Tag Archive: Featured

Expect Unpredictable Outcome In Gold & Silver Price

Expect Unpredictable Outcome In Gold & Silver Price - Alasdair Macleod | Gold Price Prediction

#goldprice #alasdairmacleod

Read More »

Read More »

FOREX QUICK: GBPUSD rotates back toward 4-hour MA support

The run to the upside in the GBPUSD is running out of steam and rotates back toward MA support.

The GBPUSD ran higher in NY trading but is seeing a rotation back toward the broken 4-hour 100 bar MA level. Can the pair stay above that and keep the buyers in more control?

Read More »

Read More »

UNGARN IST DAGEGEN! KEINE EU SANKTIONEN GEGEN RUSSLAND GEWOLLT!

Wirtschaft aktuell: Was passiert jetzt? Jetzt ein Demokonto eröffnen & in Sachwerte kaufen? Negativzinsen durch ein Online Bankkonto umgehen? Macht Forex Trading, CFD Handel und Aktien oder der sichere Hafen Girokonto und Gold Sinn?

Read More »

Read More »

Sind Aktien jetzt billig?

► Hier kannst Du Dich für das Webinar anmelden: https://onlineseminar.lars-erichsen.de/

Zweifellos sind einige Aktien mittlerweile wieder richtig günstig bewertet und es war in der Vergangenheit praktisch immer richtig dann zu kaufen, oder zuzukaufen. In diesem Video möchte ich auf den S&P500, den Dax und den EuroStoxx blicken und die Frage beantworten, ob Aktien jetzt wieder unter Fundamentalen billig sind, oder zumindest fair bewertet....

Read More »

Read More »

This Just Accelerated The End Of The Dollar – Alasdair Macleod |Gold standard

This Just Accelerated The End Of The Dollar - Alasdair Macleod |Gold standard

⬇ Inspired By: ⬇

#fiatmoney #goldstandard

Don't Forget To Subscribe For More:

shorturl.at/bgA45

Read More »

Read More »

10 Jahre UnterBlog – Ursprung, Anfänge, Entwicklung

✘ Werbung:

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

--

Heute am 3.10.22 wird der UnterBlog 10 Jahre alt. Doch er entstand nicht auf der grünen Wiese, sondern hatte seine Vorgänger. Ich spreche über die vergangenen 30 Jahre und zeige Details aus meinem Studio und des Workflows.

500. Video ►

1.000 Video ►

Korrektur mein Buch ►

Mission Money Sperrung ►

Löschung 2.000 Videos ►...

Read More »

Read More »

Central Bank Incompetence Sparks Damaging Boom-Bust Cycles

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

The Federal Reserve note spiked again versus the euro and other troubled foreign currencies on Monday before pulling back sharply mid-week. Metals markets moved predictably in the opposite direction.

Read the full Transcript Here: https://www.moneymetals.com/podcasts/2022/09/30/fed-resorts-to-brute-force-in-desperate-bid-to-regain-respect-002603

Do you own precious...

Read More »

Read More »

Die Amis hauen uns in die Pfanne / Hans A. Bernecker / Themencheck vom 28.09.2022

Quelle

BerneckerTV

Die Amis hauen uns in die Pfanne / Hans A. Bernecker / Themencheck vom 28.09.2022

https://t.me/k_d_s600/2025

Read More »

Read More »

Keep an Eye on the 200-DMA| 3:00 on Markets & Money

(10/3/22) Stocks wrapped up September by selling off to new lows for the year, begging the question: Are markets ready for a rally? Markets are extremely deviated from long term means, which historically tend to be opportunities for reflexive rallies, which equal opportunities to reduce risk. Markets are over-sold from their 200-DMA; we think markets will rally back to the 3,800 or 3,900-level on the S&P, re-testing the down trend on the...

Read More »

Read More »

October 3, 2022: A review of the major technical levels in play for the major currency pair and why.

0.40 - EURUSD - The EURUSD has moved away from the overhead resistance near the 50% midpoint of the move down from the October higher and rotates back toward the 200 and 100 hour MA barometers on the downside.

Read More »

Read More »

Weekly Market Pulse: Peak Pessimism?

Goodbye and good riddance to the third quarter of 2022. That was one of the wildest 3 months I’ve experienced in my 40 years of trading and investing. The quarter started off great with the S&P 500 rising 14% from July 1 to August 16 but ended with a 17% swan dive into the end of the quarter. And we closed on the low of the year.

Read More »

Read More »

NACH SeptemBÄR – JETZT UPtober

Hat dir das Video gefallen? Gib mir nen DAUMEN HOCH ? bzw. TEILE dieses Video um gemeinsam AT, DE und CH cryptofit zu machen!

#JulianHosp #Bitcoin #Blockchain

? Kein Video mehr verpassen? ABONNIERE meinen Kanal: https://www.youtube.com/channel/UCseNUrq7mUUWqTspr4QJ9eg?sub_confirmation=1 UND klicke die GLOCKE ? - WICHTIG!

⏰ E-MAIL ERINNERUNG beim nächsten Video erhalten: https://i-unlimited.de/youtube

——————

► Alles rund um DeFiChain...

Read More »

Read More »

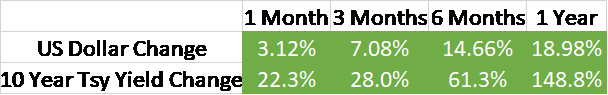

Nowhere to Go But US Dollar & Treasuries

(10/3/22) Don't let a bear market force you into making bad investing decisions. When will the real risk of recession occur? Any rally back to 4,000 is a good opportunity to "fix" your portfolio. When will the Fed begin to taper rate hikes? Today's special, un-scheduled Fed Governors meeting; dealing with recession fatigue; the real risk will be in 2023; the lagging effect of Fed rate hikes; Why are American's already tired of recession?...

Read More »

Read More »

Monday Blues

The markets begin October with some trepidation. Rumors continue to circulate about the health of a large European bank, cross currency swaps are elevated, suggest dollars are more difficult to access.

Read More »

Read More »

Aktien Schweiz: Risikoportfolios und der Low-Risk-Effekt

Gibt es den Low-Risk-Effekt auch in der Schweiz?

Mehr zum Thema erfahren? Besuchen Sie uns auf https://www.fintool.ch

?? Auf diesen Kanälen könnt ihr uns erreichen:

–––––––––––––––––––––––––––––––––––––––––––––

►Unsere Website: https://www.fintool.ch

►Unser FACEBOOK: https://www.facebook.com/fintool

►Unser LinkedIn: https://www.linkedin.com/company/fint...

►Unser INSTAGRAM: https://www.instagram.com/fintool.ch/...

Read More »

Read More »

Hans A. Bernecker: Wer jetzt kauft, hat in 2 Jahren dicke Gewinne!

"Wer heute Aktien kauft, wird in zwei Jahren dicke Gewinne haben", sagt Hans A. Bernecker. Im exklusiven Interview erklärt die Börsenlegende, warum er mit einer Erholungs-Rally rechnet wie nach dem Covid-Crash im Frühjahr 2020 und man im Dax und MDax fast alle Aktien kaufen kann momentan. Zudem erklärt Bernecker, warum die Atomkraftwerke in Deutschland noch lange laufen werden und warum er sich auch vor steigenden Zinsen und Rezession...

Read More »

Read More »

The strong Swiss franc – truth or myth?

The Swiss franc has hit an all-time high against the euro. Even though it trades at an unprecedented CHF0.95 to the euro, the strong franc no longer poses a threat to the Swiss economy. What has changed in the last ten years?

Read More »

Read More »

Swiss landlords fear lawsuits for turning down heating

Landlords and tenants are opposing government calls to reduce household heating to 19 degrees Celsius, warning it might spark a flurry of lawsuits.

Read More »

Read More »

BREAKING: BESONDERES FED MEETING AM 3. OKTOBER!!

Im heutigen Video spreche ich über das heutige FED Meeting und was möglicherweise für die Märkte folgen könnte. Weiterhin gebe ich einen kurzen Rückblick zu Q3 und teile meine Erwartung für Q4. Lass mir deine Einschätzung dazu in den Kommentaren da!

#JulianHosp #Bitcoin #Blockchain

? Kein Video mehr verpassen? ABONNIERE meinen Kanal: https://www.youtube.com/channel/UCseNUrq7mUUWqTspr4QJ9eg?sub_confirmation=1 UND klicke die GLOCKE ? -...

Read More »

Read More »

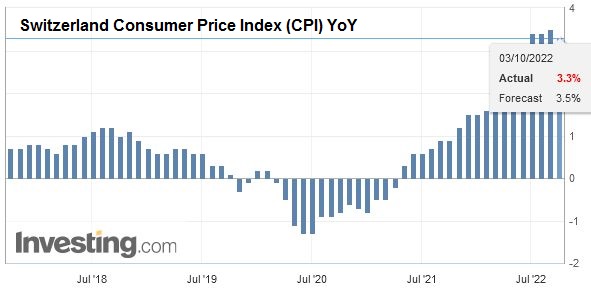

Swiss Consumer Price Index in September 2022: +3.3 percent YoY, -0.2 percent MoM

The consumer price index (CPI) fell by 0.2% in September 2022 compared with the previous month, reaching 104.6 points (December 2020 = 100). Inflation was +3.3% compared with the same month of the previous year.

Read More »

Read More »