Tag Archive: Emerging Markets

Emerging Markets: Preview of the Week Ahead

EM FX closed the week on a firm note, as softer than expected US CPI data weighed on the dollar. We continue to believe that investors are underestimating the Fed’s tightening potential. Meanwhile, idiosyncratic political risk remains high for MXN, TRY, and ZAR.

Read More »

Read More »

Emerging Markets: What has Changed

Thailand announced general elections will be held in November 2018. Czech police filed criminal charges against ANO leader Andrej Babis. South Africa President Zuma may face corruption charges that were previously dropped. The US suspended visa services for travelers from Turkey. Kenyan opposition candidate Odinga withdrew from a redo of the annulled presidential election. Saudi Arabia will take a more gradual approach to removing fuel subsidies....

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended the week under pressure, as US data points to a rate hike in December and perhaps more in 2018. FOMC minutes this Wednesday will be closely studied for clues. US retail sales and CPI data Friday will also be important. We believe the most vulnerable currencies in this environment are ZAR and TRY, but one could also add MXN and perhaps RUB to that mix too.

Read More »

Read More »

Emerging Markets: What has Changed

In the EM equity space as measured by MSCI, China (+4.1%), South Africa (+3.2%), and Hungary (+2.4%) have outperformed this week, while Egypt (-2.8%), Qatar (-2.7%), and Mexico (-1.7%) have underperformed. To put this in better context, MSCI EM rose 1.9% this week while MSCI DM rose 0.6%.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX firmed Friday, but capped off a bad week overall. US jobs data this Friday is unlikely to provide much clarity on Fed policy, though we think it remains on track to hike again in December. The Fed’s balance sheet reduction will start this month. We remain negative on EM, and believe selling pressures are likely to persist in Q4.

Read More »

Read More »

Emerging Markets: What has Changed

India Prime Minister Modi announced an INR163.2 bln program to deliver electricity to all households. Poland’s President Duda is trying to reach a compromise on judicial reforms. Fitch raised the outlook on Russia’s BBB- rating from stable to positive. Saudi Arabia announced it will remove the ban on women driving. South Africa’s biggest labor organization stepped up its opposition to President Zuma.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX was mostly firmer on Friday, but capped off a week of broad-based losses. US rates gave back some of post-FOMC rise, and that weighed on the dollar. Not much in the way of US data until Friday’s core PCE reading and Chicago PMI.

Read More »

Read More »

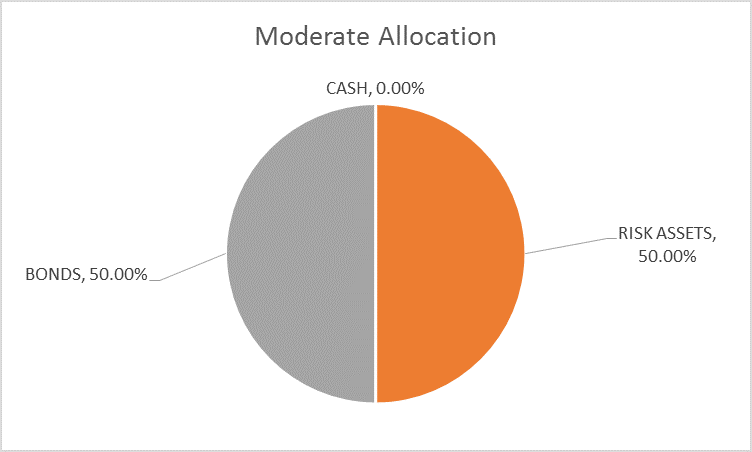

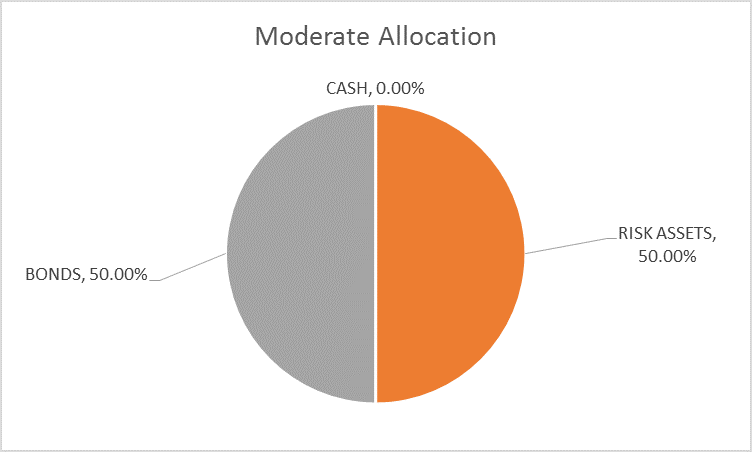

Global Asset Allocation Update: Step Away From The Portfolio

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are no changes to the portfolios this month. The post Fed meeting market reaction was a bit surprising in its intensity. The actions of the Fed were, to my mind anyway, pretty much as expected but apparently the algorithms that move markets today were singing from a different hymnal.

Read More »

Read More »

Emerging Markets: What has Changed

China plans to issue its first USD-denominated bond since 2004. China’s largest banks banned North Koreans from opening new accounts. The UN Security Council approved new sanctions on North Korea. Relations between Poland and the European Commission remain tense. Brazil’s central bank appears to be signaling discomfort with ongoing BRL strength.

Read More »

Read More »

Emerging Markets: Preview for the Week Ahead

EM FX ended the week on a mixed note, but still capped off a strong week overall. US data this week could challenge the market’s dovish take on the Fed. For now, though, the global liquidity outlook still seems to favor further gains in EM.

Read More »

Read More »

Emerging Markets: What has Changed

India Prime Minister Modi has started a cabinet shuffle. Freeport McMorAn ceded control of the world’s second largest copper mine to the Indonesian government. Central Bank of Russia took over Bank Otkritie, once Russia’s largest private bank. Kenya’s top court nullified last month’s presidential election. Fitch cut Qatar’s rating by one notch to AA- with negative outlook.

Read More »

Read More »

Emerging Market: Preview of the Week Ahead

EM FX ended last week on a strong note, buoyed by perceived dovishness from Yellen at the Jackson Hole symposium. However, US jobs data this Friday could test the market’s convictions. Within EM, data are likely to support our view that EM central banks can retain their largely dovish posture into 2018.

Read More »

Read More »

Global Asset Allocation Update: No Upside To Credit

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are other changes to the portfolio though so please read on. As I write this the stock market is in the process of taking a dive (well if 1.4% is a “dive”) and one can’t help but wonder if the long awaited and anticipated correction is finally at hand.

Read More »

Read More »

Emerging Markets: What has Changed

Tensions on the Korean peninsula are still rising. Hong Kong boosted its 2017 growth forecast. S&P affirmed Israel’s A+ rating but moved the outlook from stable to positive. The corruption investigation against Israeli Prime Minister Netanyahu has intensified. South Africa's parliament voted down the no confidence motion against President Zuma. Argentina officials are taking steps to support the peso. Banco de Mexico has ended its tightening cycle.

Read More »

Read More »

Emerging Markets: The Week Ahead

EM FX appears to be rolling over (see our recent piece “Is EM FX Finally Turning?”). Technical indicators are stretched as many EM currencies bump up against strong resistance levels. Strong US jobs data is bringing Fed tightening back into focus. We think ZAR could be shaping up to be the canary in a coalmine. It was -3% vs. USD last week and by far the worst in EM.

Read More »

Read More »

Emerging Markets: What has Changed

The Reserve Bank of India started an easing cycle by cutting all policy rates 25 bp. Bank Indonesia has tilted more dovish after signaling earlier this year that the easing cycle was over. Czech National Bank became the first in Europe to hike. Political risk is rising in Israel. President Trump signed the Russia sanctions bill. Nigeria is trying to unify its system of multiple exchange rates.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX was mixed last week, as markets await fresh drivers. Jobs report this Friday could provide greater clarity with regards to Fed policy. BOE and RBA meet but aren’t expected to change policy. Data is likely to reinforce the notion that inflation remains low in EM, allowing those central banks to remain dovish. Czech National Bank is the main exception, as it may start the tightening cycle this week.

Read More »

Read More »

Emerging Markets: What has Changed

Indonesia’s parliament approved a revised budget for 2017 that sees a wider deficit. Pakistan’s Supreme Court has ousted Prime Minister Sharif. Polish President Duda vetoed portions of the judicial reform bill submitted by the Law and Justice party.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX was mixed on Friday, but largely firmer over the entire week. Top performers were BRL, KRW, and ZAR, while the worst were ARS, MXN, and RUB. FOMC meeting this week poses some potential risks to the global liquidity story that’s supporting EM. Within EM, the low inflation/easy monetary policy narrative should continue with data and events this week.

Read More »

Read More »

Emerging Markets: What has Changed

South Korea proposed resuming military and humanitarian exchanges with North Korea. The European Union may sanction Poland over its controversial judicial overhaul. Turkish Prime Minister Yildirim announced a cabinet shuffle after meeting with President Erdogan. Turkey’s worsening relations with Germany will come with economic costs. South African Reserve Bank surprised markets by starting the easing cycle with a 25 bp cut to 7.0%.

Read More »

Read More »