Tag Archive: Emerging Markets

Emerging Markets: What has Changed

In the EM local currency bond space, Brazil (10-year yield -36 bp), Turkey (-26 bp), and Hungary (-17 bp) have outperformed this week, while Ukraine (10-year yield +9 bp), Mexico (+2 bp), and China (flat) have underperformed.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM ended the week on a soft note. Volatility is likely to remain high as markets are jittery and choppy ahead of the BOJ/FOMC meetings on Thursday. Dollar gains were broad-based last week, but EM certainly underperformed. China markets will reopen after a two-day holiday, but good news out of the mainland is doing little to help EM.

Read More »

Read More »

Emerging Markets: What has Changed

The IEA forecast that the surplus in global oil markets will last for longer than previously thought. Philippine President Duterte called for US troops to leave the southern island of Mindanao. Relations between Poland and the EU are deteriorating. Former head of Brazil’s lower house Eduardo Cunha was expelled and banned from public office for eight years. Brazil’s central bank cut the amount of daily reverse swap contracts sold to 5,000.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM ended last week on a soft note. Perhaps it was the North Korean nuclear test (see below). Perhaps it was disappointment in the ECB or rising Fed tightening odds. Whatever the trigger was, EM FX weakness persisted and appears likely to carry over into this week.

Read More »

Read More »

Emerging Markets: What has Changed

India has a new central bank head. North Korea detonated a nuclear device. The Turkish government may be eyeing the central bank for the next purge. Mexican Finance Minister Videgaray resigned. Incoming Mexican Finance Minister Meade announced new spending cuts.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM ended last week on a soft note, as Fed tightening expectations ratcheted up.The December Fed funds futures contract has an implied yield of 0.5%,the highest since June 2. Note that on June 3, US rates plunged after the May jobs shocker (+38k). If the hawkish Fed storyline can be maintained, then EM will have trouble getting traction. This Friday’s jobs report for August will be key, with consensus at +185k vs. +255k in July.

Read More »

Read More »

Emerging Markets: What has Changed

Reserve Bank of India Deputy Governor Patel has been named to succeed Governor Rajan. Political risk is back in South Africa. The Colombian government and the FARC rebels have reached a final peace agreement. S&P cut the outlook on Mexico’s BBB+ rating from stable to negative.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM ended last week on a soft note.Fed tightening expectations were buffeted first by hawkish Dudley comments and then by the more balanced FOMC minutes. On net, the markets adjusted the odds for tightening by year-end a little higher from the previous week, and stand at the highest odds since the Brexit vote. Yet despite the strong jobs data in June and July, odds of a move on September 21 or November 2 are still low, with the December 14 meeting...

Read More »

Read More »

Emerging Markets: What has Changed

China unveiled a second equity link that will allow foreign investors to buy local stocks with fewer restrictions. Saudi Arabia will allow qualified foreign investors to subscribe to local IPOs starting this January. South Africa’s two main opposition parties agreed to informally band together in local governments. The Brazilian central bank decreased the daily intervention amount to 10,000 reverse swap contracts from 15,000 before, just a week...

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX ended the week on a soft note, despite the weaker than expected US retail sales report. Official concern about strong exchange rates is beginning to emerge. First it was Korea, then on Friday it was Brazil as acting President Temer said his country needs to maintain a balanced exchange rate, neither too weak nor too strong. We expect more pushback to emerge if the current

rally is extended. Still, the global liquidity outlook for now favors...

Read More »

Read More »

Emerging Markets: What has Changed

S&P upgraded Korea a notch to AA with a stable outlook. Voters passed the constitutional referendum in Thailand by a wide margin. The IMF and Egypt have reached a staff-level agreement on a 3-year $12 bln. loan program. Argentina’s central bank will begin using a new overnight rate to manage monetary policy. Political uncertainty has returned to Brazil.

Read More »

Read More »

FX Daily, August 10: FX Consolidation Resolved in Favor of Weaker US Dollar

European bourses are mixed, and this is leaving the Dow Jones Stoxx 600 practically unchanged in late-European morning turnover. Financials are the strongest sector (+0.4%), and within it, the insurance sector is leading with a 0.8% advance and banks are up 0.4%. The FTSE's Italian bank index is up 1.4% to extend its recovery into a fifth session.

Read More »

Read More »

Great Graphic: Bullish Emerging Market Equity Index

Liquidity rather than intrinsic value seems to be driving EM assets. MSCI EM equity index looks constructive technically. The chart pattern suggests scope for around 13% gains from here.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM ended last week on a firm note, despite the stronger than expected July jobs report. As we suspected, one strong US data point is not yet enough to derail the dovish Fed outlook. With the RBA and BOE cutting last week and the RBNZ expected to cut this week, the global liquidity backdrop remains supportive for EM and risk.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM ended last week on a firm note, helped by the weaker than expected US Q2 GDP report as well as the small bounce in oil. With the RBA and BOE expected to ease this week, the global liquidity backdrop remains favorable for EM and “risk.” US jobs report Friday will be very important for EM going forward. We get our first glimpse of the Chinese economy for July with the PMI readings this week.

Read More »

Read More »

Emerging Markets: What has Changed

Indonesian President Widodo shuffled his cabinet

Egypt has requested a three-year $12 bln loan from the IMF

Johannesburg Stock Exchange data on investment flows into South Africa was wrong

Fitch downgraded South Africa’s local currency rating by one notch to BBB- with a stable outlook

Fitch cut its outlook on Colombia's BBB rating from stable to negative

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM ended the week on a soft note, as the dollar reasserted broad-based strength against most currencies. The FOMC meeting this week could see the Fed push back against the market’s dovish take on policy, in which case EM would be likely to remain under pressure.

Read More »

Read More »

Emerging Markets: What has Changed

The New York Times reported that the US is preparing to seize $1 bln in assets tied to 1MDB. S&P downgraded Turkey a notch to BB with a negative outlook, citing political uncertainty. Turkish President Erdogan declared a three-month state of emergency. The Nigerian Naira weakened above 300 per dollar for the first time. Brazil’s central bank signaled a longer wait until it cuts rates.

Read More »

Read More »

FX Daily, July 18: Coup in Turkey Repulsed, Risk-Appetites Return

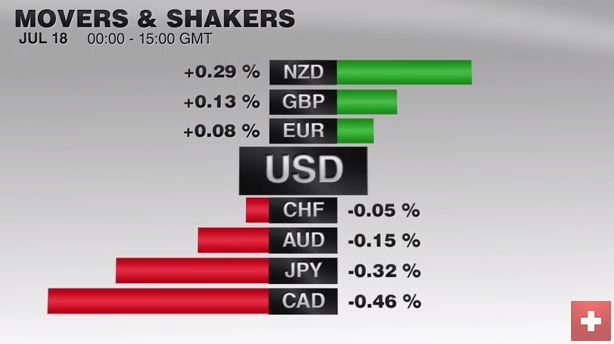

The US dollar and the yen are trading heavy, while risk assets, including emerging markets, and the Turkish lira, have jumped. Sterling is the strongest of the majors. It is up about 0.5% (~$1.6365), helped by the opportunity of GBP23.4 bln foreign direct investment and comments from a hawkish member of the MPC suggesting not everyone is onboard necessarily for a rate cut next month.

Read More »

Read More »

Some Thoughts on Turkey

INTRODUCTION After last Friday’s failed coup attempt in Turkey, a measure of calm has returned to global markets. We did not think Turkish developments have wide-reaching implications for EM assets, but we do remain very negative on Turkish assets in the wake of the coup and ongoing political uncertainty.

Read More »

Read More »