Tag Archive: Emerging Markets

Emerging Markets: What Has Changed

Moon Jae-in was elected president of South Korea. Philippine President Duterte named Nestor Espenilla as central bank governor. Nigerian President Buhari traveled to London for a follow-up to the initial medical visit earlier this year. Market expectations for 2018 inflation in Brazil rose for the first time in more than a year. Peru's central bank unexpectedly started the easing cycle with a 25 bp cut to 4.0%.

Read More »

Read More »

Emerging Markets Preview

EM FX got some limited traction as the week closed, helped by stabilizing commodity prices. However, oil, copper, and iron ore have all broken important technical levels that suggest further weakness ahead. We also think the FOMC and jobs data support our view that the next Fed hike will be in June. This backdrop should keep EM on the defensive this week.

Read More »

Read More »

Emerging Markets: What has Changed

Relations between China and North Korea appear to be worsening. The THAAD missile shield has been deployed earlier than expected in South Korea. An amendment to India’s Banking Regulation Act gives the RBI more power to address bad loans. Tensions are rising between Czech Prime Minister Sobotka and Finance Minister Babis. Brazil pension reform bill was passed 23-14 in the lower house special committee.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended last week on a mixed note. Indeed, the week and the month were also very much mixed for EM, reflecting a variety of global and country-specific drivers impacting these countries. This week’s US jobs data could bring Fed tightening back as a major driver for EM.

Read More »

Read More »

Emerging Markets: What has Changed

Moody’s moved the outlook on Vietnam’s B1 rating from stable to positive. Nigeria’s central bank introduced a new FX window for portfolio investors. Moody’s moved the outlook on Romania’s Baa3 rating from positive to stable. Central Bank of Russia accelerated its easing cycle. Central Bank of Turkey delivered a hawkish surprise. Brazil’s lower house easily approved the labor reforms, but popular resistance is rising.

Read More »

Read More »

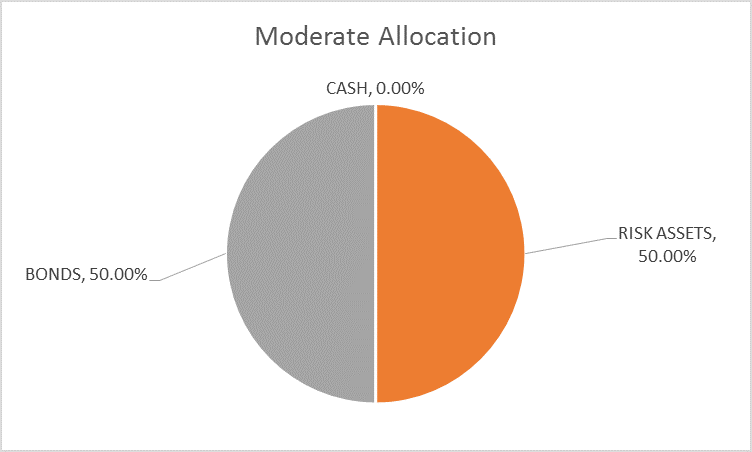

Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50.

The performance of markets in the first quarter of the year was a bit schizophrenic. Stocks performed well which one might interpret as a reflection of improving economic growth prospects. Certainly President Trump and his proxies were quick to take credit but unfortunately for the new...

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX was mostly firmer last week, helped by Trump comments and softer US data. Whilst this seems positive for EM, the global backdrop remains uncertain. Some in EM (Russia, Turkey, and Korea) remain vulnerable to geopolitical concerns. In addition, idiosyncratic domestic political risks remain in play for other EM countries, such as Brazil, South Africa, and Turkey. We expect the investment climate for EM to remain challenging this week.

Read More »

Read More »

Emerging Markets: What has Changed

Malaysia’s central bank said it will allow investors to fully hedge their currency exposure. Egypt declared a 3-month state of emergency after two deadly church attacks. South Africa’s parliamentary no confidence vote has been delayed. Argentina central bank surprised markets with a 150 bp hike to 26.25%. Brazil central bank accelerated the easing cycle with a 100 bp cut in the Selic rate.

Read More »

Read More »

Emerging Markets Preview for the Week Ahead

EM FX ended the week on a soft note, as the weaker than expected US jobs data was unable to derail the dollar’s rally. For the week, the worst performers were ZAR (-3%), TRY (-2.5%), and RUB (-2%). CZK bucked the trend, rising after the CNB exited the cap. This week, higher inflation readings in the US could draw market focus back to Fed tightening, which would be negative for EM.

Read More »

Read More »

End of EUR/CZK peg: Czech National Bank

The Czech National Bank (CNB) ended the EUR/CZK floor today. Timing was a little earlier than expected, but rising inflation and a robust economy warranted it. We think it’s too soon to talk about a rate hike, as we expect the koruna to overshoot to the strong side.

POLICY OUTLOOK

Price pressures are rising, with CPI accelerating to 2.5% y/y in February. March data will be reported April 10, with consensus at 2.6% y/y. If so,...

Read More »

Read More »

Emerging Markets: What has Changed

Reserve Bank of India surprised markets with the start of the tightening cycle. The Czech National Bank (CNB) ended the EUR/CZK floor. Israeli central bank said it won’t hike rates until Q2 2018. Both S&P and Fitch cut South Africa’s rating one notch to sub-investment grade BB+. Moody's put South Africa’s Baa2 rating on review for a downgrade.

Read More »

Read More »

Emerging Market: Preview for the Week Ahead

EM FX was mixed last week. The rebound in oil helped some, such as COP, RUB, and MXN. On the other hand, idiosyncratic political risks weighed on South Africa. This week could pose a challenge to EM, with lots of Fed speakers, FOMC minutes, and US jobs data.

Read More »

Read More »

Great Graphic: Emerging Market Stocks

MSCI Emerging Market Index is up 12.25% here in Q1. The index is approaching long-standing technical objectives. Look for profit-taking ahead of quarter-end as fund managers rebalance.

Read More »

Read More »

Emerging Markets: What has Changed

Former Korean President Park was arrested. Hungary’s central bank was more dovish than expected. South African President Zuma finally fired Finance Minister Gordhan. Brazil’s meat industry may have seen the worst of the scandal. Banco de Mexico slowed the pace of tightening.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended the week on a firm note. Indeed, virtually all of EM was up against the dollar last week, led by ZAR and MXN. BRL and PHP were the laggards. It remains to be seen how markets react to the failure to pass the health care reform in the US. Will Trump move on the tax reform? Can the Republicans proceed with its agenda in light of the fissures within the party?

Read More »

Read More »

Emerging Markets: What has Changed

Reserve Bank of India will introduce a new monetary policy tool. Moody’s raised the outlook on Russia’s Ba1 rating from stable to positive. Fitch cut Saudi Arabia’s rating a notch to A+. Moody’s cut the outlook on Turkey’s Ba1 rating from stable to negative. China has temporarily suspended beef imports from Brazil.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX had a stellar week, ending on a strong note in the aftermath of what the market perceived as a dovish Fed hike Wednesday. Every EM currency except ARS was up on the week vs. USD, with the best performers ZAR, TRY, COP, and MXN. There are some risks ahead for EM this week, with many Fed speakers lined up and perhaps willing to push back against the market’s dovish take on the FOMC.

Read More »

Read More »

Emerging Markets: What has Changed

The PBOC increased the rates it charges for OMO and MLF by 10 bp. Indian Prime Minister Modi’s BJP won elections in the state of Uttar Pradesh. Czech central bank broached the possibility of a koruna cap exit later than mid-2017. Kuwait became the first OPEC member to call for extended output cuts.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX ended last week on a firm note despite the strong US jobs data, with the dollar succumbing to some “buy the rumor, sell the fact” price action. We think the dollar should recover as the week begins, as it seems risky to be short/underweight dollars going into the FOMC meeting. With the Fed poised to hike 3 or perhaps 4 times this year, we don't think EM FX can continue to rally the way it has so far this year.

Read More »

Read More »

Emerging Markets: What has Changed

North Korean banks subject to international sanctions have been banned from using Swift. Korea’s Constitutional Court upheld Parliament’s motion to impeach President Park. Singapore eased some property market curbs after a three-year decline in home prices. Egypt partially reversed a cut in bread subsidies. Nigeria’s President Buhari returned to the nation after spending nearly two months in the UK. Moody’s moved its outlook on Argentina’s B3...

Read More »

Read More »