Tag Archive: Economics

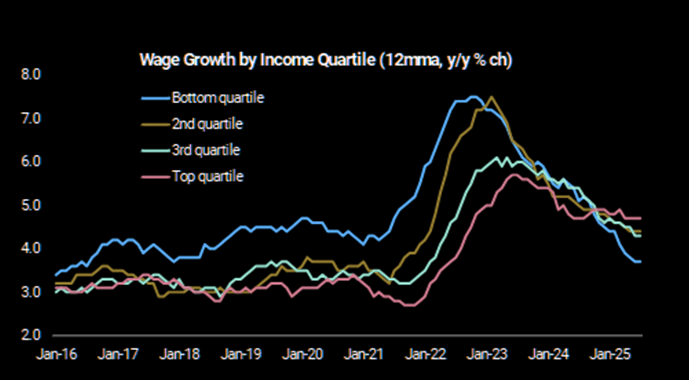

Employment Data Confirms Economy Is Slowing

While coming in much stronger than expected, the latest employment data confirmed what we already suspected: the economy is slowing. The reason the employment data is so important is that without employment growth, the economy stalls. It takes, on average, […] The post Employment Data Confirms Economy Is Slowing appeared first on RIA.

Read More »

Read More »

The Reece Committee: Lessons from history

In the early 1950s, against the backdrop of the Cold War and growing concerns over potential clandestine efforts at internal subversion, the United States Congress launched an investigation into the activities of major tax-exempt foundations. Thus the Reece Committee was born, spearheaded by Congressman B. Carroll Reece, with the aim of establishing whether certain large and influential foundations, like the Carnegie Endowment, the Ford Foundation,...

Read More »

Read More »

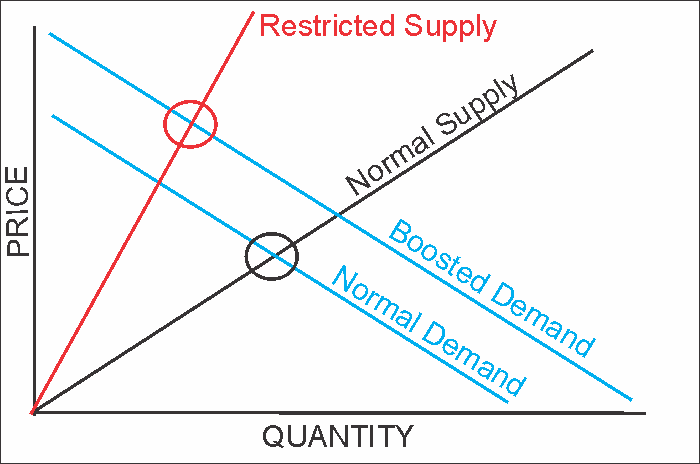

Inflation Risk Is Subsiding Rapidly

Inflation risk has been a significant topic of discussion in the mainstream media for the last few years. Such is unsurprising given that inflation spiked following the pandemic in 2020 as consumer spending (demand) was shot into overdrive from stimulus payments and production (supply) was shuttered. To understand why that occurred, we need to revisit …

Read More »

Read More »

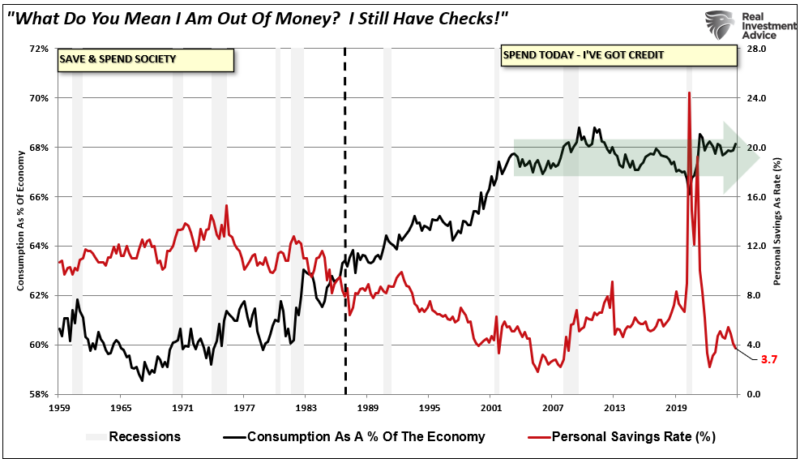

The Consumer Is Tapping Out

The recent implementation of tariffs has the media buzzing about increased recession odds as the consumer faces potentially higher costs. While recent economic reports, like the latest employment report, still show robust growth, those data points run with a lag that hasn't yet caught up with reality. As we have discussed, the American consumer is …

Read More »

Read More »

Silver: A rare buying opportunity

The gold price recently surged to unprecedented levels, surpassing the $3,000 per ounce milestone. This remarkable surge has been attributed to escalating geopolitical tensions, the revival of the trade wars, mounting inflation concerns, and of course, a very uncertain and very worrying outlook for the global economy and for the markets. As they always do, investors have once again flocked to the safe haven that gold unmistakably provides, pushing...

Read More »

Read More »

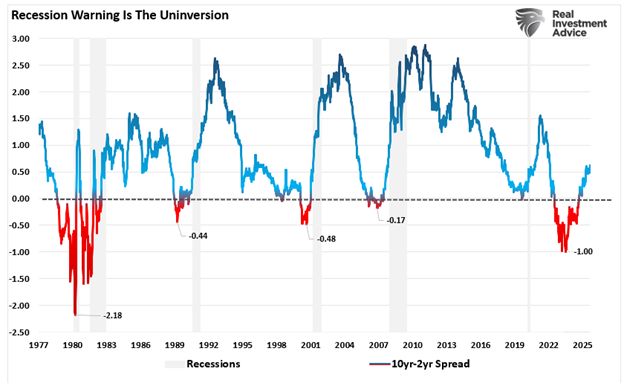

The Stock Market Warning Of A Recession?

A Wall Street axiom states that the stock markets lead the economy by about six months. While not a perfect predictor, the stock market reacts to investor expectations about future corporate earnings, economic activity, interest rates, and inflation. When sentiment shifts due to anticipated weakness in any of these areas, equity prices often decline, reflecting …

Read More »

Read More »

“Does The West Have Any Hope? What Can We All Do?”

Share this article

Interview with Godfrey Bloom

I recently had the great pleasure of being interviewed by my good friend Godfrey Bloom, whose point of view and sharp assessment skills of economic and political events I have consistently found illuminating throughout the years.

It’s always extremely refreshing talking to Godfrey, because his questions cut through the noise and concentrate on what is actually important. I find his views and...

Read More »

Read More »

“Does The West Have Any Hope? What Can We All Do?”

Interview with Godfrey Bloom

I recently had the great pleasure of being interviewed by my good friend Godfrey Bloom, whose point of view and sharp assessment skills of economic and political events I have consistently found illuminating throughout the years.

It’s always extremely refreshing talking to Godfrey, because his questions cut through the noise and concentrate on what is actually important. I find his views and arguments are also...

Read More »

Read More »

Predictions vs. Convictions

Share this article

Separating the signal from the noise

Most regular readers and friends will undoubtedly already know what my position is in regards to projections and forecasts. For many years, I have consistently maintained that any and all attempts to “time the market” are as useless as they are unrealistic and I have always urged all responsible and rational investors to be extremely wary and suspicious of anyone that claims they can...

Read More »

Read More »

Predictions vs. Convictions

Separating the signal from the noise

Most regular readers and friends will undoubtedly already know what my position is in regards to projections and forecasts. For many years, I have consistently maintained that any and all attempts to “time the market” are as useless as they are unrealistic and I have always urged all responsible and rational investors to be extremely wary and suspicious of anyone that claims they can accurately predict market...

Read More »

Read More »

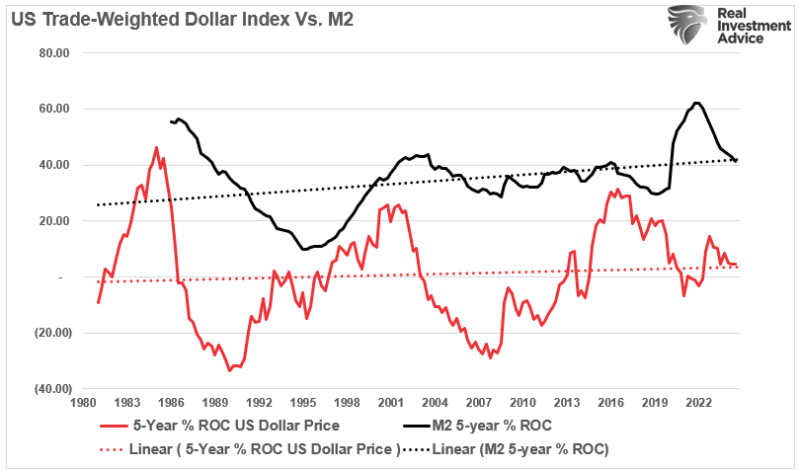

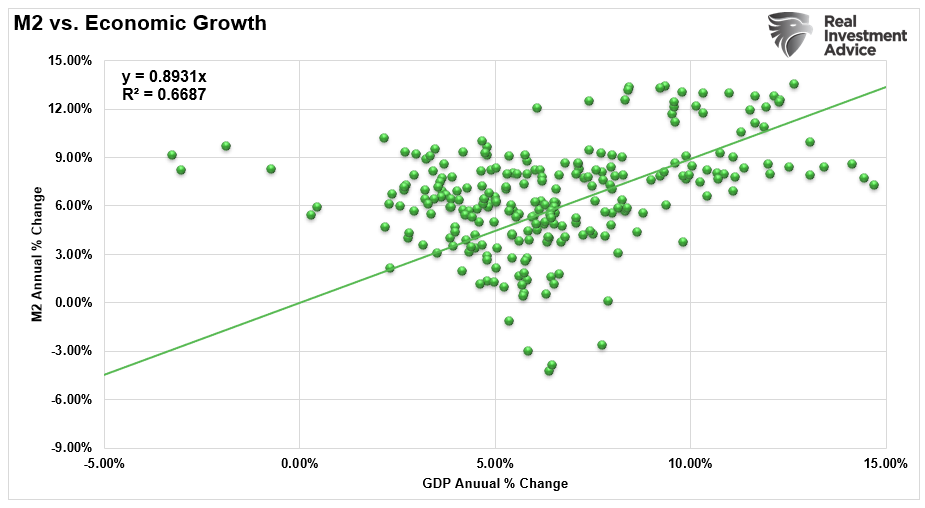

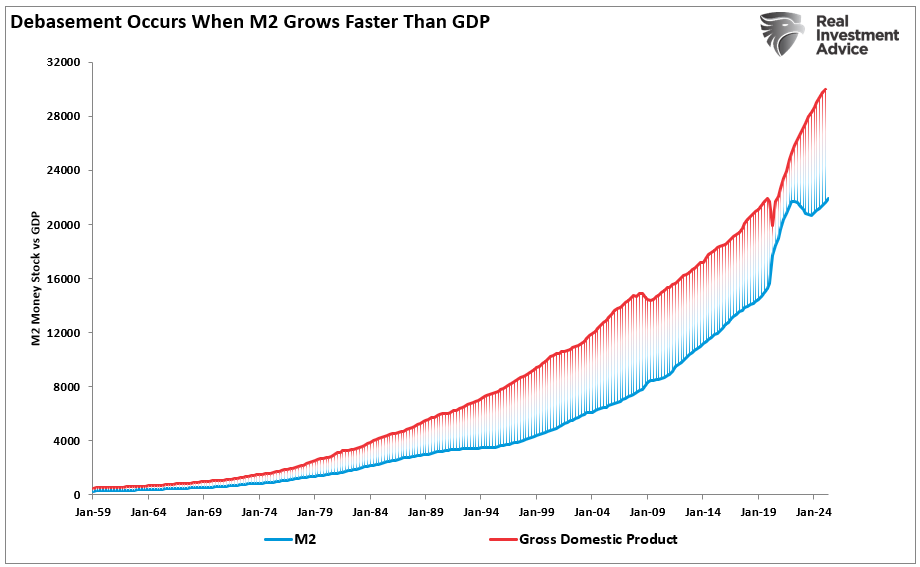

Do Money Supply, Deficit And QE Create Inflation?

I recently debated with Michael Pento, who made an interesting statement that increases in the money supply, the deficit, and a return to quantitative easing (QE) will lead to 1970s-style inflation. The recent experience of inflation in 2021 and 2022 would seem to justify such a view. However, is that historically the case, or was …

Read More »

Read More »

Year in review: A tectonic shift has only just begun

Share this article

As we’re approaching the final hours of 2024, it is a good time to take a step back and remember what this year taught us. History might not repeat itself, but it does rhyme, as the saying goes, and the past is always the best teacher to prepare us for the future.

For many of our fellow humans, 2024 was yet another turbulent year, filled with terrible strife, war, death, pain and indescribable suffering. The two ongoing war...

Read More »

Read More »

Year in review: A tectonic shift has only just begun

As we’re approaching the final hours of 2024, it is a good time to take a step back and remember what this year taught us. History might not repeat itself, but it does rhyme, as the saying goes, and the past is always the best teacher to prepare us for the future.

For many of our fellow humans, 2024 was yet another turbulent year, filled with terrible strife, war, death, pain and indescribable suffering. The two ongoing war fronts and the images...

Read More »

Read More »

Affordable Care Act & The Inflation Of Healthcare

When the Obama Administration first suggested the Affordable Care Act following the Financial Crisis, we argued that the outcome would be substantially higher, not lower, healthcare costs. It is interesting today that economists and the media complain about surging healthcare costs with each inflation report but fail to identify the root cause of that escalation. …

Read More »

Read More »

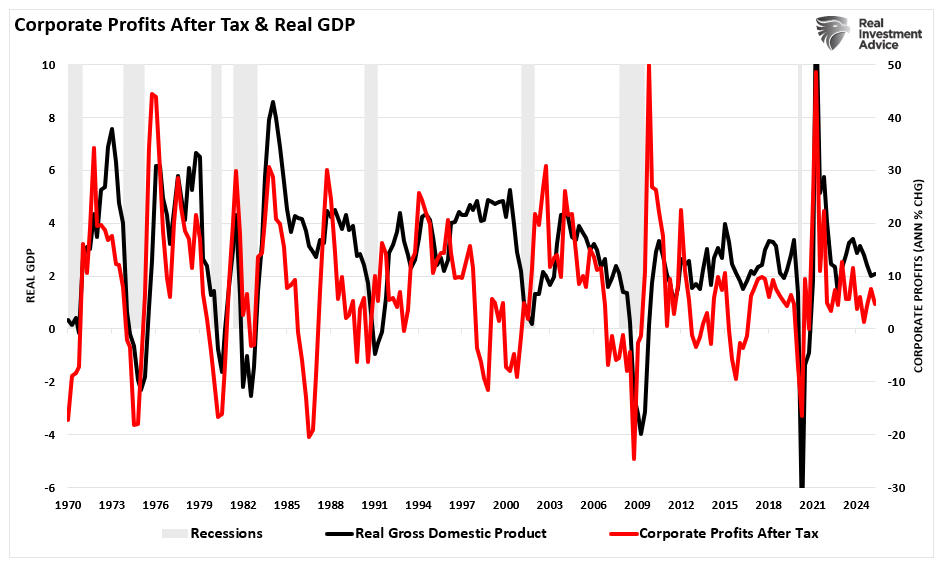

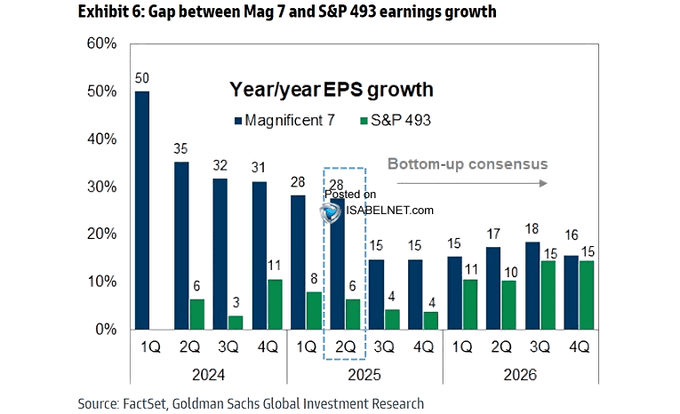

Economic Indicators And The Trajectory Of Earnings

Understanding the trajectory of corporate earnings is crucial for investors, as these earnings significantly influence stock valuations and market performance. Economic indicators such as Gross Domestic Product (GDP), the Institute for Supply Management (ISM) Manufacturing Index, and the Chicago Fed National Activity Index (CFNAI) provide valuable insights into the economic environment that shapes company profitability. …

Read More »

Read More »

“THE BIG BULL MARKET IN GOLD AND SILVER HAS ONLY JUST BEGUN”

Share this article

DR. THORSTEN POLLEIT (WWW.BOOMBUSTREPORT.COM) INTERVIEWS CLAUDIO GRASS

Thorsten Polleit (TP): On November 5, 2024, Donald J. Trump was elected the new U.S. president with a landslide victory. His declared goal is to take on the “Deep State” and its bureaucracy. His advisor, Elon Musk, is urging the reduction of national debt, and even the inflationary Federal Reserve (Fed) has become a target, described as an evil that must be...

Read More »

Read More »

“THE BIG BULL MARKET IN GOLD AND SILVER HAS ONLY JUST BEGUN”

DR. THORSTEN POLLEIT (WWW.BOOMBUSTREPORT.COM) INTERVIEWS CLAUDIO GRASS

Thorsten Polleit (TP): On November 5, 2024, Donald J. Trump was elected the new U.S. president with a landslide victory. His declared goal is to take on the “Deep State” and its bureaucracy. His advisor, Elon Musk, is urging the reduction of national debt, and even the inflationary Federal Reserve (Fed) has become a target, described as an evil that must be healed. Is all...

Read More »

Read More »

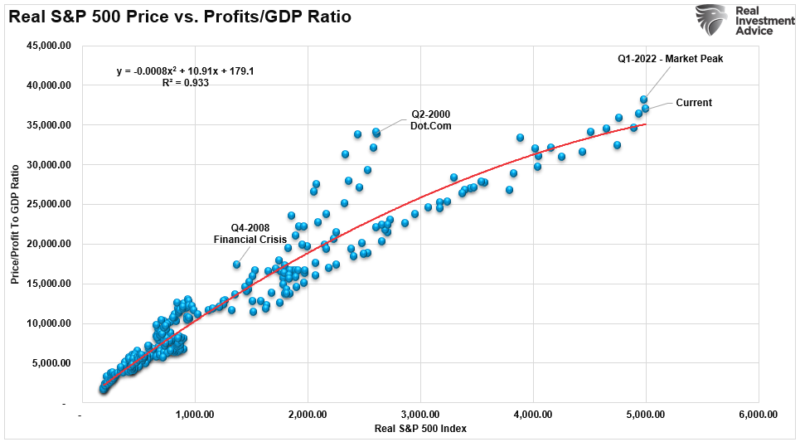

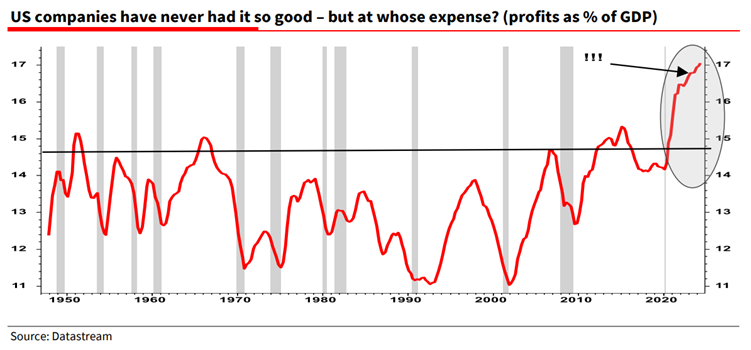

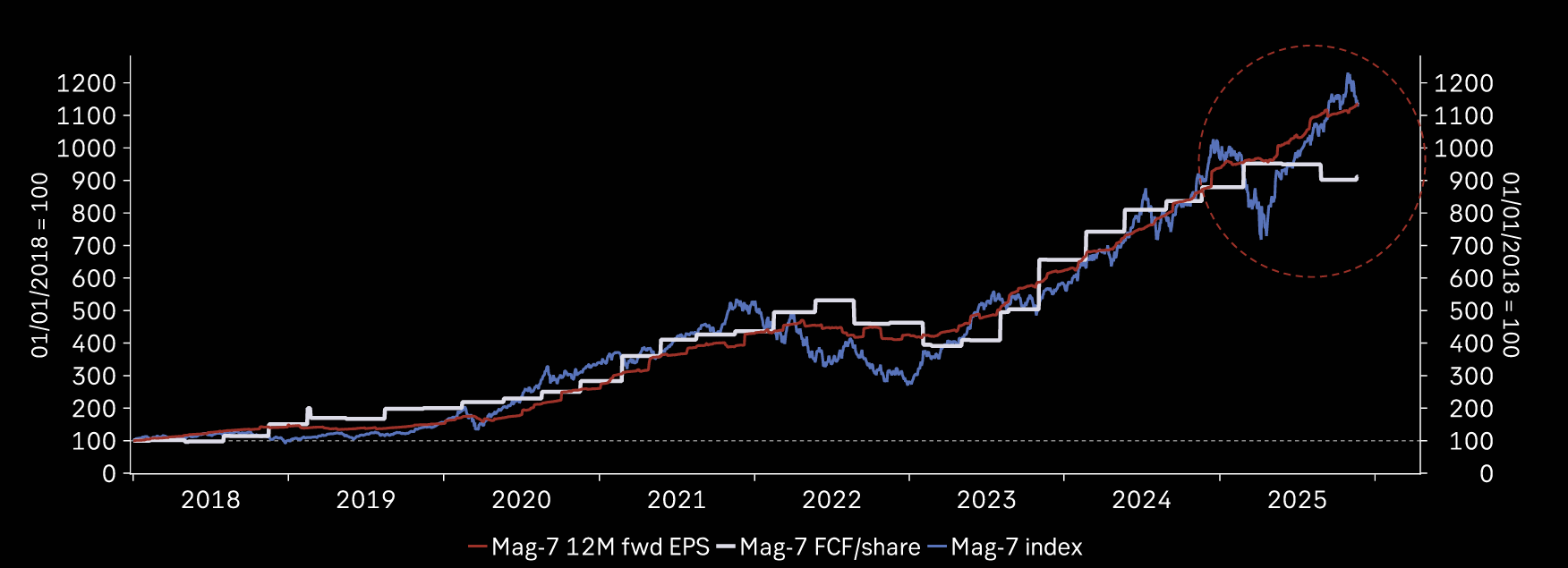

The Kalecki Profit Equation And The Coming Reversion

Corporations are currently producing the highest level of profitability, as a percentage of GDP, in history. However, understanding corporate profitability involves more than glancing at quarterly earnings reports. At its core, the Kalecki Profit Equation provides a valuable framework, especially when exploring the reasons behind today’s elevated profit margins and what could disrupt them. James …

Read More »

Read More »

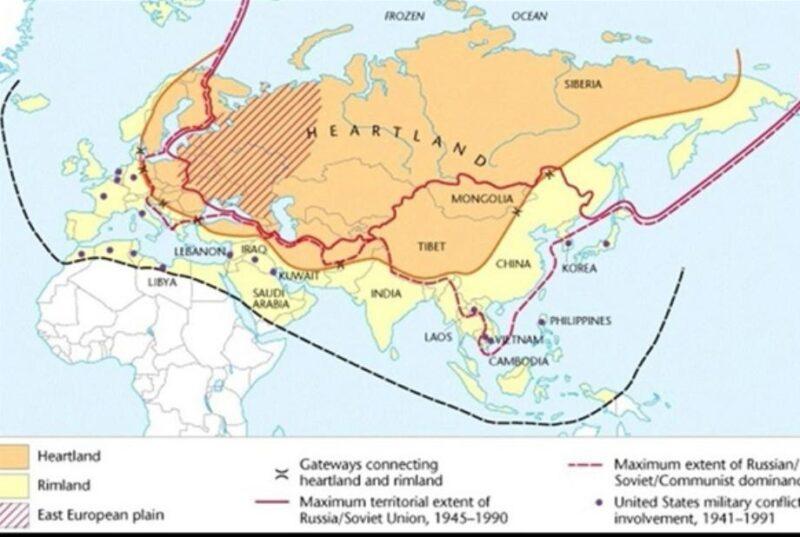

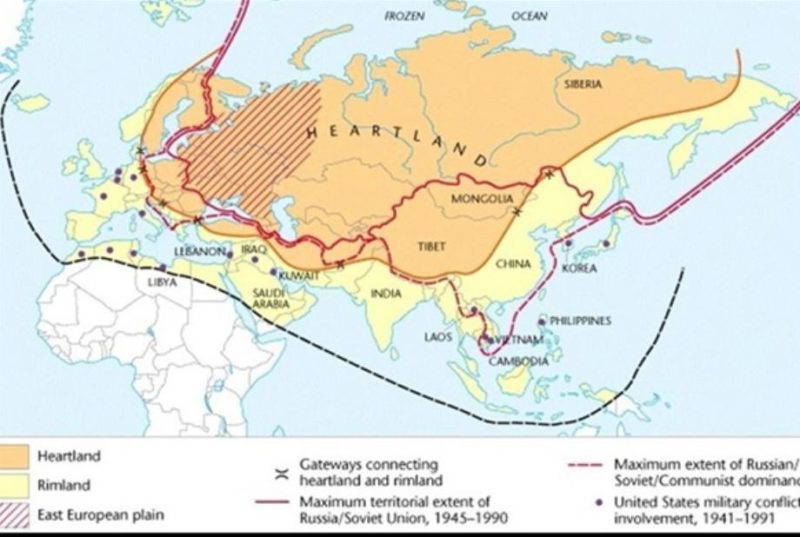

The Heartland theory: More relevant than ever?

Sir Halford Mackinder’s famous Heartland Theory was first formulated in the early 20th century, but it holds renewed relevance and importance today, especially when analyzed though a critical lens of the current geopolitical system, one that emphasizes individual freedom, limited government intervention, and skepticism of centralized power. Mackinder’s theory posits that control over the “Heartland” — roughly the region of Eastern Europe and...

Read More »

Read More »

The Heartland theory: More relevant than ever?

Share this article

Sir Halford Mackinder’s famous Heartland Theory was first formulated in the early 20th century, but it holds renewed relevance and importance today, especially when analyzed though a critical lens of the current geopolitical system, one that emphasizes individual freedom, limited government intervention, and skepticism of centralized power. Mackinder’s theory posits that control over the “Heartland” — roughly the region of...

Read More »

Read More »