Tag Archive: Featured

Steuerfrei deutsche Rente im Ausland beziehen? Geht das? ️#rente

Steuerfrei deutsche Rente im Ausland beziehen? Geht das? ?️#rente

? Ja, das geht, aber dafür müssen zwei Bedingungen erfüllt sein: Erstens muss das Wohnsitzland des Rentners gemäß Doppelbesteuerungsabkommen mit Deutschland das Recht haben, die deutsche Rente zu besteuern. Und zweitens muss das Land entschieden haben, obwohl es das Recht dazu hat, die Rente nicht zu versteuern.

Momentan erfüllen sieben Länder diese Bedingungen. Dazu gehören...

Read More »

Read More »

NVDA, SMCI, Bitcoin – So bekommst du diese Gewinner in dein Depot

Die meisten Börsenteilnehmer verpassen die bestlaufendsten Aktien oder steigen erst sehr spät ein. Im heutigen Video erkläre ich dir an Beispielen, wie du große Kurssteigerungen nicht mehr verpasst.

Vereinbare jetzt dein kostenfreies Beratungsgespräch:

https://jensrabe.de/Q1Termin24

Tägliche Updates ab sofort auf:

https://aktienkannjeder.de

Schau auf meinem Instagram-Account vorbei:

@jensrabe_official

https://www.instagram.com/jensrabe_official...

Read More »

Read More »

AUDUSD continues its run to the upside and extends to the 38.2% retracement of move lower.

The AUDUSD continued its run to the upside started yesterday and in the process tests the 38.2% of the move down from the December high at 0.66059. Just above that is a swing area between 0.66124 and 0.6624 in play.

Read More »

Read More »

Help Us Give Scholarships for AERC!

This month, we will host the Austrian Economics Research Conference (AERC), one of our most important programs. We’ll have thirty-one students attending, and nineteen students will deliver papers of their own. How encouraging!

Read More »

Read More »

The Difference Between Trading vs Investing – Andy Tanner

In this episode of the Cash Flow Academy Podcast hosted by Andy Tanner, he, along with his longtime friends Corey Halliday and Noah Davidson, discuss the difference between trading stocks and investing in businesses.

They highlight the importance of a person's temperament when making investment decisions, the crucial role of having a systematic approach in trading, and how trading could be a faster way of making money. They also mention the...

Read More »

Read More »

Kickstart your FX trading for March 7 with a technical look at EURUSD, USDJPY and GBPUSD

The EURUSD is moving lower on the back of the ECB and the USDJPY is moving lower on the back of the BOJ.

Read More »

Read More »

Ampel will Renten Milliarden für Klima-Transformation!

Geht es noch um die Rente oder geht es um die Klima-Transformation? Man weiss es nicht so genau!

Meine Depotempfehlung 3,9 % Tagesgeld-Zinsen und 5,3% für Einlagen in USD

https://link.aktienmitkopf.de/Depot*

? Tracke deine Dividenden mit dieser App http://myfinances24.de/mydividends24

Bildrechte: Von Jan Zappner / re:publica - re:publica 23 - Tag 1, CC BY-SA 2.0, https://commons.wikimedia.org/w/index.php?curid=133942579

? Mein Buch! Der Rationale...

Read More »

Read More »

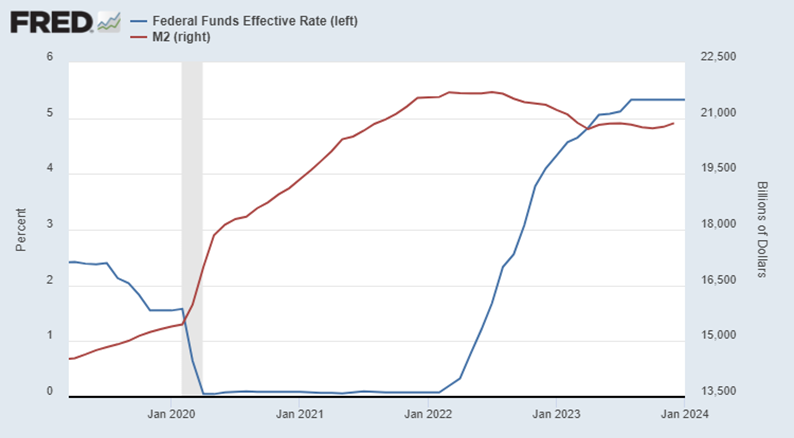

Liquidity Problems Are Closer Than You Think

Earnings growth are a function of economic growth; the US Economy is de-coupled from the rest of the world, which economy is poor. The danger of deficits (that are funding our economic growth); SOTU Preview: "The economy is great." Market continues trading in a very tight range, but ever upward; this is when complacency sets in. The market is setting up for correction as the election draws nearer. Are we in a bubble or the market top; how...

Read More »

Read More »

A Circus of Errors

When Nvidia reported high fourth quarter earnings for 2023 in February 2024, it sparked a general rally in stock markets. Stock markets in the United States, Japan, and Europe jumped to all-time highs after a few days of slight declines.

Read More »

Read More »

Central Banks and Housing Finance

Although manipulating housing finance is not among the Federal Reserve’s statutory objectives, the U.S. central bank has long been an essential factor in the behavior of mortgage markets, for better or worse, often for worse.

Read More »

Read More »

CEO pay: can Switzerland compete with the US?

Swiss CEOs are some of the best paid in Europe but compared to peers in the United States, their salaries look modest. Some in the Swiss pharmaceutical industry see this as a problem.

Read More »

Read More »

SWISS reports highest ever profit

SWISS’ turnover totalled CHF5.3 billion ($6 billion) last year, the airline announced on Thursday, a significant increase on the previous year’s CHF4.4 billion, and a return to 2019 levels for the first time since the pandemic.

Read More »

Read More »

Eklat bei Markus Lanz: Grüne außer Kontrolle!

Bei Markus Lanz offenbart die Vorsitzende der Grünen Jugend, Katharina Stolla ihr Marxistisches Weltbild!

Meine Depotempfehlung 3,9 % Tagesgeld-Zinsen und 5,3% für Einlagen in USD

https://link.aktienmitkopf.de/Depot*

? Tracke deine Dividenden mit dieser App http://myfinances24.de/mydividends24

Bildrechte: Von Jan Zappner / re:publica - re:publica 23 - Tag 1, CC BY-SA 2.0, https://commons.wikimedia.org/w/index.php?curid=133942579

? Mein Buch! Der...

Read More »

Read More »

The American Economy: A House of Cards

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

USDJPY Technical Analysis – Rate hike speculations lead to an INCREDIBLE appreciation in the Yen

#usdjpy #forex #technicalanalysis

In this video you will learn about the latest fundamental developments for the USDJPY pair. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

1:24 Technical Analysis with Optimal Entries.

3:23 Upcoming Economic Data....

Read More »

Read More »

Wichtige Morning News mit Oliver Klemm #263

Kostenfreies Video-Training (Durch Trading in 2024 absichern) ? https://oliverklemmtrading.com/casestudy-1?utm_source=youtube&utm_medium=social&utm_campaign=tradingcoacholi&utm_term=morning-news&utm_content=1

Klicke hier, um dich direkt gemeinsam mit Oli unabhängig zu machen ?...

Read More »

Read More »

Bill Belichick & Ray Dalio on Bill’s Most Important Principles: Part 2

#BillBelichick and I discuss his most important principles for success: Part 2. #principles #success #professionalfootball #teamwork

If you enjoy this, you can find our full conversation here: -TUGz4

Read More »

Read More »

Hong Kong

? Panda commemorative coins started in 1984 for the 3rd Hong Kong International Coin Exposition. ?? With a limited mintage of 1000, this first issue is a RARE FIND! ✨

❗ONLY 3 IN STOCK❗Call to order: 800.800.1865

#fyp #chinamint #chinese #commemorative #panda #ounce #coin #silver #sterling #silverstacking #silverbug #money #metals #moneymetals #numismatic #rare

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube...

Read More »

Read More »