Tag Archive: Currency Movement

European Currencies Continue to Bear the Brunt

Overview: Russia's invasion of Ukraine and the global response is a game-changer, as Fed Chair Powell told Congress yesterday. The UK-based research group NISER estimated that world output will be cut by 1% next year or $1 trillion, and global inflation will be boosted by three percentage points this year and two next.

Read More »

Read More »

Russia’s Military Action Shakes Markets

Overview: News that the separatists were calling on Moscow for military assistance began the risk-off move, and Russia hitting targets across Ukraine has rippled across the capital markets. Equites have been upended. Most bourses in the Asia Pacific region were off 2%-3%, while the Stoxx 600 in Europe gapped lower and is off around 3.5% in late morning dealings.

Read More »

Read More »

FX Daily, January 26: Federal Reserve and Bank of Canada Meet as Risk Appetites Stabilize

After a slow and mixed start in Asia, where Australia and India are on holiday, equity markets have turned higher. Europe's Stoxx 600 is up around 1.9% near midday in Europe, which if sustained would be the biggest gain of the year. US futures are snapping backing too, with the S&P 500 popping more than 1% and NASDAQ by 2%.

Read More »

Read More »

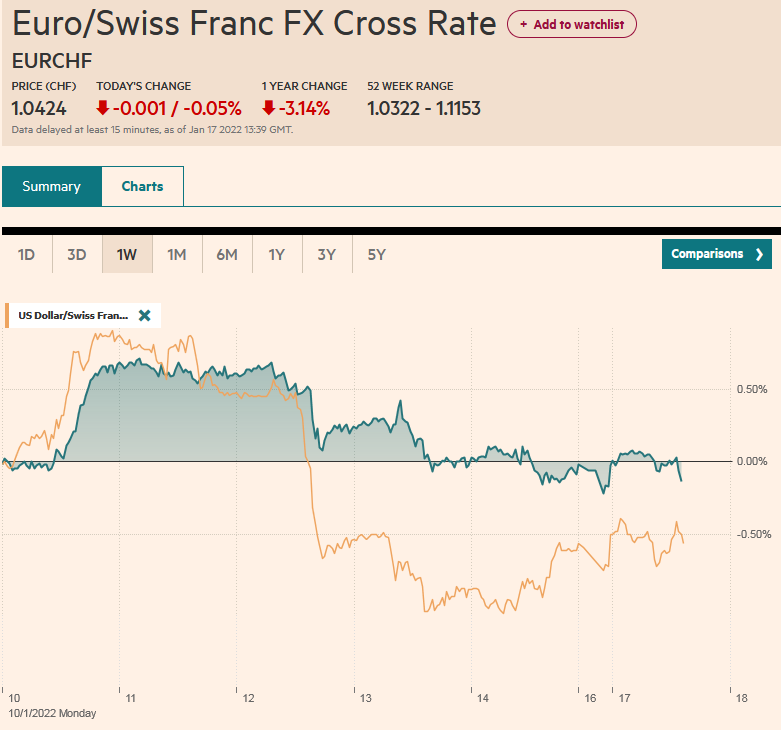

FX Daily, January 17: PBOC Eases, but the Yuan Firms

Overview: Russia is thought to be behind the cyber-attack on Ukraine at the end of last week, but a military attack over the weekend may be underpinning risk appetites today. The dollar's pre-weekend gains are being pared slightly. Led by the Canadian dollar and Norwegian krone, the greenback is lower against most major currencies, with the yen being the notable exception, which is off about 0.2%.

Read More »

Read More »

How the Market Responds to US CPI may set the Near-Term Course

Overview: US stocks built on the recovery started on Monday and Powell's suggestion of letting the balance sheet shrink later this year eased some speculation of a fourth hike this year, which seemed to allow the Treasury market to stabilize.

Read More »

Read More »

The Chagrin of Beijing and the Problem of Time

The central bank meeting cycle is over. Most of the important high-frequency data has been released until early January. The US debt ceiling has been lifted, avoiding an improbable default. A year ago, there was a sense of optimism, with a couple of vaccines being announced and monetary and fiscal stimulus boosting risk-appetites. Populism, which had been in the ascendancy after the Great Financial Crisis, seemed to be retreating in Europe and the...

Read More »

Read More »

The Week Winds Down with Equities under Pressure and the Dollar Mostly Firmer

Overview: The combination of the volatility and a large number of central bank meetings have exhausted market participants, and the holiday phase appears to have begun. Equities are under pressure following the sell-off yesterday in the US. Japan, China, and Hong Kong suffered more than 1.2% losses, while Australia, South Korea, and Taiwan posted minor gains. It was the fifth loss in the past six sessions for the MSCI Asia Pacific Index. Europe's...

Read More »

Read More »

Fed Unleashes Animal Spirits

Overview: The Fed's hawkish pivot came a few weeks before yesterday's FOMC meeting, which confirmed more or less what the market had already largely anticipated. Buy the (dollar) on rumors (of tapering and more aggressive stance on rates) and sell the fact unfolded, and unleashed the risk-appetites which rippled through the capital markets. US stocks rallied yesterday, and the futures point to a gap higher opening today. Large Asia Pacific...

Read More »

Read More »

No Turnaround Tuesday for Equities?

Overview: Activity in the capital markets is subdued today, ahead of tomorrow's FOMC meeting conclusion and the ECB meeting on Thursday. The MSCI Asia Pacific equity index fell for the third consecutive session. European bourses are heavy after the Stoxx 600 posted an outside down day yesterday. Today would be the fifth consecutive decline. Selling pressure on the US futures indices continues after yesterday's losses. Australia and New Zealand...

Read More »

Read More »

Dollar Starts the Week Bid ahead of the FOMC

Overview: Equities, bonds, and the dollar begin the new week on a firm note. Japanese, Chinese, Australian, and New Zealand equities advanced in the Asia Pacific region. Europe's Stoxx 600 is snapping a three-day decline, and US futures are 0.25%-0.35% higher. The US 10-year yield is a little softer at 1.48%. European benchmark yields are mostly 1-2 bp lower, and near 0.71%, the UK Gilt's yield is at a three-month low. The dollar is rising...

Read More »

Read More »

Markets Turn Cautious Ahead of Tomorrow’s US CPI

Overview: The euro has come back offered after its seemingly inexplicable advance yesterday. The dollar is firmer against most major currencies today, with the yen an exception after JPY114.00 held on yesterday's advance. Most emerging market currencies are also softer, with a handful of smaller Asian currencies proving a bit resilient. Most large bourses advance in the Asia Pacific region, except Japan and Australia. Europe's Stoxx 600 is...

Read More »

Read More »

Markets Calmer, Awaiting Fresh Incentives

Overview: The capital markets are calmer today, and the fear that was evident at the end of last week remains mostly scar tissue. Led by gains in Japan, China, Australia, New Zealand, and India, the MSCI Asia Pacific Index extended yesterday's gains. Europe's Stoxx and US futures are firm. The US 10-year yield is softer, around 1.43%, while European yields are mostly 1-2 bp lower. The Norwegian krone and euro lead major currencies higher...

Read More »

Read More »

Animal Spirits Roar Back

Overview: A return of risk appetites can be seen through the capital markets today, arguably encouraged by ideas that Omicron is manageable and China's stimulus. Led by Hong Kong and Japan, the MSCI Asia Pacific rose by the most in three months, while Europe's Stoxx 600 gapped higher, leaving a potentially bullish island bottom in its wake. US futures point to a gap higher opening when the local session begins. The bond market is taking it in...

Read More »

Read More »

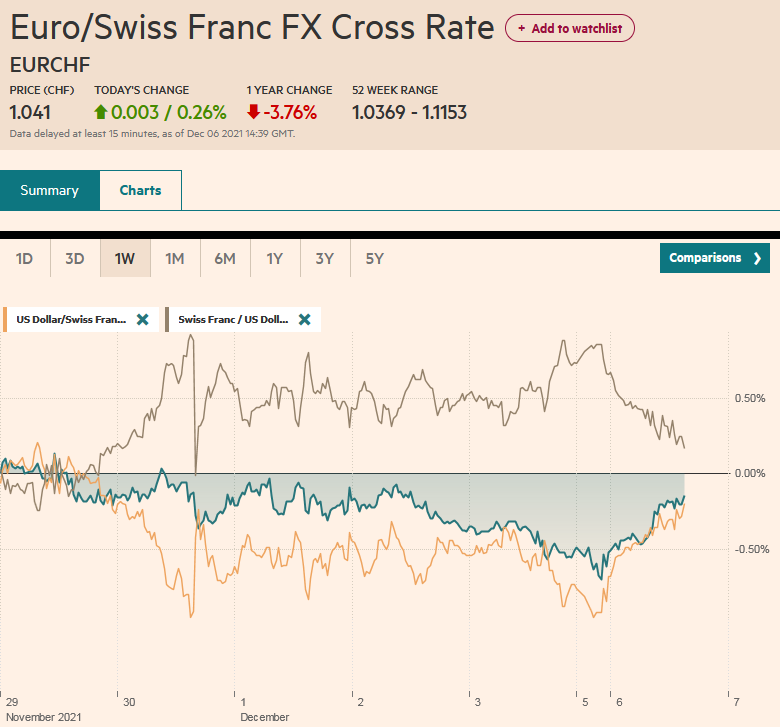

FX Daily, December 6: Semblance of Stability Returns though Geopolitical Tensions Rise

The absence of negative developments surrounding Omicron over the weekend appears to be helping markets stabilize today after the dramatic moves at the end of last week. Asia Pacific equities traded heavily, and among the large markets, only South Korea and Australia escaped unscathed today.

Read More »

Read More »

The Greenback Finds Traction ahead of the Jobs Report

Overview: The Omicron variant has been detected in more countries, but the capital markets are taking it in stride. Risk appetites appear to be stabilizing. The MSCI Asia Pacific Index rose for the third consecutive session, though Hong Kong and Taiwan markets did not participate in the advance today. Europe's Stoxx 600 is struggling to hold on to early gains, while US futures are narrowly mixed. The US 10-year yield is a little near 1.43%,...

Read More »

Read More »

FX Daily, December 02: Calm Surface Masks Lack of Conviction

The downside reversal in US stocks yesterday seemed to accelerate after the first case of the Omicron variant was found in the US. In itself, it should not be surprising, but perhaps, what was especially disheartening is that the person had been fully vaccinated.

Read More »

Read More »

Fragile Calm Returns and Powell’s Anti-Inflation Rhetoric Ratchets Up

Overview: Into the uncertainty over the implications of Omicron, the Federal Reserve Chairman injected a particularly hawkish signal into the mix in his testimony before the Senate. These are the two forces that are shaping market developments. Travel restrictions are being tightened, though the new variant is being found in more countries, and it appears to be like closing the proverbial barn door after the horses have bolted. Equities are...

Read More »

Read More »

Pessimistic Omicron Assessment Squashes Risk Appetites

Overview: A pessimistic assessment offered by the CEO of Moderna shattered the fragile calm seen yesterday after the pre-weekend turmoil. Risk appetites shriveled, sending equity markets lower and the bond markets higher. Funding currencies rallied, with the euro and yen moving above last week's highs. The uncertainty weighs on sentiment and makes investors question what they previously were certain of. The MSCI Asia Pacific Index fell over 1%...

Read More »

Read More »

Sentiment Remains Fragile

Overview: The fire that burnt through the capital markets before the weekend, triggered by the new Covid mutation, burned itself out in the Asian Pacific equity trading earlier today. A semblance of stability, albeit fragile and tentative, has emerged. Europe's Stoxx 600 is up about 1%, led by real estate, information technology, and energy. US index futures are trading higher, with the NASDAQ leading. Benchmark 10-year yields are firmer. The US...

Read More »

Read More »

Covid Strikes Back

Overview: Concerns that a new mutation of the Covid virus has shaken the capital markets. Equities are off hard, and bonds have rallied. In the foreign exchange market, the Japanese yen and Swiss franc have rallied. While there may be a safe haven bid, there also appears to be an unwinding of positions that require the buying back of the funding currencies, which is also lifting the euro. The currencies levered from growth, the dollar-bloc and...

Read More »

Read More »