Tag Archive: China Exports

The term export means shipping in the goods and services out of the jurisdiction of a country. The seller of such goods and services is referred to as an “exporter” and is based in the country of export whereas the overseas based buyer is referred to as an “importer”. In international trade, “exports” refers to selling goods and services produced in the home country to other markets.

FX Daily, December 08: Brexit Talks Move to Stage II, While Greenback Remains Firm

Sufficient progress will be judged to have been made, and negotiations of the separation between the UK and EU will be allowed to enter the second stage. The formal decision will be made at next week's EU summit. To be sure, "sufficient progress," which the diplomatic-speak that does not mean that any agreement has really been reached, but rather that the UK has made a few concessionary signals.

Read More »

Read More »

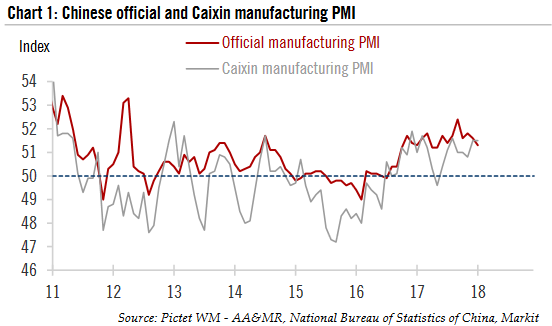

Bonds And Soft Chinese Data

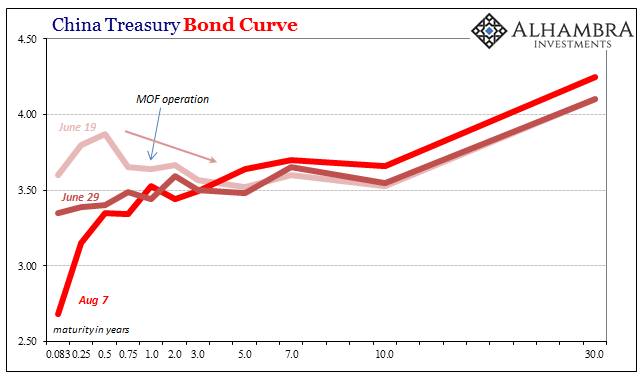

Back in June, China’s federal bond yield curve inverted. Ahead of mid-year bank checks, short-term govvies sold off as longer bonds continued to be bought. It was for some a rotation, for others a reflection of money rates threatening to spiral out of control. On June 19, for example, the 6-month federal security yielded 3.87% compared to a yield of 3.525% for the 10-year.

Read More »

Read More »

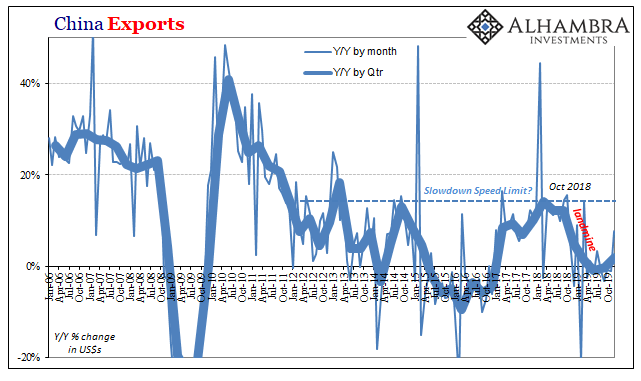

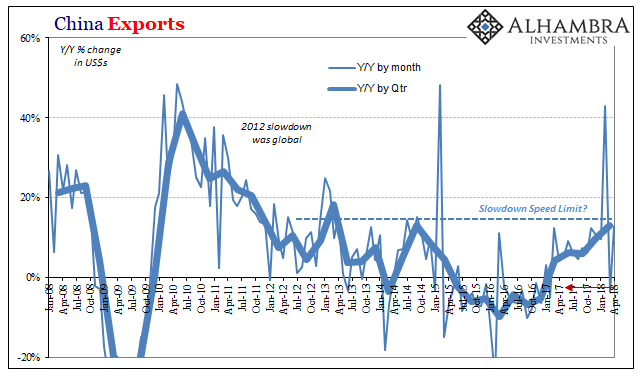

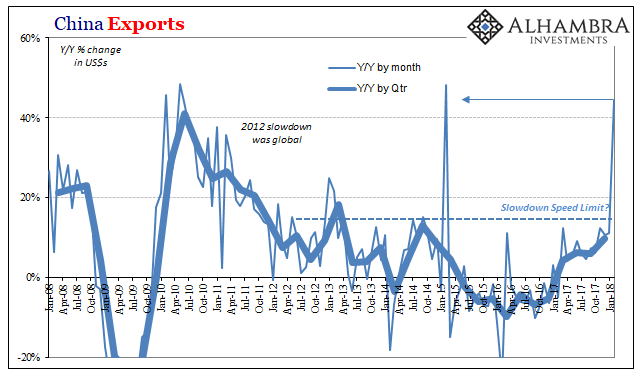

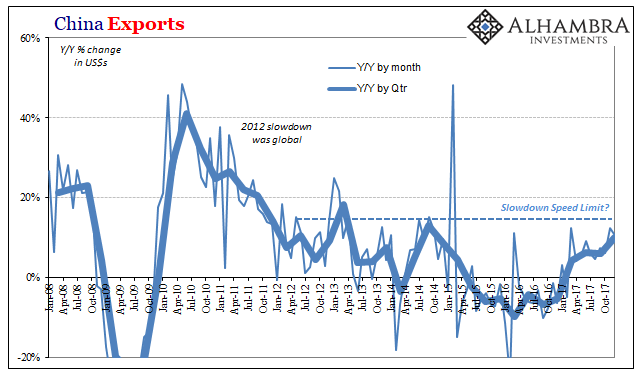

China Exports/Imports: Enforcing A Global Speed Limit

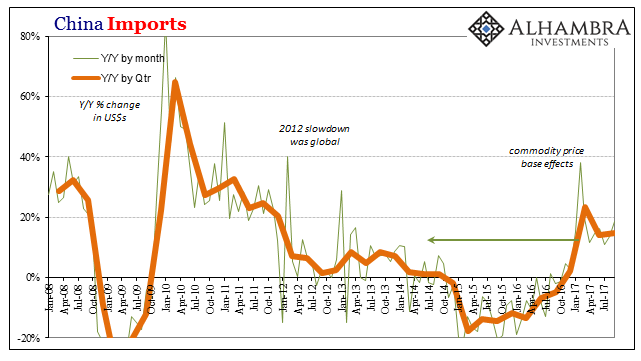

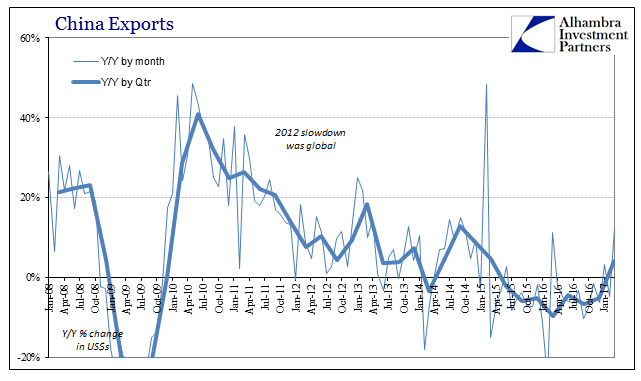

Chinese imports rose 18.7% in September 2017 year-over-year. That’s up from 13.5% growth in August. While near-20% expansion sounds good if not exhilarating, it isn’t materially different from 13.5% or 8% for that matter. In addition, Chinese trade statistics tend to vary month to month.

Read More »

Read More »

FX Daily, October 13: Sterling Extends Yesterday’s Recovery; US Data Awaited

The EU's leading negotiator whipsawed sterling yesterday. The net effect was to ease fears that the UK would leave the EU without the agreement Initial concerns that the negotiations had stalled sent sterling to nearly $1.3120. The willingness to discuss a two-year transition period spurred sterling's recovery. After trading on both sides of Wednesdays, it closed on its highs was a bullish technical signal and there has been follow-through buying...

Read More »

Read More »

Not Political Risk For China, But Unwelcome Reality

China’s Communist Party concluded the Third Plenum of its 18th Congress in November 2013. It was the much-discussed reform mandate that many in the West took to mean another positive step toward neo-liberal reform. At its center was supposed to be a greater role for markets particularly in the central task of resource allocation. In some places, the Party’s General Secretary Xi Jinping was hailed as the great Chinese reformer.

Read More »

Read More »

FX Daily, September 08: US Dollar Tracks Yields Lower

The US dollar has been unable to find any traction as US yields continue to move lower. The US 10-year year is slipping below 2.03% in European turnover, the lowest level in ten months. The risk, as we have noted, is that without prospects of stronger growth and inflation impulses, the yield returns to where was before the US election (~1.85%). The two-year note yield, anchored more by Fed policy than the long-end, is also soft. It yielded 1.25%...

Read More »

Read More »

China Exports, China Imports: Textbook

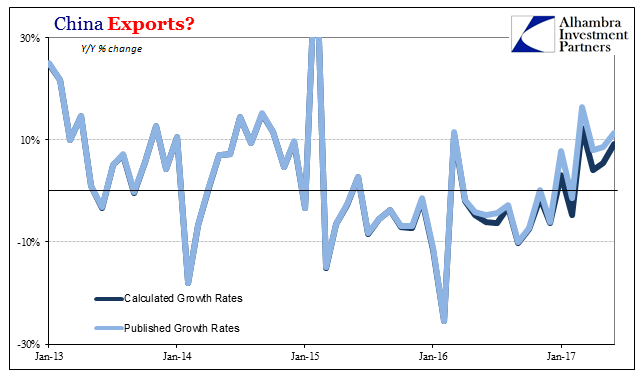

China’s export growth disappointed in July, only we don’t really know by how much. According to that country’s Customs Bureau, exports last month were 7.2% above (in US$ terms) exports in July 2016. That’s down from 11.3% growth in June, which as usual had been taken in the mainstream as evidence of “strong” or “robust” global demand.

Read More »

Read More »

FX Daily, August 08: Trade Featured as Dollar Drifts Lower

The US dollar has a slightly lower bias today, but the against most of the major currencies, it is consolidating within the range set at the end of last week. The main exceptions are sterling and the Canadian dollar. They had extended their pre-weekend losses yesterday, and are trading within yesterday's range today.

Read More »

Read More »

China Imports and Exports: The Ghost Recovery

To the naked eye, it represents progress. China has still an enormous rural population doing subsistence level farming. As the nation grows economically, such a way of life is an inherent drag, an anchor on aggregate efficiency Chinese officials would rather not put up with.

Read More »

Read More »

FX Daily, July 13: Sterling and Antipodeans Trade Higher

The US dollar is mostly consolidating yesterday's move. Sterling is pushing back through $1.29 as the hawks on the MPC may not have been dissuaded by disappointing PMI readings and the softer earnings growth. The table is being set for another 5-3 vote at next month's MPC meeting.

Read More »

Read More »

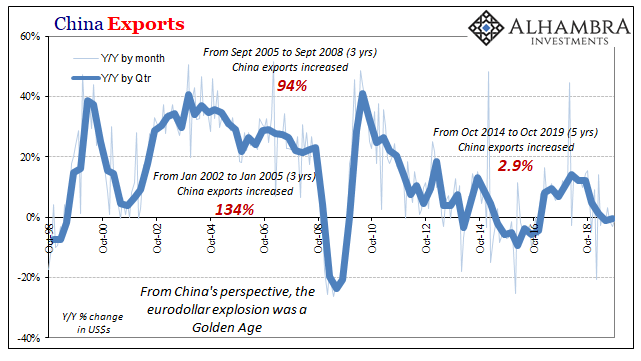

Weird Obsessions

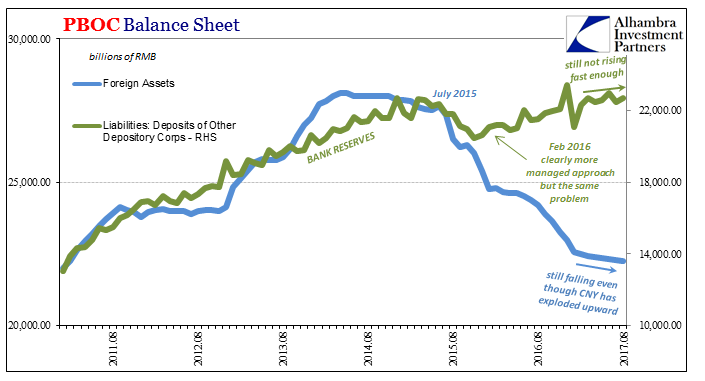

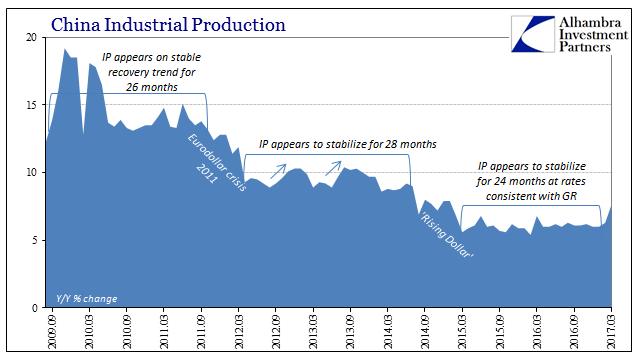

People often ask why I care so much about China. In some ways the answer is obvious, meaning that China is the world’s second largest economy (the largest under certain methods of measurement). Therefore, marginal changes in the Chinese economy are important to understanding our own global situation.

Read More »

Read More »

Questions Persist About China Trade

Chinese trade statistics were for May 2017 better than expected by economists, but on the export side questions remain as to their accuracy. Earlier this year discrepancies between estimates first published by the General Administration of Customs (GAC), those you find reported in the media, and what is captured by the National Bureau of Statistics (NBS), backed up by data from the Ministry of Commerce, became noticeable.

Read More »

Read More »

FX Daily, June 08: Thursday’s Show

Today has an anti-climactic feel to it. Yesterday's leak of what is purported to be the ECB staff forecasts point to small downward revisions to inflation forecasts and an ever small upward tweak to growth. This would be in line with only mild changes in the forward guidance language. The clear indication is that inflation is still not the conditions of a self-sustaining path toward the target.

Read More »

Read More »

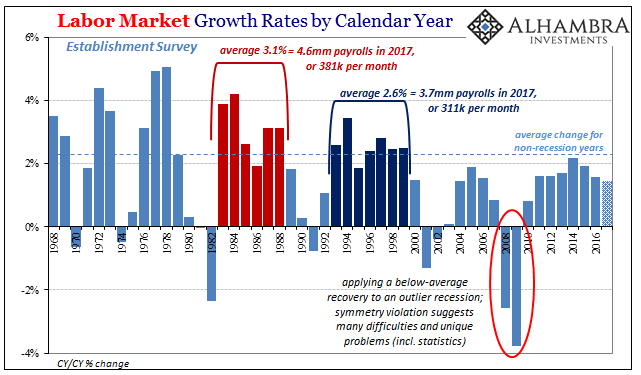

Not Do We Need One, But Do We Need A Different One

On March 24, 2009, then US President Barack Obama gave a prime time televised press conference whose subject was quite obviously the economy and markets. The US and global economy was at that moment trying to work through the worst conditions since the 1930’s and nobody really had any idea what that would mean.

Read More »

Read More »

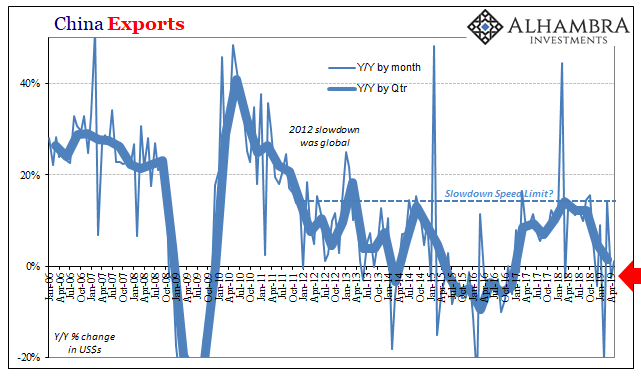

Lackluster Trade, China April Edition

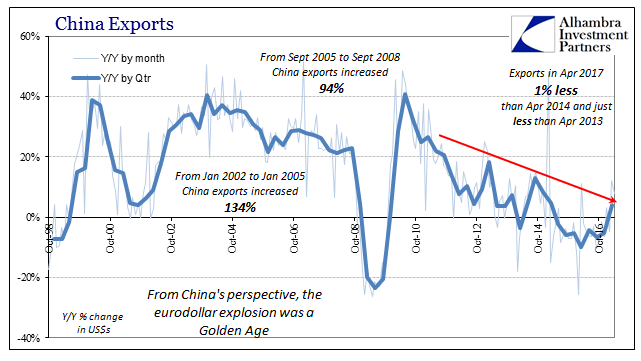

China’s trade statistics for April 2017 uniformly disappointed. They only did so, however, because expectations are being calibrated as if the current economy is actually different. It is instead merely swinging between bouts of contraction and low-grade growth, but so low-grade it really doesn’t qualify as growth.

Read More »

Read More »

Noose Or Ratchet

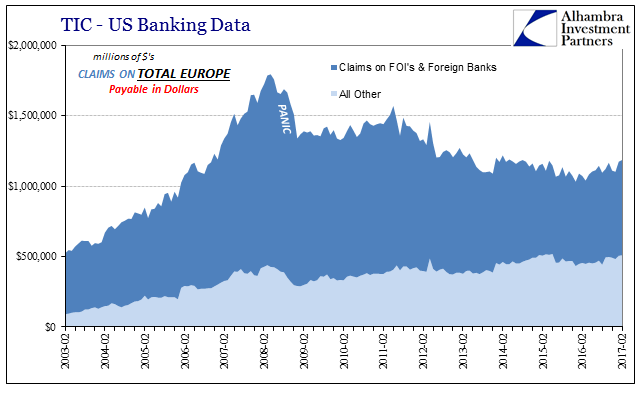

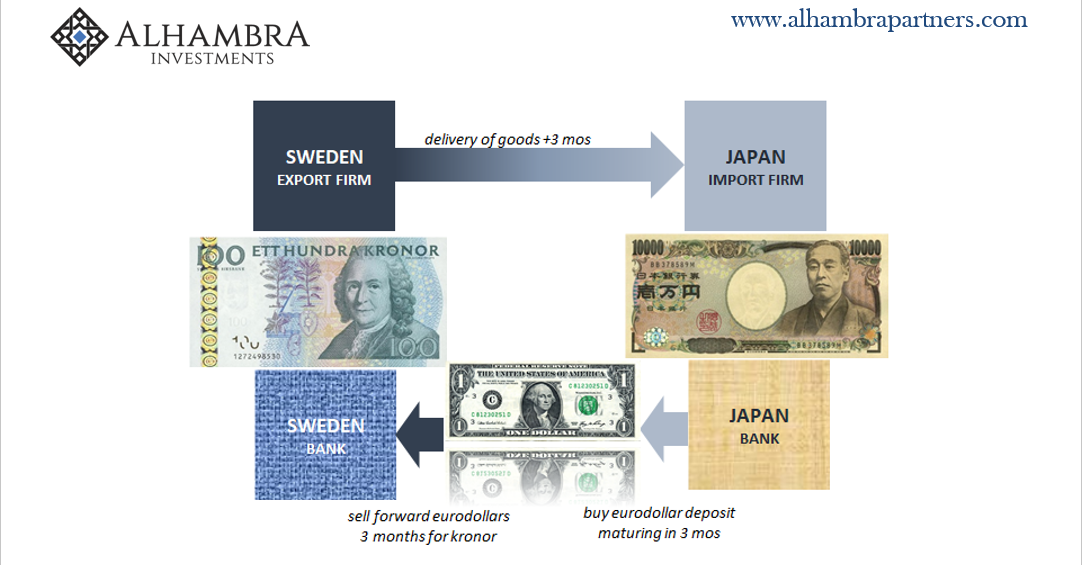

losing the book on Q4 2016 balance sheet capacity is to review essentially forex volumes. The eurodollar system over the last ten years has turned far more in this direction in addition to it becoming more Asian/Japanese. In fact, the two really go hand in hand given the native situation of Japanese banks.

Read More »

Read More »

FX Daily, May 08: Euro Bought on Rumor, Sold on Fact

The euro initially opened higher in Asia following confirmation that Macron was elected the next president of France, but quickly fell below $1.0960 before bouncing back toward $1.10 only to be sold again in early Europe below the pre-weekend low near $1.0950. A break now of $1.0930 could signal a return to the lower end of the range seen since the first round of the French election near $1.0850-$1.0870.

Read More »

Read More »

Assessing China’s Economic Risks

First quarter GDP in China rose 6.9%, better than expected and above the government’s target (6.5%) for 2017. It stands to reason, however, that if Communist officials thought they could get 6.9% to last for the whole year they would have made it their target, especially since 6.5% would be less than the GDP growth rate for 2016 (6.7%). In only that one way is China’s GDP statistic meaningful.

Read More »

Read More »

What Was Chinese Trade in March?

As with all statistics, there are discrepancies that from time to time may obscure the meaning or validity of the particular estimate in question. For the vast majority of the time, any such uncertainties amount to very little. Overall, harmony among the major accounts reduces the signal noise from any one featuring a significant inconsistency.

Read More »

Read More »

FX Daily, April 13: Greenback Stabilizes After Trump Induced Slide

The US dollar slid after US President Trump complained about its strength. The sell-off extended into early Asian activity, before stabilizing. It is mixed in late morning European turnover, which is already lightening up due to the extended Easter holiday.

Read More »

Read More »