Tag Archive: economy

Sophistry Dressed (as) Reallocation

Stop me if you’ve heard this before: About US$275 billion (about SDR 193 billion) of the new allocation will go to emerging markets and developing countries, including low-income countries.

Read More »

Read More »

Golden Collateral Checking

Searching for clues or even small collateral indications, you can’t leave out the gold market. We’ve been on the lookout for scarcity primarily via the T-bill market, and that’s a good place to start, yet looking back to last March the relationship between bills and bullion was uniquely strong. It’s therefore a persuasive pattern if or when it turns up again.

Read More »

Read More »

Weekly Market Pulse: Buy The Dip, If You Can

If you were waiting for a correction in stock prices to put some money to work, you got your chance last week. The Dow Jones Industrial Average was down nearly 1000 points at the low Monday and closed down 725, a loss of a little over 2%. The S&P 500 did a little better but closed down 1.5%.

Read More »

Read More »

Eurodollar University’s Making Sense; Episode 89, Part 2: Let’s Crack China’s RRR Code

89.2 China Warns World of (Next?) Dollar Disorder. The People’s Bank of China lowers its bank Required Reserve Ratio to get money into a slowing economy. A lowered RRR means that there aren’t enough (euro)dollars flowing into China. Why? Because there aren’t enough (euro)dollars in the world. A lower RRR is a warning for the whole world.

Read More »

Read More »

Do Rising ‘Global’ Growth Concerns Include An Already *Slowing* US Economy?

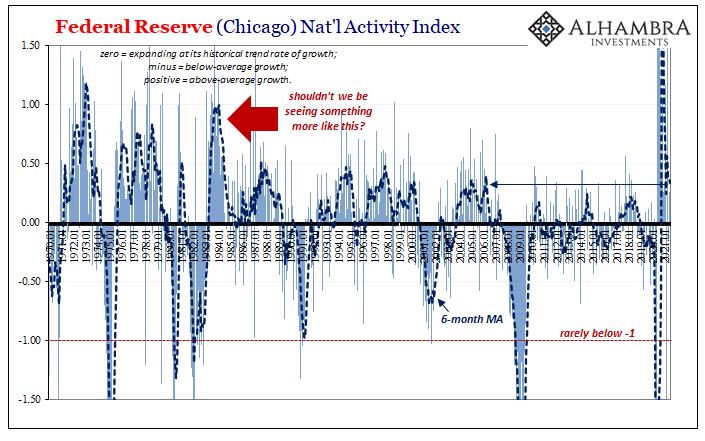

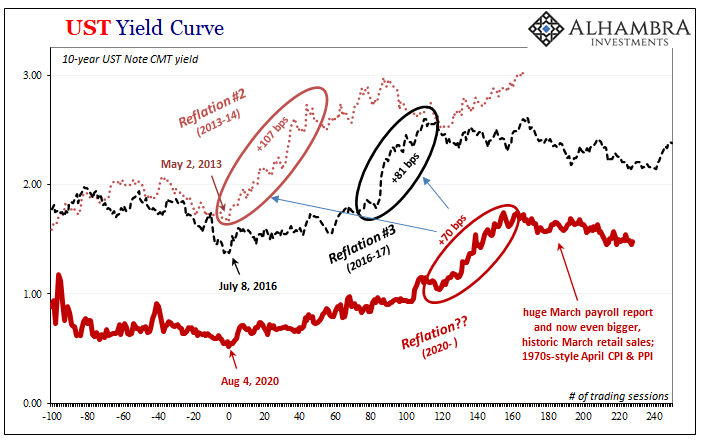

Global factors, meaning that the wave of significantly higher deflationary potential (therefore, diminishing inflationary chances which were never good to begin with) in global bond yields the past five months have seemingly focused on troubles brewing outside the US. Overseas turmoil, it was called back in 2015, leaving by default a picture of relative American strength and harmony.

Read More »

Read More »

Lower Yields And (fewer) Bills

Back on February 23, Federal Reserve Chairman Jay Powell stopped by (in a virtual, Zoom sense) the Senate Banking Committee to testify as required by law. In the Q&A portion, he was asked the following by Montana’s Senator Steve Daines.

Read More »

Read More »

Inching Closer To Another Warning, This One From Japan

Central bankers nearly everywhere have succumbed to recovery fever. This has been a common occurrence among their cohort ever since the earliest days of the crisis; the first one. Many of them, or their predecessors, since this standard of fantasyland has gone on for so long, had caught the malady as early as 2007 and 2008 when the world was only falling apart.

Read More »

Read More »

And Now Three Huge PPIs Which Still Don’t Matter One Bit In Bond Market

And just like that, snap of the fingers, it’s gone. Without a “bad” Treasury auction, there was no stopping the bond market today from retracing all of yesterday’s (modest) selloff and then some. This despite the huge CPI estimates released before the prior session’s trading, and now PPI figures that are equally if not more obscene.

Read More »

Read More »

Third CPI In A Row, Yet All Eyes On That 30s Auction

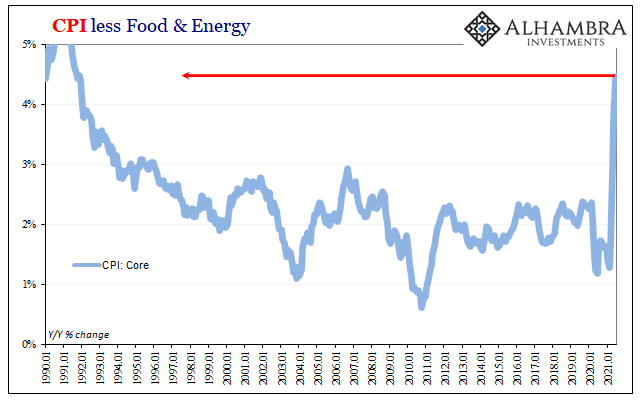

Three in a row, huge CPI gains. According to the BLS, headline consumer price inflation surged 5.39% (unadjusted) year-over-year during June 2021. This was another month at the highest since July 2008 (the last transitory inflationary episode). The core CPI rate gained 4.47% last month over June last year, the biggest since November 1991.

Read More »

Read More »

Weekly Market Pulse: Is It Time To Panic Yet?

Until last week you hadn’t heard much about the bond market rally. I told you we were probably near a rally way back in early April when the 10 year was yielding around 1.7%. And I told you in mid-April that the 10 year yield could fall all the way back to the 1.2 to 1.3% range.

Read More »

Read More »

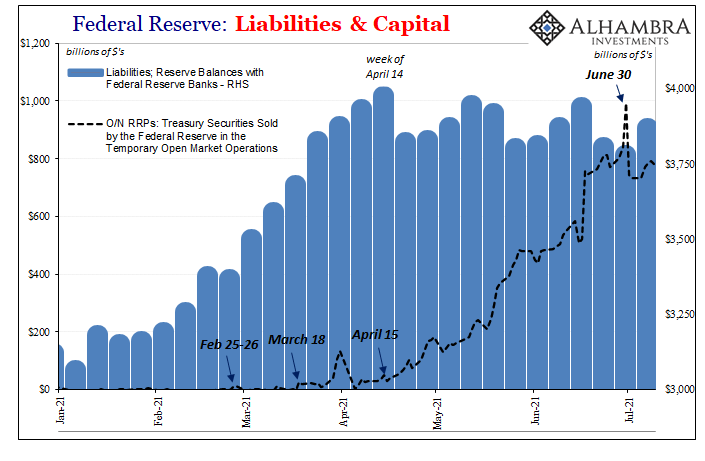

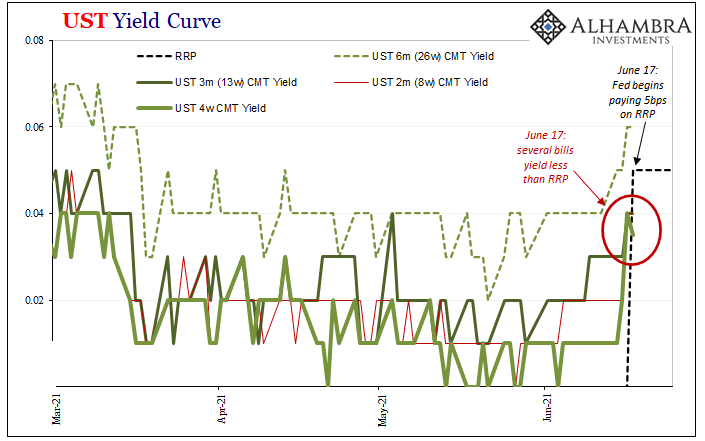

RRP No Collateral Coincidences As Bills Quirk, Too

So much going on this week in the bond market, it actually overshadowed the ridiculous noise coming from the Fed’s reverse repo. Some maybe too many want to make a huge deal out of this RRP if only because the numbers associated with it have gotten so big.

Read More »

Read More »

Bond Reversal In Japan, But Pay Attention To It In Germany

Yield curve control, remember that one? For a little while earlier this year, the modestly reflationary selloff in bonds around the world was prematurely oversold as some historically significant beginning to a massive, conclusive regime change.

Read More »

Read More »

ISM’s Nasty Little Surprise Isn’t Actually A Surprise

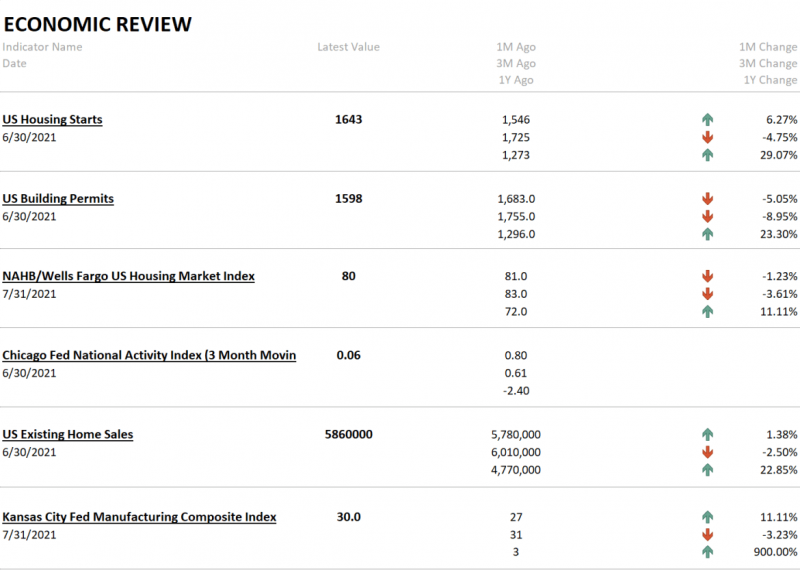

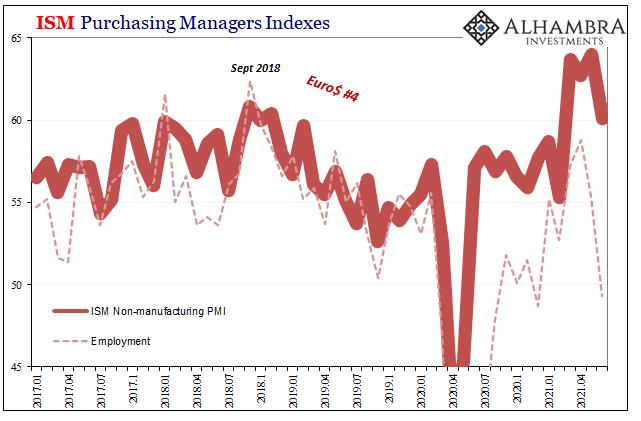

Completing the monthly cycle, the ISM released its estimates for non-manufacturing in the US during the month of June 2021. The headline index dropped nearly four points, more than expected. From 64.0 in May, at 60.1 while still quite high it’s the implication of being the lowest in four months which got so much attention.

Read More »

Read More »

Anyone Remember That Whole SLR Cliff?

Does anyone remember the SLR “cliff?” Of course you don’t, because in the end it didn’t seem to make any difference. For a few weeks, it was kind of ubiquitous if only in the sense that it was another one of those deep plumbing issues no one seems able to understand (forcing all the “experts” to run to Investopedia in order write something up about it).

Read More »

Read More »

A Clear Balance of Global Inflation Factors

Back at the end of May, Germany’s statistical accounting agency (deStatis) added another one to the inflationary inferno raging across the mainstream media. According to its flash calculations, German consumer prices last month had increased by the fastest rate in 13 years.

Read More »

Read More »

Inflation Isn’t Just The Outlier, The Inflation In It Is, Too

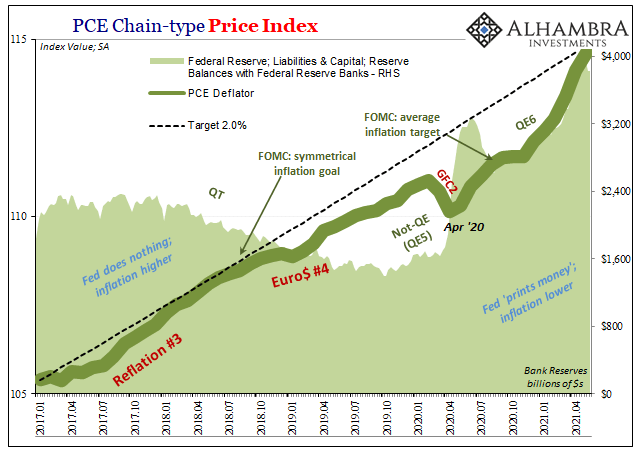

Following the same recent pattern as the BLS and its CPI, the Bureau of Economic Analysis’s (BEA) PCE Deflator ran up hotter in May 2021 than its already high increase during April. The latter’s headline consumer basket rose 3.91% year-over-year, its fastest pace since August 2008.

Read More »

Read More »

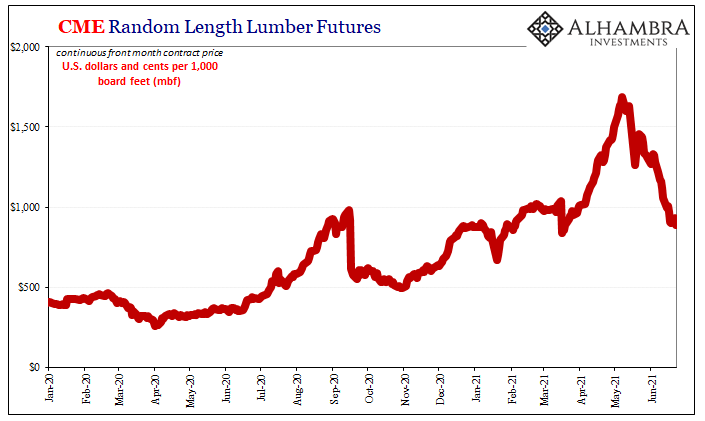

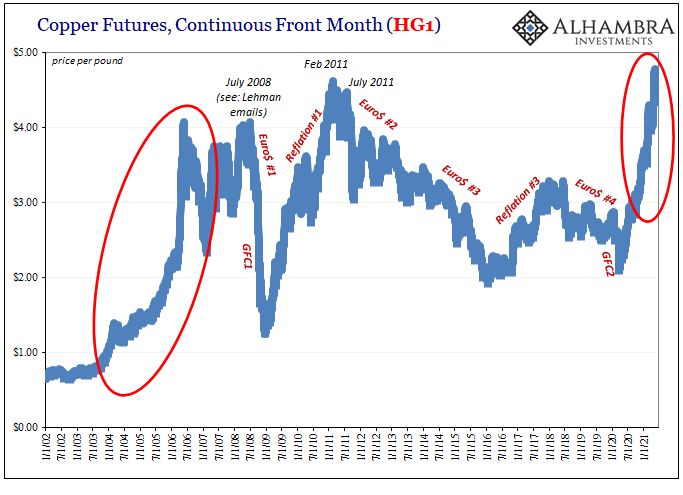

Sure Looks Like Supply Factors

If it walks like a duck and quacks like a duck, then it must be inflationary overheating. Or not? As more time passes and the situation further evolves, the more these recent price deviations conform to the supply shock scenario rather than a truly robust economy showing no signs of slowing down.

Read More »

Read More »

The FOMC Accidentally Exposes Itself (Reverse Repo-style)

Initially, the dots got all the attention. Though these things are beyond hopeless, the media needs them to write up its account of a more fruitful monetary policy outcome because markets continue to discount that entirely.

Read More »

Read More »

Copper Corroding PPI

Yesterday, lumber. Today, copper. The “doctor” has been in reverse for better than two months now, with trading in the current session pounding the commodity to a new multi-month low. Down almost $0.19 for the day, an unusual and eye-opening loss, this brings the cumulative decline to 9.2% since the peak way back on May 11.

Read More »

Read More »

Quantitative Easing: A Boon or Curse?

2021-07-24

by Stephen Flood

2021-07-24

Read More »