Tag Archive: Featured

The Decline of America

Every day, more and more Americans are awakening to the reality that the institutions in control of this nation are failing them. From violence in the streets, inflation in our stores, increasing tyranny and censorship, and absolute buffoonery on public display in halls of political power. The ruling class is getting richer while most of us suffer, and new generations are becoming increasingly warped by the dangerous ideologies of the left....

Read More »

Read More »

The Men Who Made the West

Every day, more and more Americans are awakening to the reality that the institutions in control of this nation are failing them. From violence in the streets, inflation in our stores, increasing tyranny and censorship, and absolute buffoonery on public display in halls of political power. The ruling class is getting richer while most of us suffer, and new generations are becoming increasingly warped by the dangerous ideologies of the left....

Read More »

Read More »

Property Rights, Civilization, and Their Enemies

Every day, more and more Americans are awakening to the reality that the institutions in control of this nation are failing them. From violence in the streets, inflation in our stores, increasing tyranny and censorship, and absolute buffoonery on public display in halls of political power. The ruling class is getting richer while most of us suffer, and new generations are becoming increasingly warped by the dangerous ideologies of the left....

Read More »

Read More »

Principles for Dealing with the Changing World Order (5-minute Version) by Ray Dalio

The world is changing in big ways that haven’t happened before in our lifetimes but have many times in history, so I studied past changes to understand what is happening now and anticipate what is likely to happen.

I shared what I learned in my book, Principles for Dealing with the Changing World Order, and in an animation that gives people an easy way to understand the key ides from the book in a simple and entertaining way.

Now, I’m releasing...

Read More »

Read More »

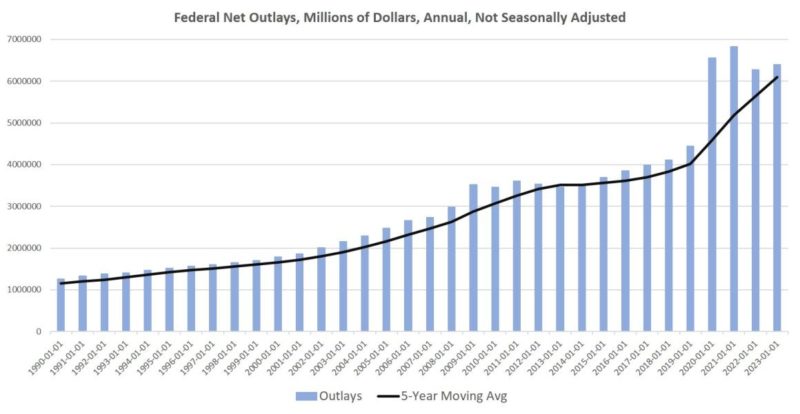

Three Lies They’re Telling You about the Debt Ceiling

Negotiations over increasing the federal debt ceiling continue in Washington. As has occurred several times over the past twenty years, Republicans and Democrats are presently using increases in the debt ceiling as a bargaining chip in negotiating how federal tax dollars will be spent.

Most of this is theater. We know how these negotiations always end: the debt ceiling is always increased, massive amounts of new federal debt are incurred, and...

Read More »

Read More »

“Dann geht’s schnell, unvorhersehbar schnell” | Dr. Markus Krall

Markus Krall Buch:

https://amzn.to/4220AQT

► Mein Merch:

https://shop.marc-friedrich.de/

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://www.amazon.de/shop/marcfriedrich oder mit Signatur:

https://www.marc-friedrich.de/

► Friedrich & Partner Vermögenssicherung

https://www.friedrich-partner.de/

► Social Media

Twitter:...

Read More »

Read More »

Wie “echt” ist das Kanzlergespräch wirklich?

► Mein Merch:

https://shop.marc-friedrich.de/

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://www.amazon.de/shop/marcfriedrich oder mit Signatur:

https://www.marc-friedrich.de/

► Friedrich & Partner Vermögenssicherung

https://www.friedrich-partner.de/

► Social Media

Twitter: http://www.twitter.com/marcfriedrich7

Instagram:...

Read More »

Read More »

How Markets Self-Corrected during the 1819 and 1919–21 Recessions

As the first signs of an economic tempest move through the United States—an alarming increase in bank failures, a surge in unemployment claims, and a troubling decline in retail sales—we find ourselves perched on the edge of a deep recession. Staring into this uncertain abyss, the self-designated guardians of our financial destiny, the Federal Reserve and the US government, are confronted with a monumental task. When the recession bells toll, how...

Read More »

Read More »

Habecks Rücktritt! Jeder ZWEITE fordert es! Zweiter Staatssekretär unter der Lupe!

? 3 Aktien geschenkt bis zu 700 €! Aktiendepot http://link.aktienmitkopf.de/Depot *

Ab 5.000 € Einzahlung aufs Handelskonto mit Code: "Freiheit"

Ab 2.000 € Einzahlung aufs Handelskonto mit Code: "Honig" gibt es

1 Aktie geschenkt

Bildrechte: Heinrich-Böll-Stiftung from Berlin, Deutschland, CC BY-SA 2.0 https://creativecommons.org/licenses/by-sa/2.0, via Wikimedia Commons

By Heinrich-Böll-Stiftung from Berlin, Deutschland -...

Read More »

Read More »

Wird die Girokarte bald abgeschafft? #finanzen #shorts

Kostenloses Depot eröffnen: ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=620&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *?

In 4 Wochen zum souveränen Investor: ►► https://link.finanzfluss.de/go/campus?utm_source=youtube&utm_medium=620&utm_campaign=ff-campus&utm_term=4-wochen&utm_content=yt-desc ?

?? Diese Finanzprodukte nutzt Thomas:

• Depot:...

Read More »

Read More »

European Song Contest 2014 – Deja Vue und Reupload

✘ Werbung:

Mein Buch Katastrophenzyklen ► https://amazon.de/dp/B0C2Z8KM9B/

-

Hat Ihnen der #ESC 2023 gefallen? Ach Nein - Sie haben gar nicht zugesehen? So ging es wohl 90% Ihrer Mitbürger. Ich habe den alten Beitrag aus 2014 herausgesucht. Das war das Jahr in dem der Transvestiekünstler #ConchitaWurst (Thoms Neuwirth) für #Österreich gewonnen hat. Ich mache einen Exkurs in die Hintergründe des ESC, wer die Strippen zieht und wer die Knete macht....

Read More »

Read More »

Das Märchen von der multipolaren Welt [Aktueller Kommentar 22.05.23]

Ein Kommentar von Ernst Wolff.

Die Mainstream-Medien sprechen immer häufiger davon, dass die Vorherrschaft der USA und des US-Dollars zu Ende geht und wir uns auf dem Weg in eine multipolare Welt befinden. Die BRICS-Staaten Brasilien, Russland, Indien, China und Südafrika, so heißt es, würden dann zu neuen, über die Welt verstreuten Machtzentren werden.

Bei dieser Argumentation handelt es sich um nichts anderes als eine weitere gezielte Kampagne...

Read More »

Read More »

Allzeithoch im DAX – 3 Gründe warum DU nicht dabei bist

Trotz Untergangsszenarien bezüglich der Wirtschaft in den Medien, hat der Dax sein Allzeithoch erreicht. Die Mehrheit der Börsenteilnehmer hat daran nicht partizipiert. Woran das liegt und was du tun musst, um nicht ebenfalls echte Chancen zu verpassen, erkläre ich dir im heutigen Video.

Vereinbare jetzt Dein kostenfreies Beratungsgespräch:

https://jensrabe.de/Q2Termin23

0:00 Allzeithoch

3:05 Grund eins

4:52 Grund zwei

7:32 Grund drei

9:30...

Read More »

Read More »

Tech-Spezial: Apple, NVIDIA, Microsoft und Meta in der Chartanalyse

? Jetzt Cashkurs-Mitglied werden ►► 1 Monat für €9,90 statt €17,70 ►https://bit.ly/Cashkurs9_90

????? ??? ??? ????? ??????????? ??? ????? ??????ü???? ????:

https://bit.ly/Tagesausblick230522

(Bei diesem Video handelt es sich um einen kurzen Ausschnitt aus dem Marktupdate vom 22.05.2023 auf Cashkurs.com.)

3️⃣ Tage Cashkurs gratis testen ►►► https://bit.ly/3TageGratis

? Gratis-Newsletter ►►► https://bit.ly/CashkursNL

? YouTube-Kanal abonnieren...

Read More »

Read More »

USDJPY makes new highs for the year, but momentum slowsLive Video

The USDJPY moved to a new high going back to November 2022 in trading today, but could not maintain momentum. The price is rotated back to the downside ahead of the US stock market open. Technically, failure to extend hire is a disappointment, but if the price can remain above 138.139 on the daily chart, that would keep the buyers and control. Watch that level in trading today for short and long term-term clues.

Read More »

Read More »

EURUSD stretches toward the low from last week and away from 100 day MA. What next?

Join us as we delve into the EURUSD's current price action and uncover its potential for a downside move. The pair is currently approaching the low from last week, indicating a significant level to watch.

A breakthrough below this level, along with the 1.0750 support level from the daily chart, could pave the way for further downside momentum. Traders will closely monitor whether the pair can sustainably stay below its 100-day moving average at...

Read More »

Read More »

Eine Investition in die Zukunft #shorts

Vereinbare jetzt Dein kostenloses Beratungsgespräch??:

► https://go.investorenausbildung.de/3n29OKX

kostenloses Webinar ansehen???:

► https://go.investorenausbildung.de/3zRHbI0

Aktienanalyse auf Knopfdruck?:

► https://go.investorenausbildung.de/3zVtfwv

kostenloses Buch sichern?:

► https://go.investorenausbildung.de/3xJn7ow

▬ Über Mich ▬▬▬▬▬▬▬▬▬▬▬▬

Florian Günther ist der Kopf hinter Investorenausbildung.de. Er ist studierter Bankkaufmann und...

Read More »

Read More »

Argentina Sleepwalks into Hyperinflation (Yet Again)

A century ago, Argentina was one of the world's wealthiest nations and the Argentine peso rivaled the dollar. Today, Argentina is famous for periodic hyperinflation.

Original Article: "Argentina Sleepwalks into Hyperinflation (Yet Again)"

Read More »

Read More »

A Good (White Collar) Job is Hard to Find

(5/23/23) Richard's new home-delivery food service: Donuts, Eggnog, & Seclusion; the mucky market and media scare tactics: Default is not in the cards. Saudi's warning to oil short-sellers: Global oil supplies are to tighten further. The Sixth Sense you need when considering private capital investing; transparency is key. The FTX fiasco: The correct question asked by Taylor Swift. Issues of liquidity in private infesting; the Stanford Pitch....

Read More »

Read More »

Taking Notes out of Rothbard’s Taiwan Playbook

Writing pseudonymously in a series of articles for Faith and Freedom in the 1950s, Murray Rothbard took on the question of whether or not the United States should defend Formosa (Taiwan) from attack by mainland China. While his conclusions will surprise no one familiar with his work (that war is the health of the state, that individuals concerned with the fate of Taiwan should do as they will privately, but that their lives and property are not for...

Read More »

Read More »