Tag Archive: eurodollar standard

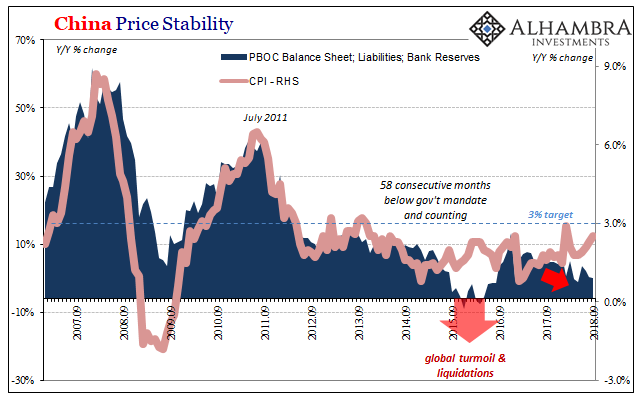

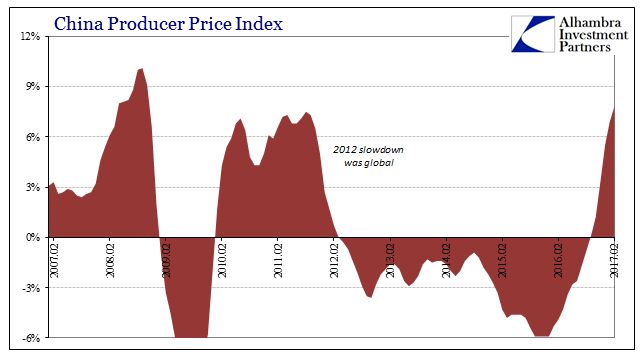

Raining On Chinese Prices

It was for a time a somewhat curious dilemma. When it rains it pours, they always say, and for China toward the end of 2015 it was a real cloudburst. The Chinese economy was slowing, dangerous deflation developing around an economy captured by an unseen anchor intent on causing havoc and destruction. At the same time, consumer prices were jumping where they could do the most harm.

Read More »

Read More »

China’s Seven Years Disinflation

In early 2011, Chinese consumer prices were soaring. Despite an official government mandate for 3% CPI growth, the country’s main price measure started out the year close to 5% and by June was moving toward 7%. It seemed fitting for the time, no matter how uncomfortable it made PBOC officials. China was going to be growing rapidly even if the rest of the world couldn’t.

Read More »

Read More »

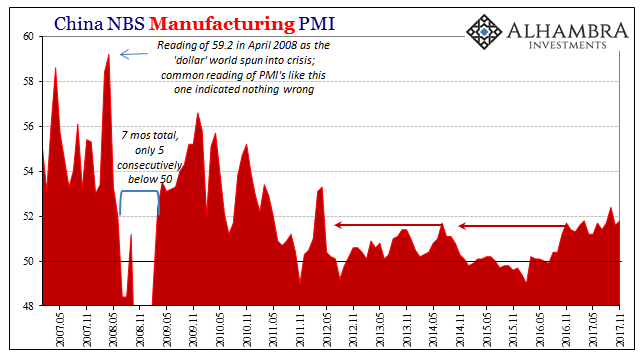

Three Years Ago QE, Last Year It Was China, Now It’s Taxes

China’s National Bureau of Statistics reported last week that the official manufacturing PMI for that country rose from 51.6 in October to 51.8 in November. Since “analysts” were expecting 51.4 (Reuters poll of Economists) it was taken as a positive sign. The same was largely true for the official non-manufacturing PMI, rising like its counterpart here from 54.3 the month prior to 54.8 last month.

Read More »

Read More »

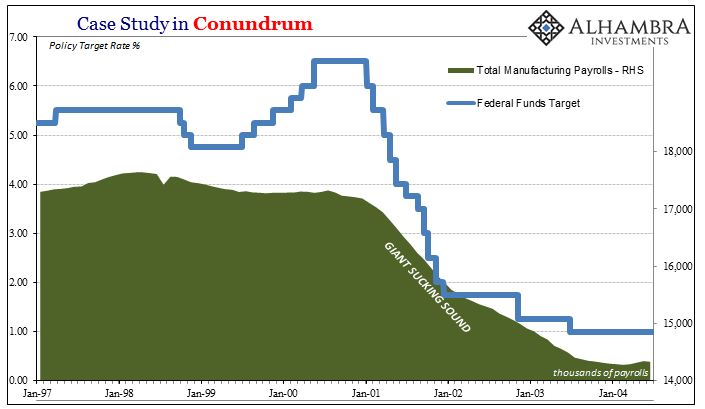

Giant Sucking Sound Sucks (Far) More Than US Industry Now

There are two possibilities with regard to stubbornly weak US imports in 2017. The first is the more obvious, meaning that the domestic goods economy despite its upturn last year isn’t actually doing anything positive other than no longer being in contraction. The second would be tremendously helpful given the circumstances of American labor in the whole 21st century so far. In other words, perhaps US consumers really are buying at a healthy pace,...

Read More »

Read More »

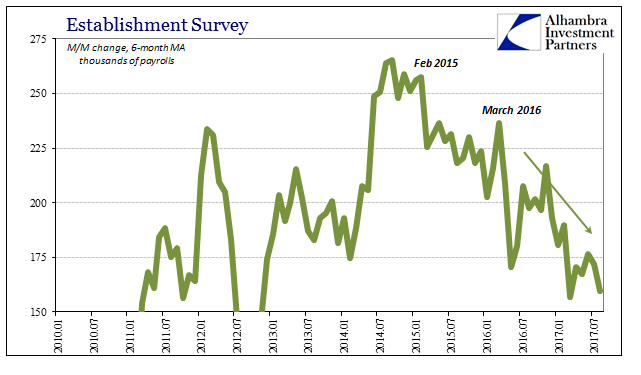

2017 Is Two-Thirds Done And Still No Payroll Pickup

The payroll report for August 2017 thoroughly disappointed. The monthly change for the headline Establishment Survey was just +156k. The BLS also revised lower the headline estimate in each of the previous two months, estimating for July a gain of only +189k. The 6-month average, which matters more given the noisiness of the statistic, is just +160k or about the same as when the Federal Reserve contemplated starting a third round of QE back in 2012.

Read More »

Read More »

Noose Or Ratchet

losing the book on Q4 2016 balance sheet capacity is to review essentially forex volumes. The eurodollar system over the last ten years has turned far more in this direction in addition to it becoming more Asian/Japanese. In fact, the two really go hand in hand given the native situation of Japanese banks.

Read More »

Read More »

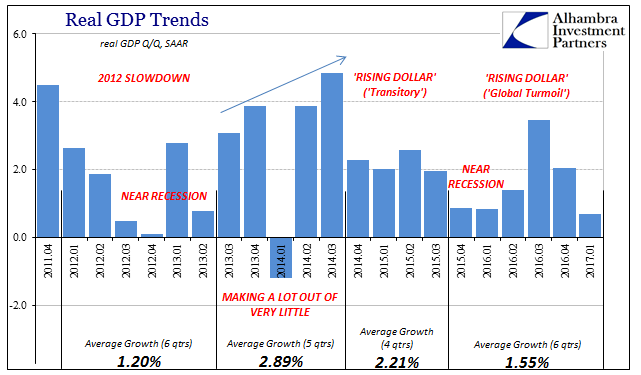

This Is Not Expansion

Back in October, the Bureau of Economic Analysis released GDP figures that suggested what those behind “reflation” had hoped. After a near miss to start 2016, the economy had shaken off the effects of “transitory” weakness, mainly manufacturing and oil, poised to perform in a manner consistent with monetary policy rhetoric.

Read More »

Read More »

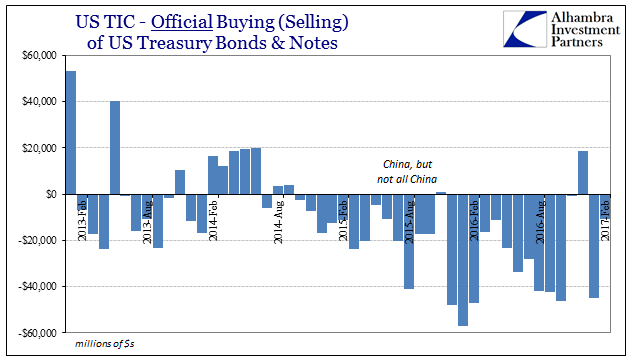

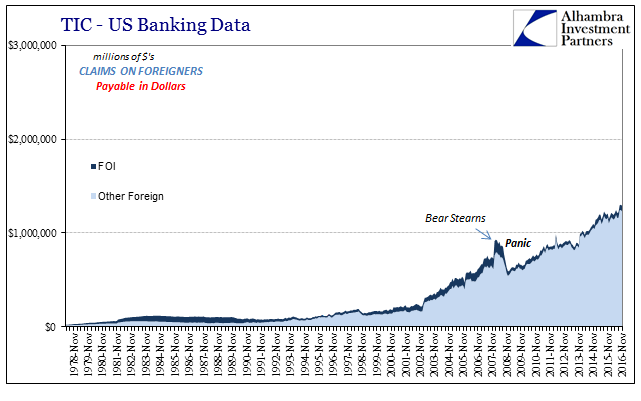

‘Dollar’ ‘Improvement’

According to the headline TIC statistics, foreign central banks have in the past six months sold the fewest UST’s since the 6-month period ended November 2015. That may indicate an easing of “dollar” pressure in the private markets due to “reflation” sentiment.

Read More »

Read More »

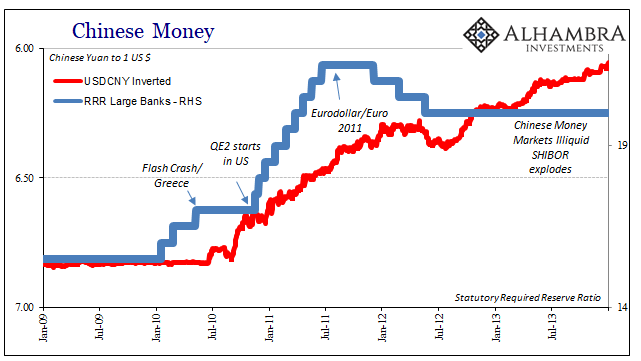

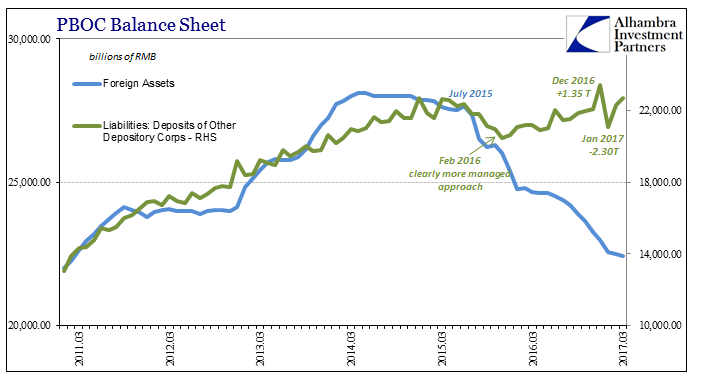

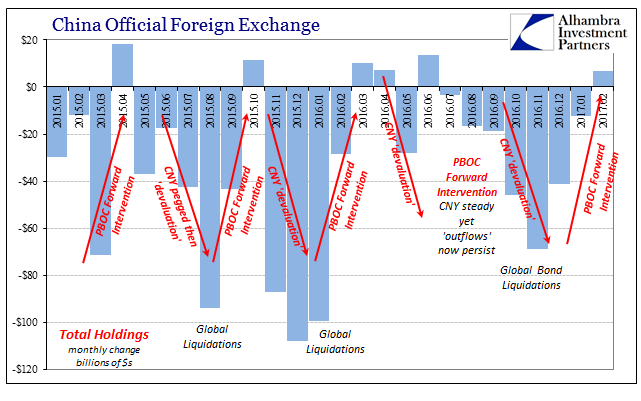

PBoC: Mechanical Tightening PBoC is China Central Bank

The mainstream narrative as it relates to Chinese money is “tightening.” Having survived the economic downturn last year, we are to believe that the PBOC is once again on bubble duty. They raised their reverse repo rates, considered to be their policy benchmarks, three times up to mid-March.

Read More »

Read More »

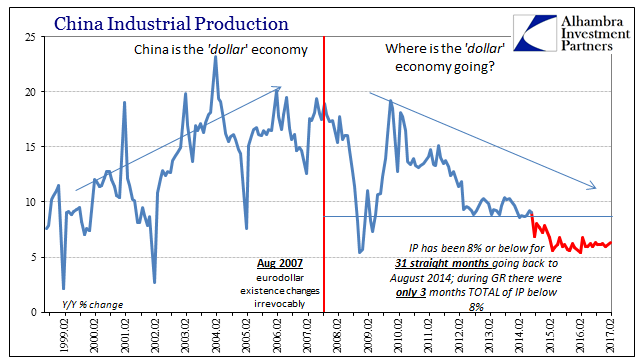

Assessing China’s Economic Risks

First quarter GDP in China rose 6.9%, better than expected and above the government’s target (6.5%) for 2017. It stands to reason, however, that if Communist officials thought they could get 6.9% to last for the whole year they would have made it their target, especially since 6.5% would be less than the GDP growth rate for 2016 (6.7%). In only that one way is China’s GDP statistic meaningful.

Read More »

Read More »

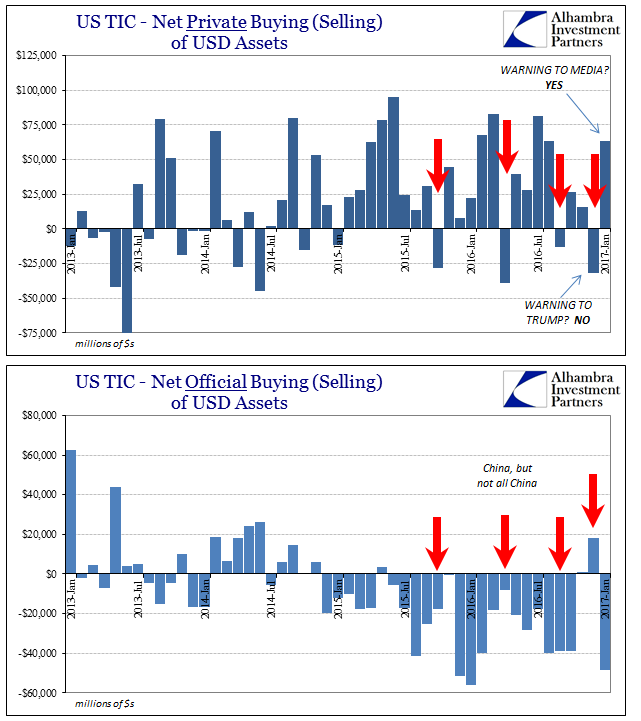

TIC Analysis of Selling

When the Treasury Department released its Treasury International Capital (TIC) data for December, what was a somewhat obscure report suddenly found mainstream attention. Private foreign investors had sold tens of billions in US securities primarily US Treasury bonds and notes which the media then made into some kind of warning to then-incoming President Trump. It was supposed to be a big deal, the kind of rebuke reserved for disreputable leaders of...

Read More »

Read More »

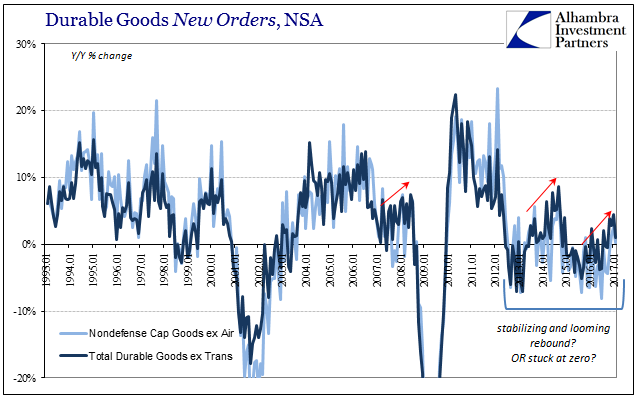

Durable Goods After Leap Year

New orders for durable goods (not including transportation orders) were up 1% year-over-year in February. That is less than the (revised) 4.4% growth in January, but as with all comparisons of February 2017 to February 2016 there will be some uncertainty surrounding the comparison to the leap year version.

Read More »

Read More »

China Starts 2017 With Chronic, Not Stable And Surely Not ‘Reflation’

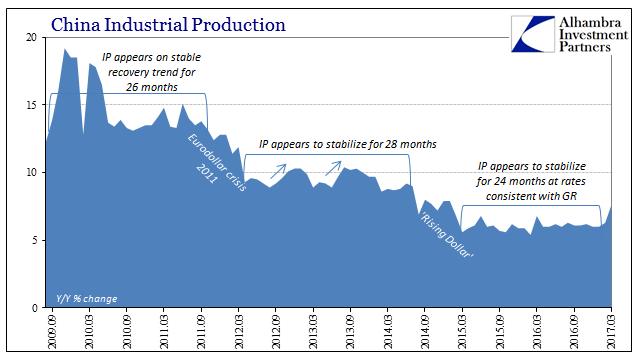

The first major economic data of 2017 from China was highly disappointing to expectations of either stability or hopes for actual acceleration. On all counts for the combined January-February period, the big three statistics missed: Industrial Production was 6.3%, Fixed Asset Investment 8.9%, and Retail Sales just 9.5%.

Read More »

Read More »

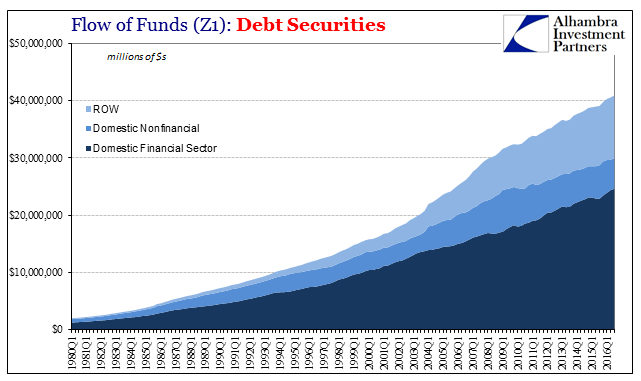

Do Record Debt And Loan Balances Matter? Not Even Slightly

We live in a non-linear world that is almost always described in linear terms. Though Einstein supposedly said compound interest is the most powerful force in the universe, it rarely is appreciated for what the statement really means. And so the idea of record highs or even just positive numbers have been equated with positive outcomes, even though record highs and positive growth rates can be at times still associated with some of the worst. It...

Read More »

Read More »

Same Country, Different Worlds

To my mind, “reflation” has always proceeded under false pretenses. This goes for more than just the latest version, as we witnessed the same incongruity in each of the prior three. The trend is grounded in mere hope more than rational analysis, largely because I think human nature demands it. We are conditioned to believe especially in the 21st century that the worst kinds of things are either unrealistic or apply to some far off location nowhere...

Read More »

Read More »

China And Reserves, A Straightforward Process Unnecessarily Made Into A Riddle

The fact that China reported a small increase in official “reserves” for February 2017 is one of the least surprising results in all of finance. The gamma of those reserves is as predictable as the ticking clock of CNY, in no small part because what is behind the changes in those balances are the gears that lie behind face of the forex timepiece.

Read More »

Read More »

Do Record Eurodollar Balances Matter? Not Even Slightly

The BIS in its quarterly review published yesterday included a reference to the eurodollar market (thanks to M. Daya for pointing it out). The central bank to central banks, as the outfit is often called, is one of the few official institutions that have taken a more objective position with regard to the global money system. Of the very few who can identify eurodollars, or have even heard of them, the BIS while not fully on board is at least open...

Read More »

Read More »

It Was ‘Dollars’ All Along

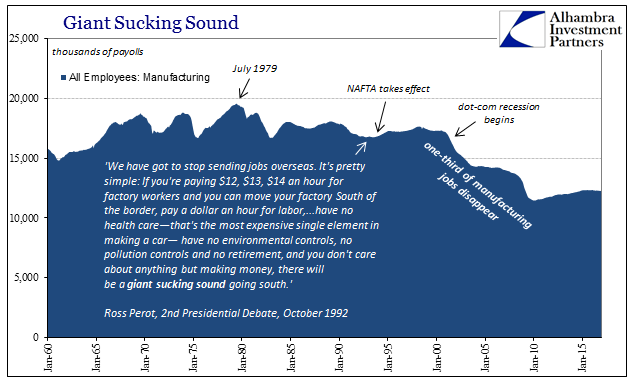

Ross Perot famously declared the “giant sucking sound” in the 1992 Presidential campaign. The debate over NAFTA did not end with George H. W. Bush’s defeat, as it simmered in one form or another for much of the 1990’s. Curiously, however, it seemed almost perfectly absent during the 2000’s, the very decade in which Perot’s prophecy came true. Americans didn’t notice because there was a bubble afoot.

Read More »

Read More »

Jobless Claims Look Great, Until We Examine The Further Potential For What We Really, Really Don’t Want

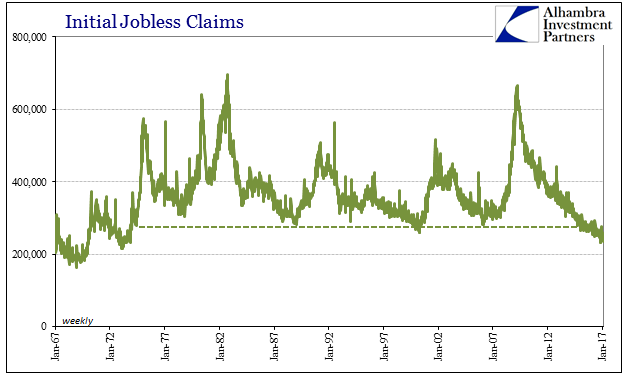

Initial jobless claims fell to just 234k for the week of February 4, nearly matching the 233k multi-decade low in mid-November. That brought the 4-week moving average down to just 244k, which was a new low going all the way back to the early 1970’s. Jobless claims seemingly stand in sharp contrast to other labor market figures which have been suggesting an economic slowdown for nearly two years.

Read More »

Read More »