Tag Archive: ECB

FX Daily, October 27: Rising Yields Continue to be the Main Driver

The euro remains pinned near the seven-month low it recorded two days ago near $1.0850. It approached $1.0950 yesterday and has been confined to about a 15-tick range on either side of $1.0905 today. Against the yen, the dollar remains near the three-month high (~JPY104.85) also seen two days ago. New dollar buying emerged yesterday near JPY104.

Read More »

Read More »

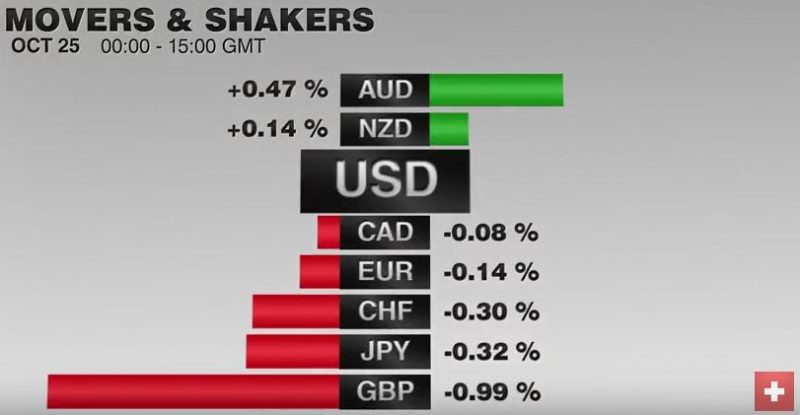

FX Daily, October 25: Germany IFO, Dollar Going Nowhere

The US dollar has been confined to extremely narrow ranges against the euro, yen, and sterling. To the extent that there is much action in the foreign exchange market, it is with the dollar-bloc and emerging market currencies.The Canadian dollar was whipsawed by comments from the Bank of Canada.

Read More »

Read More »

FX Weekly Preview: Forces of Movement in the Week Ahead

Fitch cut Italy's rating outlook to negative from stable, while DBRS left Portugal's rating and outlook unchanged. Europe and Canada's free trade negotiations broke down, but many seem to be making exaggerating the significance of the drama. Japan and Australia report inflation figures, and both are exceptions to the generalization that price pressures are rising in (most) high income countries.

Read More »

Read More »

Great Graphic: Italian Banks and a German Bank

DB and Italian bank stocks have been moving in tandem. They suffer from fundamentally different problems. The euro has been selling off as the bank shares rebound.

Read More »

Read More »

Cool Video: Double Bloomberg Feature–ECB and US Baby Boomers

This afternoon I had the privilege of being on Bloomberg TV, with anchors Scarlet Fu and Matt Miller. I was joined by an old market friend Bob Sinche. We had a lively discussion (what did you expect?) on two issues. The first was on the ECB. At his press conference earlier today, Draghi indicated that the question of extending QE and tapering was not discussed.

Read More »

Read More »

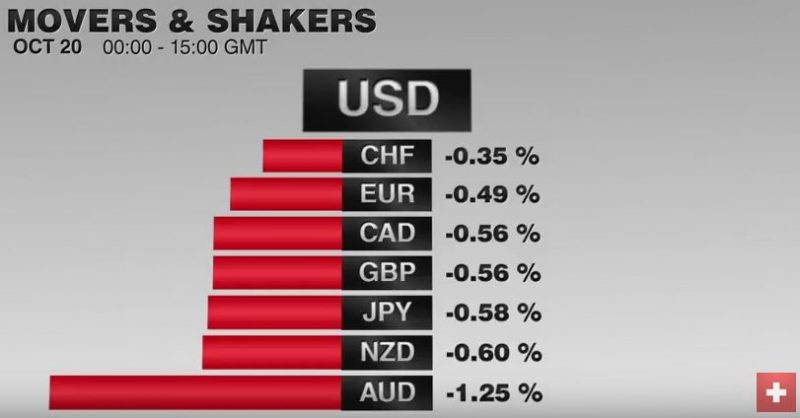

FX Daily, October 20: ECB Unlikely to Shake Dollar’s Slumber

GBP/CHF rates have fallen dramatically over the past month, as Sterling continues to find itself under pressure against the major currencies. However, despite these losses it is not all doom and gloom for those clients holding GBP, as Tuesday’s positive spike for the Pound proved. Currency does not move in a straight line and therefore we will see opportunities for those clients holding GBP to take advantage of, even if a sustainable Sterling...

Read More »

Read More »

Draghi Says Nothing to Undermine Expectations of New Action in December

Extending or tapering QE was not discussed, but means little in terms of what the ECB decides in Sept. Draghi said growth risks are on the downside and inflation has yet to enter a meaningful uptrend. Reiterates that abrupt end of purchases is unlikely.

Read More »

Read More »

ECB: Dovish Hold

Draghi will like emphasis inflation is the key to policy and ECB is committed using allow for its technical tools to achieve its legal mandate. Key decisions will be made in December. The more the euro rises against sterling, the greater the pressure for the euro to fall against the dollar.

Read More »

Read More »

FX Weekly Preview: Four Key Events in the Week Ahead

Of the forces driving prices in the week ahead, events appear more important than economic reports.There are four such events that investors must navigate.The Bank of Canada and the European Central Bank meet. The UK High Court will deliver its ruling on the role of Parliament in Brexit.The rating agency DBRS updates its credit rating for Portugal.

Read More »

Read More »

FX Daily, October 14: Firm Dollar Consolidating, Awaiting US Retail Sales

The US dollar is firm against most of the major currencies, but within yesterday's ranges, which seems somewhat fitting amid the light new stream. The high-yielding Australian and New Zealand dollars are resisting the stronger greenback, while on the week the Aussie and the Canadian dollar are the only majors to gain.

Read More »

Read More »

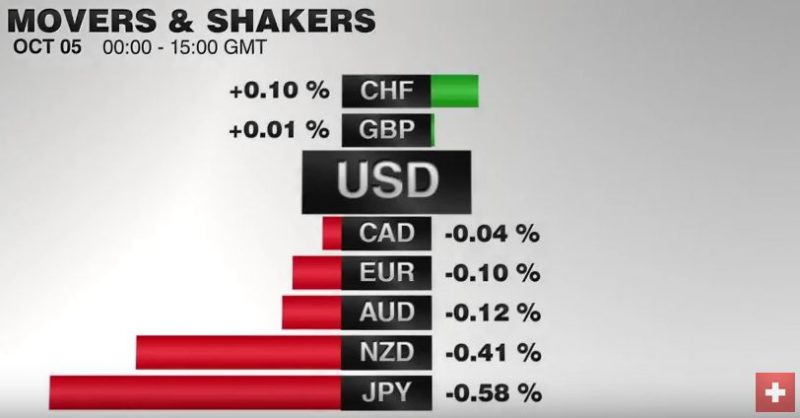

FX Daily, October 05: Euro Remains Firm Despite Dubious Tapering Story

After the sudden rise to 1.0973 the EUR/CHF is falling again. The volatiliy is related to the CHF speculative postion, that suddenly was Short CHF. Traders that moved with the SNB Window Dressing for Q3 are closing their shorts again.

Read More »

Read More »

FX Daily, September 28: Dollar Mostly Firmer, but Going Nowhere Quickly

The US dollar is enjoying a firmer bias today, but it remains narrowly mixed on the week. It is within well-worn ranges. Of the several themes that investors are focused on, there have not significant fresh developments. In terms of monetary policy, both Draghi and Yellen speak today. The former is behind closed doors with a Germany parliamentary committee.

Read More »

Read More »

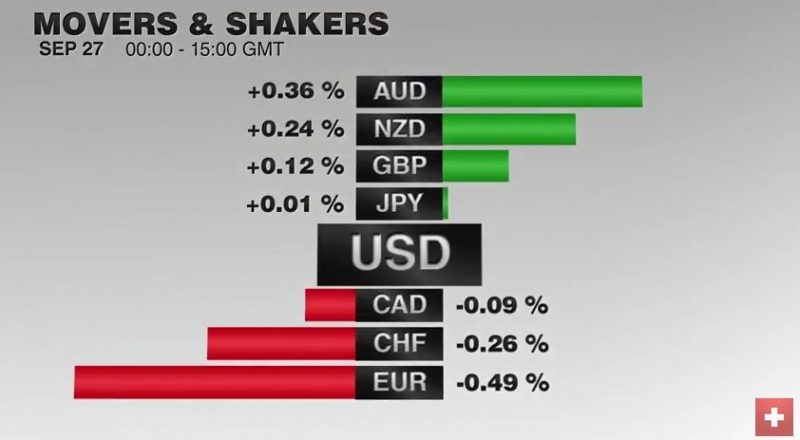

FX Daily, September 27: US Debate Lifts Peso, but Leaves the Dollar Non-Plussed

Since the monetary assessment meeting, the EUR/CHF is trending downwards. Sight deposits indicate that the SNB is intervening 0.9 bn per week. We emphasized that the preferred intervention corridor is between 1.08 and 1.0850. The first US Presidential debate may not sway many voters but has lifted the Mexican peso. The peso, which has fallen by about 1.3% over the past two sessions, has stormed by 1.5% today as the seemingly biggest winner of the...

Read More »

Read More »

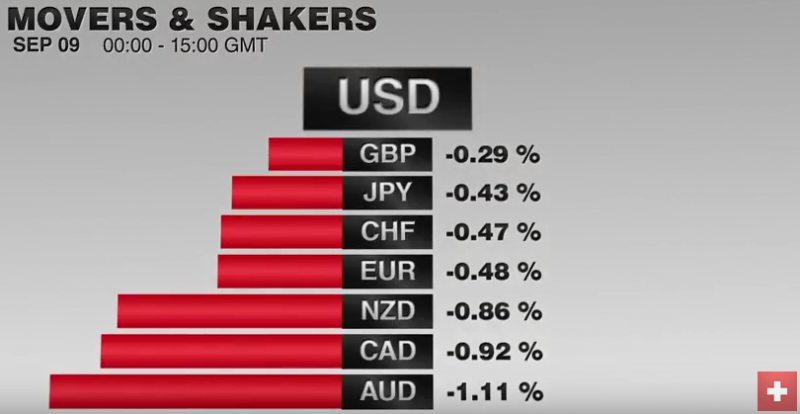

FX Daily, September 9: Ahead of the Weekend

The US dollar is lower against all the major currencies this week as North American participants close it out. On the day, the dollar is consolidating swings yesterday and is narrowly mixed.Bond yields are higher and equities are mostly lower. The euro has finished lower the last three Fridays. The streak may end today. The euro has found support nearly $1.1260, and the intraday technicals favor a move higher in the US morning.

Read More »

Read More »

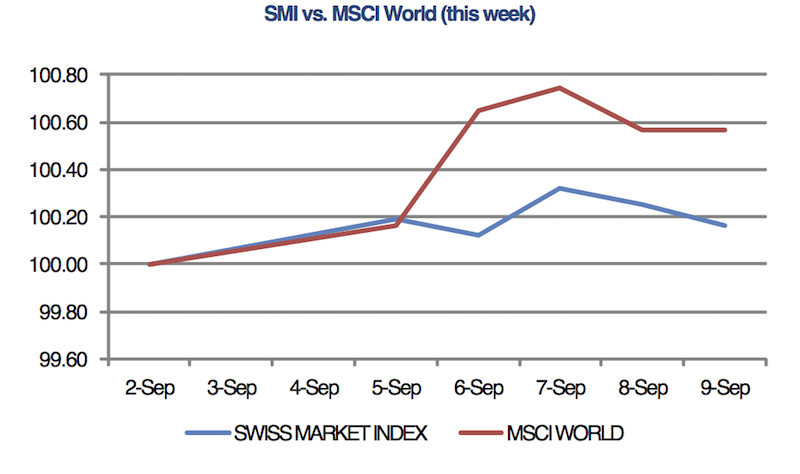

Swiss stocks fluctuate as central bank decisions dominate the landscape

The Swiss Market Index, along with other European markets, fluctuated this week as central bank decisions dominated the landscape. Equity markets advanced at the beginning of the week as chances of the Federal Reserve raising US interest rates later this month declined after a surprisingly weak report on the US service-sector earlier this week.

Read More »

Read More »

FX Daily, August 31: Dollar Bides Times, Month-End at Hand, Jobs Data Ahead

The US dollar is a little softer against most of the major and emerging market currencies. The exception is the Japanese yen, where the greenback has moved above JPY103 for the first time in a month. The tone is consolidative as the market awaits assurances that the jobs growth this month has been sufficiently strong as to keep the prospects of a September meeting still alive.

Read More »

Read More »

Natural Rates and Terminal Fed Funds

The neutral or natural interest rate is linked to potential growth. Potential growth has fallen so has the neutral rate. The implication is that the FOMC has made the bulk of the adjustment on its long-term Fed funds forecast.

Read More »

Read More »

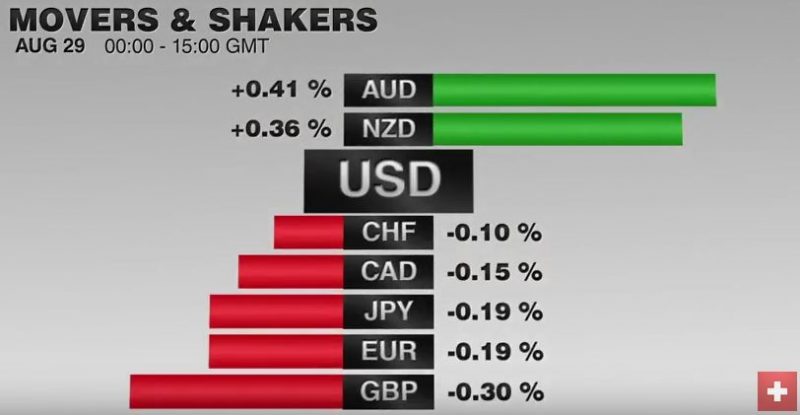

FX Daily, August 29: Dollar Gains Extended, but Momentum Fades

The US dollar staged a strong pre-weekend rally on hints that the Fed will raise rates before the end of the year. There was initially follow through dollar buying in Asia before a more stable tone emerged in Europe, where London markets are closed for a bank holiday. The easing of the dollar’s upside momentum may set the stage for a bout of profit-taking later today and tomorrow.

Read More »

Read More »

Loose Monetary Policy and Social Inequality

It has been almost eight years since former U.S. President George W. Bush warned the world that “without immediate action by Congress, America could slip into a financial panic and a distressing scenario would unfold.” The government’s response to the crisis was a USD700 billion rescue package that was supposed to prevent U.S. banks from collapsing and encourage them to resume lending, which was soon to be followed by a series of Quantitative...

Read More »

Read More »