Tag Archive: Emerging Markets

EM Preview for the Week Ahead

EM FX was mixed last week, with most risk assets continuing to fight a tug of war between improving economic data and worsening virus numbers. Sentiment may be hurt early this week over lack of consensus in the EU and the US regarding further fiscal stimulus. Three of the four EM central banks meeting this week are expected to cut rates.

Read More »

Read More »

EM Preview for the Week Ahead

This is likely to be one of the most eventful weeks we’ve had in a while. Not only do three major central banks meet, but four EM central banks also meet, and we get important June and July data from the US, the first Q2 GDP reading from China, an OPEC+ meeting, and an EU summit.

Read More »

Read More »

EM Preview for the Week Ahead

Risk assets remain hostage to swings in market sentiment. Stronger than expected US jobs data last week was welcome news. However, the tug of war between improving economic data and worsening viral numbers is likely to continue this week, with many US states reporting record high infection rates.

Read More »

Read More »

EM Preview for the Week Ahead

Risk assets came under pressure last week as the virus news stream worsened. It’s clear that large parts of the US will be forced to delay reopening until their virus numbers improve. Markets had gotten too bullish on the US recovery story and so this reality check soured sentiment. This is a very important week for US data, and we think risk sentiment will remain under pressure ahead of what we think will be a likely downside surprise in the US...

Read More »

Read More »

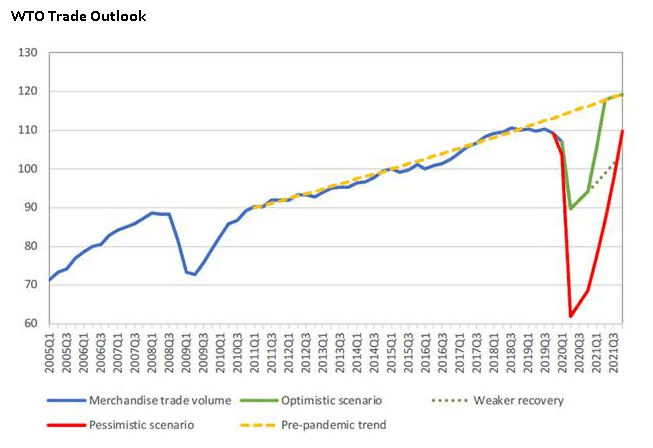

Recent Trade Developments Suggest Some Caution Ahead Warranted

There’s never a good time for a trade war. Yet here we are on the cusp of one between the US and the EU over unfair aircraft subsidies and comes at a time when renewed COVID-19 outbreaks are making the global economic outlook even cloudier. These developments suggest some caution ahead is warranted for risk assets like EM and equities.

Read More »

Read More »

Restricted Market Trading Comments

There were minimal changes to the status quo as the week commences. Bangladesh has announced revised trading hours on the local exchanges. No change of status in Nigeria and Kenya as they both continue to face limited liquidity. Please see trading comments below.

Read More »

Read More »

EM Preview for the Week Ahead

EM and other risk assets stabilized to end the week after Thursday’s selloff, but remain vulnerable. The risks ahead are the same as before, which include a second wave of infections as well as a longer and shallower than expected recovery in global growth. The Fed’s message of low rates as far as the eye can see was balanced by Powell’s grim outlook for unemployment.

Read More »

Read More »

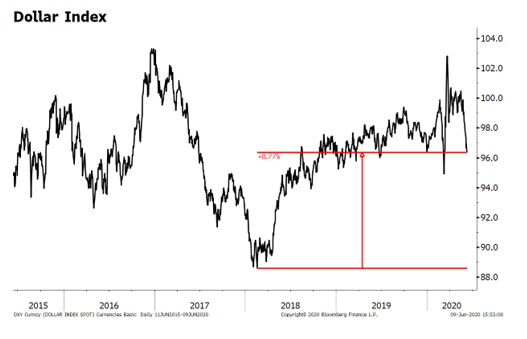

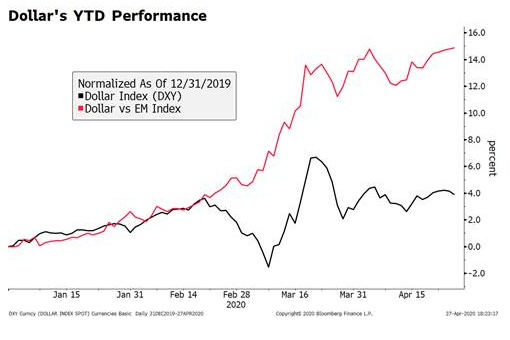

Our Latest Thoughts on the Dollar

The dollar remains under pressure, due in large part to the Fed’s aggressive efforts to inject stimulus. We see dollar weakness persisting near-term. From a longer-term perspective, we note that the greenback remains largely rangebound and is unlikely to fall below its 2018 lows.

Read More »

Read More »

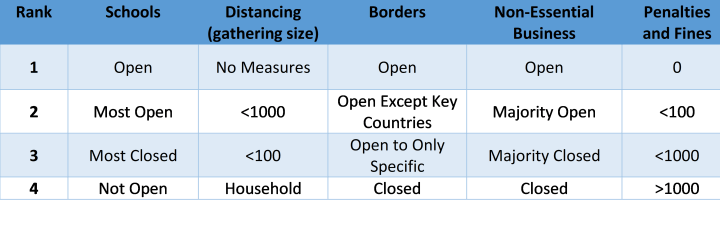

Asia Lockdowns vs. Re-Openings

We apply the five-factor model used to analyse lockdowns and openings in developed markets and in Latin America to Asian Markets. It evaluates the restrictions imposed by different countries in the region, how they compare in terms of severity of lockdown, and where they are heading in the spectrum of reopening. The scale we use measures grade restrictions from 1 (open) to 4 (closed) across the following five factors: (a) schools/universities, (b)...

Read More »

Read More »

Hong Kong Turbulence Likely to Rise as US-China Relations Worsen

Recent moves by China call into direct question the “one country, two systems” approach. Hong Kong assets have held up surprisingly well but we see turbulence ahead as US-China relations are set to deteriorate further.

Read More »

Read More »

Restricted Market Trading Comments

By Dara O’Sullivan, Derrick Leonard, and Ilan Solot, Covid-19 related measures for restricted markets remain largely unchanged this week. Philippines, Bangladesh and Kuwait have extended their lockdown periods, while Kenya and Nigeria continue to face limited liquidity.

Read More »

Read More »

Restricted Market Trading Comments

Covid-19 related measures for restricted markets remain largely unchanged this week. Philippines, Bangladesh and Kuwait have extended their lockdown periods, while Kenya and Nigeria continue to face limited liquidity. Please see trading comments below

Read More »

Read More »

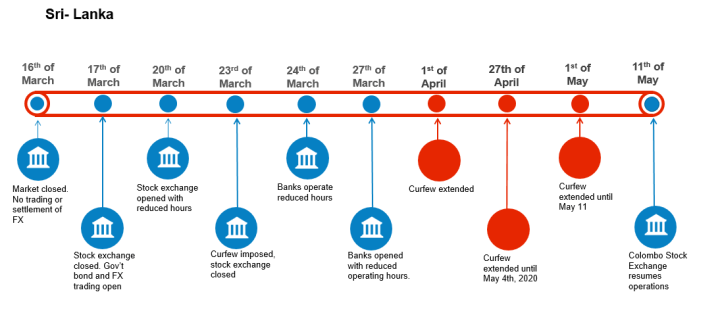

Restricted Market Trading Comments

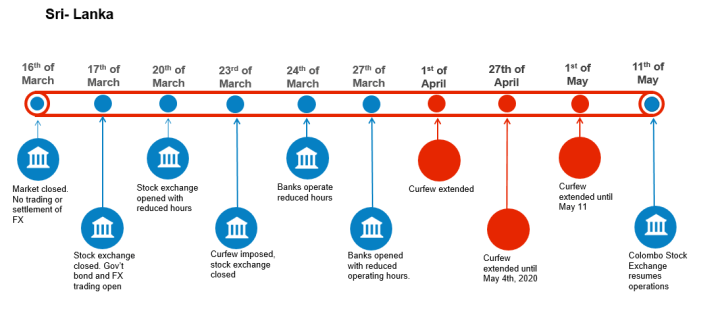

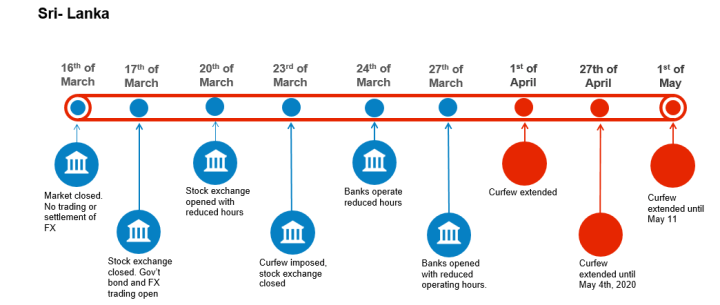

Covid-19 related measures for restricted markets remain largely unchanged from last week. Sri Lanka and India have extended their lockdown periods, while Kenya and Nigeria continue to face limited liquidity. Please see trading comments below.

Read More »

Read More »

Restricted Market Trading Comments

Covid-19 related measures for restricted markets remain largely unchanged from last week. Sri Lanka and India have extended their lockdown periods, while Kenya and Nigeria continue to face limited liquidity.

Read More »

Read More »

Some Thoughts on Recent Foreign Exchange Intervention

Dollar softness this week will take some pressure off of the foreign currencies but it’s too early to sound the all clear. This piece focuses on how central banks around the world may be intervening to influence their currencies. Most of the world, particularly EM, is grappling with supporting weak currencies but a select few are dealing with stronger currencies. This is a very opaque process and so we are simply making our best guesses.

Read More »

Read More »

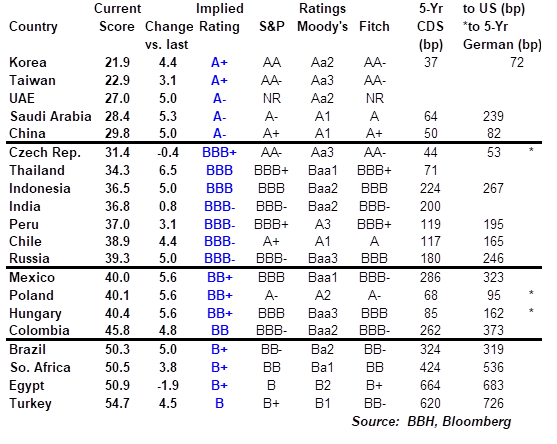

EM Sovereign Rating Model For Q2 2020

The major ratings agencies are punishing Emerging Markets (EM) credits much more than their DM counterparts. Our own sovereign ratings model suggests that there is still more pain to come.

We have produced this interim ratings model to assist investors in assessing relative sovereign risk across the major EMs.

Read More »

Read More »

Lessons from Singapore?

Singapore has been hailed for its quick response to the coronavirus that limited initial infections, but the outlook is shifting. Despite their early success, they will have to revert to a lockdown. Can Singapore’s experience offer any lessons for European and the US policymakers?

Read More »

Read More »

EM Preview for the Week Ahead

EM may get a little support from a potential OPEC+ deal to limit oil. Even if a deal is struck, the impact is likely to be fleeting as the global growth outlook remains terrible. We remain negative on EM for the time being.

Read More »

Read More »

EM Preview for the Week Ahead

Market sentiment is likely to open this week on an upswing after the Fed’s emergency rate cut and expanded QE were announced Sunday afternoon local time. Yet as we have seen time and again this past couple of weeks, added stimulus has had little lasting impact on markets as the virus numbers continue to worsen. Europe is now reporting more daily cases than China did at its peak. We remain negative on EM until the global growth outlook becomes...

Read More »

Read More »

Seven Big-Picture Considerations for Covid-19

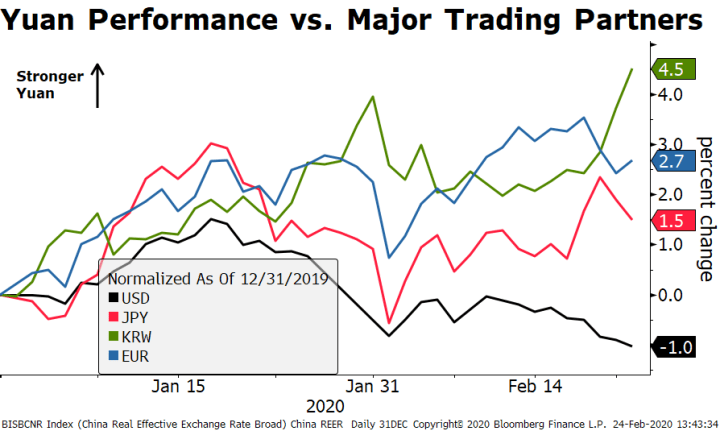

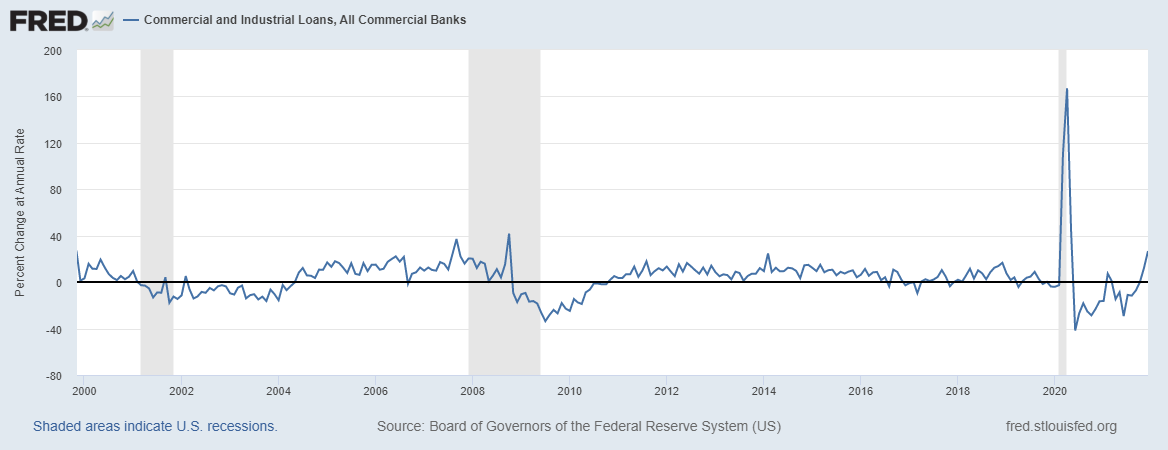

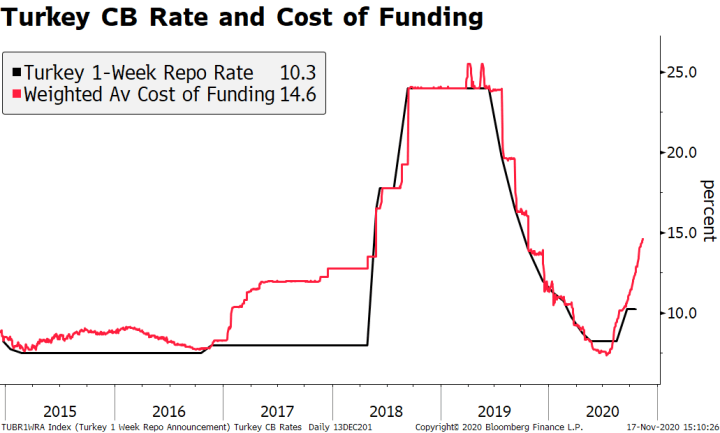

Below is a non-exhaustive list of medium- and long-term implications from the Covid-19. We discuss the yuan, China’s competitiveness, its position in the global production chains, the impact on the Phase One trade deal, and rising financial stability risks. Globally, the virus will bring about a new wave of fiscal spending and revive the discussions about the limits of monetary policy.

Read More »

Read More »