(post written originally in March 2013)

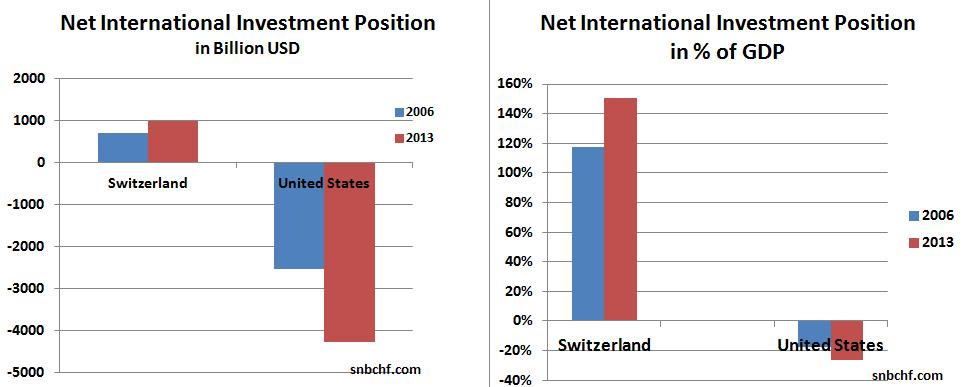

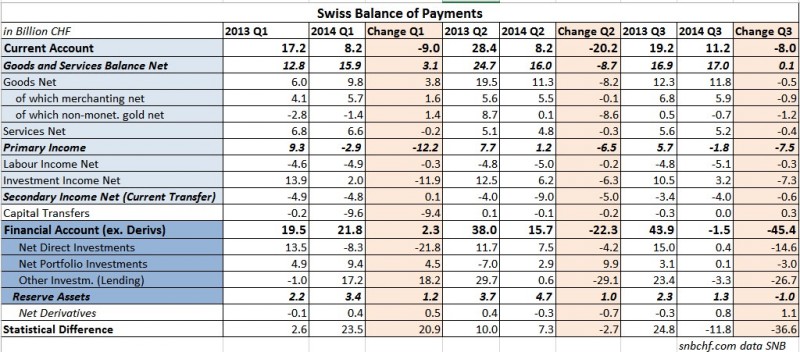

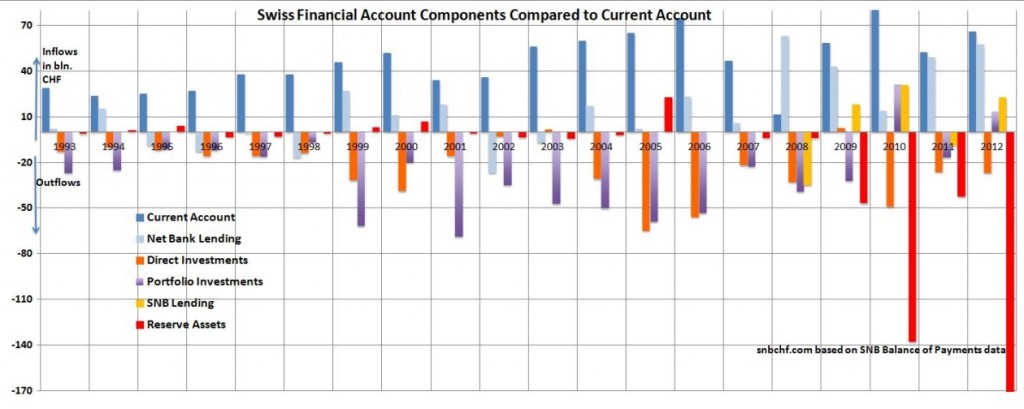

We reckon that the Swiss National Bank (SNB) will have issues maintaining the EUR/CHF floor in the longer term, because the expected yields on Swiss investments abroad will not be sufficiently higher than the yield on investments in Switzerland. Because of this insufficient risk-reward relationship, outflows in the capital account of the Swiss balance of payments will not cover the persistent Swiss current...

Read More »

Tag Archive: capital account

(5) The Balance of Payments Model

The Balance of Payments is the sum of current and capital account. The Balance of Payments model states that a currency appreciate when the Balance of Payments is positive. We give an explanation in around 400 words, that clarifies the relationships.

Read More »

Read More »

(5.2) FX Rates, the Balance of Payments Model and Central Bank Interventions

We will apply the balance of payments model for determining FX rate movements and FX interventions by central banks.

Read More »

Read More »

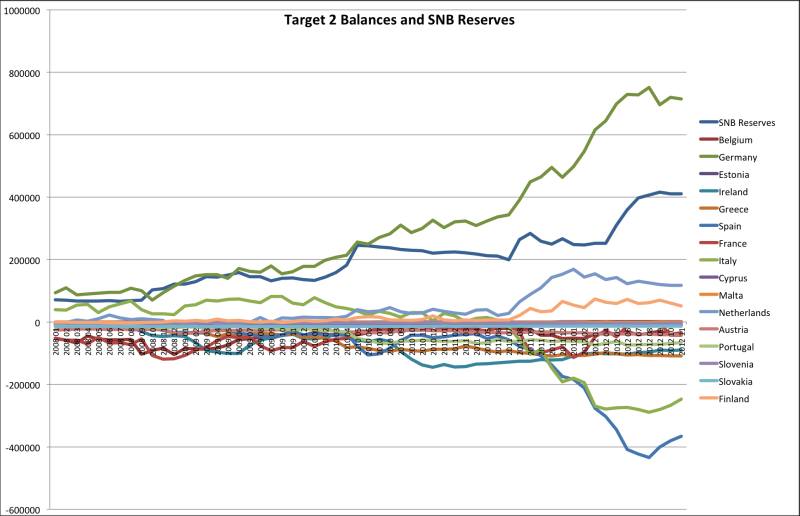

Target2 Balances and SNB Currency Reserves: Same Concept, Update February 2013

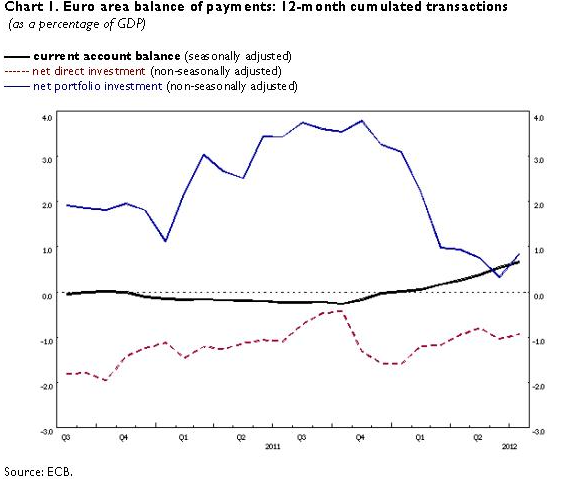

We show that Target2 imbalances and the SNB currency reserves represent the same issues, namely current account surpluses/deficits and capital flight. Therefore it makes sense to compare them, in total and by inhabitant.

Read More »

Read More »

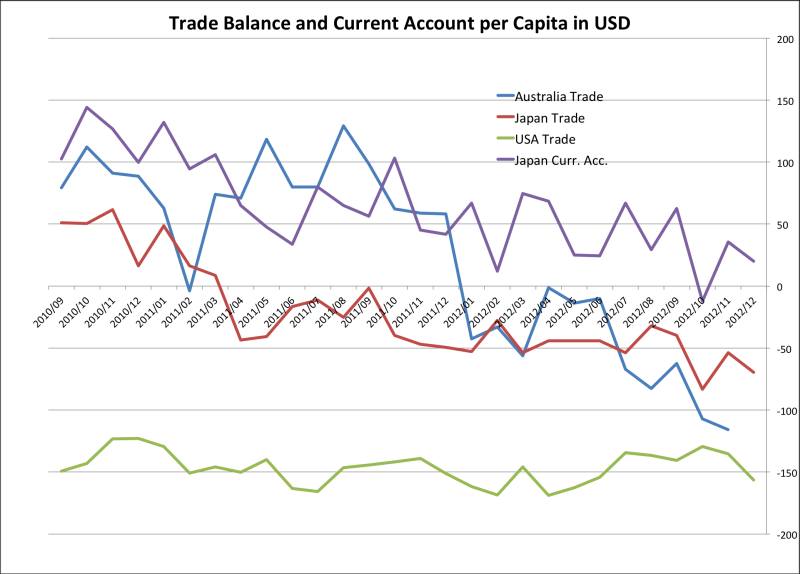

Japanese Currency Debasement, Part 1: Current Account and Japanese Bond Bears

In our first part on Japans currency debasement, we look on three aspects, government bond yields, current account balances and potential hyper-inflation which causes yields to rise strongly.

Read More »

Read More »

Target2 Balances and SNB Currency Reserves. They are Both the Same Concept

We show that Target2 imbalances and the SNB currency reserves represent the same issues, namely current account surpluses/deficits and capital flight. Therefore it makes sense to compare them, in total and by inhabitant.

Read More »

Read More »

German Currency and Gold Reserves and the German Trade Surplus

During the Bretton Woods system, Germany managed to obtain current account surpluses. They converted these surpluses into gold. At the time they bought it at 35$ per ounce at a relatively cheap price – at the end of the 1960s the price was augmented to 42$. At the end of the 1960 and with …

Read More »

Read More »

FX Theory: The Balance of Payments Model Explained in 400 Words

The balance of payments leads to many confusions because definitions vary. For example, the IMF’s definition is different from the usual or historical definition. Secondly, the relationship between the balance of payments and reserve assets is difficult to grasp, especially in the IMF definition. Thirdly the origin of “errors and omissions” is often unclear. Therefore …

Read More »

Read More »