Tag Archive: China Non-Manufacturing PMI

China Non-Manufacturing Purchasing Managers Index (PMI) provides an early indication each month of economic activities in the Chinese Non-manufacturing sector.It is compiled by China Federation of Logistics & Purchasing (CFLP) and China Logistics Information Centre (CLIC), based on data collected by the National Bureau of Statistics (NBS).Li & Fung Research Centre is responsible for drafting and disseminating the English PMI report. Every month questionnaires are sent to over 700 Non-manufacturing enterprises all over China. The data presented here is compiled from the enterprises responses about their purchasing activities and supply situations. The PMI should be compared to other economic data sources when used in decision-making. A higher than expected reading should be taken as positive/bullish for the CNY , while a lower than expected reading should be taken as negative/bearish for the CNY.

FX Daily, May 31: China Raises Reserve Requirement for FX, Stemming the Yuan’s Rise

US and UK markets are closed for holidays today, contributing to the rather subdued price action today. The MSCI Asia Pacific Index rallied two percent last week, the most in three months, and most markets began off the week with modest gains. Japan, Australia, and Singapore, for notable exceptions.

Read More »

Read More »

FX Daily, June 30: When Primary is Secondary

The gains in US equities yesterday carried into Asia Pacific trading today, but the European investors did not get the memo. The Dow Jones Stoxx 600 is succumbing to selling pressure and giving back yesterday's gain. Energy and financials are the biggest drags, while real estate and information technology sectors are firm. All the markets had rallied in the Asia Pacific region, with the Nikkei and Australian equities leading with around 1.3%...

Read More »

Read More »

FX Daily, April 30: ECB Takes Center Stage

Overview: Equities continue to recover even as deep economic contractions are reported. Yesterday, the US said Q1 GDP contracted at an annualized pace of 4.8%, while the eurozone reported today that output fell 3.8% quarter-over-quarter in Q1. Hong Kong and South Korea were closed, but the rest of the Asia Pacific bourses rallied strongly with several, including Australia and India, rising more than 2%.

Read More »

Read More »

FX Daily, October 31: No Good Deed Goes Unpunished

Overview: The equity and bond rally in North America yesterday carried over into today's session. With some notable exceptions, like China, Taiwan, Australia, and Indonesia, most bourses in Asia Pacific and Europe traded higher. US shares are little changed in early Europe after the S&P 500 rose to new record highs.

Read More »

Read More »

FX Daily, September 30: A Busy Week Begins Quietly

Overview: As the quarter ends, the capital markets are mixed. Equities in Asia Pacific were heavier, except in Hong Kong and Australia, while shares were mixed, leaving the Dow Jones Stoxx 600 little changed through the European morning. US shares are trading firmer. Benchmark 10-year bond yields are 2-3 basis points higher, though Australia's bond yield was up seven basis points.

Read More »

Read More »

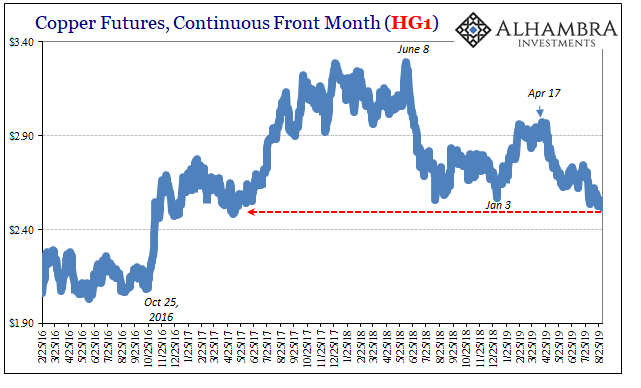

Copper Confirmed

Copper prices behave more deliberately than perhaps prices in other commodity markets. Like gold, it is still set by a mix of economic (meaning physical) and financial (meaning collateral and financing). Unlike gold, there doesn’t seem to be any rush to get to wherever the commodity market is going. Over the last several years, it has been more long periods of sideways.

Read More »

Read More »

FX Daily, April 30: Dollar Pares more Gains as EMU GDP Surprise

Overview: The S&P 500 set a new record high and close yesterday, but the lift to global markets was not strong enough to overcome the disappointing Chinese PMI. Although Chinese equities traded higher on ideas that the news will spur additional stimulative measures, other Asian markets were mixed.

Read More »

Read More »

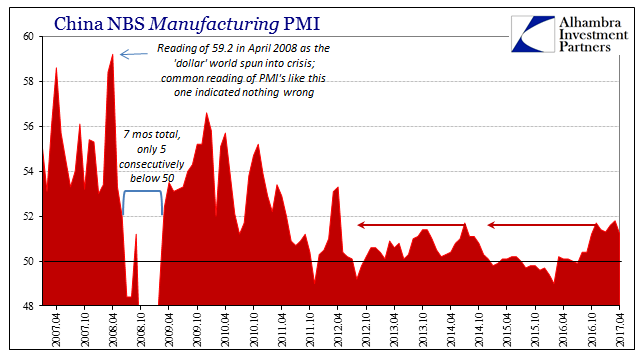

China’s Global Slump Draws Closer

By the time things got really bad, China’s economy had already been slowing for a long time. The currency spun out of control in August 2015, and then by November the Chinese central bank was in desperation mode. The PBOC had begun to peg SHIBOR because despite so much monetary “stimulus” in rate cuts and a lower RRR banks were hoarding RMB liquidity.

Read More »

Read More »

FX Daily, May 31: Don’t Confuse Calmer Markets with Resolution

The global capital markets that were in panic mode on Tuesday stabilized yesterday, and corrective forces have carried into today's activity. However, the underlying issues in Italy and Spain are hardly clarified in the past 48 hours. Moreover, the US push on trade is intensifying again.

Read More »

Read More »

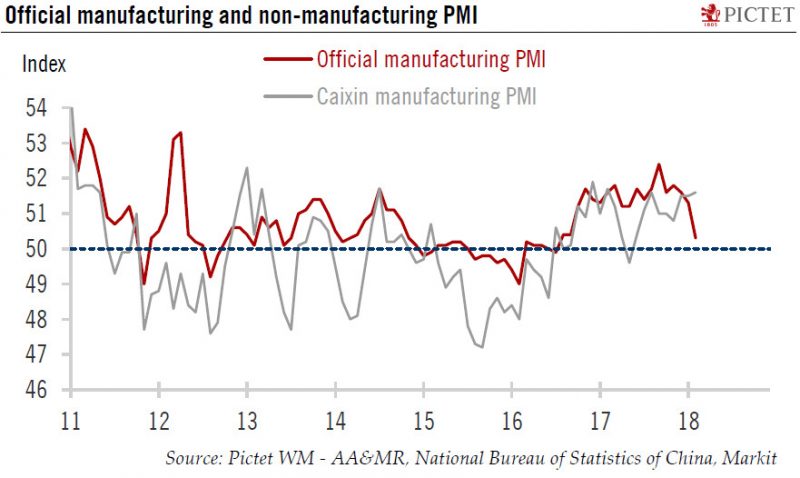

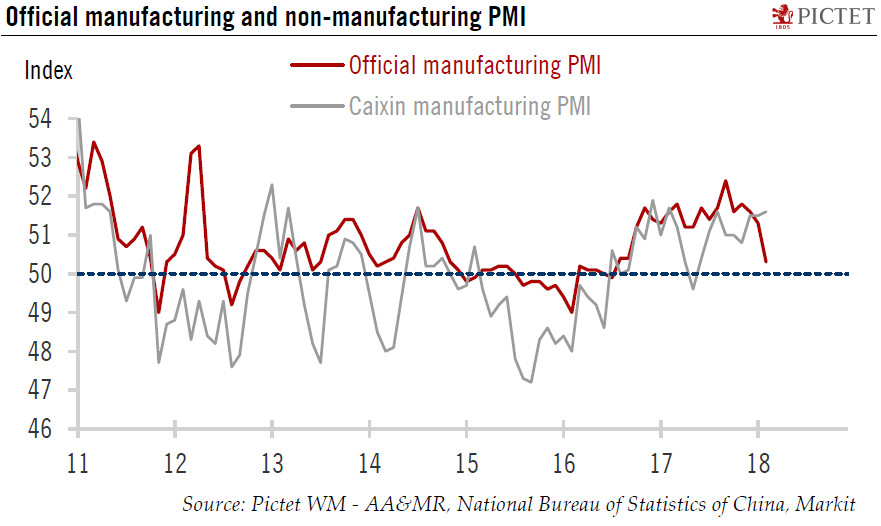

China: February PMIs point to deceleration in industrial activity

China’s official manufacturing Purchasing Manager Index (PMI) for February, compiled by the National Bureau of Statistics of China and the China Federation of Logistics and Purchasing, came in at 50.3, down from 51.3 in January and 51.6 in December 2017. This is the lowest reading of this gauge since October 2016. The Markit PMI (also known as the Caixin PMI), however, edged up slightly to 51.6 in February from 51.5 in the previous month

Read More »

Read More »

FX Daily, February 28: It Takes Powell to Convince the Market that Yellen was Right

Many market participants think they heard Fed Chair Powell give a fairly strong signal that he favored a more aggressive course. The implied yield on the December Eurodollar futures rose five basis points to 1.535%. The December Fed funds futures contract rose three basis points.

Read More »

Read More »

FX Daily, November 30: US Dollar Comes Back Bid, but Brexit Hopes Underpin Sterling

The US dollar is broadly firmer. The rise in US yields yesterday has seen the greenback extend its recovery against the yen. It briefly pushed through JPY112.40, after dipping below JPY111.00 at the start of the week, for the first time since mid-September. Since the end of last week, been capped at the 200-day moving average against the yen, found near JPY111.70, but yesterday it pushed past. There are nearly $1 bln of options struck between...

Read More »

Read More »

FX Daily, October 31: Month-End Leaves Market at Crossroads

Global equity markets are closing another strong month. The MSCI Asia Pacific Index was little changed on the day, but up 4.3% in October, the 10th consecutive monthly advance. Europe's Dow Jones Stoxx 600 is also flattish today, but up 1.6% on the month. It is the second monthly advance after a June-August swoon. The benchmark is closing in on the high for the year set in May.

Read More »

Read More »

FX Daily, July 31: Monday Morning Blues

The euro is up by 0.15% to 1.1385 CHF. The US dollar is enjoying a respite from the recent selling, but its gains have been shallow, and will likely prove brief. The upticks have been concentrated in the recently high-flying dollar-bloc currencies, and sterling. The tone appears to be more consolidative than corrective, and month-end adjustment provides an additional wrinkle.

Read More »

Read More »

FX Daily, June 30: Greenback Stabilizes

The US dollar has been battered this week amid a shift in sentiment seen in how the market responded to comments mostly emanating from the ECB's annual conference. It is not really clear that Draghi or Carney gave new policy indications.

Read More »

Read More »

FX Daily, May 31: Sterling Takes it On the Chin

Projections showing that the UK Tories could lose their outright majority in Parliament in next week's election spurred sterling sales, which snapped a two-day advance. Polls at the end of last week showed a sharp narrowing of the contest, and this saw sterling shed 1.3% last Thursday and Friday.

Read More »

Read More »

China: Blatant Similarities

Declines in several of the world’s PMI’s in April have furthered doubts about the global “reflation.” But while many disappointed, some sharply, it isn’t just this one month that has sown them. In China, for example, both the manufacturing and non-manufacturing sentiment indices declined to 6-month lows.

Read More »

Read More »

FX Daily, May 01: May Day Calm

Many financial centers are closed for May. Japanese markets were open today, but will be closed for three sessions beginning Wednesday for the Golden Week celebrations. The US dollar is narrowly mixed.

Read More »

Read More »

FX Daily, March 31: Greenback Finishing Weak Quarter in Mixed Fashion

The US dollar fell against all the major currencies in the first three months of 2017. The weakness initially seemed to be a correction to the rally, which began before the US election last year. The dollar recovered in February, in anticipation of a hawkish Fed in March.

Read More »

Read More »

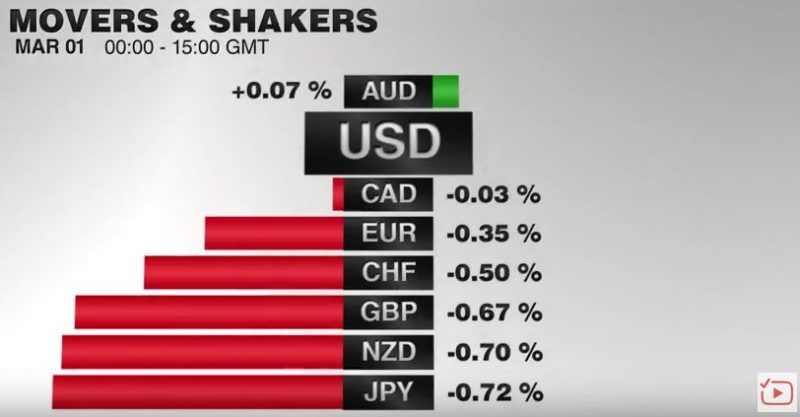

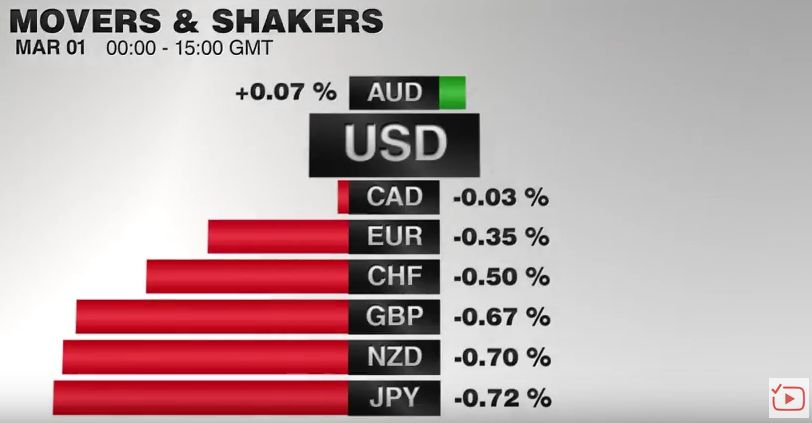

FX Daily, March 01: Greenback Bounces, More Fed than Trump

The much-anticipated speech by US President Trump was light on the details that investors interested in, like the tax reform, infrastructure initiative, and deregulation. There appears to be an agreement to repeal the national healthcare, but there is no consensus on its replacement.

Read More »

Read More »