Tag Archive: Featured

Katrin Göring-Eckardt gehen die Nerven durch!

Es gibt kein Monopol auf Demokratie in Deutschland. Jeder darf mitmachen, nicht nur Jene, die links von der Mitte stehen. Je früher ihr das akzeptiert, desto besser für Alle.

Meine Depotempfehlung 3,9 % Tagesgeld-Zinsen und 5,3% für Einlagen in USD

https://link.aktienmitkopf.de/Depot*

? Tracke deine Dividenden mit dieser App http://myfinances24.de/mydividends24

Bildrechte: By Kasa Fue - Own work, CC BY-SA 4.0,...

Read More »

Read More »

Wichtige Morning News mit Oliver Klemm #248

Kostenfreies Video-Training (Durch Trading in 2024 absichern) ? https://oliverklemmtrading.com/casestudy-1?utm_source=youtube&utm_medium=social&utm_campaign=tradingcoacholi&utm_term=morning-news&utm_content=1

Klicke hier, um dich direkt gemeinsam mit Oli unabhängig zu machen ?...

Read More »

Read More »

ESCÁNDALO DE GASTO POLÍTICO EN TVE Y MONCLOA

Pedro Sánchez incrementa su equipo de asesores a un número sin precedentes, mientras que los directivos de Radio Televisión Española ganan enormes sumas de dinero.

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon...

Read More »

Read More »

Desaströse Entgleisung von Kiesewetter (CDU)!

Der US-Amerikanische Nobelpreisträger Steven Chu, der unter Obama Energie-Minister war, hat die Grüne Politik der Ampel massiv kritisiert! Er wirft den Grünen nicht nur Fakenews bezüglich der Kernenergie vor, sondern sagt auch, dass die Grüne Politik unvereinbar mit der Realität sei!

Das hat gesessen!

Meine Depotempfehlung 3,9 % Tagesgeld-Zinsen und 5,3% für Einlagen in USD

https://link.aktienmitkopf.de/Depot*

? Tracke deine Dividenden mit dieser...

Read More »

Read More »

Die Zeit für Deutschland läuft ab! (Oberst a.D. Ralph Thiele & Florian Günther)

⭐ Kapitaltag 2024: Erlebe Max Otte, Markus Krall, Stefan Homburg und weitere spannende Redner live am 19. April. Jetzt Ticket sichern: https://kapitaltag.de/

ℹ️ Zum Video

Ist der Krieg in der Ukraine für den Westen noch zu gewinnen? Oder sind die Kosten, die vor allem Deutschland trägt, mittlerweile viel zu hoch? Im Kölner Privatinvestor-Studio sprach Florian Günther mit dem bekannten Militärexperten Oberst a.D. Ralph Thiele darüber, wie es in...

Read More »

Read More »

Breaking: Nobelpreisträger zerlegt Habeck komplett!

Der US-Amerikanische Nobelpreisträger Steven Chu, der unter Obama Energie-Minister war, hat die Grüne Politik der Ampel massiv kritisiert! Er wirft den Grünen nicht nur Fakenews bezüglich der Kernenergie vor, sondern sagt auch, dass die Grüne Politik unvereinbar mit der Realität sei!

Das hat gesessen!

Meine Depotempfehlung 3,9 % Tagesgeld-Zinsen und 5,3% für Einlagen in USD

https://link.aktienmitkopf.de/Depot*

? Tracke deine Dividenden mit dieser...

Read More »

Read More »

Dividenden/Thesaurierung bei ETFs: Was passiert im Hintergrund?

Wie funktioniert die Thesaurierung bei einem ETF?

Unser Depot-Testsieger: ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=769&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *?

Tracke dein Vermögen mit dem Finanzfluss Copilot: ►► https://www.finanzfluss.de/copilot/?utm_source=youtube&utm_medium=769&utm_campaign=ff-campus&utm_term=4-wochen&utm_content=yt-desc ?

ℹ️...

Read More »

Read More »

Günstig reisen mit Kreditkarten? Der Faktencheck

Gewisse Anzeigen zum Thema günstige Luxus-Flüge sind in letzter Zeit oft zu sehen. Was du wissen musst, bevor du dich auf diese Thematik einlässt, erkläre ich dir im heutigen Video.

Vereinbare jetzt dein kostenfreies Beratungsgespräch:

https://jensrabe.de/Q1Termin24

Tägliche Updates ab sofort auf

https://aktienkannjeder.de

Schau auf meinem Instagram-Account vorbei:

@jensrabe_official

https://www.instagram.com/jensrabe_official

ALLE Bücher von...

Read More »

Read More »

Biden and Forgotten Federal Financial Tyranny

Under Obama and Biden, the banking sector has been weaponized against industries American leftists don't like. The Obama administration acted as if its regulatory targets did not deserve due process, and the program ravaged far and wide.

Original Article: Biden and Forgotten Federal Financial Tyranny

Read More »

Read More »

If One Wishes to Discredit Capitalism, One Should at Least Understand How It Works

Scott R. Sehon tries to be intellectually honest in his critique of capitalism and his endorsement of socialism, but David Gordon writes that Sehon needs to better know the arguments favoring capitalism.

Original Article: If One Wishes to Discredit Capitalism, One Should at Least Understand How It Works

Read More »

Read More »

Are Free Markets More Dangerous than Regulated Markets?

Is the regulatory choice a tradeoff between safety or “breaking a few eggs” via free markets? The logic of allowing for free and unhampered markets is compelling.

Original Article: Are Free Markets More Dangerous than Regulated Markets?

Read More »

Read More »

Biden’s Middle East Policy Puts Americans at Risk

The Biden administration’s Middle East policies are going to produce the same kind of blowback that led to the 9/11 attacks. The more reckless Biden becomes, the more American lives are placed at risk.

Original Article: Biden's Middle East Policy Puts Americans at Risk

Read More »

Read More »

NUESTRAS PELICULAS FAVORITAS DE TERROR

#premiosgoya2024 #cine #terrorjapones #terror #cineespañol

Hablamos con Marcos García Ortega sobre nuestras películas de terror favoritas. Desde clásicos hasta joyas ocultas.

Suscríbete a su canal: @BladeCinema5481

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página...

Read More »

Read More »

10% Dividendenrendite mit British American Tobacco Aktien!

Die British American Tobacco Aktie bietet aktuell bereits 10% Dividendenrendite. Ich kaufe nun weitere Aktien von BAT dazu! Ein weiterer Vorteil ist, dass die Dividenden aus Großbritannien Quellensteuerfrei sind!

Meine Depotempfehlung 3,9 % Tagesgeld-Zinsen und 5,3% für Einlagen in USD

https://link.aktienmitkopf.de/Depot*

? Tracke deine Dividenden mit dieser App http://myfinances24.de/mydividends24

? Mein Buch! Der Rationale Kapitalist...

Read More »

Read More »

Los DESAFÍOS que enfrentan los PAÍSES LATINOAMERICANOS

VIDEO COMPLETO EN MI CANAL.

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

“Dann können wir auch Konten stilllegen!”

Immer mehr Menschen haben das berechtigte Gefühl, dass die Meinungsfreiheit in Deutschland in Gefahr ist. Nun geht es auch noch der ökonomischen Freiheit an den Kragen! Bundesinnenministerin Nancy Faeser will ein weiteres Gesetz auf den Weg bringen, welches im Extremfall sogar Konten von "rechtsextremen" Netzwerken stilllegen könnte!

Meine Depotempfehlung 3,9 % Tagesgeld-Zinsen und 5,3% für Einlagen in USD...

Read More »

Read More »

New Jobs Report: Full-Time Jobs Disappear as Fewer Americans Find Work

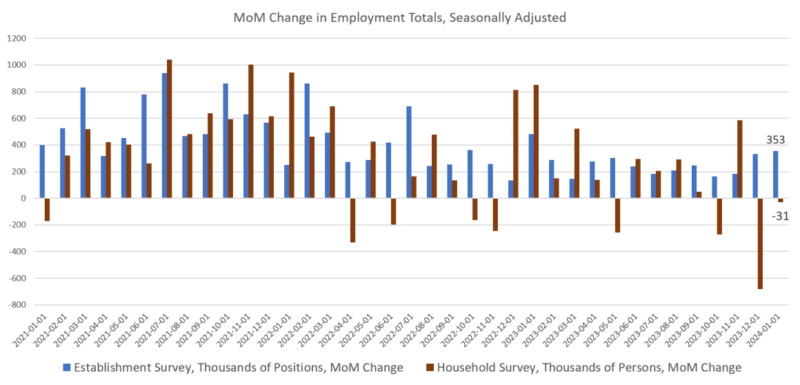

According to a new report from the federal government's Bureau of Labor Statistics last Friday, the US economy added 353,000 jobs for the month of January while the unemployment rate held at 3.7%. CNN news was sure to tell us that this was a "shockingly good jobs report" and it "shows America's economy is booming."

At this point, many of us who follow these numbers have become accustomed to the routine: the BLS reports...

Read More »

Read More »

Wieviel kostet ein König? #royals

Wieviel kostet ein König? ? #royals

Die jährlichen Ausgaben sind enorm.

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir...

Read More »

Read More »

Week Ahead: Will Soft US CPI and Retail Sales Mark the End of the Interest Rate Adjustment and Help Cap the Greenback?

The

markets are still correcting from the overshoot on rates and the dollar that

took place in late 2023. The first Fed rate cut has been pushed out of March

and odds of a May move have been pared to the lowest since last November. The

extent of this year's cuts has been chopped to about 4.5 quarter-point move

(~112 bp) from more than six a month ago. The market has reduced the extent

of ECB cuts to about 114 bp (from 160 bp at the end of January...

Read More »

Read More »

Fed Wisdom and the Magnificent Seven

In this week's episode, Mark takes a quick look back at Fed wisdom in the year 2000, and then surveys today's stock market—and, in particular, the Magnificent Seven stocks, which represent very narrow leadership of the overall stock market.

Be sure to follow Minor Issues at Mises.org/MinorIssues.

Get your free copy of Dr. Guido Hülsmann's How Inflation Destroys Civilization at Mises.org/IssuesFree.

Read More »

Read More »