du gemeinsam mit Saidi Schritt für Schritt Deinen Finanz-Masterplan auf.

Alle Kanäle von Finanztip:

Die Finanztip Academy ► https://www.finanztip.de/academy/?utm_source=youtube&utm_medium=videobeschreibung&utm_campaign=5-WVKwJXmRM

Der Finanztip Newsletter...

Read More »

Read More »

So steigerst du dein Gehalt als Angestellter

Wie planst du deine Gehaltssteigerung? ?? Bleibst du auf deiner Position oder strebst du eine Karriere an?

Read More »

Read More »

LA HIPOCRESÍA DE LA POLÍTICA ENERGÉTICA

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

Putin-Analyse: Gierig aber kalkuliert?

▬ Kontakt ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

Vereinbare jetzt Dein kostenloses Beratungsgespräch??:

► https://go.investorenausbildung.de/3n29OKX

kostenloses Webinar ansehen???:

► https://go.investorenausbildung.de/3zRHbI0

Aktienanalyse auf Knopfdruck?:

► https://go.investorenausbildung.de/3zVtfwv

kostenloses Buch sichern?:

► https://go.investorenausbildung.de/3xJn7ow

▬ Über Mich ▬▬▬▬▬▬▬▬▬▬▬▬

Florian Günther ist der Kopf hinter Investorenausbildung.de. Er ist...

Read More »

Read More »

Was steckt hinter den Geschehnissen in Syrien? – Ernst Wolff im Gespräch mit Krissy Rieger

Ein weiteres Gespräch mit @krissyrieger über die Geschehnisse in Syrien...

Mehr zu Krissy Rieger:

Finanzkanal ►► / @chrisrieger91

Zweitkanal ►► / @krissy.rieger2

Instagram ►► https://www.instagram.com/krissy.rieg...

Twitter ►► https://twitter.com/krissyrieger?lang=de

Telegram ►► https://t.me/KrissyRieger

____________________

? Alle Termine und die Links zu meiner Vortragsreihe finden Sie hier:

? https://ernstwolff.com/#termine

Auf dem...

Read More »

Read More »

Dred Scott, Politics, and the “Living” Constitution

In a 2022 article titled “Will the U.S. Supreme Court ever get around to overruling the shame of Dred Scott?” the surprising proposition is advanced that the1857 Dred Scott case is “still precedent” in the United States, and that “racist lawyers and racist judges can (blatantly or discreetly) rely on it in their arguments and rulings.” Like President Biden’s Antilynching Act of 2021, we are asked to believe that the injustices of past centuries are...

Read More »

Read More »

Real Democracy Can Only Be Freedom

With the advent of representative democracy over a century ago in most of the West, the popular belief was that the “rule of the few” would be relegated to the dustbin of history. This never happened, of course, as has become clearer to the “many” over the decades. Indeed, the ruling Western oligarchy has become more visible than before, too brazen in its attempts to ram through its globalist agenda on the world.The illusion of representative...

Read More »

Read More »

NZDUSD testing floors from 2022 and 2023 . Can the floor be broken?

Swing lows from November 2022 and 0.57397, and October 2023 and 0.5772 are being tested this week. Break below increases the bearish bias. Stay above and a rotation higher would be eyed

Read More »

Read More »

#557 Fürs Ja-Wort in den Dispo: Das kostet Heiraten 2024

#557 Fürs Ja-Wort in den Dispo: Das kostet Heiraten 2024

Was kostet eigentlich eine Hochzeit und wie viel zahlen Paare laut einer Umfrage für ihre Party? Den Kosten sind nach oben keine Grenzen gesetzt, aber genauso gibt es auch einige Maßnahmen, mit denen man Kosten einsparen kann. Außerdem diskutieren wir die Frage: kann man mit einem Hochzeitsplaner Geld sparen?

Read More »

Read More »

Zuseherfrage: Lebensziele – Glück, Wohlstand und Gesundheit

✘ Werbung:

Mein Buch Katastrophenzyklen ► https://amazon.de/dp/B0C2SG8JGH/

Kunden werben Tesla-Kunden ► http://ts.la/theresia5687

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

-

Heute geht es um die #Lebensziele, die der Mensch hat. Und ich lege die meinen dar. Und sie sind recht einfach strukturiert. Man kommt von ganz alleine darauf, wenn man einmal feste nachdenkt. Naja – ganz schön lange nachdenkt. Und es bedarf glasklarer...

Read More »

Read More »