Tag Archive: Emerging Markets

Emerging Markets: Preview of the Week Ahead

Czech Republic reported disappointing December industrial (0.7 vs 5.9% y/y consensus). It reported a small trade surplus rather than the expected deficit. It will report January CPI on Friday, and is expected to rise 0.5% y/y vs. 0.1% in December. ...

Read More »

Read More »

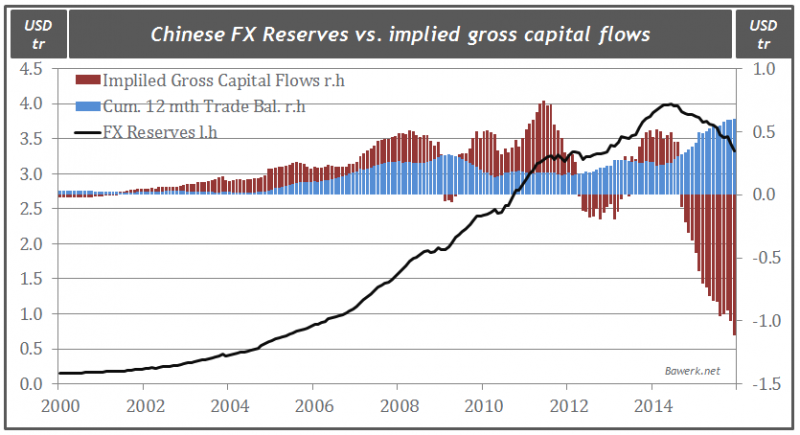

China’s 3 trillion dollar mistake

When looking at the current state of the Chinese economy it is important to note what happened leading up the ongoing predicament. By managing the USD/CNY exchange rate the Chinese factory worker was essentially funding excess consumption in the Unit...

Read More »

Read More »

Emerging Markets: What has Changed

In the EM equity space, UAE (+6.2%), Indonesia (+4.0%), and Qatar (+1.8%) have outperformed this week, while Hong Kong (-2.0%), Czech Republic (-1.9%), and Hungary (-1.2%) have underperformed. To put this in better context, MSCI EM fell -0.1% this w...

Read More »

Read More »

Emerging Market Preview: Week Ahead

As we suspected, the current EM bounce still has some legs. The BOJ’s surprise easing helped EM and risk end on last week on a strong note, and we expect that to carry over into this week. Within EM, we will start to see the first readings for January. The biggest risk perhaps is the … Continue reading »

Read More »

Read More »

Emerging Markets: What has Changed

1) Korea’s Financial Services Commission will introduce a so-called “omnibus account” for foreigners investing in local stocks 2) Malaysian Attorney General Apandi Ali closed the investigation into transfers of foreign money into Prime Minister Najib Razak’s personal bank accounts 3) The South African Reserve Bank increased the pace of its tightening 4) The Egyptian central bank …

Read More »

Read More »

Emerging Market Preview: Week Ahead

Singapore reports December CPI Monday, and is expected at -0.7% y/y vs. -0.8% in November. It then reports December IP Tuesday, and is expected at -6.8% y/y vs. -5.5% in November. Q4 unemployment will be reported Thursday. With deflation risks per...

Read More »

Read More »

Emerging Markets: What has Changed

In the EM equity space, Russia (+5.9%), Colombia (+2.0%), and Thailand (+1.8%) have outperformed this week, while Qatar (-6.8%), UAE (-5.1%), and the Philippines (-3.7%) have underperformed. To put this in better context, MSCI EM rose 0.1% this week...

Read More »

Read More »

Central Bank’s Dovish Tilt Will Weigh on Brazilian Assets

(from my colleague Dr. Win Thin) Brazilian central bank President Tombini said it will take into account the IMF’s revised forecasts for a deeper recession when it meets this week to decide on policy. Sorry, but we don’t buy it. No central bank should ever be affected by IMF forecasts. Yes, the IMF has great …

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM ended last week on a sour note. The most important factor for global risk appetite has become China, with the Fed tightening cycle now on the back burner. Our base case remains that China muddles through, but policymakers there need to commu...

Read More »

Read More »

Emerging Markets: What has Changed

1) The Hong Kong dollar posted its biggest two-day decline since 1992

2) Bank Indonesia restarted its easing cycle, cutting rates for the first time since February 2015

3) Poland’s current Monetary Policy Council (RPP) held its last policy meeti...

Read More »

Read More »

Emerging Markets: Week Ahead Preview

Brazil reports December trade later today. Exports are expected at -1% y/y and imports at -35% y/y. That would result in a $6.1 bln surplus, one of the largest on record. Brazil then reports November IP Thursday, and is expected at -10.3% y/y vs. ...

Read More »

Read More »

Emerging Markets: What has Changed

In the EM equity space, Poland (+5.6%), Colombia (+5.6%), and China (+4.4%) have outperformed over the last week, while Brazil (-2.1%), Qatar (-0.8%), and Russia (+0.1%) have underperformed. To put this in better context, MSCI EM rose 2.3% over the ...

Read More »

Read More »

Emerging Markets: Week Ahead Preview

Indonesia reports November trade Tuesday. Exports are expected at -11.5% y/y, while imports are expected at -21.3% y/y. Bank Indonesia then meets Thursday and is expected to keep rates steady at 7.5%. We believe an easing bias is in place, given ...

Read More »

Read More »

Emerging Markets: What has Changed

1) South African President Jacob Zuma fired Finance Minister Nene and replaced him with little-known ANZ lawmaker David Van Rooyen

2) S&P revised the outlook on South Africa’s BBB- rating from stable to negative

3) People’s Bank of Chi...

Read More »

Read More »

Emerging Market Preview: Week Ahead

Taiwan reports November CPI Tuesday, and is expected to rise 0.36% y/y vs. 0.31% in October. The central bank does not have an explicit inflation target, but low price pressures should allow the easing cycle to continue at the December meeting. Nov...

Read More »

Read More »

Emerging Markets: What has Changed

(from my colleague Ilan Solot) 1) The Chinese yuan will be in the SDR. 2) Brazil had one of the most important weeks of the year, and possibly of its history. 3) Russia enacted sanctions against Turkey, while Turkey got a deal from the EU. 4) Moody’s raised Russia’s credit-rating outlook to stable from negative. … Continue reading...

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

(from my colleagues Dr. Win Thin and Ilan Solot) This is set to be one of the most important weeks of the year. EM is likely to take a backseat between the ECB monetary policy decision, the OPEC meeting and the US jobs report. That said, there are several potential sources of idiosyncratic risk to … Continue reading »

Read More »

Read More »

Emerging Markets: What has Changed

(from my colleagues Dr. Win Thin and Ilan Solot)

1) Mauricio Macri, the mayor of Buenos Aires, won the Argentine presidential election with 52% of vote

2) The latest political developments in Brazil rocked asset prices

3) The Brazilian cent...

Read More »

Read More »