Tag Archive: Europe

FX Daily, April 10: Eight Things to Know about Global Capital Markets on Good Friday

Most of the financial centers in Europe and North America are closed today for the Good Friday holiday. Many markets in Europe will also be closed on Monday. Here is a summary of key developments.

Read More »

Read More »

FX Daily, April 9: Three Deals Needed ahead of Holiday Weekend

Overview: Three deals need to be struck. First, the Eurogroup of finance ministers needs to reach an agreement of proposals for joint action to the heads of state. Second, oil producers need to cut output if prices are to stabilize. Third, the US Congress needs to strike a deal to provide more funding. Investor seems hopeful, and risk appetites are have lifted equities.

Read More »

Read More »

Cool Video: OIl, ECB, and Animal Spirits

I had the privilege to join Ben Lichtenstein at TD Ameritrade (from a remote location) this morning to talk about the global markets. I make four points. First, the reversal of the S&P 500 yesterday set the tone for Asia and Europe. Volatility throughout the capital markets remains elevated, even if off the peaks.

Read More »

Read More »

Schaetze To That

When Mario Draghi sat down for his scheduled press conference on April 4, 2012, it was a key moment and he knew it. The ECB had finished up the second of its “massive” LTRO auctions only weeks before. Draghi was still relatively new to the job, having taken over for Jean-Claude Trichet the prior November amidst substantial turmoil.

Read More »

Read More »

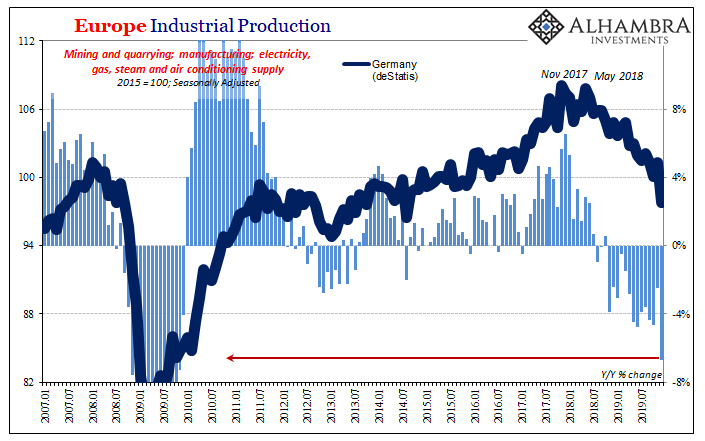

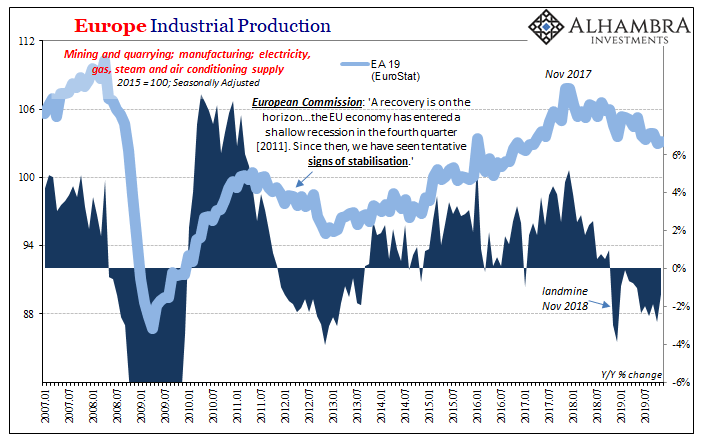

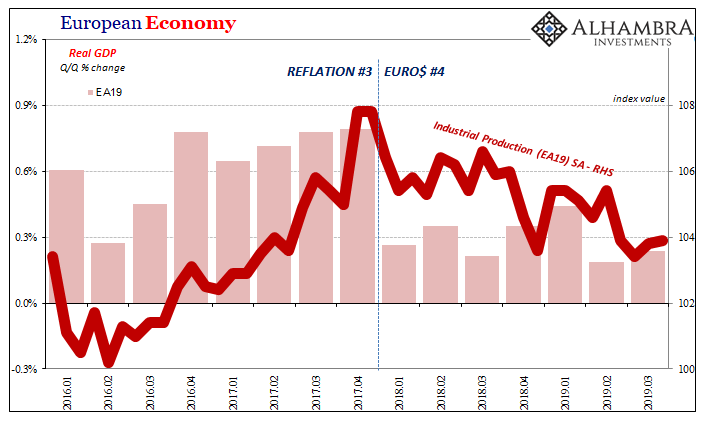

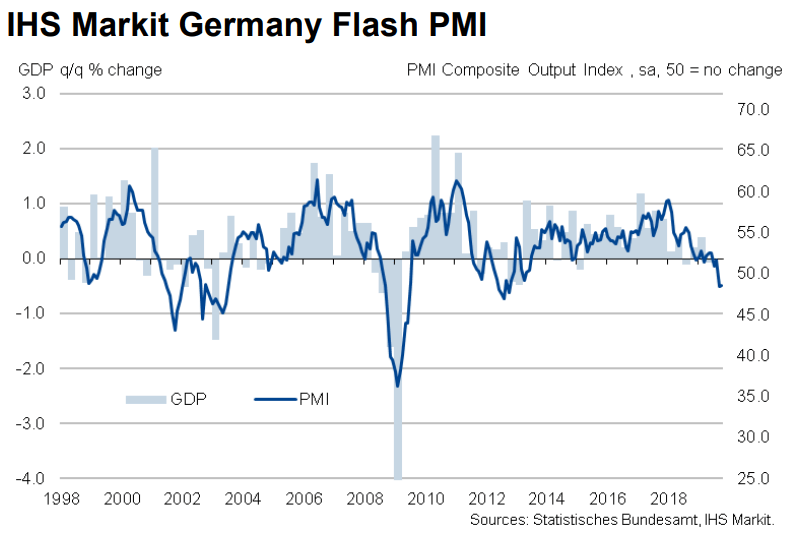

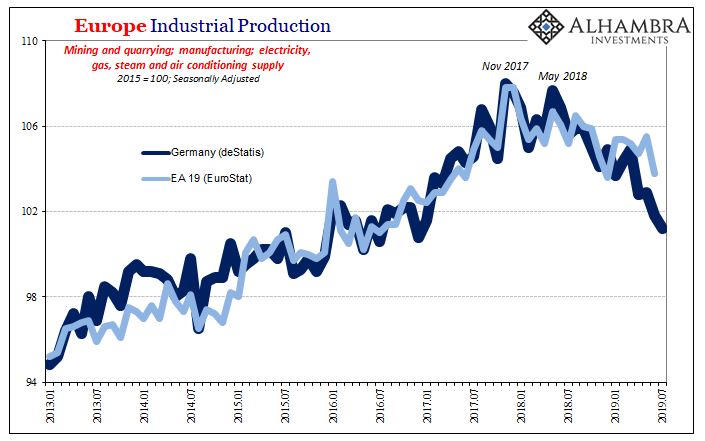

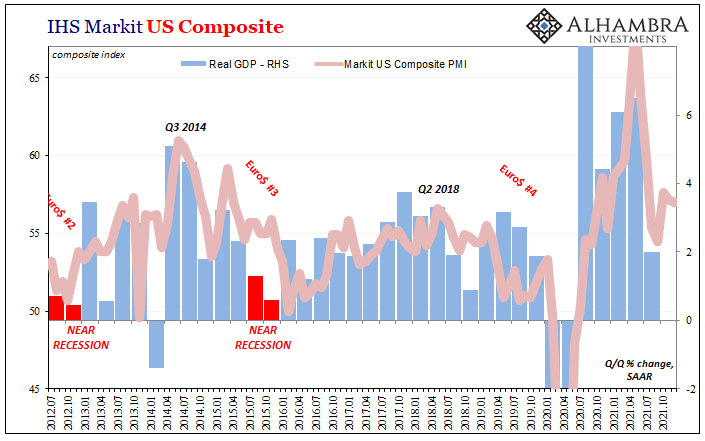

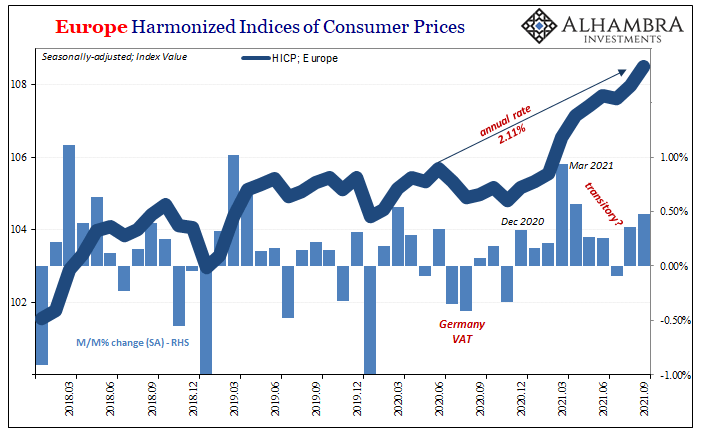

European Data: Much More In Store For Number Four

It’s just Germany. It’s just industry. The excuses pile up as long as the downturn. Over across the Atlantic the situation has only now become truly serious. The European part of this globally synchronized downturn is already two years long and just recently is it becoming too much for the catcalls to ignore. Central bankers are trying their best to, obviously, but the numbers just aren’t stacking up their way.

Read More »

Read More »

As the Data Comes In, 2019 Really Did End Badly

The coronavirus began during December, but in its early stages no one knew a thing about it. It wasn’t until January 1 that health authorities in China closed the Huanan Seafood Wholesale Market after initially determining some wild animals sold there might have been the source of a pneumonia-like outbreak. On January 5, the Wuhan Municipal Health Commission issued a statement saying it wasn’t SARS or MERS, and that the spreading disease would be...

Read More »

Read More »

COT Black: German Factories, Oklahoma Tank Farms, And FRBNY

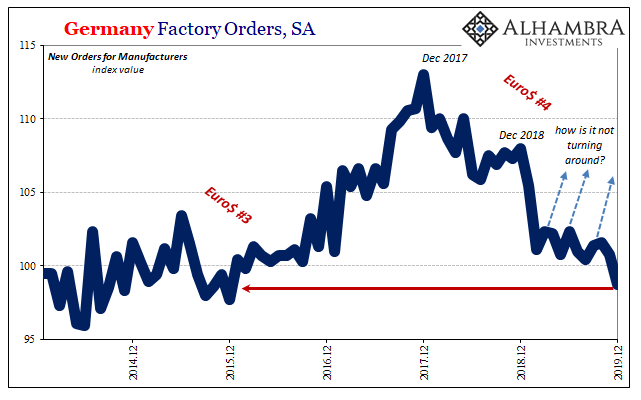

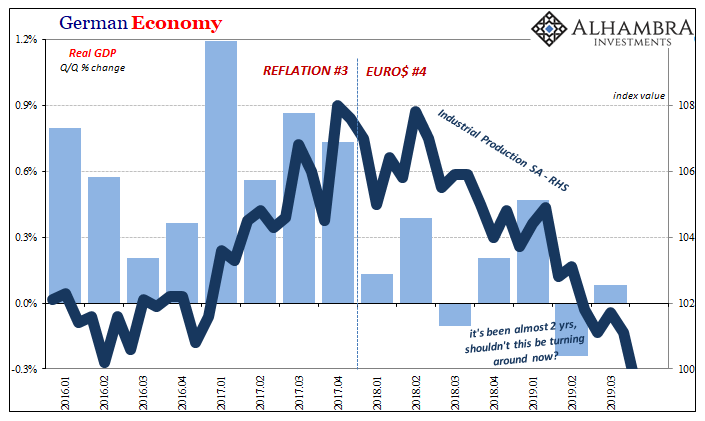

I wrote a few months ago that Germany’s factories have been the perfect example of the eurodollar squeeze. The disinflationary tendency that even central bankers can’t ignore once it shows up in the global economy as obvious headwinds. What made and still makes German industry noteworthy is the way it has unfolded and continues to unfold. The downtrend just won’t stop.

Read More »

Read More »

Germany, Maybe Europe: No Signs Of The Bottom

For anyone thinking the global economy is turning around, it’s not the kind of thing you want to hear. Germany has been Ground Zero for this globally synchronized downturn. That’s where it began, meaning first showed up, all the way back at the start of 2018. Ever since, the German economy has been pulling Europe down into the economic abyss along with it, being ahead of the curve in signaling what was to come for the whole rest of the global...

Read More »

Read More »

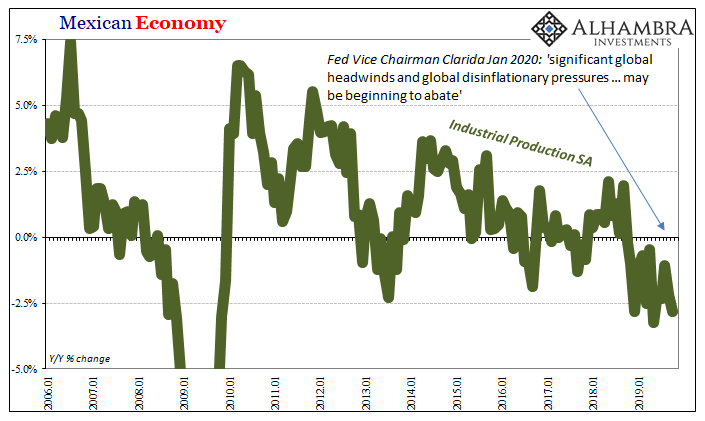

Global Headwinds and Disinflationary Pressures

I’m going to go back to Mexico for the third day in a row. First it was imports (meaning Mexico’s exports) then automobile manufacturing and now Industrial Production. I’ll probably come back to this tomorrow when INEGI updates that last number for November 2019. For now, through October will do just fine, especially in light of where automobile production is headed (ICYMI, off the bottom of the charts).

Read More »

Read More »

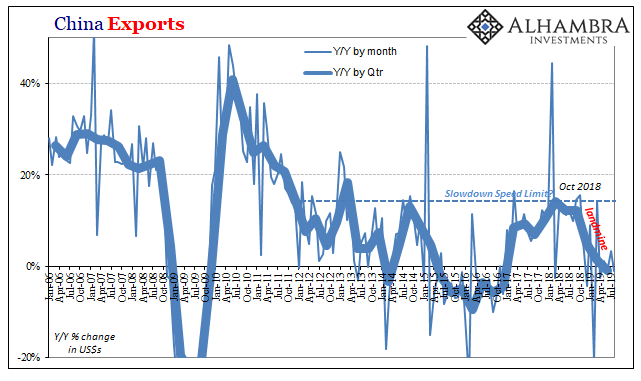

The Real Trade Dilemma

When I write that there are no winners around the world, what I mean is more comprehensive than just the trade wars. On that one narrow account, of course there are winners and losers. The Chinese are big losers, as the Census Bureau numbers plainly show (as well as China’s own). But even the winners of the trade wars find themselves wondering where all the spoils are.

Read More »

Read More »

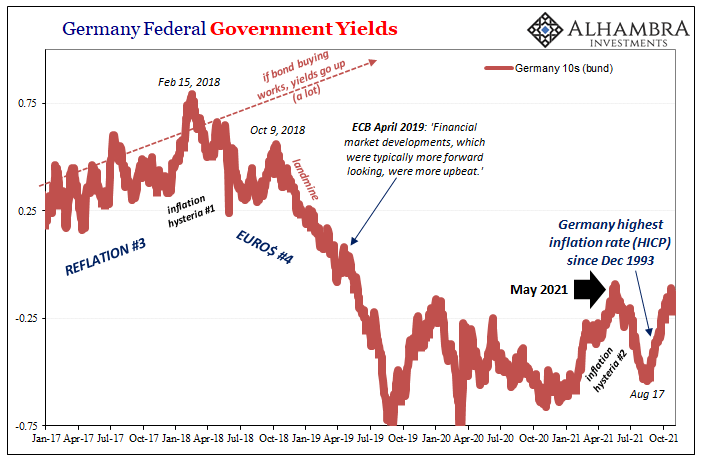

Latest European Sentiment Echoes Draghi’s Last Take On Global Economic Risks

While sentiment has been at best mixed about the direction of the US economy the past few months, the European economy cannot even manage that much. Its most vocal proponent couldn’t come up with much good to say about it – while he was on his way out the door. At his final press conference as ECB President on October 24, Mario Draghi had to acknowledge (sort of) how he is leaving quite the mess for Christine Lagarde.

Read More »

Read More »

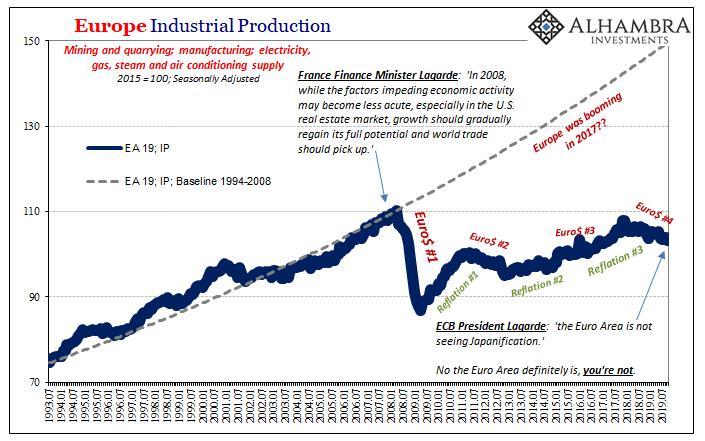

Lagarde Channels Past Self As To Japan Going Global

As France’s Finance Minister, Christine Lagarde objected strenuously to Ben Bernanke’s second act. Hinted at in August 2010, QE2 was finally unleashed in November to global condemnation. Where “trade wars” fill media pages today, “currency wars” did back then. The Americans were undertaking beggar-thy-neighbor policies to unfairly weaken the dollar.

Read More »

Read More »

You Will Never Bring It Back Up If You Have No Idea Why It Falls Down And Stays Down

It wasn’t actually Keynes who coined the term “pump priming”, though he became famous largely for advocating for it. Instead, it was Herbert Hoover, of all people, who began using it to describe (or try to) his Reconstruction Finance Corporation. Hardly the do-nothing Roosevelt accused Hoover of being, as President, FDR’s predecessor was the most aggressive in American history to that point, economically speaking.

Read More »

Read More »

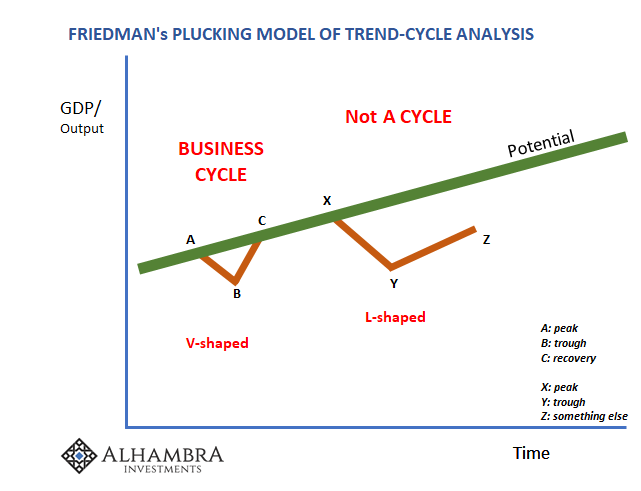

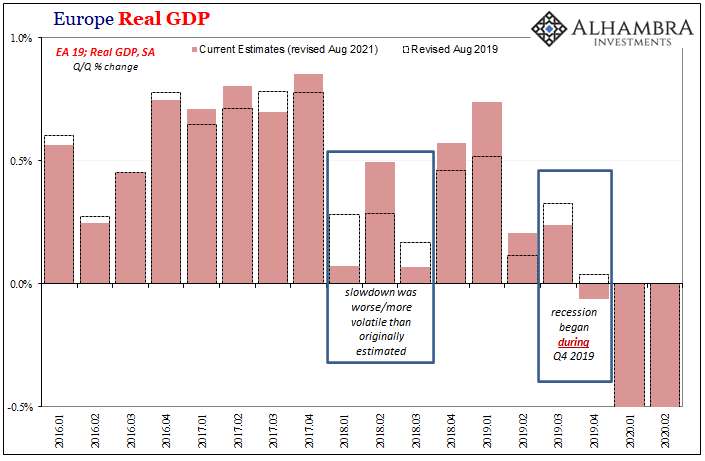

European Economy: A Time Recession

Eurostat confirmed earlier today that Europe has so far avoided recession. At least, it hasn’t experienced what Economists call a cyclical peak. During the third quarter of 2019, Real GDP expanded by a thoroughly unimpressive +0.235% (Q/Q). This was a slight acceleration from a revised +0.185% the quarter before.

Read More »

Read More »

More Signals Of The Downturn, Globally Synchronized

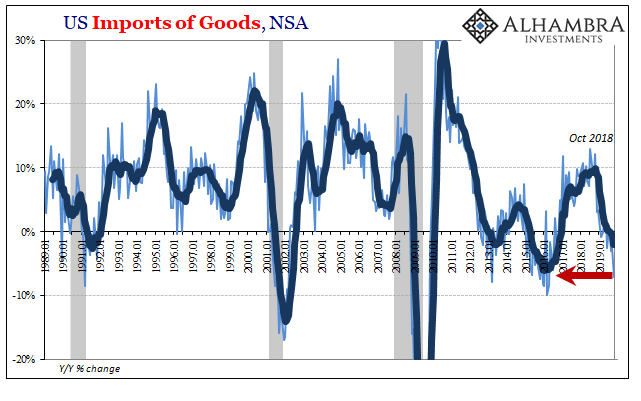

For US importers, October is their month. And it makes perfect sense how it would be. With the Christmas season about to kick into full swing each and every November, the time for retailers to stock up in hearty anticipation is in the weeks beforehand. The goods, a good many future Christmas presents, find themselves in transit from all over the world during the month of October.

Read More »

Read More »

FX Daily, November 6: Markets Catch Collective Breath as Dollar Consolidates Yesterday’s Advance

Overview: Investors seem to be catching their collective breath today, and the global capital markets are consolidating recent moves. A notable exception is the Chinese yuan, which has continued to strengthen, and the dollar has slipped back below CNY7.0. Asia Pacific equities were mixed, and the four-day advance in the regional benchmark stalled today.

Read More »

Read More »

Somehow Still Decent European Descent

How times have changed. In the middle of 2018, we were told the risks to the global economy were all tilted to the upside. If central bankers weren’t careful, they chanced an uncontrollable inflationary breakout, the kind that would make the last few years of the 2010’s look too much like the 1970’s. Always eager to bottle up the inflation genie, Germany out of everyone actually welcomed negative factors as they built up during the year.

Read More »

Read More »

No Longer Hanging In, Europe May Have (Been) Broken Down

Mario Draghi can thank Jay Powell at his retirement party. The latter being so inept as to allow federal funds, of all things, to take hold of global financial attention, everyone quickly shifted and forgot what a mess the ECB’s QE restart had been. But it’s not really one or the other, is it? Once it actually finishes, the takeaway from all of September should be the world’s two most important central banks each botching their...

Read More »

Read More »

A Bigger Boat

For every action there is a reaction. Not only is that Sir Isaac Newton’s third law, it’s also a statement about human nature. Unlike physics where causes and effects are near simultaneous, there is a time component to how we interact. In official capacities, even more so.

Read More »

Read More »

Is The Negativity Overdone?

Give stimulus a chance, that’s the theme being set up for this week. After relentless buying across global bond markets distorting curves, upsetting politicians and the public alike, central bankers have responded en masse. There were more rate cuts around the world in August than there had been at any point since 2009.

Read More »

Read More »