Tag Archive: Commitment of Traders

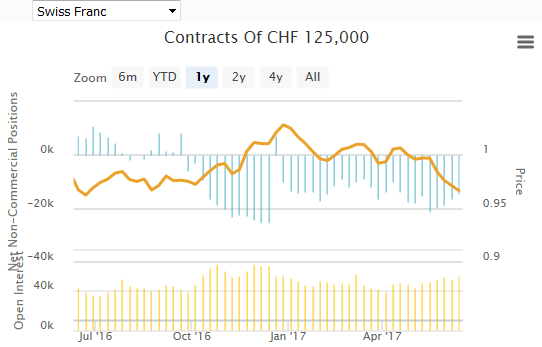

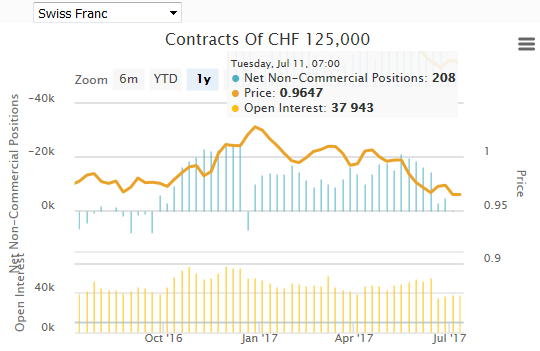

Weekly Speculative Positions (as of June 13): Specs Cut Euro, Yen, and Aussie Exposure and Do Little Else

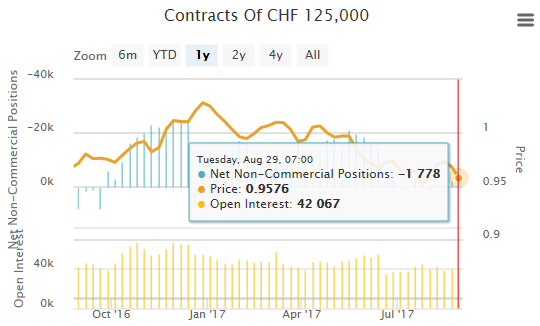

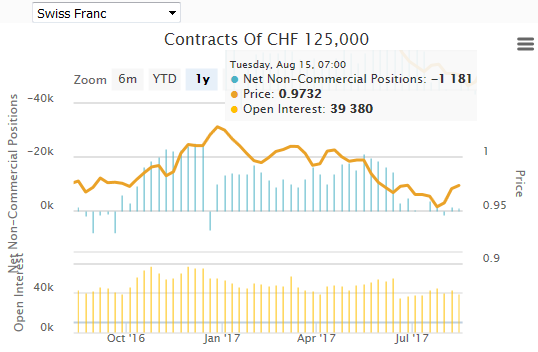

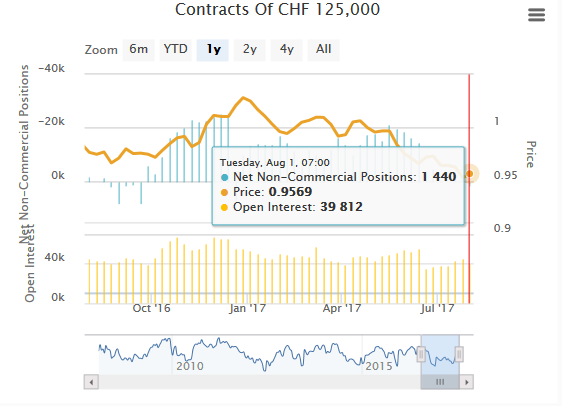

The net short CHF position has fallen from 16.5 short to 14.5K contracts short (against USD). We wonder how long this will be the case, given that we expect Euro zone inflation to fall under 1% from December 2017 onward.

Read More »

Read More »

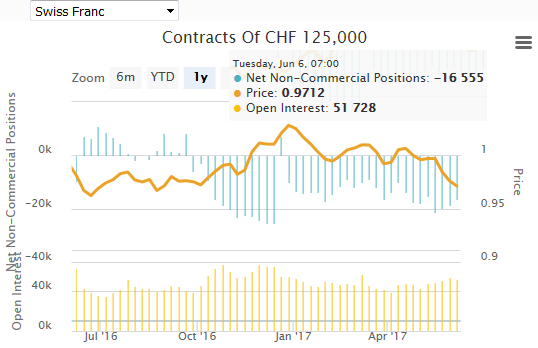

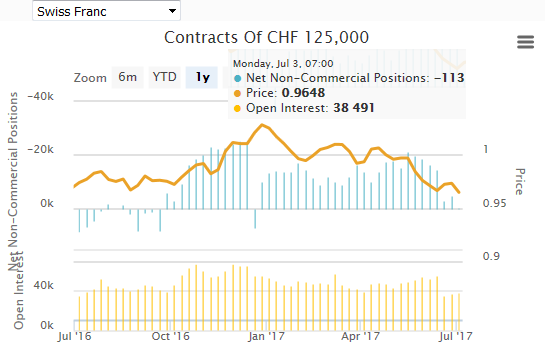

Weekly Speculative Positions (as of June 06): Speculators Trimmed Exposure Ahead of Super Thursday

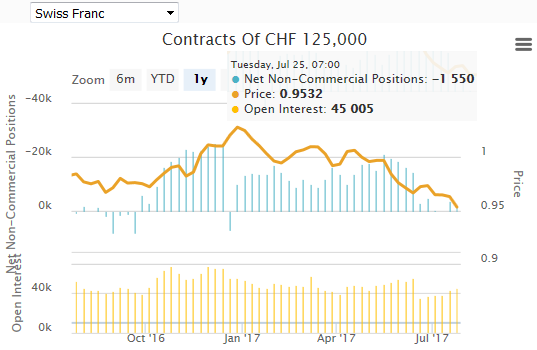

The net short CHF position has fallen from 18.5 short to 16.5K contracts short (against USD). But the major movement was that speculators are net long the euro now and not the dollar any more. This implies that they are also long Euro against CHF. In the CFTC reporting week that covered the US employment data and the run-up to Super Thursday that featured an ECB meeting, former FBI Director Comey's testimony before the Senate Intelligence...

Read More »

Read More »

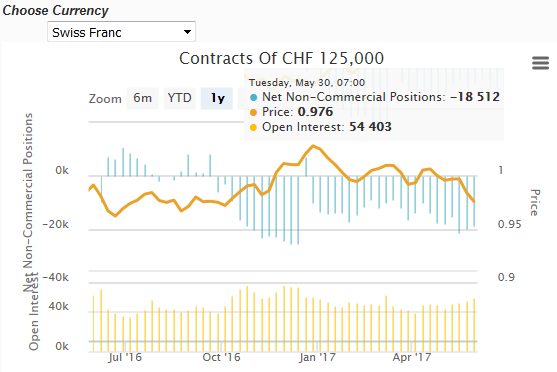

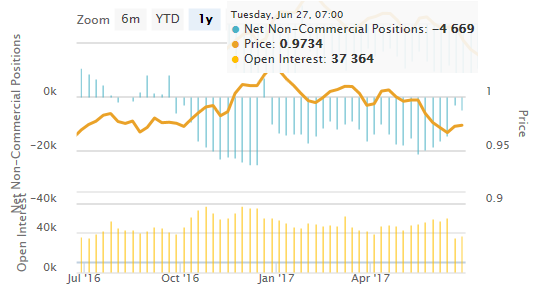

Weekly Speculative Positions (as of May 30): Speculators make Small Adjustments, but Like that Peso

The net short CHF position has fallen from 19.8 short to 18.5K contracts short (against USD). But the major movement was that speculators are net long the euro now and not the dollar any more. This implies that they are also long Euro against CHF. Speculators in the future market made mostly minor adjustment in the gross positioning in the currencies.

Read More »

Read More »

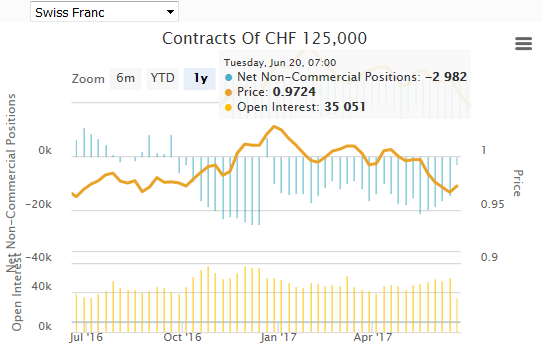

Weekly Speculative Positions (as of May 23): Speculators Remain Bearish the Dollar and Bullish Bonds

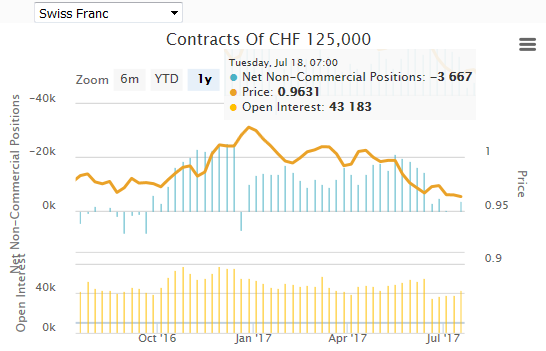

The net short CHF position has fallen from 21.1 short to 19.8K contracts short (against USD). But the major movement was that speculators are net long the euro now and not the dollar any more. This implies that they are also long Euro against CHF. In the CFTC reporting week ending May 23 speculators in the futures market continued to largely position themselves for further dollar weakness.

Read More »

Read More »

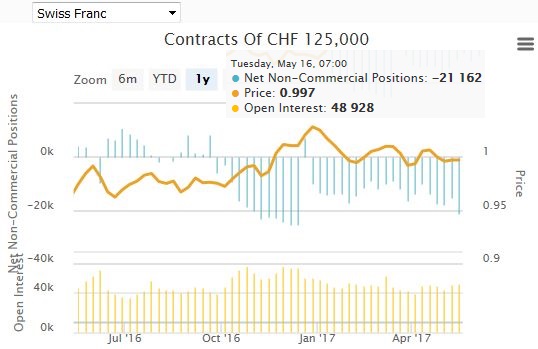

Weekly Speculative Positions (as of May 16): Yen and Aussie Bears Push Forward, while Sterling Bears Continue to Run for Cover

The net short CHF position has risen from 15.2 short to 21.1K contracts short (against USD). But the major movement was that speculators are net long the euro now and not the dollar any more. This implies that they are also long Euro against CHF. In the Commitment of Traders reporting week ending May 16, speculators in the futures market made three significant adjustments in the currency futures.

Read More »

Read More »

Weekly Speculative Positions (as of May 09): Significant Position Adjustment in the Currency Futures

The net short CHF position has fallen from 17.7 short to 15,2K contracts short (against USD).

But the major movement was that speculators are net long the euro now and not the dollar any more. This implies that they are also long Euro against CHF.

Read More »

Read More »

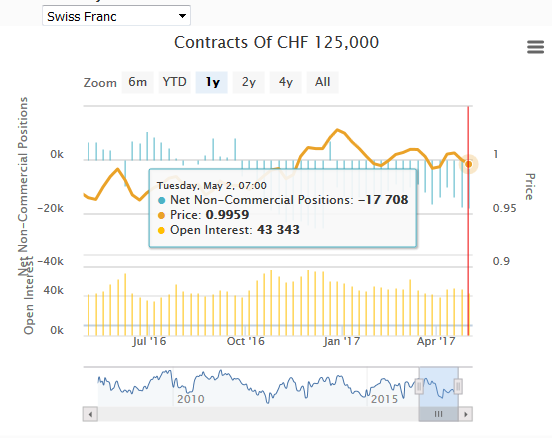

Weekly Speculative Positions (as of May 02): Euro Shorts Covered, Yen Longs Liquidated

The net short CHF position has risen to 17K contracts (against USD). It was feast or famine in the adjustment of speculative positions in the currency futures market during the CFTC reporting period ending May 2. Speculators either made large adjustments or very small adjustments, and little in between.

Read More »

Read More »

Weekly Speculative Positions (as of April 25): Bulls Take Charge of 10-year Note Futures, while Sterling Bears Hang On

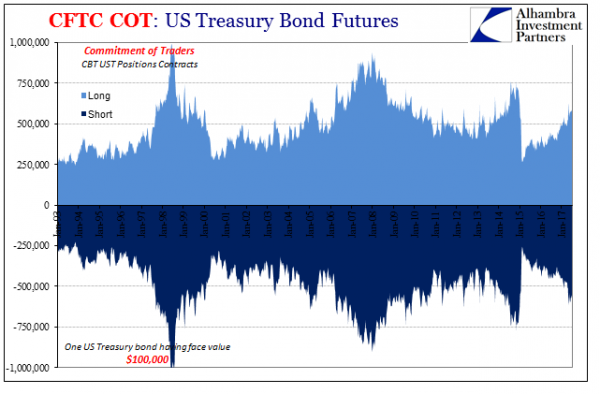

The net short CHF position has risen to 17K contracts (against USD). The striking development among speculators in the futures market is the reversal of the record gross (and net) short Treasury note position two months ago.

Read More »

Read More »

Weekly Speculative Positions (as April 18): CHF Position Stands at same Level

The net short CHF position stands at 13K contracts (against USD). In the CFTC reporting period ending April 21, speculators to significant positions in the euro, sterling and the Mexican peso. Bulls and bears were took more exposure in the euro and sterling, while in the peso the former added on while later sought cover.

Read More »

Read More »

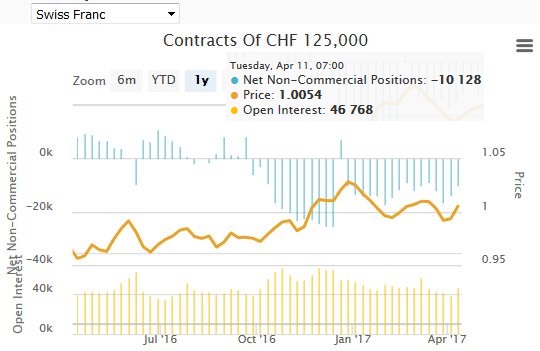

Weekly Speculative Positions (as of April 11): Adding To Foreign Currency Exposure Before Trump’s Talk

The net short CHF position has fallen to 10K contracts (against USD). In the days before US President Trump expressed concern about the dollar's exchange value, speculators in the futures market mostly added to the gross long foreign currency positions.

Read More »

Read More »

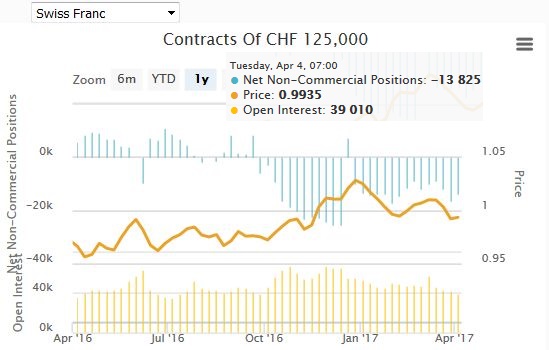

Weekly Speculative Positions (April 4 Data): Reduction in CHF Net Shorts

Speculators continued to reduce their net short euro exposure until March 28. Apparently they do not understand the difference between core inflation and the headline figure. In the last week, finally they increased their Euro shorts again.... and reduced their CHF shorts.

Read More »

Read More »

Weekly Speculative Positions: Last Reduction of Euro Short Positions?

Speculators continued to reduce their net short euro exposure until March 28. Apparently they do not understand the difference between core inflation and the headline figure.

Read More »

Read More »

Weekly Speculative Positions: Continued reduction of Euro Shorts

Another time speculators reduced their net Euro shorts after the less dovish ECB. But the net short of CHF nearly remains stable. This resulted in an appreciation of EUR/CHF.

Read More »

Read More »

Weekly Speculative Position: After ECB, Reduction of Euro Shorts

Speculators reduced their net Euro shorts after the less dovish ECB. But the net short of CHF nearly remains stable. This resulted in an appreciation of EUR/CHF.

Read More »

Read More »

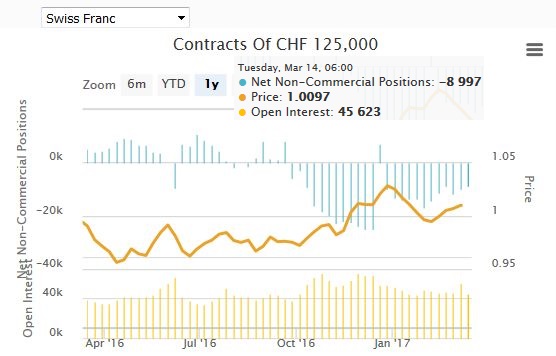

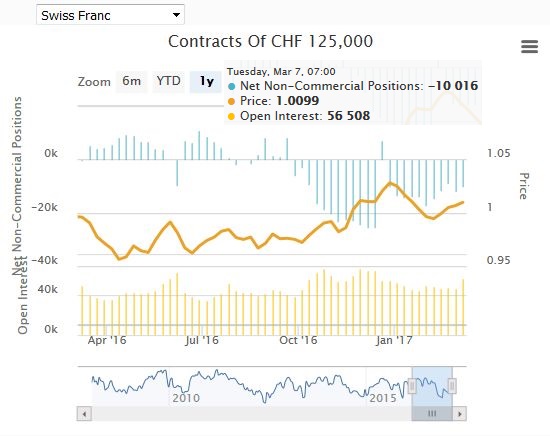

Weekly Speculative Position: Less dovish ECB not include yet

The commitments of traders were released on March 7 before the ECB meeting of March 9. We expect a considerable re-adjustment.

Read More »

Read More »

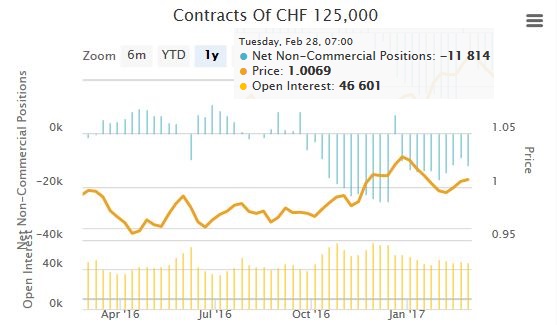

Weekly Speculative Position: More CHF Shorts, Less EUR Shorts this time

Speculators reduced their EUR net short positions, on a potential reduction of ECB quantitative easing. At the same time, they increased the CHF net shorts.

Read More »

Read More »

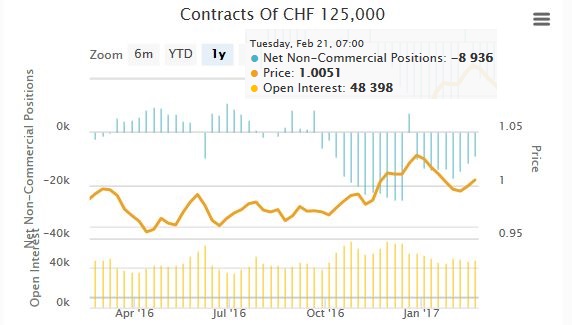

Weekly Speculative Position: More EUR Shorts, Less CHF Shorts .. Again

Speculators increased their EUR net short position against the dollar, but lowered their CHF net shorts (vs. USD). This tendency confirms our view that EUR/CHF will move towards parity.

Read More »

Read More »

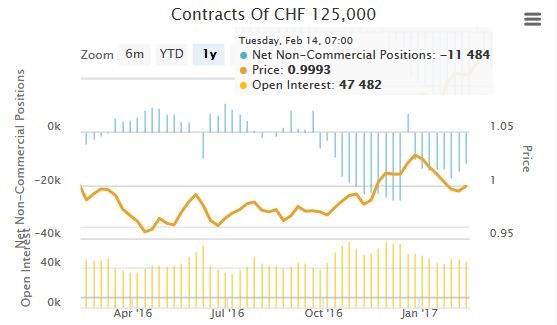

Weekly Speculative Position: Rising EUR shorts and falling CHF shorts point to weaker EUR/CHF

Speculators increased their EUR net short position against the dollar, but lowered their CHF net shorts (vs. USD). This tendency confirms our view that EUR/CHF will move towards parity.

Read More »

Read More »

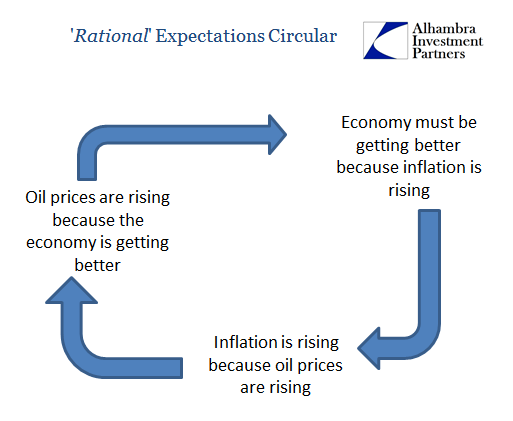

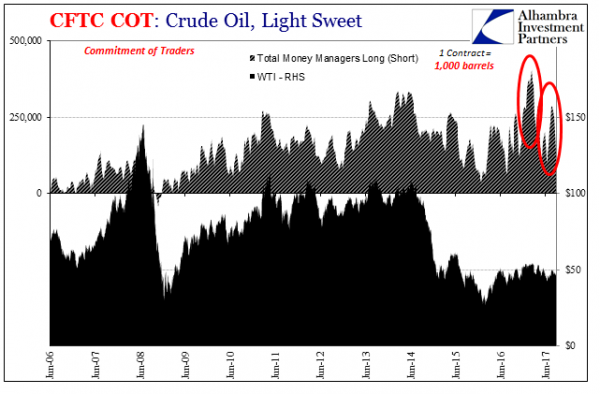

Why Aren’t Oil Prices $50 Ahead?

Right now there are two conventional propositions behind the “reflation” trade, and in many ways both are highly related if not fully intertwined. The first is that interest rates have nowhere to go but up. The Fed is raising rates again and seems more confident in doing more this year than it wanted to last year. With nominal rates already rising in the last half of 2016, and with more (surveyed) optimism than even 2014, it may at times seem the...

Read More »

Read More »

Weekly Speculative Position: Speculators are long all currencies of the dollar bloc

Speculators are net short CHF with 14.6K contracts against USD. This is less than the 17K last week.

Read More »

Read More »