Tag Archive: economy

Distinct Lack of Good Faith, Part ??

It was a busy weekend in retrospect, starting with Janet Yellen and other central bankers uncomfortably facing a global media that has become (for once) increasingly unconvinced. Reporters, really, don’t have much choice. The Federal Reserve Chairman might not be aware of just how much she has used the “transitory” qualifier since 2015, but others can’t be helped from noticing.

Read More »

Read More »

Is This The Best Way To Bet On The Fed Losing Control Of The Bond Market?

Authored by Kevin Muir via The Macro Tourist blog, Lately, one of my biggest duds of a call has been for the yield curve to steepen. Sure, I have all sorts of fancy reasons why it should steepen, but reality glares back at me in black and white on my P&L run. Sometimes fighting with the market is an exercise in futility.

Read More »

Read More »

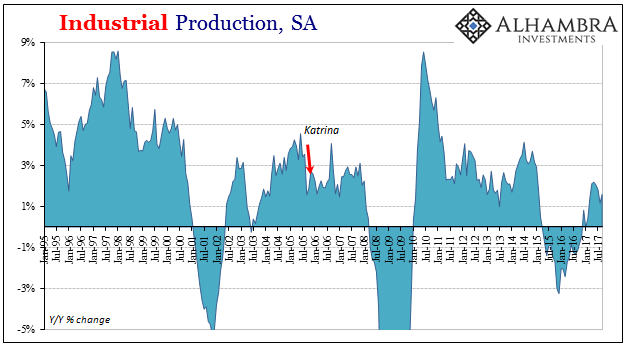

Broader Slowing in Industrial Production

Industrial Production rose 1.6% year-over-year in September 2017. That’s up from 1.2% growth in August, both months perhaps affected to some degree by hurricanes. The lack of growth and momentum, however, clearly predated the storms. The seasonally-adjusted index for IP peaked in April 2017, and has been lower ever since. This pattern, the disappointment this year is one we see replicated nearly everywhere on both sides (supply as well as demand)...

Read More »

Read More »

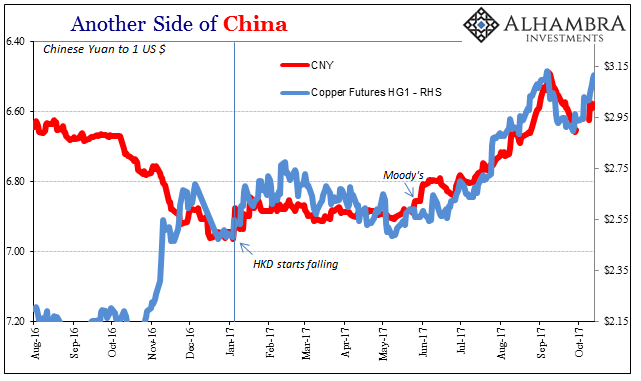

Global Inflation Continues To Underwhelm

Chinese producer prices accelerated in September 2017, while consumer price increases slowed. The National Bureau of Statistics reported this weekend that China’s PPI was up 6.9% year-over-year, a quicker pace than the 6.3% estimated for August and a 5.5% rate in July. Earlier in the year producer prices were driven mostly by 2016’s oil rebound, along with those in the rest of the global economy, but in recent months there has been more influence...

Read More »

Read More »

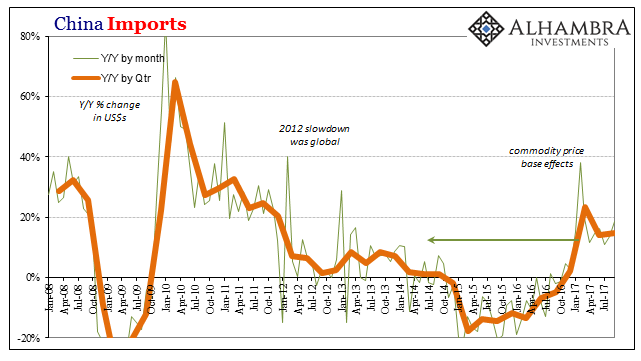

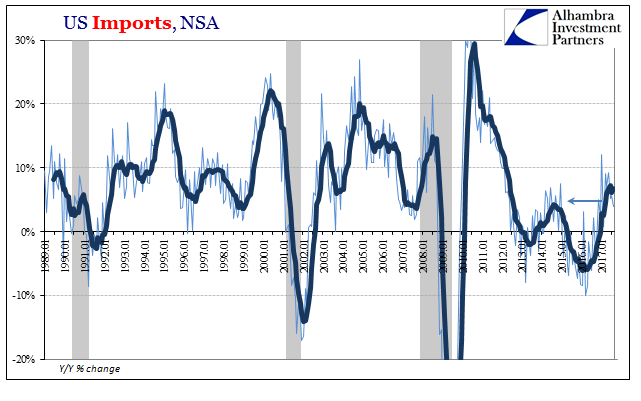

China Exports/Imports: Enforcing A Global Speed Limit

Chinese imports rose 18.7% in September 2017 year-over-year. That’s up from 13.5% growth in August. While near-20% expansion sounds good if not exhilarating, it isn’t materially different from 13.5% or 8% for that matter. In addition, Chinese trade statistics tend to vary month to month.

Read More »

Read More »

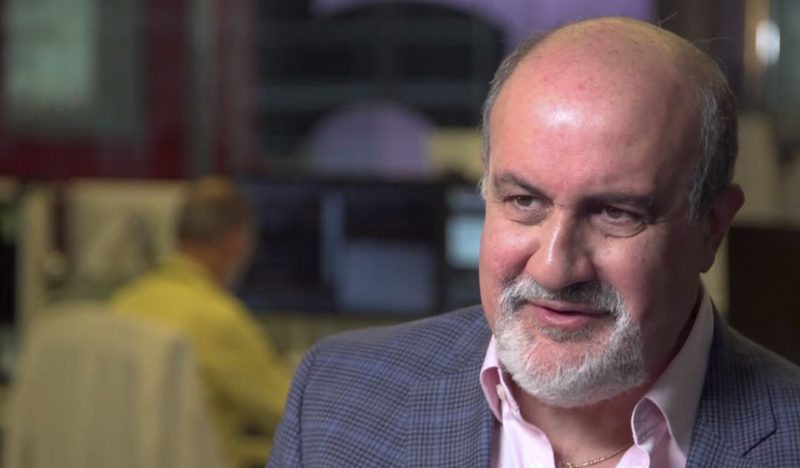

Taleb Explains How He Made Millions On Black Monday As Others Crashed

Former trader and author of best-selling book “The Black Swan” sat down for an interview with Bloomberg News to mark the upcoming thirtieth anniversary of the stock-market crash that occurred on Oct. 19, 1987 – otherwise known as Black Monday.

Read More »

Read More »

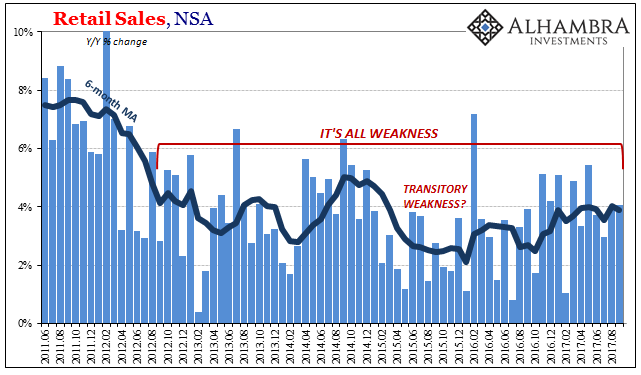

US Retail Sales: Retail Storms

Retail sales were added in September 2017 due to the hurricanes in Texas and Florida (and the other states less directly impacted). On a monthly, seasonally-adjusted basis, retail sales were up a sharp 1.7% from August. The vast majority of the gain, however, was in the shock jump in gasoline prices. Retail sales at gasoline stations rose nearly 6% month-over-month, so excluding those sales retail sales elsewhere gained a far more modest 0.6%.

Read More »

Read More »

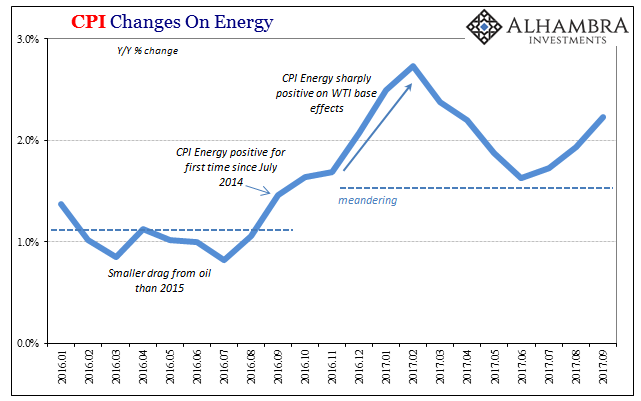

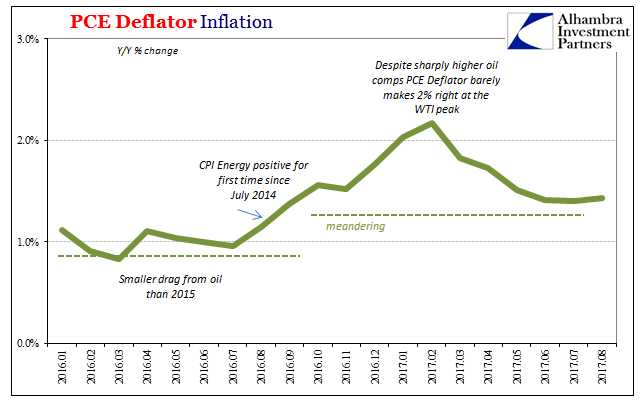

US CPI: Inflation Still Isn’t About Inflation

The US Consumer Price Index (CPI) rose back above 2% in September 2017 for the first time since April. Boosted yet again by energy prices, consumer prices overall still aren’t where the Fed needs them to be (by its own policies, not consumer reality). In fact, despite a 10.2% gain in the energy price index last month, the overall CPI just barely crossed the 2% mark (though for the Fed it really needs to be closer to 3% to match a 2% PCE Deflator).

Read More »

Read More »

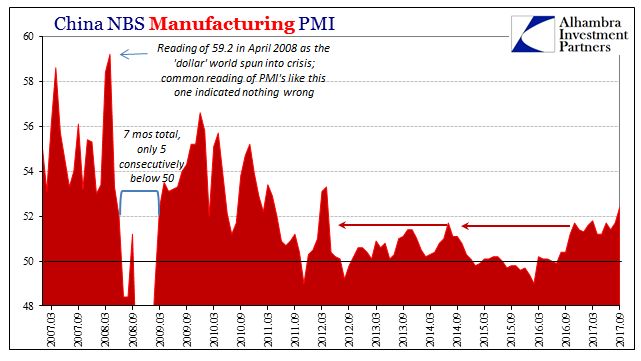

Noisy PMI’s In China

In the US our economic data for a few months at least will be on shaky ground due to the lingering economic impacts of severe hurricanes. In China, the potential for irregularity is perhaps as great, though it has nothing to do with the weather. In a little over a week, Communist Party officials will gather for their 19th Party Congress.

Read More »

Read More »

The Payroll Report To Focus On Is August’s, Not September’s

The hurricanes didn’t disappoint, causing major damage at least to the BLS. Precisely how much the statistics were affected by the disruptions in Texas and Florida really can’t be calculated, not that everyone won’t try. It makes this month’s payroll report a Rorschach test of sorts. You can pretty much make it out to be whatever you want.

Read More »

Read More »

Non-Transitory Meandering

Monetary officials continue to maintain that inflation will eventually meet their 2% target on a sustained basis. They have no other choice, really, because in a monetary regime of rational expectations for it not to happen would require a radical overhaul of several core theories. Outside of just the two months earlier this year, the PCE Deflator has missed in 62 of the past 64 months. The FOMC is simply running out of time and excuses.

Read More »

Read More »

The Damage Started Months Before Harvey And Irma

Ahead of tomorrow’s payroll report the narrative is being set that it will be weak because of Harvey and Irma. Historically, major storms have had a negative effect on the labor market. Just as auto sales were up sharply in September very likely because of the hurricane(s) and could remain that way for several months, payrolls could be weak for the same reasons and the same timeframe.

Read More »

Read More »

Auto Sales Up Last Month, But Why?

Auto sales rebounded sharply in September, with most major car manufacturers reporting better numbers. Sales at Ford were up 8.9% last month from September 2016; +11.9% at GM; Toyota +14.9%; Nissan +9.5%; Honda +6.8%. The only negatives were reported by FCA (-9.7%) and Mercedes (-1.7%).

Read More »

Read More »

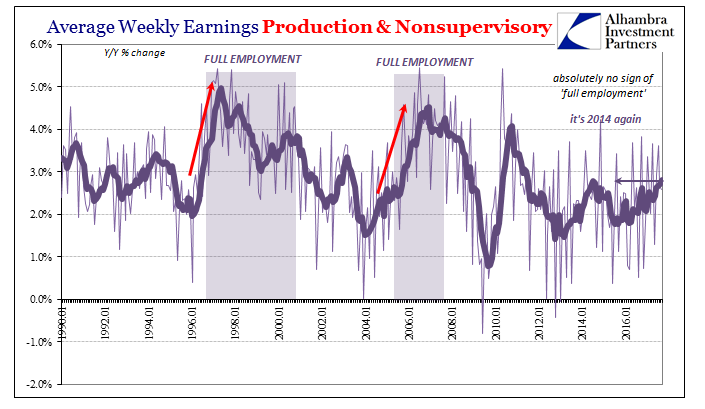

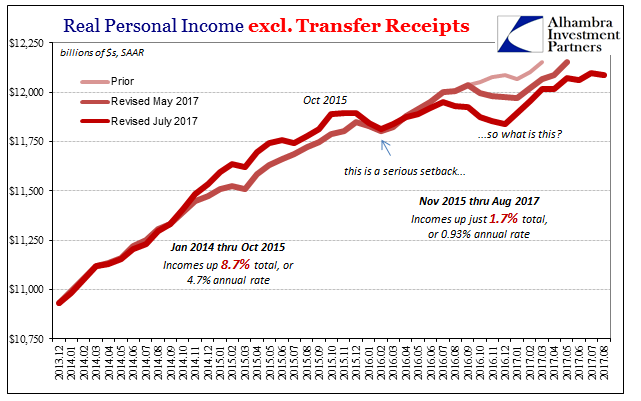

Incomes Are What Matters, So Bad Month, Bad Year, Bad Decade

Sometimes economics can be complicated, such as why the labor market has slowed in such lingering fashion since early 2015. Sometimes economics can be easy, such as why there is so much less to the economy this year than thought. The easy part relates to the hard part. The labor market slowed and so did national income. Though so much of official focus is on debt supplementation, it’s always, always about income.

Read More »

Read More »

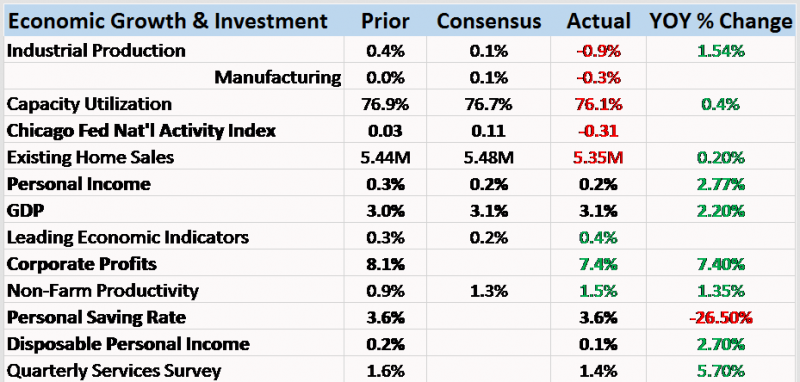

Bi-Weekly Economic Review: Maximum Optimism?

The economic reports of the last two weeks were generally of a more positive tone. The majority of reports were better than expected although it must be noted that many of those reports were of the sentiment variety, reflecting optimism about the future that may or may not prove warranted. Markets have certainly responded to the dreams of tax reform dancing in investors’ heads with US stock markets providing a steady stream of all time highs, bond...

Read More »

Read More »

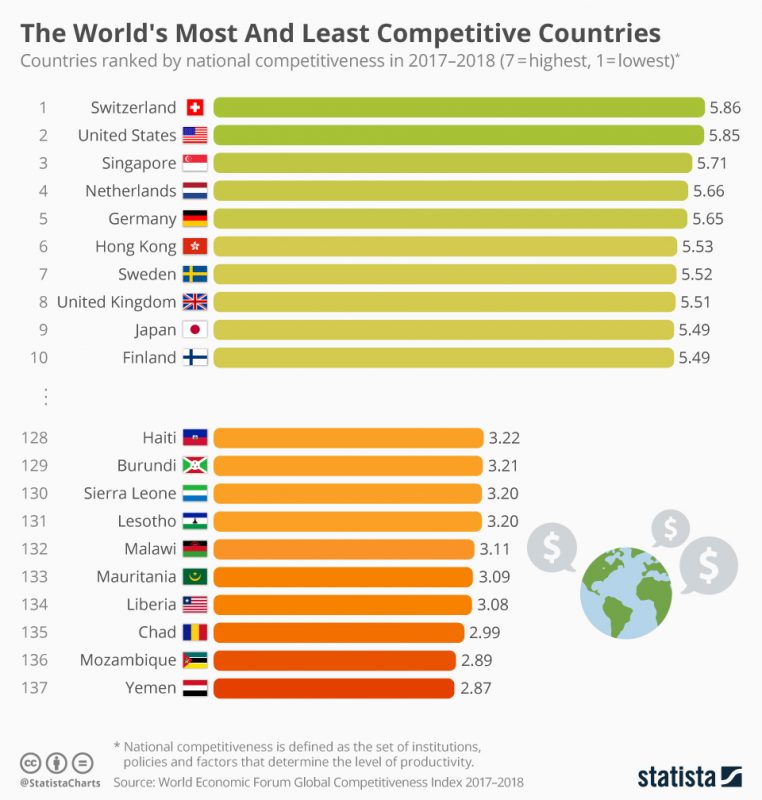

Switzerland Tops World’s Most Competitive Countries Index (Yemen Least)

Something else 'Murica is no longer #1 in... A recently released World Economic Forum report has found that the global economy is recovering well nearly a decade on from the start of the global financial crisis with GDP growth hitting 3.5 percent in 2017. The eurozone in particular is regaining traction with 1.9 percent growth expected this year. As Statista's Niall McCarthy points out, the improvement in Europe's economic fortunes can be seen in...

Read More »

Read More »

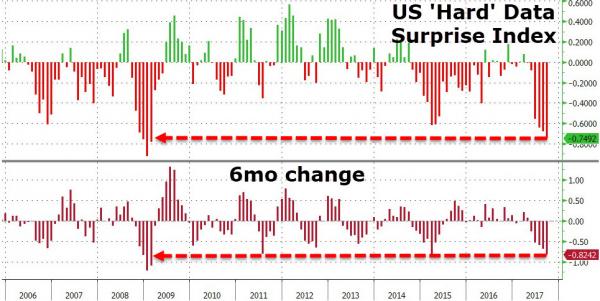

Dollar & Stocks Jump; Bonds & Bullion Dump In Lowest Volatility September Ever

It has now been 318 trading days since the S&P 500 suffered a 5% drawdown - the 4th-longest streak since 1928... So everything is awesome...BUT...US 'hard' economic data has not been this weak (and seen the biggest drop) since Feb 2009...Q3 Was a Roller-Coaster...Q3 was the 8th straight quarterly gain in a row for The Dow - the longest streak since Q3 1997.

Read More »

Read More »

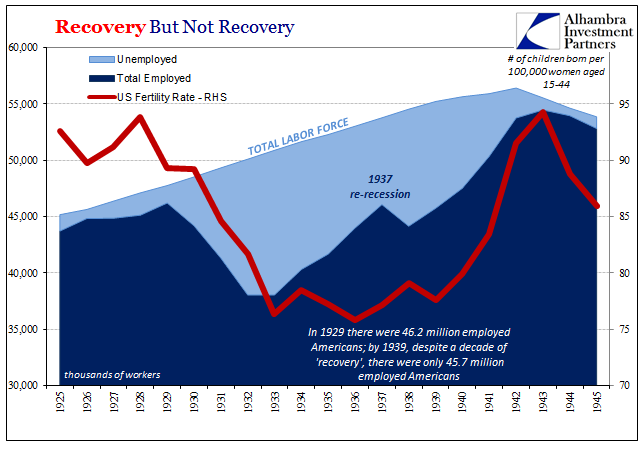

US: Reflation Check

There is a difference between reflation and recovery. The terms are similar and relate to the same things, but in many ways the latter requires first the former. To get to recovery, the economy must reflate if in contraction it was beaten down in money as well as cyclical forces. In the Great Crash of 1929 and after, reflation was required because of the wholesale devastation of the money supply.

Read More »

Read More »