Tag Archive: capital destruction

It’s Only Paper, Market Report 27 Apr

The response to the virus has added a new mechanism of capital consumption to the many we have documented over the years. Businesses are shut down, yet they continue to incur expenses. There is a popular misconception out there that this is merely a paper loss. One can almost picture a neutron bomb that somehow wipes out only paper, leaving all the physical assets and plant unscathed.

Read More »

Read More »

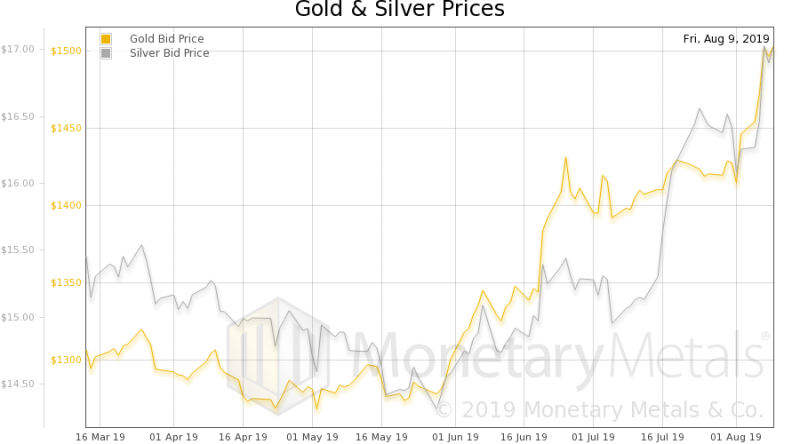

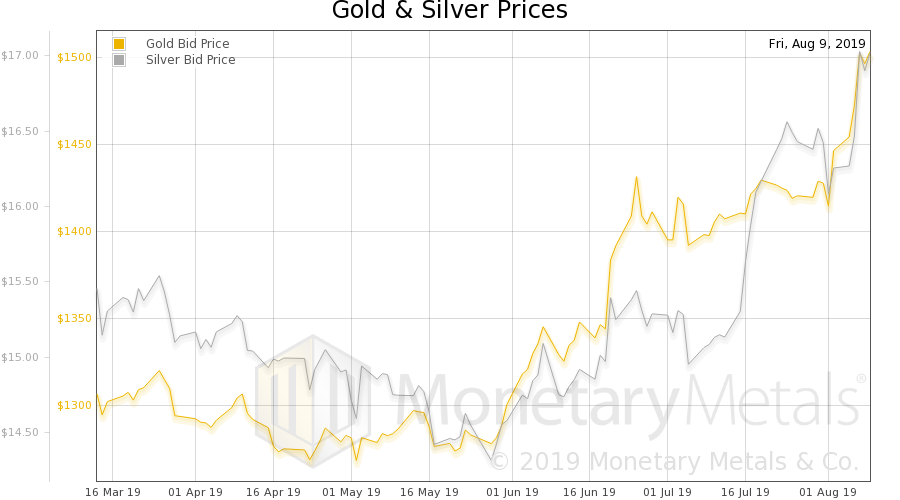

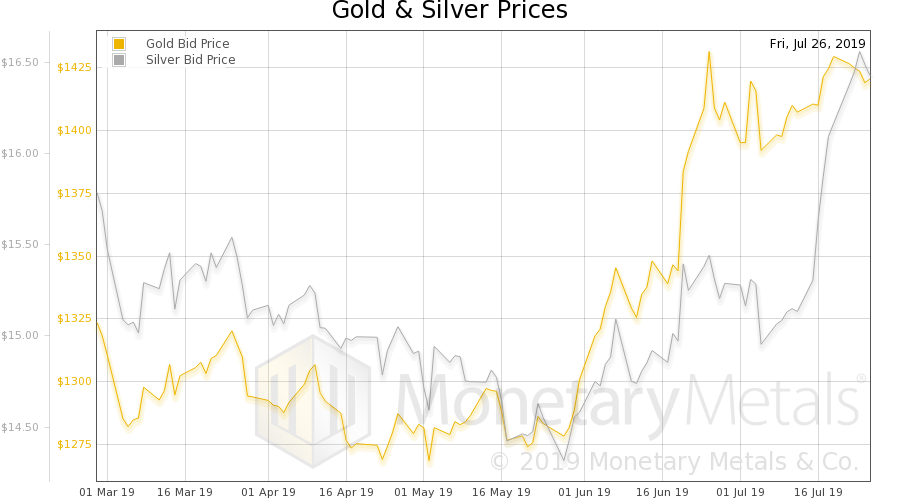

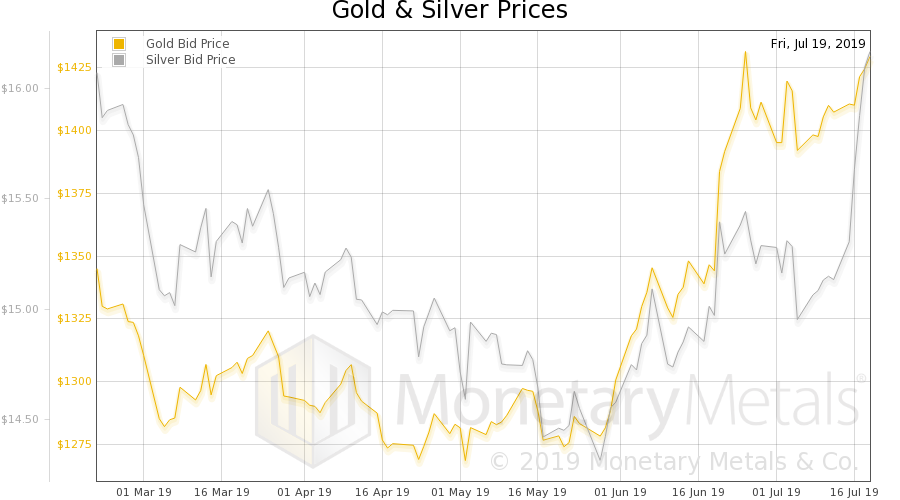

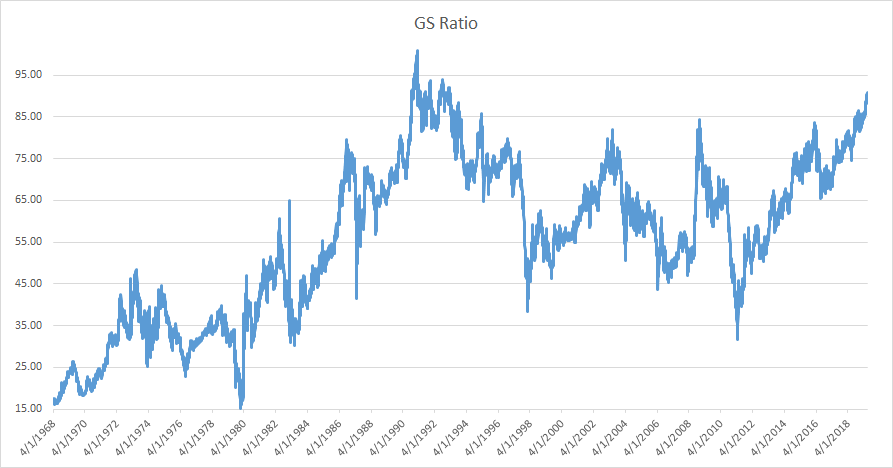

The Economic Singularity, Report 11 Aug

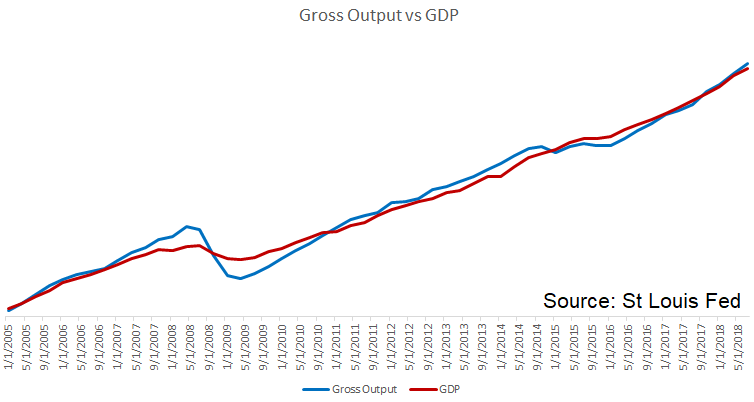

We have recently written several essays about the fallacious concept of Gross Domestic Product. Among GDP’s several fatal flaws, it goes up when capital is converted to consumer goods, when seed corn is served at the feast. So we proposed—and originally dismissed—the idea of a national balance sheet.

Read More »

Read More »

Obvious Capital Consumption, Report 28 Jul

We have spilled many electrons on the topic of capital consumption. Still, this is a very abstract topic and we think many people still struggle to picture what it means. Thus, the inspiration for this week’s essay. Suppose a young man, Early Enterprise, inherits a car from his grandfather. Early decides to drive for Uber to earn a living. Being enterprising, he is up at dawn and drives all day.

Read More »

Read More »

The Fake Economy, Report 21 Jul

Folks in the liberty movement often say that the economy is fake. But this does not persuade anyone. It’s just preaching to the choir! We hope that this series on GDP provides more effective ammunition to argue with the Left-Right-Wall-Street-Main-Street-Capitalists-Socialists.

Read More »

Read More »

What Gets Measures Gets Improved, Report 23 June

Let’s start with Frederic Bastiat’s 170-year old parable of the broken window. A shopkeeper has a broken window. The shopkeeper is, of course, upset at the loss of six francs (0.06oz gold, or about $75). Bastiat discusses a then-popular facile argument: the glass guy is making money (to which all we can say is, “plus ça change, plus c’est la même chose”).

Read More »

Read More »

Is Capital Creation Beating Capital Consumption? Report 3 Mar

We have written numerous articles about capital consumption. Our monetary system has a falling interest rate, which causes both capital churn and conversion of one party’s wealth into another’s income. It also has too-low interest, which encourages borrowing to consume (which, as everyone knows, adds to Gross Domestic Product—GDP).

Read More »

Read More »

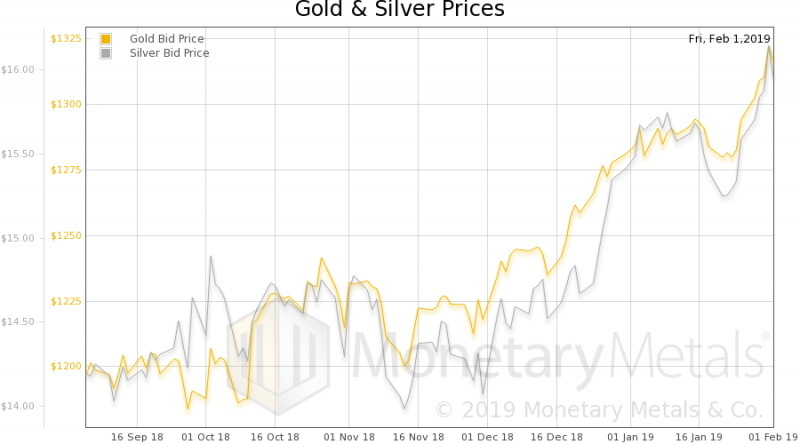

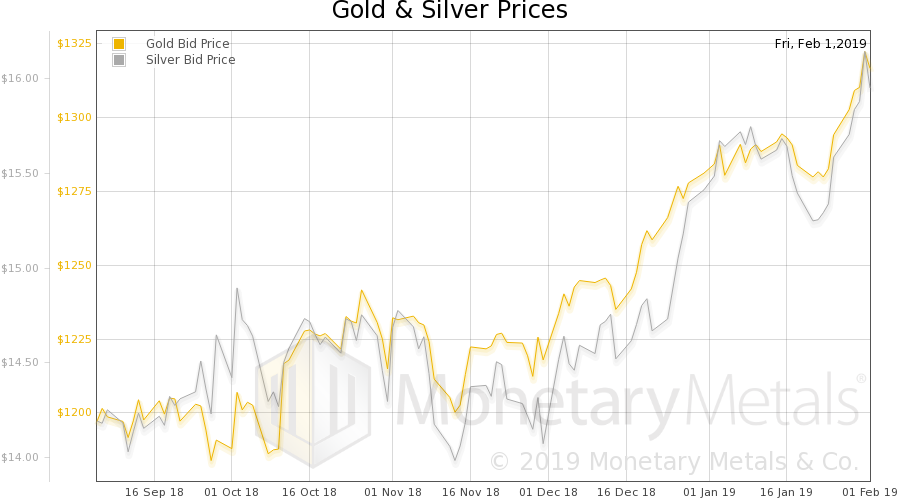

Who Knows the Right Interest Rate, Report 3 Feb 2019

On January 6, we wrote the Surest Way to Overthrow Capitalism. We said: “In a future article, we will expand on why these two statements are true principles: (1) there is no way a central planner could set the right rate, even if he knew and (2) only a free market can know the right rate.” Today’s article is part I that promised article.

Read More »

Read More »

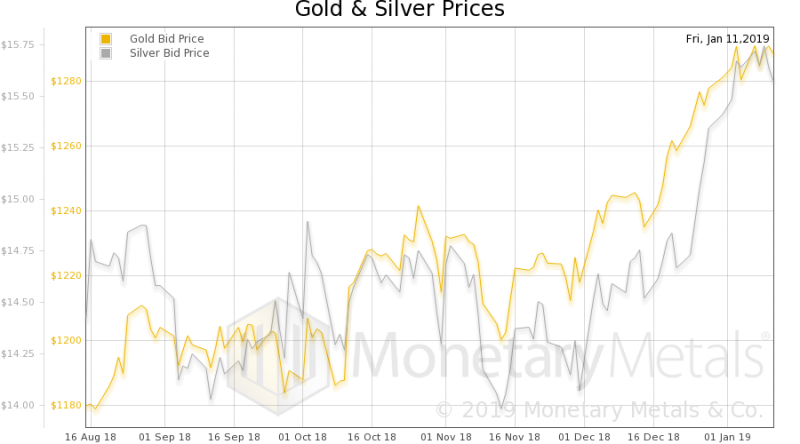

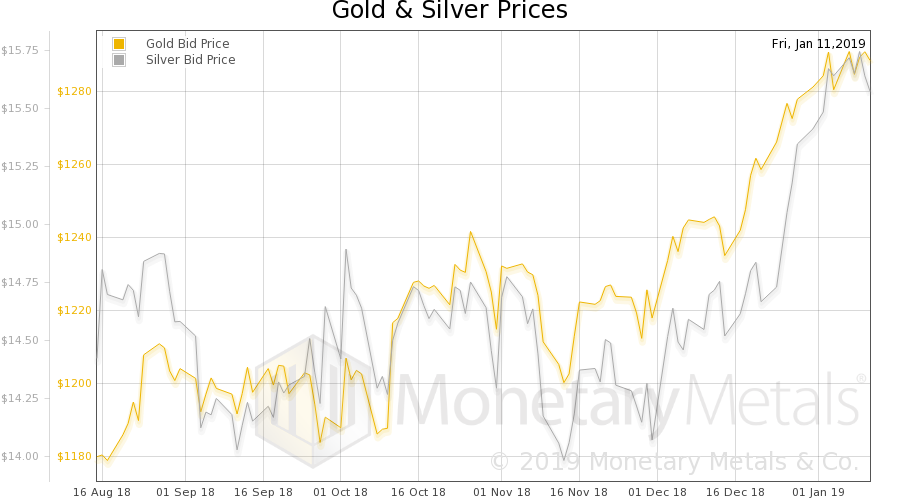

Rising Interest and Prices, Report 13 Jan 2019

For years, people blamed the global financial crisis on greed. Doesn’t this make you want to scream out, “what, were people not greedy in 2007 or 1997??” Greed utterly fails to explain the phenomenon. It merely serves to reinforce a previously-held belief.

Read More »

Read More »

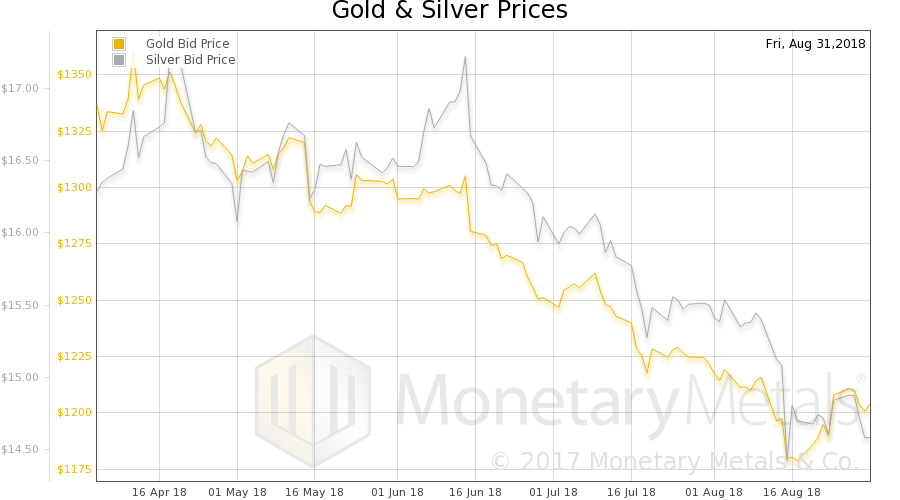

Illicit Arbitrage Cut by Tax Cuts and Jobs Act, Report 3 Sep 2018

This week, we are back to our ongoing series on capital destruction. Let’s consider the simple transaction of issuing a bond. Party X sells a bond to Party Y. We will first offer something entirely uncontroversial. If the interest rate rises after Y buys the bond, then Y takes a loss. Or if the interest rate falls, then Y makes a capital gain. This is simply saying that the bond price moves inverse to the interest rate.

Read More »

Read More »

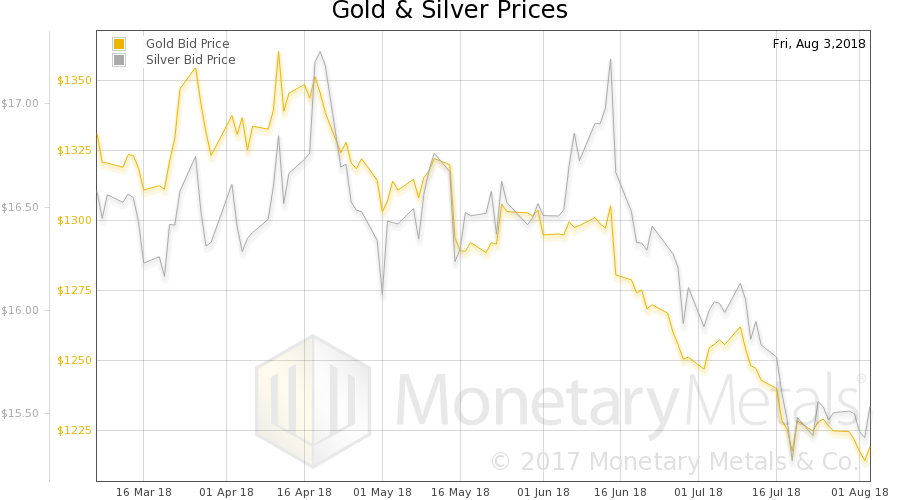

Monetary Paradigm Reset, Report 5 August 2018

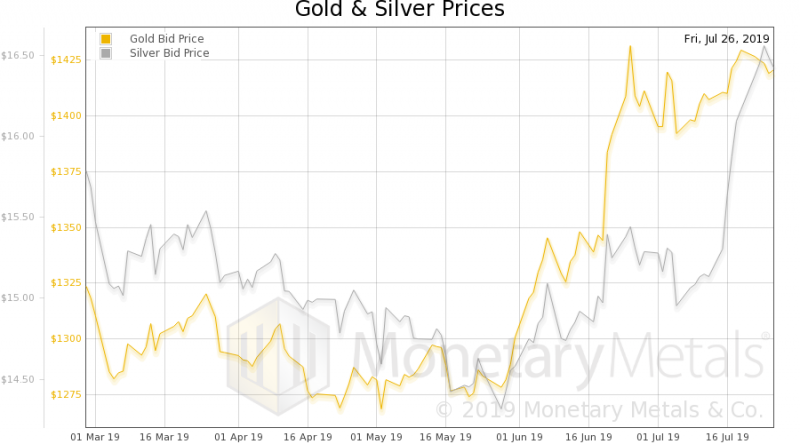

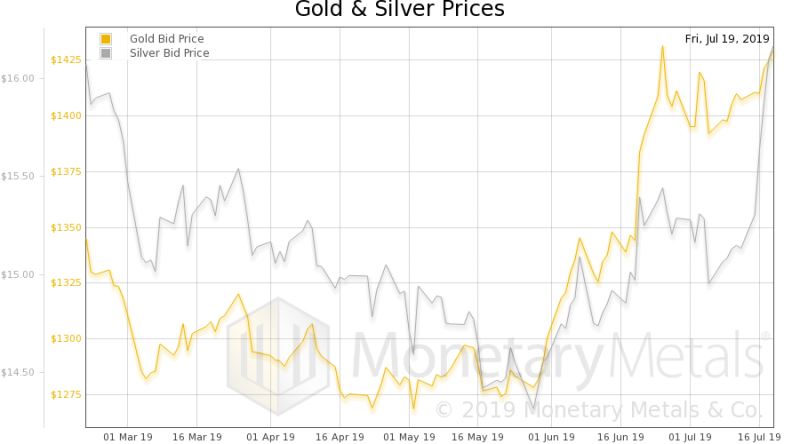

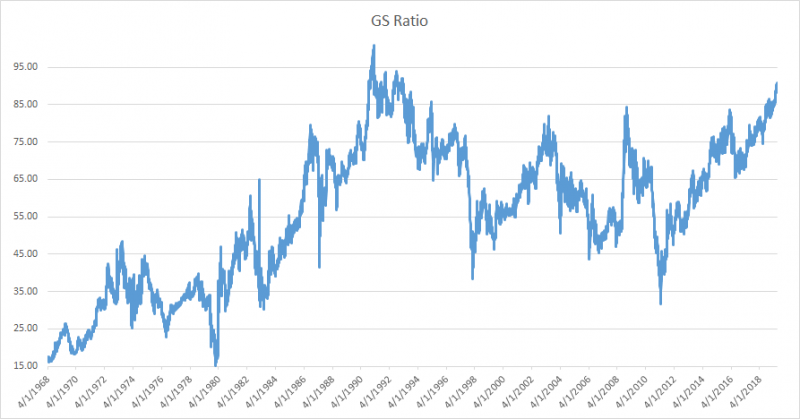

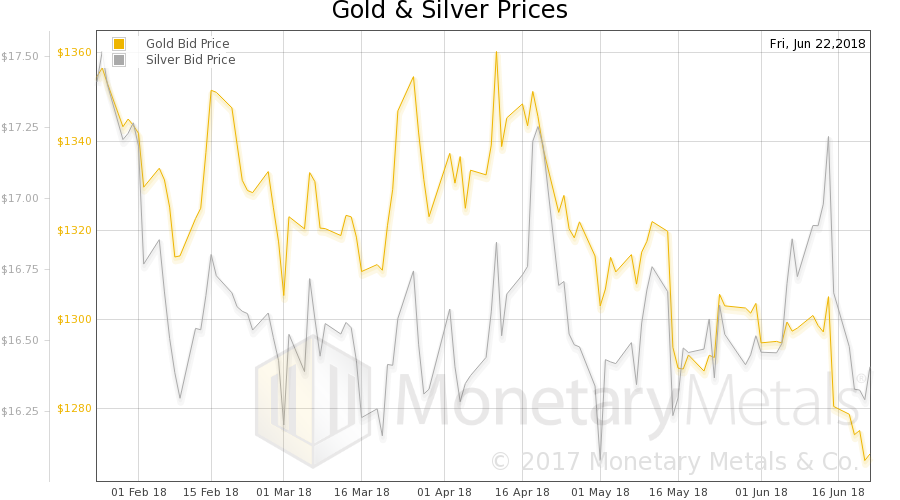

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Getting Their Pound of Flesh – Precious Metals Supply and Demand

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

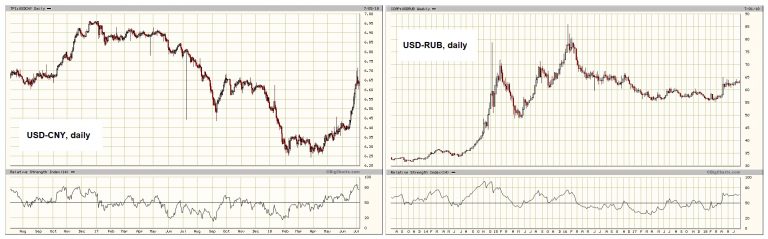

Black Holes for Capital – Precious Metals Supply and Demand

Race to the Bottom, Last week the price of gold fell $17, and that of silver $0.30. Why? We can tell you about the fundamentals. We can show charts of the basis. But we can’t get into the heads of the sellers. We can say that in the mainstream view, the dollar is rising. The dollar, in their view, is not measured in gold but in rupees in yuan and rubles. You know, all the superior forms of money…

Read More »

Read More »

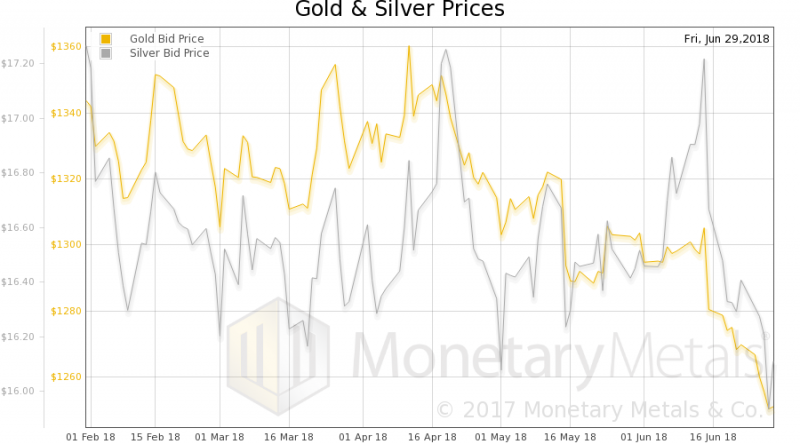

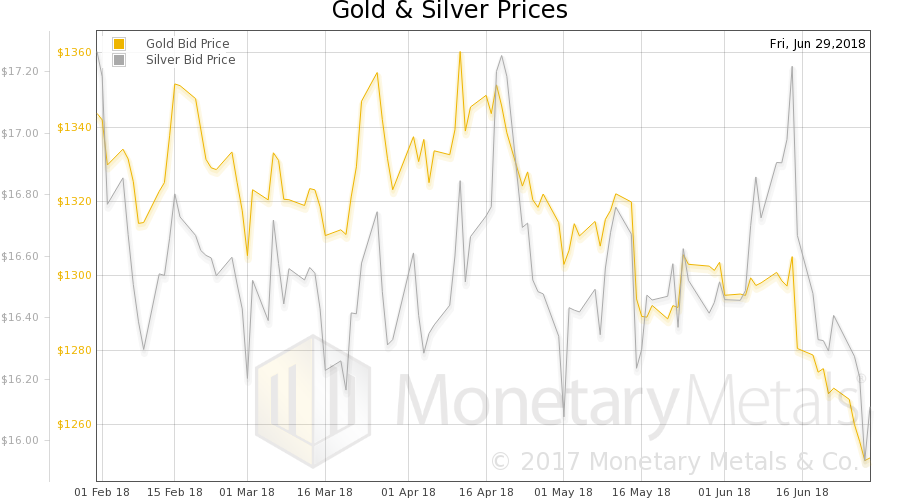

An Idea Whose Time Has Come, Report 1 July 2018

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

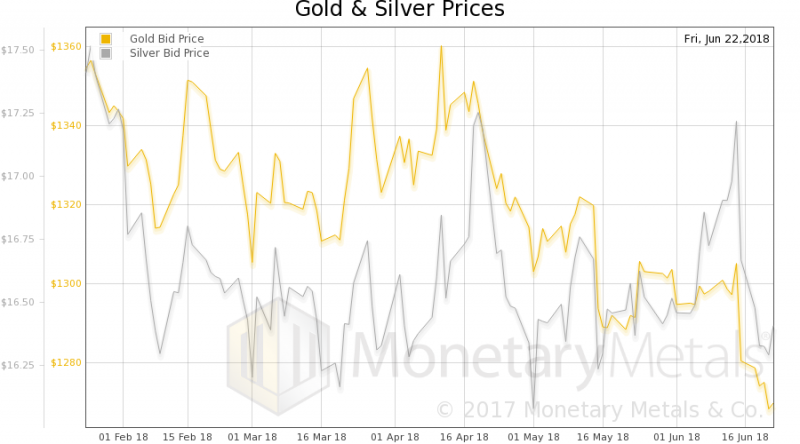

The Wealth Effect, Report 24 Jun 2018

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

12 days ago -

SNB Sight Deposits: decreased by 3.6 billion francs compared to the previous week

2025-12-17 -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: decreased by 3.6 billion francs compared to the previous week

2025-12-17 -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Was kocht man einem Multimillionär?

-

Paukenschlag in Budapest: Maja T. erwartet URTEIL schon Mittwoch!

Paukenschlag in Budapest: Maja T. erwartet URTEIL schon Mittwoch! -

2-2-26 Bears Are an Endangered Species

2-2-26 Bears Are an Endangered Species -

Vor 5 Minuten: ADAC Präsident tritt zurück! 60.000 Kündigungen!

Vor 5 Minuten: ADAC Präsident tritt zurück! 60.000 Kündigungen! -

UN 20% DE LOS INMIGRANTES NO TRABAJA

UN 20% DE LOS INMIGRANTES NO TRABAJA -

Berlin SCHOCK: “60% der Wärmepumpen zerstört”!!!

Berlin SCHOCK: “60% der Wärmepumpen zerstört”!!! -

Swiss bank Julius Bär posts lower profits

Swiss bank Julius Bär posts lower profits -

Michael Burry warnt, das ist passiert

Michael Burry warnt, das ist passiert -

Hong Kong and Switzerland Discuss Fintech, Sustainability and Market Connectivity

-

Silbercrash! WAS JETZT?!

Silbercrash! WAS JETZT?!

More from this category

It’s Only Paper, Market Report 27 Apr

It’s Only Paper, Market Report 27 Apr28 Apr 2020

The Economic Singularity, Report 11 Aug

The Economic Singularity, Report 11 Aug13 Aug 2019

Obvious Capital Consumption, Report 28 Jul

Obvious Capital Consumption, Report 28 Jul30 Jul 2019

The Fake Economy, Report 21 Jul

The Fake Economy, Report 21 Jul23 Jul 2019

What Gets Measures Gets Improved, Report 23 June

What Gets Measures Gets Improved, Report 23 June25 Jun 2019

Is Capital Creation Beating Capital Consumption? Report 3 Mar

Is Capital Creation Beating Capital Consumption? Report 3 Mar4 Mar 2019

Who Knows the Right Interest Rate, Report 3 Feb 2019

Who Knows the Right Interest Rate, Report 3 Feb 20194 Feb 2019

Rising Interest and Prices, Report 13 Jan 2019

Rising Interest and Prices, Report 13 Jan 201914 Jan 2019

Illicit Arbitrage Cut by Tax Cuts and Jobs Act, Report 3 Sep 2018

Illicit Arbitrage Cut by Tax Cuts and Jobs Act, Report 3 Sep 20184 Sep 2018

Monetary Paradigm Reset, Report 5 August 2018

Monetary Paradigm Reset, Report 5 August 20187 Aug 2018

Getting Their Pound of Flesh – Precious Metals Supply and Demand

Getting Their Pound of Flesh – Precious Metals Supply and Demand21 Jul 2018

Black Holes for Capital – Precious Metals Supply and Demand

Black Holes for Capital – Precious Metals Supply and Demand7 Jul 2018

An Idea Whose Time Has Come, Report 1 July 2018

An Idea Whose Time Has Come, Report 1 July 20183 Jul 2018

The Wealth Effect, Report 24 Jun 2018

The Wealth Effect, Report 24 Jun 201827 Jun 2018