Tag Archive: Currency Movement

Fed Day

Overview: The markets are mostly treading water ahead of the FOMC decision later today. Tech stocks tumbled in Hong Kong and the Hang Seng fell a little more than 1%, while India was the worst performer in the region falling over 2% following an unexpected and intra-meeting hike by the Reserve Bank of India.

Read More »

Read More »

RBA Surprises with a 25 bp Hike

Overview: The large bourses in Asia Pacific except Hong Kong eased. Japan and China's mainland markets are closed for the holiday. Europe's Stoxx 600 is up about 0.6%. It gapped lower yesterday and has not entered the gap today. US futures are a little softer.

Read More »

Read More »

The Euro Continues to Stuggle to Sustain Even Modest Upticks, but Specs Still Long in the Futures

Overview: The US dollar begins the new week on a firm note ahead of the mid-week conclusion of the FOMC meeting. Many centers are closed for the May Day holiday, making for thinner market conditions. Equities are mostly lower in the markets that traded today. This includes Japan, South Korea, Australia, and India in the Asia Pacific.

Read More »

Read More »

Did China’s Politburo Throw Markets a Lifeline?

Overview: Speculation that a midday statement by China's Politburo signals new efforts to support the economy ahead of next week's holiday appears to have stirred the animal spirits.

Read More »

Read More »

China’s Covid Sends Commodities Lower and helps the Dollar Extend Gains

Overview: Fears that the Chinese lockdowns to fight Covid, which have extended for four weeks in Shanghai, are not working, and may be extended to Beijing has whacked equity markets, arrested the increase in bond yields, and lifted the dollar.

Read More »

Read More »

The Yen Bounces after 13-Day Slide and BOJ Defends Yield Cap

Overview: The record-long yen slide has stalled just shy of JPY129.50, even though the Bank of Japan defended its Yield-Curve Control cap on the 10-year bond and will continue to do so for the next four sessions. The greenback fell to almost JPY128 before steadying. China again defied expectations for lower rates (loan prime rate), the yuan's sell-off accelerated and slide to its lowest level since last October.

Read More »

Read More »

Yen Blues

Benchmark 10-year bonds yields in the US and Europe are at new highs for the year. The US yield is approaching 2.90%, while European rates are mostly 5-8 bp higher. The 10-year UK Gilt yield is up nine basis points to push near 1.98%. The higher yields are seeing the yen's losing streak extend, and the greenback has jumped 1% to around JPY128.45 The dollar is trading lower against the other major currencies but the Swiss franc.

Read More »

Read More »

Good Friday

Overview: Most centers are closed for the holidays today. The Asia Pacific equity markets were open and moved lower following the losses on Wall Street yesterday. The weakness of the yen failed to underpin Japanese shares.

Read More »

Read More »

Short Covering in the US Treasury Market Extends the Yield Pullback

Overview: What appears to be a powerful short-covering rally in the US debt market has helped steady equities and weighed on the dollar. Singapore and South Korea joined New Zealand and Canada in tightening monetary policy. Attention turns to the ECB now on the eve of a long-holiday weekend for many members. The tech-sector led the US equity recovery yesterday, snapping a three-day decline. Most of the major markets in Asia Pacific advanced but...

Read More »

Read More »

New Day, Same as the Old Day

Overview: It is a new day, but with the continued rise in interest rates and weaker equities, it feels like yesterday. Only China and Hong Kong among the major markets in Asia Pacific resisted the pull lower. Europe's Stoxx 600 is off by more than 0.5% led by health care and real estate. It is the fourth loss in five sessions and brings the benchmark to its lowest level since March 18. US futures are flattish.

Read More »

Read More »

RBA Drops “patience” to Send the Aussie Higher

Overview: The Reserve Bank of Australia hinted that it was getting closer to a rate hike. The Australian dollar was bid to its best level since the middle of last year. Australian stocks advanced in a mixed regional session while China and Hong Kong markets were closed for the local holiday. BOJ Kuroda called the yen's recent moves "rapid." The yen is sidelined today as the dollar weakens against other major currencies, led by the...

Read More »

Read More »

BOJ Steps-Up its Efforts, US 2-10 Curve steepens, and the Dollar Softens

Overview: A pullback in US yields yesterday and the Bank of Japan's stepped-up efforts to defend the Yield Curve Control policy helped extend the yen's recovery. This spurred profit-taking on Japanese stocks, where the Nikkei had rallied around 11% over the past two weeks.

Read More »

Read More »

Calmer Markets: Hope Springs Eternal

Overview: Interest rates continue to rise, but equities are looking through it today and the dollar is drawing less succor. Asia Pacific equities were mostly higher. With half of Shanghai in lockdown, Chinese equities were unable to join the regional advance. Europe's Stoxx 600, led by energy and consumer discretionary sectors, is rising for the third consecutive sessions. US futures have a small upward bias.

Read More »

Read More »

Yields Jump, Greenback Bid

Overview: Yields are surging. Canada and Australia's two-year yields have jumped 20 bp, with

the US yield up 10 bp to 2.37% ahead of the $50 bln sale later today. The US 10-year yield has risen a more modest three basis points to 2.50%, flattening the 2-10-year yields curve. The 5–30-year curve has inverted for the first time since 2016.

Read More »

Read More »

Cautious Markets after China Disappoints

Overview: Ukraine's Mariupol refuses to surrender as the war is turning more brutal according to reports. Iran-backed rebels in Yemen struck half of a dozen sites in Saudi Arabia, driving oil prices higher. China’s prime lending rates were unchanged. The MSCI Asia Pacific Index, which rallied more than 4% last week, traded heavily today though China and Taiwan's markets managed to post small gains. Tokyo was closed for the spring equinox.

Read More »

Read More »

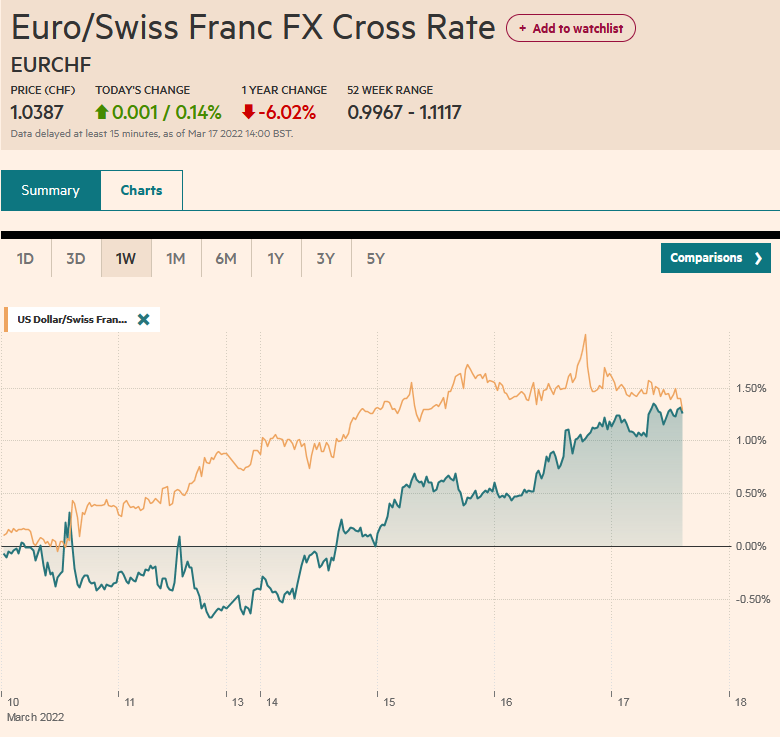

FX Daily, March 17: Investors are Skeptical that the Fed can Achieve a Soft-Landing. Can the BOE do Better?

Overview: The markets continue to digest the implications of yesterday's Fed move and Beijing's signals of more economic supportive efforts as the Bank of England's move awaited. The US 5–10-year curve is straddling inversion and the 2-10 curve has flattened as the Fed moves from one horn of the dilemma (behind the inflation curve) to the other horn (recession fears). Asia Pacific equities extended yesterday's surge. The Hang Seng led the...

Read More »

Read More »

China and Hong Kong Stocks Plummet, Yields Soar

Overview: While the World Health Organization debates about downgrading Covid from a pandemic, the rise China and Hong Kong cases is striking. A lockdown in Shenzhen and restrictions in Shanghai, coupled with a record fine by PBOC officials on Tencent drove local stocks sharply lower. China's CSI 300 fell 3% and a measure of Chinese stocks that trade in HK plunged more than 7%.

Read More »

Read More »

Risk Assets Given a Reprieve

Overview: US equities failed to sustain early gains yesterday, but risk appetites have returned today. Asia Pacific equities had a poor start, with Chinese and Japanese indices losing ground, but the equity benchmarks in Taiwan, Australia, India, and most of the smaller markets traded higher. Taiwan's 1.1% gain is notable as foreign investors continued to be heavy sellers.

Read More »

Read More »

Vladimir Nogoodnik Roils Markets

Overview: The economic disruption seen since the US warning of an imminent Russian attack on February 11 continue to ripple through the capital and commodity markets. Equities are being slammed. Most Asia Pacific bourses were off 2-3% today. Europe's Stoxx 600 gapped lower ad has approached February 2021 levels, orr about 2.6% today. US futures are around 1.5% lower.

Read More »

Read More »

Capital and Commodity Markets Strain

Overview: The capital and commodity markets are becoming less orderly. The scramble for dollars is pressuring the cross-currency basis swaps. Volatility is racing higher in bond and stock markets. The industrial metals and other supplies, and foodstuffs that Russia and Ukraine are important providers have skyrocketed. Large Asia Pacific equity markets, including Japan, Hong Kong, China, and Taiwan fell by 1%-2%, while South Korea, Australia,...

Read More »

Read More »