Tag Archive: Canada

FX Daily, October 22: Trudeau will Lead a Coalition Government in Canada, while the UK’s Johnson Fights Another Day

Overview: Bismark is said to have warned that laws were like sausages, and to respect them, one ought not to see how they are made. The UK had a non-binding referendum more than three years ago, and although it won by 52%-48% and the party leaders committed to adhering to the results, it still cannot figure out how to leave.

Read More »

Read More »

FX Daily, October 21: Dollar Soft, but Stage is being Set for Turn Around Tuesday

Overview: The UK's departure from the EU remains up in the air as a new attempt to pass the necessary legislation through Parliament continues today. Many market participants seem to remain optimistic that Prime Minister Johnson's plan will ultimately succeed. After slipping to $1.2875 initially, sterling briefly pushed through $1.30, which had held it back last week.

Read More »

Read More »

FX Weekly Preview: The Week Ahead Excluding Brexit

I feel a bit like the proverbial guy that asks, "Besides that, Mrs. Lincoln, how did you like the play?" in trying to discuss the week ahead without knowing the results of the UK Parliament's decision on the new deal negotiated between Prime Minister Johnson and the EU. I will write a separate note about Brexit before the Asian open. However, there are several other developments next week that will help shape the investment climate.

Read More »

Read More »

FX Daily, October 4: The US Jobs Data to Close a Sobering Week

Overview: The recovery of US shares yesterday signaled today's fragile stability. Gains in Japan, Australia, and Taiwan blunted the losses elsewhere in the region, including a 1% slide in Hong Kong. The MSCI Asia Pacific Index fell for the third week. China's markets have been closed since Monday and will re-open Monday and may play some catch-up.

Read More »

Read More »

FX Daily, September 06: Focus Shifts to North American Jobs Before Turning Back to Europe next Week

Investors hope that the world took a step away from the abyss in recent days. Developments in Hong Kong, US-China talking, a political and economic crisis in Italy appears to have been averted, and a risk of a no-deal Brexit has lessened. Asia Pacific equities closed the week on a firm note and extended the rally the third week.

Read More »

Read More »

FX Weekly Preview: Talking and Fighting in the Week Ahead

Equity markets and the US dollar closed last week and August on a firm note. Ahead of the weekend, the dollar rose to new highs for the year against the euro, Swedish krona, Norwegian krone, and the New Zealand dollar. While the next set of US and Chinese tariffs start September 1, the market is making the most of the lull.

Read More »

Read More »

FX Daily, July 05: Dollar is Bid Ahead of Jobs Report

Overview: The dovish response to news that Lagarde was nominated to replace Draghi was extended by the dismal German factory order report that has pushed the euro to new two-week lows and kept bond yields near record lows. The focus ahead of the weekend is squarely on the US employment data, where a second consecutive poor report will fan expectations for a large Fed cut to initiate an easing cycle.

Read More »

Read More »

FX Daily, June 28: The World may Look Different Come Monday

Overview: Quarter-end positioning seems to dominate today's activity. The outcome of bilateral talks at the G20 gathering partly reflects the influence of the US President who eschews multilateral efforts as a hindrance to its sovereignty. Equities in Asia Pacific slipped today but held on to modest gains for the week.

Read More »

Read More »

FX Daily, June 26: Biggest Drop in the S&P 500 in June Weighs on Global Equities

The S&P 500 fell nearly one percent yesterday, its steepest fall this month and this was a weight on Asia Pacific and European activity. Most markets have eased, though not as much as the US did. Hong Kong, India, and Singapore were notable exceptions in Asia, where the MSCI benchmark slipped for a second day.

Read More »

Read More »

FX Daily, June 7: Jobs Data and Tariffs Dominate

Overview: Global equities continue to recover from the recent slide. Chinese and Hong Kong markets were on holiday today, but the MSCI Asia Pacific Index eked out a minor gain and ensured that its four-week slide ended. Europe's Dow Jones Stoxx 600 is up about 0.7% through the European morning.

Read More »

Read More »

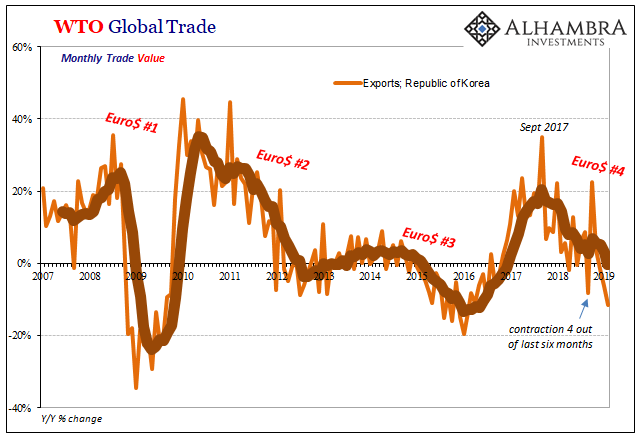

Globally Synchronized…

The economic sickness is predictably spreading. While unexpected in most of the world which still, somehow, depends on central banking forecasts, it really has been almost inevitable. From the very start, just the utterance of the word “decoupling” was the kiss of death.

Read More »

Read More »

FX Weekly Preview: Six Events to Watch

The divergence thesis that drives our constructive outlook for the dollar received more support last week than we expected. A few hours after investors learned that Japan's flash PMI remained below the 50 boom/bust level, Europe reported disappointing PMI data as well. And a few hours after that the US reported that retail sales surged in March by the most in a year and a half (1.6%).

Read More »

Read More »

FX Weekly Preview: What Can Bite You This Week?

Several major central banks will meet next week, including the European Central Bank, but it is only the Bank of Canada that is expected to hike rates. The flash PMIs and the first official estimate of Q3 US GDP are among the data highlights. Beyond the events and data, the volatility from global equity markets from Shanghai to New York will continue to have a strong influence on other capital markets.

Read More »

Read More »

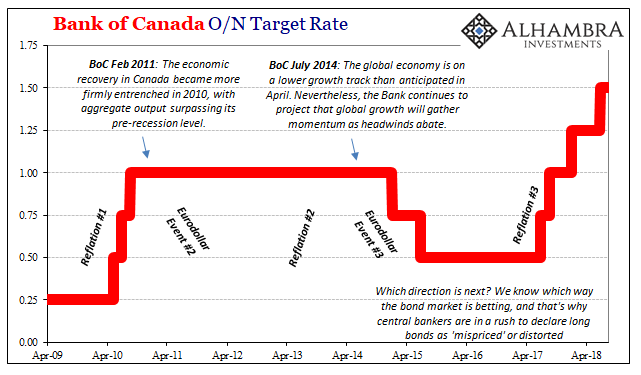

‘Mispriced’ Bonds Are Everywhere

The US yield curve isn’t the only one on the precipice. There are any number of them that are getting attention for all the wrong reasons. At least those rationalizations provided by mainstream Economists and the central bankers they parrot. As noted yesterday, the UST 2s10s is now the most requested data out of FRED. It’s not just that the UST curve is askew, it’s more important given how many of them are.

Read More »

Read More »

FX Daily, May 18: EUR/CHF Continues the Collapse

The US dollar is mostly firmer. US yields have stabilized. Asian equities were mostly higher, while European bourses are struggling. Oil prices are steady. There have been a number of sustained trends in the markets that we have been monitoring. The euro, for example, has fallen each day this week. It recorded its low for the year on Wednesday near $1.1765.

Read More »

Read More »

FX Weekly Preview: Drivers and Views

It is not easy to recall another week in which there were so many potential changes to the broad investment climate. The relatively light economic calendar in the week ahead may allow investors to continue to ruminate about some of those developments. Here we provide thumbnail assessments of the main drivers.

Read More »

Read More »

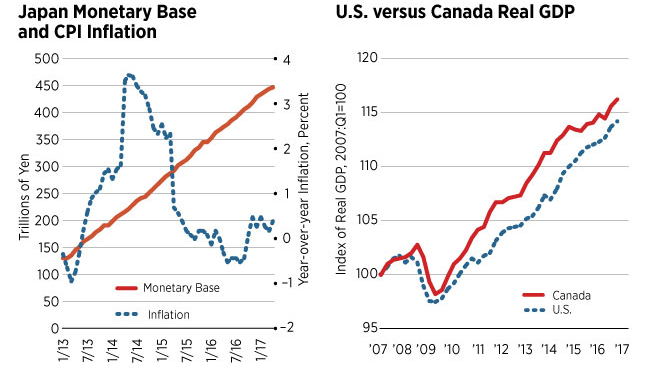

Why The Fed’s Balance Sheet Reduction Is As Irrelevant As Its Expansion

The FOMC is widely expected to vote in favor of reducing the system’s balance sheet this week. The possibility has been called historic and momentous, though it may be for reasons that aren’t very kind to these central bankers. Having started to swell almost ten years ago, it’s a big deal only in that after so much time here they still are having these kinds of discussions.

Read More »

Read More »

FX Daily, September 22: Markets Limp into the Weekend

The cycle of sanctions, recriminations, and provocative actives continues as the Trump Administration leads a confrontation with North Korea. The US announced yesterday new round of sanctions on North Korea. Reuters reported that the PBOC has instructed its banks not to take on new North Korean clients and to begin unwinding existing relationships.

Read More »

Read More »

Canada’s RHINO(s)

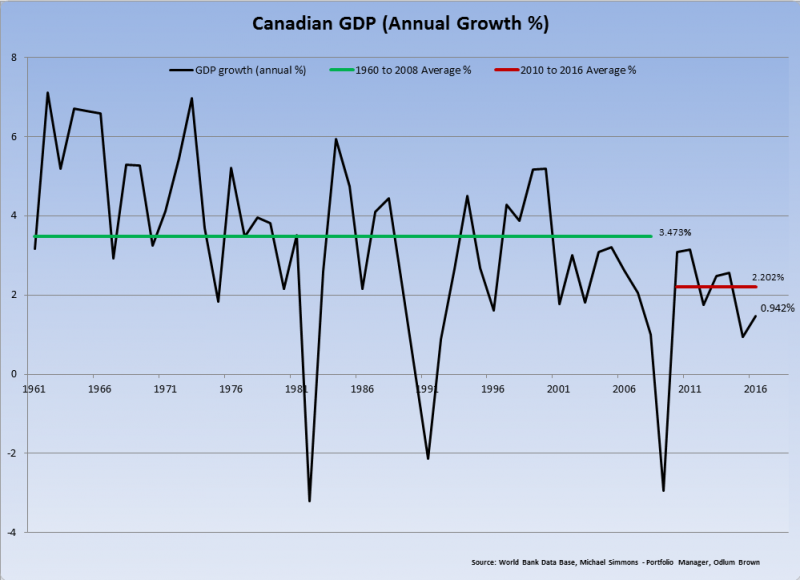

The Bank of Canada “raised rates” again today, this time surprising markets and economists who were expecting more distance between the first and second policy adjustments. The central bank paid typical lip service to being data dependent. It has a vested interest if you, as any Canadian reader, believe that to be a fact.

Read More »

Read More »

FX Weekly Preview: Three Central Banks Dominate the Week Ahead

Following strong Q2 GDP figures, risk is that Bank of Canada's rate hike anticipated for October is brought forward. ECB's guidance to that it will have to extend its purchases into next year will continue to evolve. Among Fed officials speaking ahead of the blackout period, Brainard and Dudley's comments are the most important.

Read More »

Read More »