Tag Archive: Featured

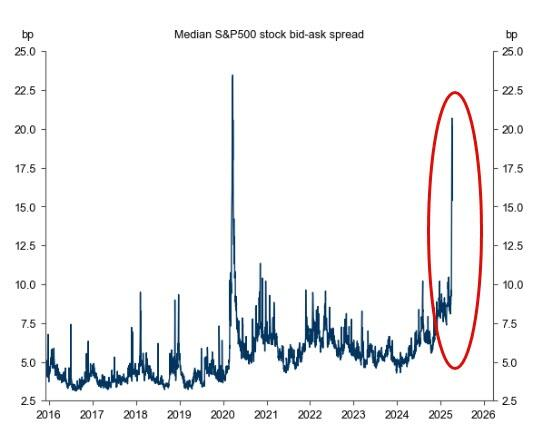

Yield Spreads Suggest The Risk Isn’t Over Yet

In November last year, I discussed the importance of yield spreads, historically the market's "early warning system." To wit:" "Yield spreads are critical to understanding market sentiment and predicting potential stock market downturns. A credit spread refers to the difference in yield between two bonds of similar maturity but different credit quality. This comparison often …

Read More »

Read More »

Das kocht hoch: NGO will ARD Journalistin canceln!

✅ Meine Depotempfehlung 👉 https://link.aktienmitkopf.de/Depot *

Beginne mit dem Investieren beim Freedom24-Broker:

Mehr als 40.000 Aktien und ETFs mit transparenter Preisgestaltung

Direkter Zugang zu 15 globalen Börsen und Märkten

Kostenloser persönlicher Assistent und Anlageideen

Erhalte bis zu 20 Aktien gratis dazu für die Aufladung deines Kontos:

https://link.aktienmitkopf.de/Depot *

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »

The Dollar And Inflation: Don’t Believe The Hype

Recently, we have seen claims that the "collapsing" dollar will cause inflation. While a weaker dollar can create inflation, many factors impact prices. Accordingly, we have two issues with such dire statements. First, the dollar is not collapsing. Second, we have experienced much more significant dollar declines without an inflationary impulse. The dollar has fallen …

Read More »

Read More »

Eilmeldung: Merz geht bei Miosga völlig unter!

✅ Meine Depotempfehlung 👉 https://link.aktienmitkopf.de/Depot *

Beginne mit dem Investieren beim Freedom24-Broker:

Mehr als 40.000 Aktien und ETFs mit transparenter Preisgestaltung

Direkter Zugang zu 15 globalen Börsen und Märkten

Kostenloser persönlicher Assistent und Anlageideen

Erhalte bis zu 20 Aktien gratis dazu für die Aufladung deines Kontos:

https://link.aktienmitkopf.de/Depot *

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »

USDJPY Technical Analysis – The greenback suffers from confidence hit

#usdjpy #forex #technicalanalysis

In this video you will learn about the latest fundamental developments for the USDJPY pair. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

0:56 Technical Analysis with Optimal Entries.

2:17 Upcoming Catalysts...

Read More »

Read More »

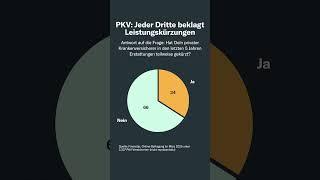

PKV: Jeder dritte Versicherte beklagt Leistungskürzungen

Nicht nur bei der GKV hat sich das Verhältnis von Beitrag zu Leistung in den letzten Jahren verändert. In unserer Finanztip-Umfrage haben wir Euch gefragt, ob Ihr in den letzten Jahren von Leistungskürzungen betroffen wart. Hier ist das Ergebnis.

#Finanztip

Read More »

Read More »

Inflation is coming down on the ground according to Guest Danielle DiMartino Booth.

Have you experienced this in your daily life? Or is a banana still $10? @DanielleDiMartinoBoothQI

Read More »

Read More »

Sensation: Javier Milei mit MEGA NEWS!

✅ Meine Depotempfehlung 👉 https://link.aktienmitkopf.de/Depot *

Beginne mit dem Investieren beim Freedom24-Broker:

Mehr als 40.000 Aktien und ETFs mit transparenter Preisgestaltung

Direkter Zugang zu 15 globalen Börsen und Märkten

Kostenloser persönlicher Assistent und Anlageideen

Erhalte bis zu 20 Aktien gratis dazu für die Aufladung deines Kontos:

https://link.aktienmitkopf.de/Depot *

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »

Schneewittchen Katastrophe: Disney Skandal wird immer schlimmer!

✅ Meine Depotempfehlung 👉 https://link.aktienmitkopf.de/Depot *

Beginne mit dem Investieren beim Freedom24-Broker:

Mehr als 40.000 Aktien und ETFs mit transparenter Preisgestaltung

Direkter Zugang zu 15 globalen Börsen und Märkten

Kostenloser persönlicher Assistent und Anlageideen

Erhalte bis zu 20 Aktien gratis dazu für die Aufladung deines Kontos:

https://link.aktienmitkopf.de/Depot *

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »

Bitcoinkurs & Co. aktuell: So steht es am Sonntagnachmittag um die Kurse der Digitalwährungen

Am Nachmittag verbilligt sich der <a href="/devisen/bitcoin-dollar-kurs">Bitcoin</a>-Kurs um -1,80 Prozent. Damit ist <a href="/devisen/bitcoin-dollar-kurs">Bitcoin</a> um 17:11 83.737,39 US-Dollar wert, nach 85.275,45 US-Dollar am Vortag.Währenddessen zeigt sich <a href="/devisen/bitcoin-cash-dollar-kurs">Bitcoin Cash</a> im Minus.

Read More »

Read More »

FIN DEL CEPO EN ARGENTINA: MILEI ACABA CON LA MAYOR ABERRACIÓN

Milei elimina el cepo cambiario, símbolo de saqueo y extorsión estatal, logrando con reformas récord reducir pobreza, impulsar empleo y abrir una nueva era de libertad económica en Argentina.

Mi nuevo libro ya está disponible:

"El nuevo orden económico mundial: EE. UU., China, Europa y el descontento global" (Deusto)

☑ Amazon: https://amzn.eu/d/6wTTNJI

☑ Casa del libro:...

Read More »

Read More »

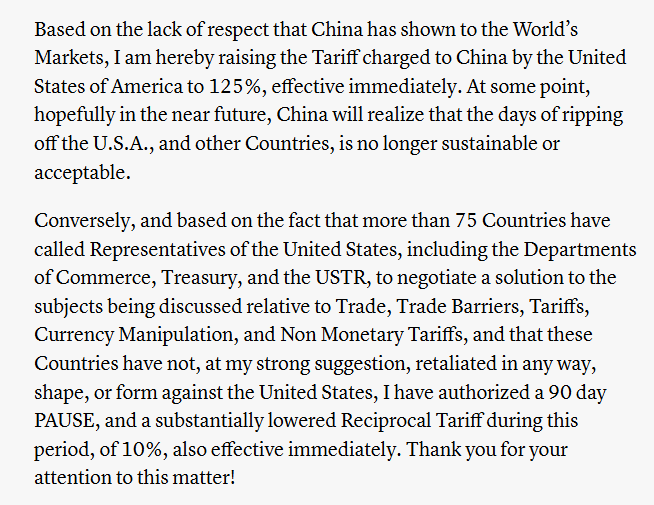

Ist das Trump eigentlicher Plan? #tariffs

Ist das Trump eigentlicher Plan? 📉 #tariffs

🎥 Extreme Schwankungen an der Börse: DAS bedeuten Trumps Zölle für ETF-Anleger:

?si=1LFNjqhuGMo6mtBi

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest...

Read More »

Read More »

Krankenkassen schlagen Alarm: Das sprengt das System!

✅ Kostenlose Annmeldung Webinar am 23.04. 👉 https://kettner.shop/aktienmitkopf *

Beginne mit dem Investieren beim Freedom24-Broker:

Mehr als 40.000 Aktien und ETFs mit transparenter Preisgestaltung

Direkter Zugang zu 15 globalen Börsen und Märkten

Kostenloser persönlicher Assistent und Anlageideen

Erhalte bis zu 20 Aktien gratis dazu für die Aufladung deines Kontos:

https://link.aktienmitkopf.de/Depot *

Trete der Aktien mit Kopf ProLounge bei...

Read More »

Read More »

Christine Lagarde: “Digitaler Euro SCHÜTZT Privatsphäre”

✅ Kostenlose Annmeldung Webinar am 23.04. 👉 https://kettner.shop/aktienmitkopf *

Beginne mit dem Investieren beim Freedom24-Broker:

Mehr als 40.000 Aktien und ETFs mit transparenter Preisgestaltung

Direkter Zugang zu 15 globalen Börsen und Märkten

Kostenloser persönlicher Assistent und Anlageideen

Erhalte bis zu 20 Aktien gratis dazu für die Aufladung deines Kontos:

https://link.aktienmitkopf.de/Depot *

Trete der Aktien mit Kopf ProLounge bei...

Read More »

Read More »

LA NARRATIVA SOBRE LOS ARANCELES

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

Was Trump mit den Zöllen bewirken will #tariffs

Was Trump mit den Zöllen bewirken will 📉 #tariffs

🎥 Extreme Schwankungen an der Börse: DAS bedeuten Trumps Zölle für ETF-Anleger:

?si=1LFNjqhuGMo6mtBi

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔...

Read More »

Read More »

Could China win a trade war with America?

China and America have hit each other with eye-watering tariffs. It’s an economic poker match between two superpowers but could China have the better cards?

Read More »

Read More »