Tag Archive: Featured

China schockt alle mit neuen Wirtschaftszahlen!

Zu meinen Onlinekursen: https://thomas-anton-schuster.coachy.net/lp/finanzielle-unabhangigkeit

Vortrags- und Seminartermine, sowie kostenlose Anforderung des Aktienbewertungsblatts: https://aktienerfahren.de

Read More »

Read More »

4-19-24 Did You Pay Your Fair Share of Taxes?

Markets respond to Israel attack on Iran; Procter & Gamble disappoints; markets are in a churning phase. Fed rate decisions & market behaviors. How much do you really need to survive in retirement (What's your number?) Managing expectations, spending habits, and dependency on Social Securituy; the scinece & art of financial planning; retirement realities. The intimate process of deliverying financial plans; Candid Coffee preview. The...

Read More »

Read More »

Kickstart your FX trading for April 19 w/ a technical look at the EURUSD, USDJPY & GBPUSD

What is driving the FX markets after Israel's retaliation against Irans weekend drone attack

Read More »

Read More »

Swiss Fintech Awards 2024 Announce Top 10 Swiss Fintech Startups

A jury of 20 experts from the Swiss fintech space have reviewed over 60 applications (out of a total of 100 submissions) of fintech startups and have picked the five most promising companies in the categories “Early Stage Start-up of the Year” and “Growth Stage Start-up of the Year” for their 2024 edition.

Reducing Friction And Adding Value With AI And Blockchain Applications

While being diverse in its use cases, this year’s top 10 of the Swiss...

Read More »

Read More »

Robeyns Peter to Pay Paul

Limitarianism: The Case against Extreme Wealthby Ingrid RobeynsAstra House, 2022; 301 pp.Some people have vastly more income and wealth than others, and this situation greatly disturbs Ingrid Robeyns, who teaches ethics at Utrecht University. She does not want to replace the market economy with central planning, but no one should be allowed to become a billionaire. Some of her comments on central planning sound like they might have emanated from...

Read More »

Read More »

FDR’s War Against Civil Liberties

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

CERN, hypersonic planes and archaeology are the focus of our #science #podcast, The Swiss Connection

Check out new episodes of the 'Swiss Connection' science podcast. Search for ‘The Swiss Connection’ on Apple Podcasts, Overcast, Spotify, or wherever you get your podcasts.

https://www.youtube.com/playlist?list=PLfpcqY4d92c6mVUR9ZGjZgTAu_XkMmRxE

---

swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events.

For more...

Read More »

Read More »

Wahnsinn: Strack-Zimmermann lässt die Maske fallen!

Unfassbar. Diese Politik MUSS AUFHÖREN! SOFORT!!!!

Depotempfehlung 3,9 % Tagesgeld-Zinsen und 5,3% für Einlagen in USD

https://link.aktienmitkopf.de/Depot*

? Tracke deine Dividenden mit dieser App http://myfinances24.de/mydividends24

? Mein Buch! Der Rationale Kapitalist ►►http://amzn.to/2kludNT

?JETZT auch als Hörbuch bei Audible ►► https://goo.gl/iWvTRR

Haftungsausschluss: Anlagen in Wertpapieren und anderen Finanzinstrumenten bergen immer das...

Read More »

Read More »

Carl Menger Explains Caitlin Clark’s “Low” Rookie Salary and Her Monetized Popularity

President Joe Biden is outraged. It seems that women’s basketball star Caitlin Clark, who played for the University of Iowa, does not have a rookie Women’s National Basketball Association (WNBA) that a typical NBA (for the men) top draft pick would have. He declared on his official X (formerly Twitter) account:Women in sports continue to push new boundaries and inspire us all. But right now we're seeing that even if you're the best, women are not...

Read More »

Read More »

USDJPY Technical Analysis – Waiting for a breakout

#usdjpy #forex #technicalanalysis

In this video you will learn about the latest fundamental developments for the USDJPY pair. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

1:40 Technical Analysis with Optimal Entries....

Read More »

Read More »

Gross Domestic Income Shows America Is In Stagnation

In a recent CNN poll, 48% of respondents stated that they believe the economy remains in a downturn, and only 35% said that things in the country today are going well. The disparity between somber economic sentiment and a surprisingly strong headline unemployment rate and Gross Domestic Product (GDP) can be easily explained.The divergence between headline GDP and Gross Domestic Income (GDI) is staggering. While GDP suggests a strong economy, GDI...

Read More »

Read More »

The PPI Again!

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

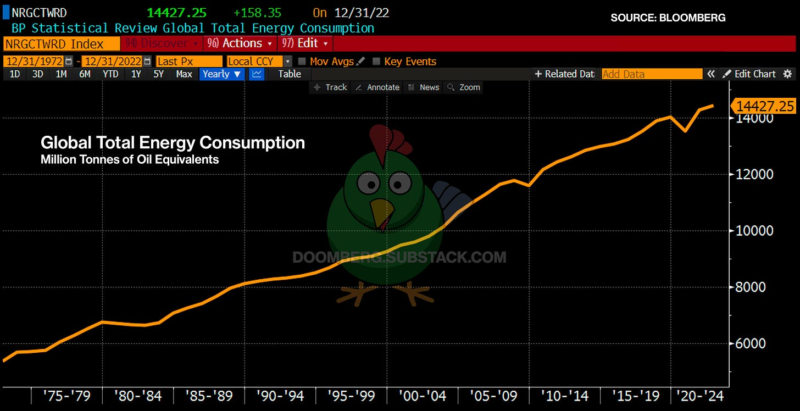

Climate Worries Are Non-Credible, Luxury Beliefs That Harm Civilization Itself

I live in a small village at the edge of lands surrounded by very harsh nature. Those who occupied these valleys in ages past lived ruthlessly dangerous lives, where starvation was a constant worry, the sea just as often nurtured as it took away, and the winters were long and perilous. Nowadays, while I’m walking the desolate mountains or admiring the fierce storms from inside my nice, sheltered existence, echoing in my head is Thomas Hobbes’s...

Read More »

Read More »

Navigating Market Bubbles and Lessons on Shorts – Andy Tanner

In this episode of the Cashflow Academy podcast, host Andy Tanner, along with guests Noah Davidson and Corey Halliday, dives into a rich discussion on market strategies, focusing on shorting the market, insights from the movie 'The Big Short,' and the intricacies of CDOs and CDSs.

They touch upon the actions and insights of notable investors like Michael Burry, Mark Cuban, and Warren Buffett, examining their strategic moves in the banking and...

Read More »

Read More »

How the World can Tackle Climate Change

How the #world can tackle #climatechange.

From my conversation with Jake Tapper on @CNN State of the Union.

#globalwarming #environment #raydalio #principles #climate #climateaction

Read More »

Read More »

+18% im MSCI World: Don’t you start thinking #etf

+18% im MSCI World? Obwohl man doch eigentlich sagt, dass es durchschnittlich 7-8% p. a. sind? Wie ist das möglich? Saidi erklärt Dir heute was es damit auf sich hat und wieso Du trotzdem aufpassen solltest.

Read More »

Read More »

Cayetana Álvarez de Toledo Destroza a Sánchez y Bolaños

#CAYETANA #daniellacalle #libertad #españa #economia #pedrosanchez

Aquí tienes el enlace del programa completo - &t=1s

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon -...

Read More »

Read More »

Ich raste komplett aus!

Unfassbar. Diese Politik MUSS AUFHÖREN! SOFORT!!!!

Depotempfehlung 3,9 % Tagesgeld-Zinsen und 5,3% für Einlagen in USD

https://link.aktienmitkopf.de/Depot*

Bildrechte: By Superbass - Own work, CC BY-SA 4.0, https://commons.wikimedia.org/w/index.php?curid=112266926

? Tracke deine Dividenden mit dieser App http://myfinances24.de/mydividends24

? Mein Buch! Der Rationale Kapitalist ►►http://amzn.to/2kludNT

?JETZT auch als Hörbuch bei Audible ►►...

Read More »

Read More »