Tag Archive: central-banks

Stockman Rages: Ben Bernanke Is “The Most Dangerous Man Walking This Planet”

Ben Bernanke is one of the most dangerous men walking the planet. In this age of central bank domination of economic life he is surely the pied piper of monetary ruin. At least since 2002 he has been talking about “helicopter money” as if a notion which is pure economic quackery actually had some legitimate basis.

Read More »

Read More »

Larry Summers Wants to Give You a Free Lunch

Consequences of Central Bank Policies The existing capital stock continues to be frittered away at the expense of savers and retirees. Nonetheless, central bankers don’t give a doggone about it. This, after all, is one consequence of roughly eight years of near zero interest rate policy.

Read More »

Read More »

Planet Debt

She is a low-interest-rate person. She has always been a low-interest-rate person. And I must be honest. I am a low-interest-rate person. If we raise interest rates, and if the dollar starts getting too strong, we’re going to have some very major problems.

Read More »

Read More »

Money confuses and blurs economic relations

Money, generally accepted medium of exchange, acts as a veil that confuse and blurs economic relations. This is especially true when it comes to intertemporal considerations. Whilst probably the most important institution in a free market, money can be highly destructive when politicized.

Read More »

Read More »

The Fed Doomsday Device

Debt is just the flip side of credit. As debt goes bad, credit disappears. And then the system that created so much credit-money will go into reverse, destroying the nation’s money supply.

The money supply (actually, the supply of ready credit) will shrink – suddenly and dramatically. And what should have been a minor, routine pullback in the economy will become a catastrophic panic.

Read More »

Read More »

Janet Yellen’s $200-Trillion Debt Problem

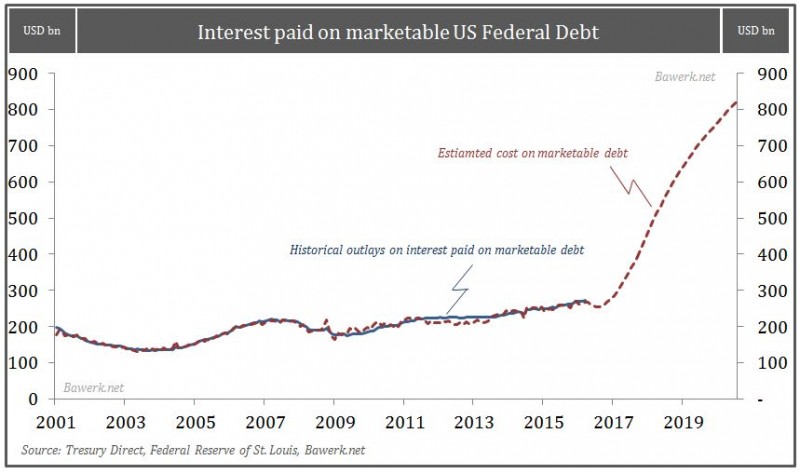

More than $10 trillion of government bonds now trade at negative yields. And another $10 trillion or so worth of U.S. stocks trade well above their long-term average valuations.

And there’s more than $200 trillion of debt in the world. All of this sits on the Fed’s financial applecart. Does Janet Yellen dare upset it?

Read More »

Read More »

Down Go the Hopes and Dreams of Three Generations

On Wednesday, Janet Yellen pressed on the broken buttons again. After the two day FOMC meeting, the Fed Chair announced they’d continue pressing the federal funds rate down to just a ¼ to ½ percent – effectively zero. What type of insanity is this?

If she keeps it up, and whole thing doesn’t implode, the yield on the 10-Year Treasury note could also slip below zero…along with the hopes and dreams of three generations of retirees.

Read More »

Read More »

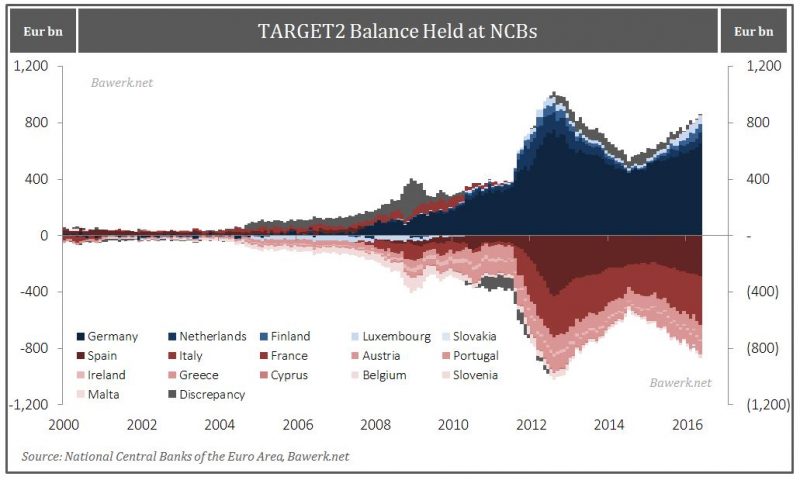

Dumbest monetary experimental end game in history (including Havenstein and Gono’s)

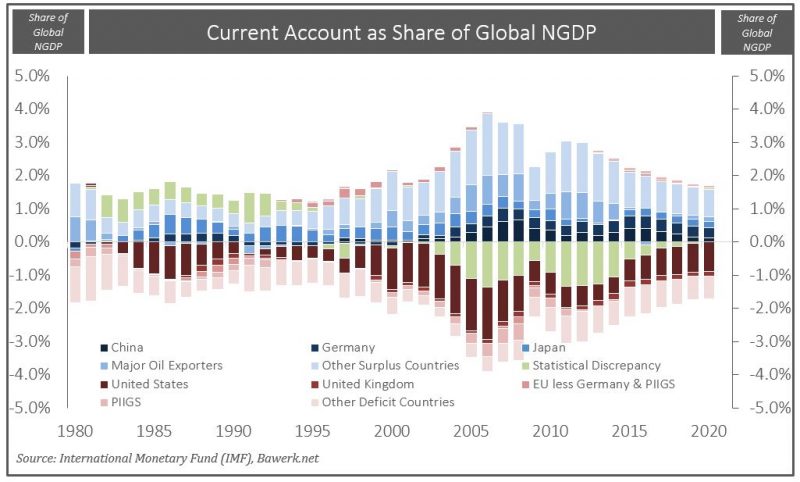

The Greatest Keynesian monetary experiment is not sustainable. It will not continue ad infinitum. Our money masters are just postponing the inevitable bust that will eventually correct these imbalances through worldwide capital re-allocation. Bawerk shows 3 graphs how investment growth gets slower and slower since the End of Bretton, how debt is increasing and how cheap dollar fuel debt-driven growth.

Read More »

Read More »

Central Banks & Governments and their gold coin holdings

While this is true in some cases, it is not the fully story because many central banks and governments, such as the US, France, Italy, Switzerland, the UK and Venezuela, all hold an element of gold bullion coins as part of their official monetary gold reserves.

Read More »

Read More »

A Darwin Award for Capital Allocation

Beyond Human Capacity Distilling down and projecting out the economy’s limitless spectrum of interrelationships is near impossible to do with any regular accuracy. The inputs are too vast. The relationships are too erratic. The economy – comple...

Read More »

Read More »

Janet Yellen – Backtracking Again

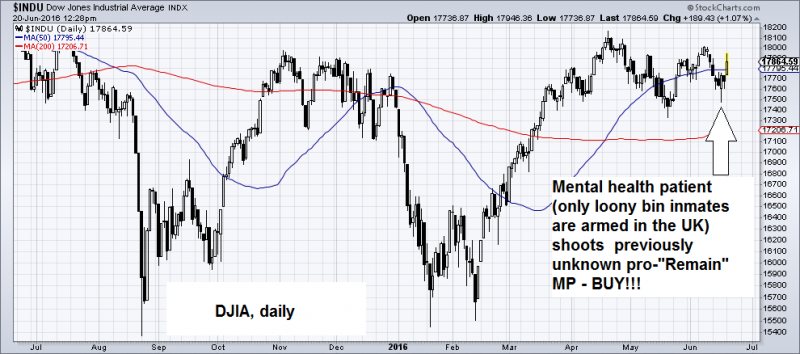

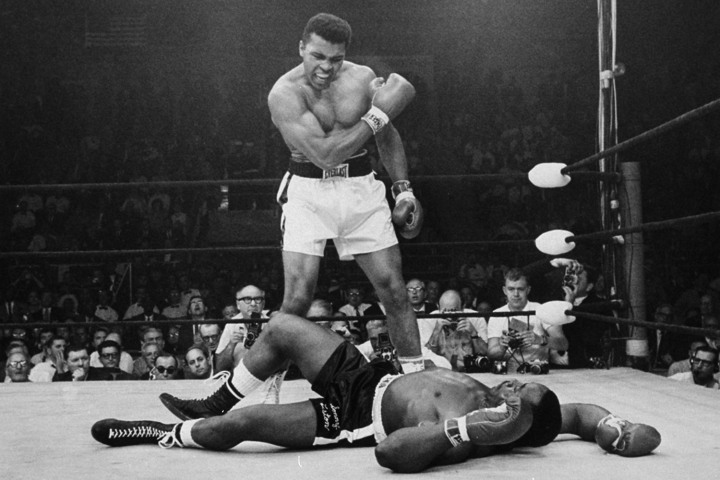

Muhammad Ali Could Take a Punch BALTIMORE – You had to admit. Muhammad Ali could take a punch. Unlike Donald Trump, Dick Cheney, George W. Bush, and Bill Clinton, he was a real war hero. He stood up and faced his enemies on the draft board, rather ...

Read More »

Read More »

Turning Stones Into Bread – The Japanese Miracle

Stuffing the Futon Our friend Ramsey Su just asked what Haruhiko Kuroda and Shinzo Abe are going to do now in light of the strong yen (aside from perhaps doing the honorable thing). Isn’t it time to just “wipe out some debt with the stroke of a pen...

Read More »

Read More »

Guided By Nonsense

Seven Year Achievement “Read the directions and directly you will be directed in the right direction.” — Lewis Carroll See? It’s easy Janet! Just read the directions! Illustration credit: Walt Disney U.S. consumers are at it again. After a s...

Read More »

Read More »

Notes from ECB Press Conference

ECB press conference June 2 2016 Q; Risk to inflation balanced? April meeting, no conclusive evidence of second round effects, are they now? A; Additional stimulus beyond CSPP and TLTRO2 not necessary as we expect higher inflation. We do not see evid...

Read More »

Read More »

On the Road to Panicville

An Alert for the Global Posse of Liquidity Junkies In the summer of 2015 and again in December-February this year, global stock markets were rattled by weakness in the yuan’s exchange rate vs. the US dollar. Yuan weakness is widely held to exacerba...

Read More »

Read More »

Nigeria Currency Devaluation Looms As FX Forwards Crash To Record Lows

Despite US equity investors' exuberance over bouncing crude oil prices, the world's crude producers continue to suffer and while Venezuela is in the headlines every day (having already collapsed into chaos), Nigeria appears the nearest to that abyss ...

Read More »

Read More »

Academic Skulduggery – How Ivory Tower Hubris Wrecks your Life

In the 1970s economists started to incorporate rational expectations into their models and not long after the seminal Kydand & Prescott (1977) article named Rules Rather than Discretion: The Inconsistency of Optimal Plan was published. Their work has...

Read More »

Read More »

The Japanese Popsicle Affair

Policy-Induced Contrition in Japan As we keep saying, there really is no point in trying to make people richer by making them poorer – which is what Shinzo Abe and Haruhiko Kuroda have been trying to do for the past several years. Not surprisingly,...

Read More »

Read More »

Fed Suppression, Long Term Economic Repression

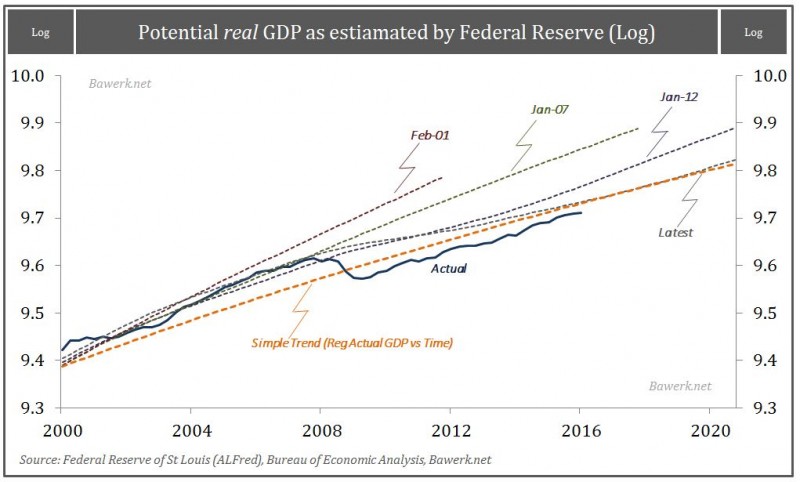

The Federal Reserve really wants to raise rates, but they do not dare as the consequence of interrupting an unprecedented level of capital misallocation is too grave to face head on. So our money masters continue their low interest rate policy; pulli...

Read More »

Read More »

Kuroda-San in the Mouth of Madness

Deluded Central Planners Zerohedge recently reported on an interview given by Lithuanian ECB council member Vitas Vasiliauskas, which demonstrates how utterly deluded the central planners in the so-called “capitalist” economies of the West have bec...

Read More »

Read More »