Tag Archive: ECB

FX Daily, August 4: Markets Looking for Fresh Directional Cues

Asia Pacific equities rallied after the US shares rallied with the Nasdaq reaching record highs after it and the S&P 500 gapped higher yesterday. Japan and Hong Kong led the rally with more than 2% gains, while the Shanghai Composite lagged with about a 0.1% gain.

Read More »

Read More »

Accusing the Accused of Excusing the Mountain of Evidence

Why not let the accused also sit in the jury box? The answer seems rather obvious. While maybe the truly honest man accused of a crime he did commit would vote for his own conviction, the world seems a bit short on supply of those while long and deep offering up practitioners of pure sophistry in their stead.

Read More »

Read More »

FX Daily, July 16: Equities Slide and the Greenback Bounces After China’s GDP and Before the ECB

Overview: Profit-taking, perhaps spurred by disappointing retail sales figures, sent Chinese equity markets down by 4.5%-5.2% today, the most since early February. It appears to be triggering a broader setback in equities today. The Hang Seng fell 2%, and most other markets in the region were off less than 1%.

Read More »

Read More »

FX Daily, June 30: When Primary is Secondary

The gains in US equities yesterday carried into Asia Pacific trading today, but the European investors did not get the memo. The Dow Jones Stoxx 600 is succumbing to selling pressure and giving back yesterday's gain. Energy and financials are the biggest drags, while real estate and information technology sectors are firm. All the markets had rallied in the Asia Pacific region, with the Nikkei and Australian equities leading with around 1.3%...

Read More »

Read More »

FX Daily, June 25: Contagion Growth and Calendar-Effect Saps Investor Enthusiasm

Given the huge run-up in risk assets this quarter, and the technical indicators warning of corrective forces, concerns over the new infections is pushing on an open door. The S&P 500 gapped lower yesterday and fell 2.6%, led by energy and airlines. The NASDAQ snapped an eight-day rally. Follow-through selling in the Asia Pacific region saw most markets fall at least 1%, with Korea and Australia seeing losses in excess of 2%.

Read More »

Read More »

FX Daily, June 17: Correction Phase does not Appear Over

Overview: Investors have not yet completely shaken off the angst that saw equities slide last week. All equity markets in the Asia Pacific region, but Japan, edged higher today, including China, India, and South Korea, where political/military tensions are elevated. Europe followed suit, and the Dow Jones Stoxx 600 is firm near yesterday's highs. It has entered but not yet filled the gap created by the sharply lower opening on June 11.

Read More »

Read More »

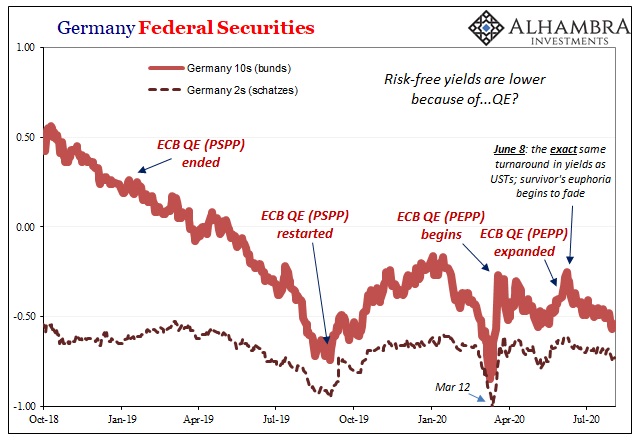

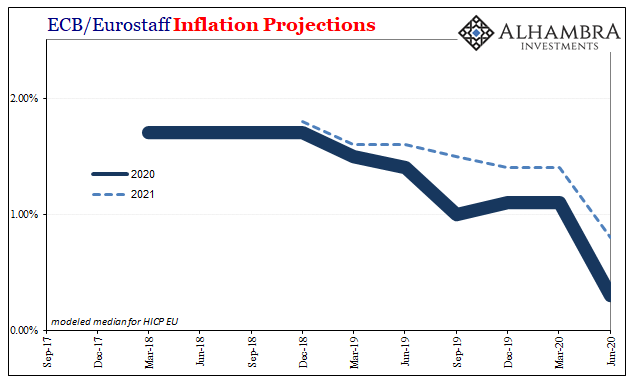

ECB Doubles Its QE; Or, The More Central Banks Do The Worse You Know It Will Be

A perpetual motion machine is impossible, but what about a perpetual inflation machine? This is supposed to be the printing press and central banks are, they like to say, putting it to good and heavy use. But never the inflation by which to confirm it. So round and round we go. The printing press necessary to bring about consumer price acceleration, only the lack of consumer price acceleration dictates the need for more of the printing press.

Read More »

Read More »

FX Daily, June 5: Greenback Remains Soft Ahead of Employment Report, but Reversal Possible

The modest loss in the S&P 500 and NASDAQ yesterday did not signal the end of the bull run. All the markets in the Asia Pacific region rallied, with the Hang Seng among the strongest with a 1.6% advance that brought the week's gain to around 7.8%. South Korea's Kospi was not far behind with a weekly gain of 7.5%. In the past two weeks, the MSCI Asia Pacific Index is up nearly 10%.

Read More »

Read More »

FX Daily, June 4: Risk Taking Pauses Ahead of the ECB

Overview: After several days of aggressive risk-taking, investors are pausing ahead of the ECB meeting. Equities were mostly higher in the Asia Pacific region, though China was mixed, and Indian shares slipped. Europe's Dow Jones Stoxx 600 is snapping a five-day advance, and US shares are trading with a heavier bias. The S&P 500 gapped higher yesterday, and that gap (~3081-3099) offers technical support.

Read More »

Read More »

FX Daily, May 29: Month-End Profit-Taking Weighs on Equities as the Euro Pops Above $1.11

Overview: The announcement that President Trump will hold a press conference on China later today rattled investors yesterday after they had earlier shrugged off the escalation of tension between the US and China to take the S&P 500 up to its highest level in nearly three months. The S&P 500 reversed and settled on its lows, and this carried over into today's activity, which also may be reflecting month-end adjustments.

Read More »

Read More »

FX Daily, May 28: Escalating Tensions, Calm Markets

Overview: The US Secretary of State's announcement that the autonomy of Hong Kong could no longer be affirmed did not derail the rally in US equities. However, the threat of an executive order against social media companies may be discouraging follow-through buying, leaving US equities little changed ahead of the open. In contrast, Asia Pacific and European equities are mostly higher.

Read More »

Read More »

FX Daily, May 27: China and Hong Kong Pressures are Having Limited Knock-on Effects

Overview: The S&P 500 gapped higher yesterday, above the recent ceiling and above the 200-day moving average for the first time since early March. The momentum faltered, and it finished below the opening level and near session lows. The spill-over into today's activity has been minor. The heightened tensions weighed on China and Hong Kong markets, but Japan, South Korea, Taiwan, and Indian equity markets rose.

Read More »

Read More »

FX Daily, May 26: Fear is Still on Holiday

Overview: The heightened tensions between the US and China sapped risk-appetites before the weekend, but appear to be missing in action today. Equity markets have rebounded strongly. Nearly all the equity markets in the Asia Pacific region rose (India was a laggard) led by an almost 3% rally in Australia, which was seen as particularly vulnerable to the Sino-American fissure.

Read More »

Read More »

The global economy doesn’t care about the ECB (nor any central bank)

The monetary mouse. After years of Mario Draghi claiming everything under the sun available with the help of QE and the like, Christine Lagarde came in to the job talking a much different approach. Suddenly, chastened, Europe’s central bank needed assistance. So much for “do whatever it takes.”They did it – and it didn’t take.Lagarde’s outreach was simply an act of admitting reality.

Read More »

Read More »

FX Daily, May 6: The Euro is Knocked Back Further

Overview: The late sell-off in US stocks yesterday has not prevented gains in Asia and Europe. Most of the equity markets, including the re-opening of China, gain more than 1%. Australia was a notable exception, falling about 0.4%, and Taiwan was virtually flat. European bourses opened higher but made little headway before some profit-taking set in, while US shares are trading higher.

Read More »

Read More »

FX Daily, April 30: ECB Takes Center Stage

Overview: Equities continue to recover even as deep economic contractions are reported. Yesterday, the US said Q1 GDP contracted at an annualized pace of 4.8%, while the eurozone reported today that output fell 3.8% quarter-over-quarter in Q1. Hong Kong and South Korea were closed, but the rest of the Asia Pacific bourses rallied strongly with several, including Australia and India, rising more than 2%.

Read More »

Read More »

FX Daily, April 29: Heavy Dollar amid Month-End Pressure

Overview: The dollar is lower across the board as dealers attribute the selling to month-end pressures ahead of the FOMC today and ECB tomorrow and long-holiday weekend for many. Japan's Golden Week holiday has already begun. Despite the loss in US equities yesterday, despite the higher opening, it has not spilled over, as Alphabet earnings helped lift sentiment.

Read More »

Read More »

The Greenspan Bell

What set me off down the rabbit hole trying to chase modern money’s proliferation of products originally was the distinct lack of curiosity on the subject. This was the nineties, after all, where economic growth grew on trees. Reportedly. Why on Earth would anyone purposefully go looking for the tiniest cracks in the dam?

Read More »

Read More »

FX Daily, April 9: Three Deals Needed ahead of Holiday Weekend

Overview: Three deals need to be struck. First, the Eurogroup of finance ministers needs to reach an agreement of proposals for joint action to the heads of state. Second, oil producers need to cut output if prices are to stabilize. Third, the US Congress needs to strike a deal to provide more funding. Investor seems hopeful, and risk appetites are have lifted equities.

Read More »

Read More »

FX Daily, April 8: Flavor of the Day: Consolidation

Overview: Global equities are struggling after the S&P 500 staged a dramatic reversal yesterday. The early 3.5% gain was completely unwound and closed slightly lower. With few exceptions (e.g., Japan and the Philippines), most equity markets in the Asia Pacific region and Europe are lower.

Read More »

Read More »