Tag Archive: EU

FX Daily, April 23: Investors Take PMI Crash in Stride

Overview: Investors have remained fairly calm in the face of flash April PMI crashes and an increase of virus cases in several European countries. Most equity markets in the Asia Pacific region rose, with the notable exceptions of China and Australia. The Nikkei rose for the first time this week, and its 1.5% gain led the region.

Read More »

Read More »

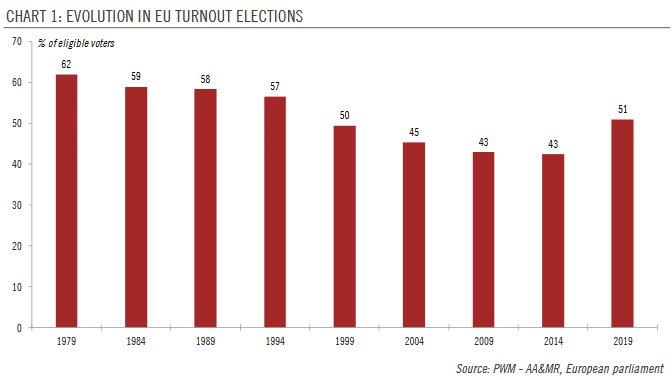

European elections – a more diverse but still pro-Europe parliament

Voter turnout for European parliament elections surged across the continent, exceeding 50% for the first time in a quarter century and breaking the downward trend of the last four decades. However, differences in turnout across the EU have been substantial and a more fragmented parliament has emerged.Voter turnout was up for the first time ever and at 51%, higher than in any election since 1994. The results delivered a parliament with a...

Read More »

Read More »

FX Daily, April 10: Be Careful What You Wish For

There were only a few formal disputes under NAFTA 1.0. It says more about the adjudication process than the underlying issues. It was not binding. The Democrats want stronger enforcement provisions in what the NAFTA 2.0. It is understandable. Still, without opening up the agreement, which had been already agreed to by three heads of state, it is difficult to see how this will happen.

Read More »

Read More »

Europe and China

The US-China trade talks look like they may very well continue through most of the second quarter, despite how much progress is being claimed. Meanwhile, the tariffs remain in effect, but the market's sensitivity to developments has slackened since it was clear the Trump and Xi were not going to meet at the end of this month.

Read More »

Read More »

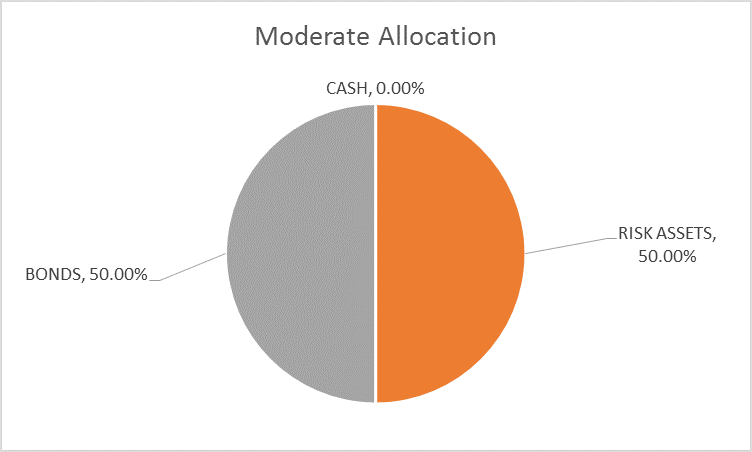

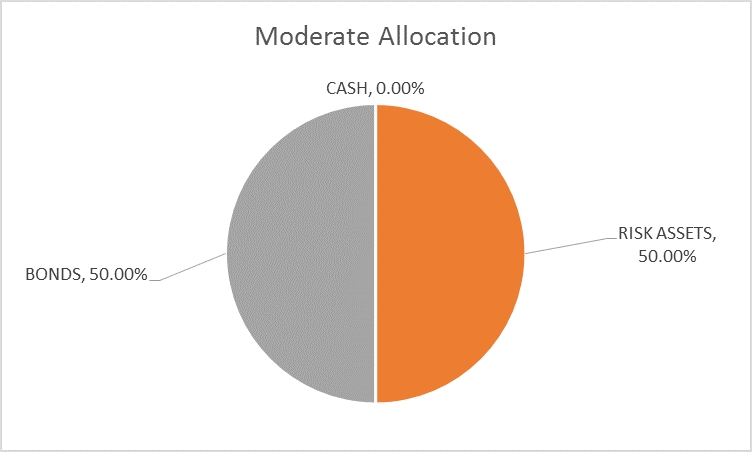

Global Asset Allocation Update

The risk budget is unchanged again this month. For the moderate risk investor, the allocation between bonds and risk assets is evenly split. The only change to the portfolio is the one I wrote about last week, an exchange of TIP for SHY.

Read More »

Read More »

Global Asset Allocation Update

Note: This will be a short update. We are shifting the timing of some of our reports. The monthly Global Asset Allocation update will now be published in the first week of the month, aiming for the first of each month. I’ll put out a full report next week. The Bi-Weekly Economic Review is shifting to a monthly update, published on the 15th of each month.

Read More »

Read More »

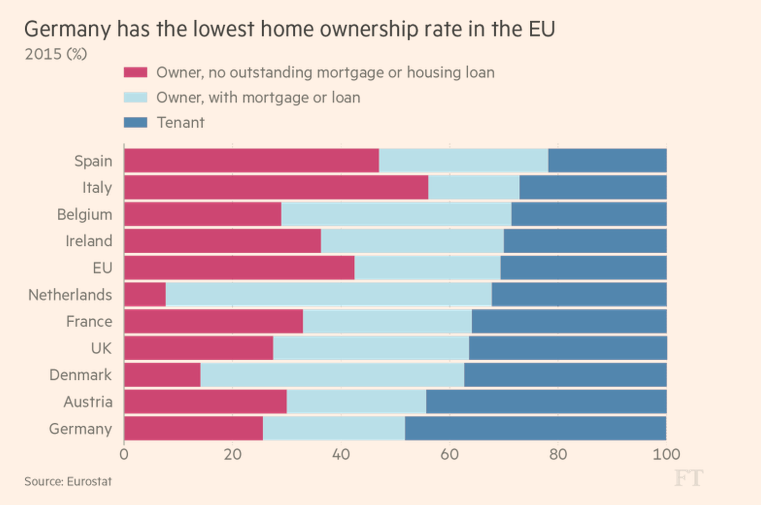

Great Graphic: Home Ownership and Measuring Inflation

Home ownership varies throughout the EU but is overall near US levels. Germany has the lowest home ownership, and Spain has the most. Italy has the least amount of mortgages. US include owner equivalent rents in CPI, the EU does not.

Read More »

Read More »

Rising Trade Tensions

Obama Administration has taken a hardline against China's trade practices. Other countries are also resisting China's arguments that it is a market economy. Last week, US imposed anti-dumping duties on imported washing machines from China.

Read More »

Read More »

No Big Thoughts, but Several Smaller Observations

Notable that as the CRB Index moves lower, MSCI emerging market equities have done well. European banks are retreating after the stress test results. Tokyo elected its first women governor as this seem to be in part a sign of protest against Abe.

Read More »

Read More »

FX Weekly Preview: EMU Returns to Center Stage in the Week Ahead

Key event in Europe is not on many calendars--it is a ruling by the European Court of Justice. UK government and Tory Party stabilizing, leaving the Labour Party in disarray. US economy appears to have accelerated into the end of Q2. BOJ's meeting at the end of the month.

Read More »

Read More »

Return of the Repressed: Europe’s Unresolved Banking Crisis

The IMF identified three banks that posted the most significant systemic risks. It has been overshadowed by new pressure on Italy's banks, and Three UK commercial real estate funds have been frozen to prevent redemptions.

Read More »

Read More »