Tag Archive: Featured

Stagnation Is Lulling The Fed To Sleep

The JOLTs data released on Wednesday paint a picture of labor market stagnation. The graph below shows that the number of job openings has fallen to levels similar to those right before the pandemic. While the number of openings seems somewhat stable, layoffs are slowly increasing, while new hires are near a 15-year low. Similarly, …

Read More »

Read More »

New Year’s Resolutions For 2026 – Investor Version

Every January, it happens like clockwork: you drive by gym parking lots that look like a Taylor Swift concert. Go to the store, and the salad aisles are ransacked like there’s a lettuce shortage, and half of your coworkers suddenly start quoting Warren Buffett while buying stock in companies they can’t spell. You got it, …

Read More »

Read More »

USA bebt: Links-Aufständische greift ICE Agenten an und wird getötet! JD Vance eskaliert gegen CNN!

Werbung:

✅ Sichere dir 30 € in Bitcoin bei deiner ersten Investition in eine Kryptowährung bei Coinbase 👉 https://coinbase-consumer.sjv.io/c/6428886/3162518/9251 *

Mehr Infos zu Coinbase:

✅ In Deutschland reguliert seit 2021

💹 260+ Kryptowährungen

💰Ab 0,15% Gebühren (Advanced-Modus)

📦Limit-, Markt-& Stop-Orders

📅Flexible Sparpläne (täglich bis monatlich)

💳Visa-Karte zum Zahlen mit Krypto oder Euro

Read More »

Read More »

Why Vivek Is So Wrong about the Founding of the United States

Vivek Ramaswamy promotes a fictional version of American history in which a handful of people created America and that culture and religion are canceled out by an ideological "creed." In truth, the American nation and the American state are two different things.

Read More »

Read More »

Cutting Interest Rates Isn’t a Cure‑All for the Economy

The Fed is cutting its discount rate again, but Americans will be disappointed with the results, as the Fed’s latest action only contributes to the boom-and-bust cycle.

Read More »

Read More »

How to Compare Prices and Progress over the Years

One way to compare prices of similar commodities and services over long periods of time is to convert the nominal prices to ounces of gold.

Read More »

Read More »

Darum hassen Linke Bitcoin!

Werbung:

✅ Sichere dir 30 € in Bitcoin bei deiner ersten Investition in eine Kryptowährung bei Coinbase 👉 https://coinbase-consumer.sjv.io/c/6428886/3162518/9251 *

Mehr Infos zu Coinbase:

✅ In Deutschland reguliert seit 2021

💹 260+ Kryptowährungen

💰Ab 0,15% Gebühren (Advanced-Modus)

📦Limit-, Markt-& Stop-Orders

📅Flexible Sparpläne (täglich bis monatlich)

💳Visa-Karte zum Zahlen mit Krypto oder Euro

Read More »

Read More »

Venezuela-Sturz: Insider berichtet vor Ort

Venezuela besitzt die größten Ölreserven der Welt - und steht nach dem Sturz von Diktator Maduro im Zentrum der globalen Machtkämpfe. Gemeinsam mit CryptoCity-Gründer Tim Stern, der seit Jahren in Venezuela lebt, analysieren wir, warum die USA jetzt handeln, welche Rolle China und Russland spielen und ob Venezuela vor einem wirtschaftlichen Neustart steht. Besonders interessant: Tims Eindrücke vor Ort!

Tims CryptoCity:

www.cryptocity.land

Mein...

Read More »

Read More »

Las protestas en Irán que los medios ocultan

Irán vive protestas masivas por inflación descontrolada, represión brutal y una moneda destruida pese a ingresos récord por petróleo.

Mi nuevo libro ya está disponible:

"El nuevo orden económico mundial: EE. UU., China, Europa y el descontento global" (Deusto)

☑ Amazon: https://amzn.eu/d/6wTTNJI

☑ Casa del libro: https://www.casadellibro.com/libro-el-nuevo-orden-economico-mundial/9788423438891/16782241

Te animo a suscribirte a mi...

Read More »

Read More »

De-Dollarization Is Real: Gold Just Beat U.S. Treasuries

🔔 SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

De-Dollarization Is Real: Gold Just Beat U.S. Treasuries

De-dollarization is real — and it’s no longer a fringe theory. In this clip, Mike Maharrey breaks down why gold surpassing U.S. Treasuries as a global reserve asset is a major warning sign for the dollar.

Even a modest shift away from the dollar can create serious consequences at home. The U.S. depends on global...

Read More »

Read More »

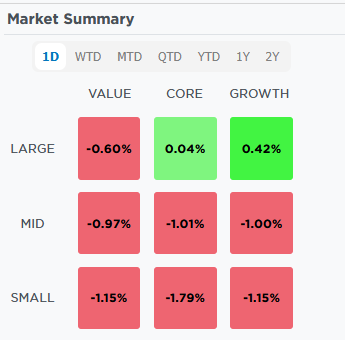

1-8-26 Markets Don’t Need a Crash to Go Down in 2026

Markets don’t need a crash to go down in 2026—valuation compression alone can do the damage.

In this Short video, Michael Lebowitz and I discuss why stretched multiples, normal volatility, and rotation risk matter more than bullish forecasts.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

Tariff revenue is less than half of what Trump claims

“Let’s be clear: President Trump’s claim that the U.S. government collected $600 billion from tariffs in 2025 is incorrect,” The true amount is closer to $289 billion.

Read More »

Read More »

Freeze forces SWISS to cancel dozens of flights

Swiss International Air Lines has cancelled 57 flights since the beginning of the year due to the weather. +Get the most important news from Switzerland in your inbox The airline expects further cancellations in the coming days due to the current weather conditions in Europe. A total of around 7,430 passengers were affected by the …

Read More »

Read More »

Tag 152

@MarkusElsaesser1 👈

Um immer up-to-date zu sein, tragen Sie sich jetzt in den Mailverteiler ein

👉 https://www.elsaessermarkus.de/newsletteranmeldung

Read More »

Read More »

Achtung: Rubio verkündet nächsten MEGA SCHOCK für EU!

🎁 Erhalte bis zu 20 US-Aktien gratis (im Wert von bis zu 800 USD, bis 31.03.) 👉

https://link.aktienmitkopf.de/Depot *

✅ Meine Depotempfehlung

Investiere global mit dem Freedom24-Broker:

Mehr als 40.000 Aktien und 3,600 ETFs mit transparenter Preisgestaltung

Direkter Zugang zu mehr als 20 globalen Börsen

Kostenloser persönlicher Assistent und Anlageideen

👉 https://link.aktienmitkopf.de/Depot*

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »

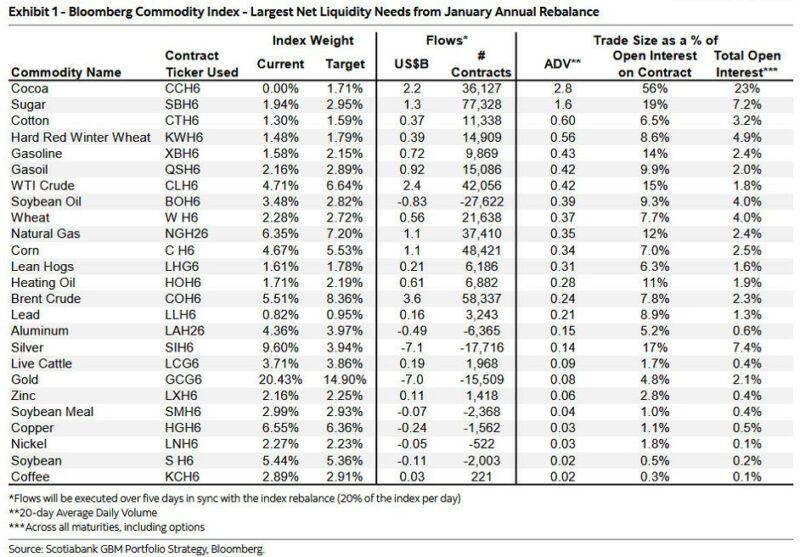

Gold and Silver: Who Co-ordinated The Selling?

The recent pullback in gold and silver has sparked nonstop commentary, but how much of it actually reflects what’s moving the markets?

In this video, we break down the real driver behind recent price action: index rebalancing, a scheduled, rule-based flow that forced major funds to sell futures as gold and silver became oversized in commodity benchmarks like the Bloomberg Commodity Index. This is not about sentiment, geopolitics, or macro...

Read More »

Read More »