Tag Archive: Featured

CBDCs & World Economic Forum | Lexikon der Finanzwelt mit Ernst Wolff

Die höchste Konzentration von Vermögen in immer weniger Händen,

die höchste Konzentration von Macht in immer weniger Institutionen und

der dadurch ermöglichte historisch einmalige Demokratieabbau.

Read More »

Read More »

Jahresausblick 2023 – darauf solltet Ihr Euch vorbereiten

Liebe YouTube Freunde,

das Jahr 2022 neigt sich dem Ende zu. Es war ein sehr turbulentes Jahr - und das wird 2023 auch. Viele Investoren und Anleger haben Geld verloren, weitere werden es noch tun.

Read More »

Read More »

Immokredite: Jetzt besser fix oder variabel verzinsen?

EZB und FED erhöhen die Zinsen um weitere 0,5%. Aktuell sehen wir eine inverse Zinskurve, ein Anzeichen einer Rezession. Aber was bedeutet diese Zinsentwicklung für Immobilieninvestoren und ihre Finanzierungen?

Read More »

Read More »

Jeden Monat Dividenden: Mit diesen ETFs!

Dividenden ETFs: Jeden Monat Dividende!

Kostenloses Depot eröffnen: ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=554&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *?

Zur ETF Suche: ►► https://www.finanzfluss.de/informer/etf/suche/ ?

In 4 Wochen zum souveränen Investor: ►►...

Read More »

Read More »

Bringt euer Geld in Sicherheit ?

?Hol dir 100 CHF Trading Credits bei einer Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

Bringt euer Geld in Sicherheit ?

Ist unser Geld auf der Bank eigentlich sicher? Wie ich persöhnlich die Dinge handhabe und was meine Empfehlungen sind, teile ich euch in diesem Video mit.

#geld #sicherheit #Finanzrudel

? Kein Geld mehr für Aktien? ►►...

Read More »

Read More »

Austerity: A Real Solution to Help Heal the U.S. Economy

Austerity works. We know what it is and don’t like it, but it works. It usually means cutting your consumption and spending, paying down your debts, pawning assets, and working more hours to restore your economic situation.

Read More »

Read More »

Deutschland in der Krise – Mein Statement

Deutschland ist bestenfalls nur noch mittelmäßig. In zahlreichen Gebieten hängt Deutschland im internationalen Vergleich hinterher, was dramatische Auswirkungen auf das Leben jedes Einzelnen haben könnte. Wo momentan die Probleme liegen und welche 4 Schritte du zur Vorbereitung tun solltest, erkläre ich dir im heutigen Video.

KOSTENLOSES BUCH - "Börse ist ein Business" von Jens Rabe

https://jensrabe.de/DeKriseStatementBuch

Nur für kurze...

Read More »

Read More »

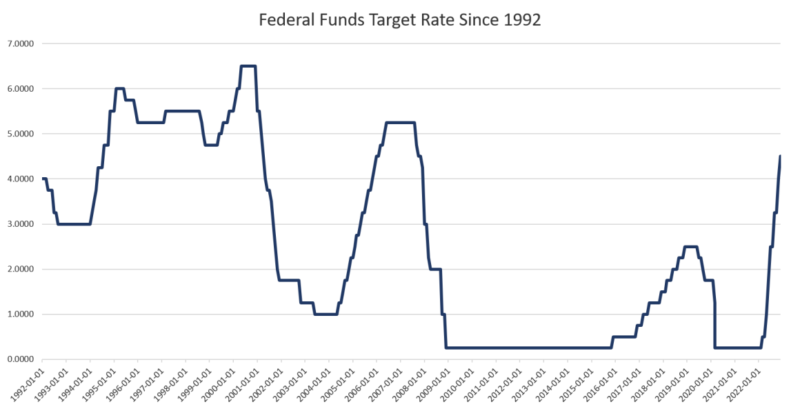

The Fed’s Powell Admits “I Don’t Know What We’ll Do” in 2023

The Federal Reserve's Federal Open Market Committee (FOMC) on Wednesday announced it will raise the target federal funds rate by 50 basis points, bringing the target rate to 4.5 percent. Wednesday's rate hike followed four hikes in a row of 75 basis points, and is the smallest rate hike since March.

Read More »

Read More »

NATO: Russia’s President Putin is planning for long war; Putin meets top military brass | WION

We are close to the end of 2022 but it's been 10 months since Russia invaded Ukraine even after witnessing defeat in three Ukrainian cities. Russian President Vladimir Putin is not ready to back, so how far will this go?

Read More »

Read More »

Missouri Bill Would End Capital Gains, Invest State Funds in Gold and Silver, Establish State Gold Depository

(Jefferson City, Missouri, USA -- December 14, 2022) - A state senator from St. Charles County has introduced a bill in Missouri to eliminate income taxes on sales of gold and silver, invest state funds in gold and silver, and establish the Missouri Bullion Depository.

Read More »

Read More »

La fine dei Templari (parte 2) Andreas Beck

1307-1314: un processo farsa condannò a morte il più potente ordine militare del medioevo. I templari erano ormai diventati uno dei più ricchi gruppi monastico-militari e il re di Francia, bisognoso delle loro ricchezze, sollevò contro di loro un castello di accuse: pratiche omosessuali, riti magici di iniziazione, blasfemia. Un inquisitore francese sottopose i membri dell'ordine a torture e interrogatori pur di ottenere le prove e le confessioni...

Read More »

Read More »

US Opening Bell mit Marcus Klebe – 23.12.22

HIER geht´s zum kostenlosen JFD Livetradingroom: https://attendee.gotowebinar.com/register/5477297854855570446?source=marcus-social-media

Folge uns auf:

Telegramm: https://t.me/jfdbank_de

LinkedIn: https://www.linkedin.com/showcase/jfd...

Facebook: https://www.facebook.com/JFDGermany/

Twitter: https://twitter.com/JFD_Group

Webseite: https://www.jfdbank.com/de...

Read More »

Read More »

US Opening Bell mit Marcus Klebe – 22.12.22

HIER geht´s zum kostenlosen JFD Livetradingroom: https://attendee.gotowebinar.com/register/5477297854855570446?source=marcus-social-media

Folge uns auf:

Telegramm: https://t.me/jfdbank_de

LinkedIn: https://www.linkedin.com/showcase/jfd...

Facebook: https://www.facebook.com/JFDGermany/

Twitter: https://twitter.com/JFD_Group

Webseite: https://www.jfdbank.com/de...

Read More »

Read More »

US Opening Bell mit Marcus Klebe – 21.12.22

HIER geht´s zum kostenlosen JFD Livetradingroom: https://attendee.gotowebinar.com/register/5477297854855570446?source=marcus-social-media

Folge uns auf:

Telegramm: https://t.me/jfdbank_de

LinkedIn: https://www.linkedin.com/showcase/jfd...

Facebook: https://www.facebook.com/JFDGermany/

Twitter: https://twitter.com/JFD_Group

Webseite: https://www.jfdbank.com/de...

Read More »

Read More »

Was macht der US Markt aus der BoJ Überraschung? – US Opening Bell mit Marcus Klebe – 20.12.22

HIER geht´s zum kostenlosen JFD Livetradingroom: https://attendee.gotowebinar.com/register/5477297854855570446?source=marcus-social-media

Folge uns auf:

Telegramm: https://t.me/jfdbank_de

LinkedIn: https://www.linkedin.com/showcase/jfd...

Facebook: https://www.facebook.com/JFDGermany/

Twitter: https://twitter.com/JFD_Group

Webseite: https://www.jfdbank.com/de...

Read More »

Read More »

“DAX Long oder Short?” mit Marcus Klebe – 23.12.22

HIER geht´s direkt zur LIVE- oder DEMOKONTOERÖFFNUNG:

https://partners.jfdbrokers.com/visit/?bta=35101&nci=5424

Ich freue mich über eure Daumen ???

#DAX #MarcusKlebe #Trading

ÜBER JFD:

WER WIR SIND:

JFD ist eine führende Unternehmensgruppe, die Finanz- sowie Investmentdienstleistungen und -aktivitäten anbietet. Die Muttergesellschaft, JFD Group Ltd, wurde im Dezember 2011 gegründet und ist heute ein international lizenzierter, globaler...

Read More »

Read More »

“DAX Long oder Short?” mit Marcus Klebe – 22.12.22

HIER geht´s direkt zur LIVE- oder DEMOKONTOERÖFFNUNG:

https://partners.jfdbrokers.com/visit/?bta=35101&nci=5424

Ich freue mich über eure Daumen ???

#DAX #MarcusKlebe #Trading

ÜBER JFD:

WER WIR SIND:

JFD ist eine führende Unternehmensgruppe, die Finanz- sowie Investmentdienstleistungen und -aktivitäten anbietet. Die Muttergesellschaft, JFD Group Ltd, wurde im Dezember 2011 gegründet und ist heute ein international lizenzierter, globaler...

Read More »

Read More »

“DAX Long oder Short?” mit Marcus Klebe – 21.12.22

HIER geht´s direkt zur LIVE- oder DEMOKONTOERÖFFNUNG:

https://partners.jfdbrokers.com/visit/?bta=35101&nci=5424

Ich freue mich über eure Daumen ???

#DAX #MarcusKlebe #Trading

ÜBER JFD:

WER WIR SIND:

JFD ist eine führende Unternehmensgruppe, die Finanz- sowie Investmentdienstleistungen und -aktivitäten anbietet. Die Muttergesellschaft, JFD Group Ltd, wurde im Dezember 2011 gegründet und ist heute ein international lizenzierter, globaler...

Read More »

Read More »

CONTROL GLOBAL: MONEDAS DIGITALES. CHINA, RUSIA, AMÉRICA LATINA

#crisis #economia #inversiones #argentina #chile #rusia #china #americalatina #macroeconomía #colombia #dinero

Programa completo aquí: https://www.youtube.com/watch?v=-AceG1iiJD4&t=2775s

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web -...

Read More »

Read More »