Tag Archive: Emerging Markets

EM Preview for the Week Ahead

The still-growing impact of the coronavirus should keep EM and risk sentiment under pressure this week. The weekend G20 meeting in Saudi Arabia acknowledged the risks to the global economy and said participants agreed on a “menu of policy options.” However, the G20 offered little specific in terms of a coordinated policy response.

Read More »

Read More »

EM Preview for the Week Ahead

EM remains vulnerable to deteriorating risk sentiment as the coronavirus spreads. China announced a series of measures over the weekend to help support its financial markets, but this may not be enough to turn sentiment around yet. China markets reopen Monday after the extended Lunar New Year holiday and it won’t be pretty.

Read More »

Read More »

EM Preview for the Week Ahead

The spread of the coronavirus continues and is likely to weigh on risk assets and EM. Most markets in Emerging Asia are closed for all or part of this week due to the Lunar New Year holiday. China has extended the holiday until February 2 as it struggles to contain the virus.

Read More »

Read More »

EM Preview for the Week Ahead

Market sentiment on EM remains positive after the Phase One trade deal was signed. Data out of China is also supportive for EM. Key forward-looking data this week are Taiwan export orders and Korea trade data for the first 20 days of January. The global liquidity story also remains beneficial for risk, with the ECB, Norges Bank, BOC, and BOJ all set to maintain steady rates this week.

Read More »

Read More »

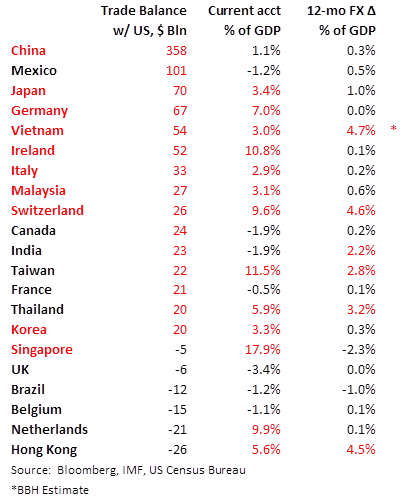

Some Thoughts on the Latest Treasury FX Report

The US Treasury’s latest “Macroeconomic and Foreign Exchange Policies of Major Trading Partners of the United States” report no longer considers China a currency manipulator. The underlying message is that the Trump administration will continue to use an ad hoc “carrot and stick” approach to improve US access to the domestic markets of its major trading partners.

Read More »

Read More »

EM Preview for the Week Ahead

EM has been able to get some traction as markets basically shrugged off the risk-off sentiment after the Iran attacks. This week’s planned signing of the Phase One trade deal should help boost EM further, but we remain cautious. The Iran situation is by no means solved, and we see periodic bouts of risk-off sentiment coming from smaller skirmishes.

Read More »

Read More »

EM Preview for the Week Ahead

While the global economic backdrop remains favorable for EM, rising geopolitical risks will be a growing headwind. The EM VIX surged above 18% Friday as Iran tensions escalated, the highest since early December. With these tensions likely to persist, EM may remain under some pressure for the time being. High oil prices are positive for the exporters in Latin America and the Middle East but negative for the importers in Asia and Eastern Europe.

Read More »

Read More »

EM Preview for the Week Ahead

EM FX was broadly firmer last week, taking advantage of the dollar’s soft tone as well as another wave of risk-on sentiment. Bullishness on the global economy is quite strong, whilst we are perhaps a bit more skeptical given ongoing weakness in the UK, Japan, and the eurozone. Dollar bearishness may also be overdone given our more constructive outlook on the US economy, but technical damage has been done that must now be repaired.

Read More »

Read More »

EM Preview for the Week Ahead

EM FX was mostly firmer last week. ZAR, PEN, and CLP outperformed while TRY, HUF, and CNY underperformed. MSCI EM traded at new highs for the cycle but ran out of steam near the 1110 area, while MSCI EM FX lagged a bit and has yet to surpass its July high. Overall, the backdrop for EM remains constructive but investors must be prepared to differentiate amongst credits in 2020.

Read More »

Read More »

EM Preview for the Week Ahead

Risk assets such as EM got a big boost last week, as tail risks from a hard Brexit and the US-China trade war have clearly ebbed. Still, the initial lack of details on the Phase One deal as well as uncertainty regarding the next phases have left the markets a bit jittery and nervous. Hopefully, this week may bring some further clarity and the good news is that the December 15 tariffs have been canceled.

Read More »

Read More »

EM Preview for the Week Ahead

EM has had a good month so far as market optimism on a Phase One trade deal remains high. Yet November trade data due out this week should show that until that deal is finalized, the outlook for EM remains weak. Deadline for the next round of US tariffs is December 15 and so talks this week are crucial.

Read More »

Read More »

EM Preview for the Week Ahead

Over the weekend, China reported stronger than expected November PMI readings while Korea reported weaker than expected November trade data. While the China data is welcome, we put more weight on Korea trade numbers, which typically serve as a good bellwether for the entire region. Press reports suggest the Phase One trade deal has stalled due to Hong Kong legislation passed by the US Congress.

Read More »

Read More »

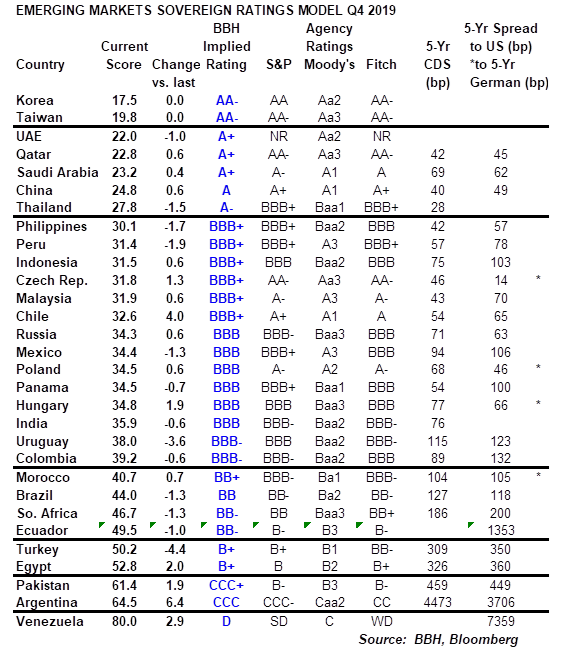

EM Sovereign Rating Model For Q4 2019

We have produced the following Emerging Markets (EM) ratings model to assess relative sovereign risk. An EM country’s score directly reflects its creditworthiness and underlying ability to service its external debt obligations. Each score is determined by a weighted compilation of fifteen economic and political indicators, which include external debt/GDP, short-term debt/reserves, import cover, current account/GDP, GDP growth, and budget balance.

Read More »

Read More »

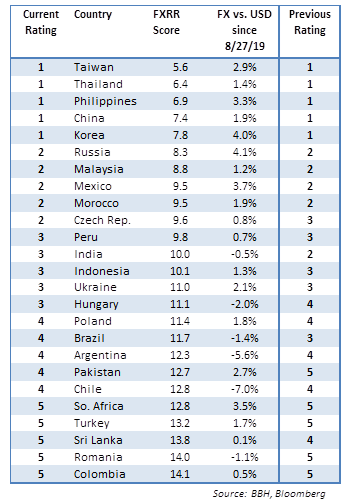

EM FX Model for Q4 2019

EM FX has rallied sharply in recent weeks, helped by growing optimism that we’ve seen the worst of the US-China trade war. Given our more constructive outlook on EM, we believe MSCI EM FX should eventually test the 1657.50 high from July. We see continued divergences within the asset class. Our 1-rated (strongest fundamentals) grouping for Q4 2019 consists of TWD, THB, PHP, CNY, and KRW.

Read More »

Read More »

EM Preview for the Week Ahead

EM FX was mostly weaker last week due to doubts about a Phase One trade deal between the US and China. Those talks continue this week and while we expect a deal to be struck, there is likely to be a lot of last minute posturing that will likely keep markets volatile over the short-run. In the meantime, investors need to beware of idiosyncratic country risk within EM.

Read More »

Read More »

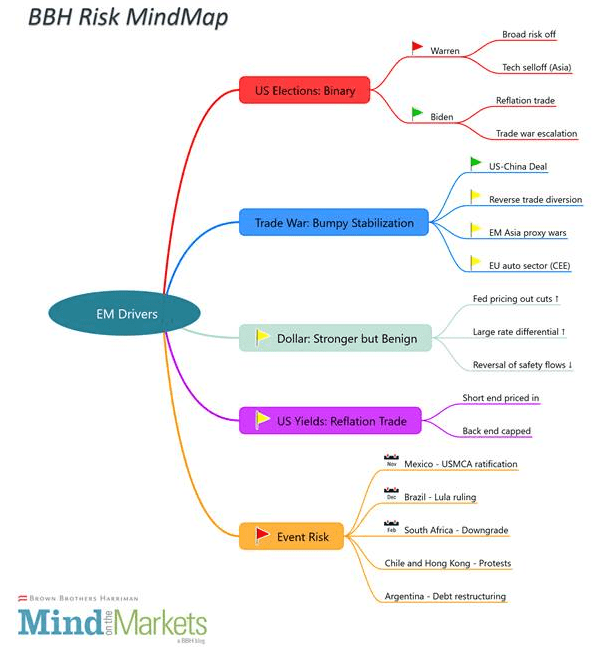

Emerging Market Risk Map

With year-end upon us, we review some of the key risks to EM assets and how we think they progress from here. In short, the two most significant downside risks would be a decisive improvement in Elizabeth Warren’s polling figures and an upset in the US-China trade negotiations.

Read More »

Read More »

EM Preview for the Week Ahead

EM was mostly lower last week, as doubts crept in about the recent trade optimism. Some events also served as reminders of idiosyncratic EM risk that can’t be overlooked, such as downgrade risks (South Africa), failed oil auctions (Brazil), and violent protests (CLP). EM may remain on its back foot until we get further clarity on the US-China talks, but we remain confident in our call that a deal will be struck soon that lower existing tariffs.

Read More »

Read More »

EM Preview for the Week Ahead

EM should continue to benefit from the generalized improvement in the global backdrop. Trade tensions have eased whilst the risks of a hard Brexit have fallen, at least for now. Yet recent developments in some major EM countries underscores how important it is for investors to differentiate between the strong credits and the weak ones.

Read More »

Read More »

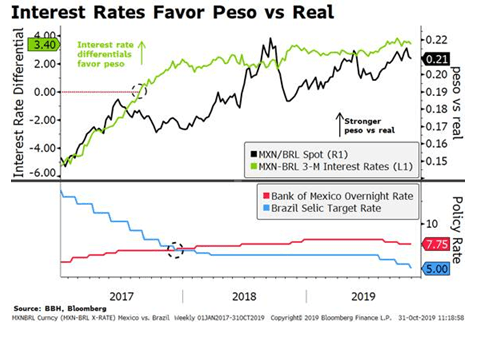

Mexico vs. Brazil Near-Term Outlook

Both Brazil and Mexico are in a good position to benefit from the current improvement in market sentiment. However, when comparing the factors driving the currencies of both countries, we think there are relatively more near-term positives for the Mexican peso than for the Brazilian real.

Read More »

Read More »

EM Preview for the Week Ahead

EM has been on a good run but this week will be a big test. Brexit uncertainty may finally end. Or it may not. A delay would be positive for EM, whilst a potential hard Brexit would be negative. The Fed meets Wednesday and key US data will be reported during the week, culminating with the jobs report Friday.

Read More »

Read More »