Tag Archive: Bunds

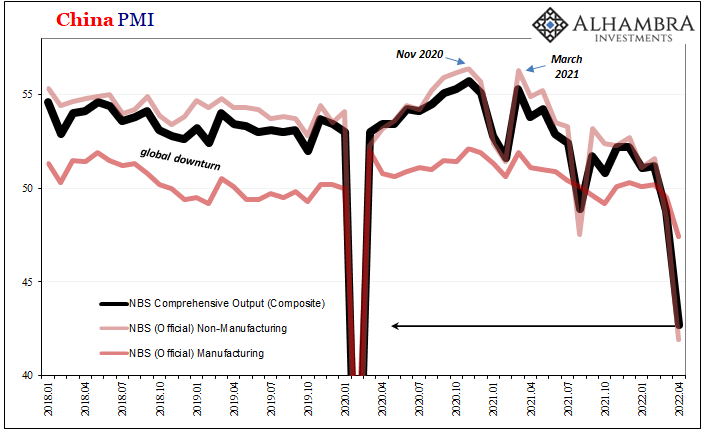

China Then Europe Then…

This is the difference, though in the end it only amounts to a matter of timing. When pressed (very modestly) on the slow pace of the ECB’s “inflation” “fighting” (theater) campaign, its President, Christine Lagarde, once again demonstrated her willingness to be patient if not cautious.

Read More »

Read More »

Meanwhile, Outside Today’s DC

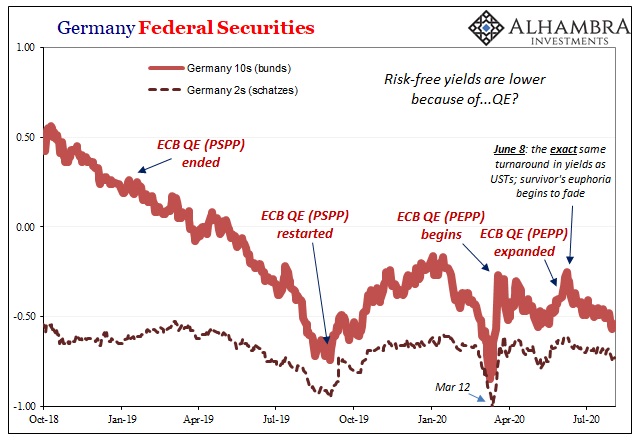

With all eyes on Washington DC, today, everyone should instead be focused on Europe. As we’ve written for nearly three years now, for nearly three years Europe has been at the unfortunate forefront of Euro$ #4. We could argue about whether coming out of GFC2 back in March pushed everything into a Reflation #4 – possible – or if this is still just one three-yearlong squeeze of a global dollar shortage.

Read More »

Read More »

Accusing the Accused of Excusing the Mountain of Evidence

Why not let the accused also sit in the jury box? The answer seems rather obvious. While maybe the truly honest man accused of a crime he did commit would vote for his own conviction, the world seems a bit short on supply of those while long and deep offering up practitioners of pure sophistry in their stead.

Read More »

Read More »

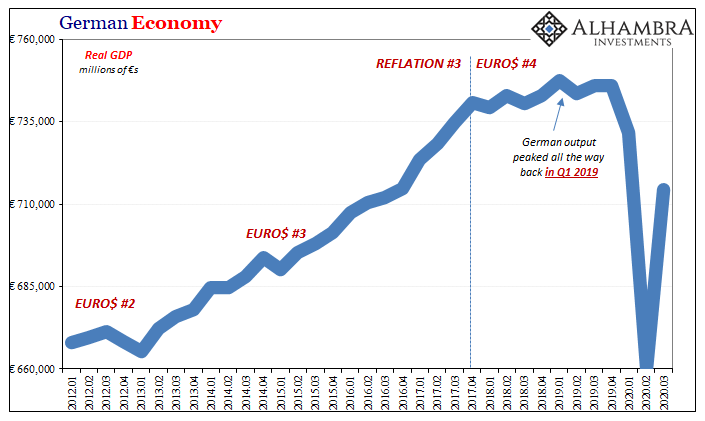

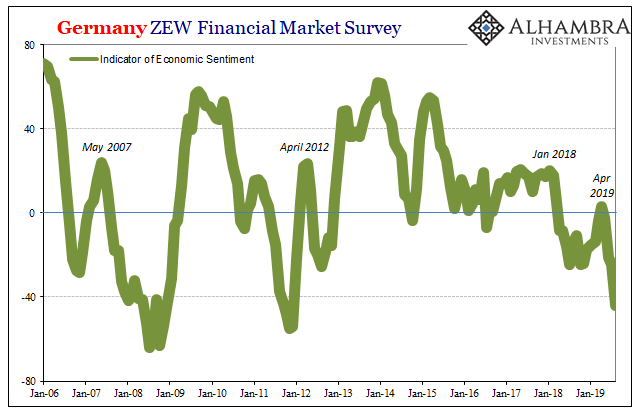

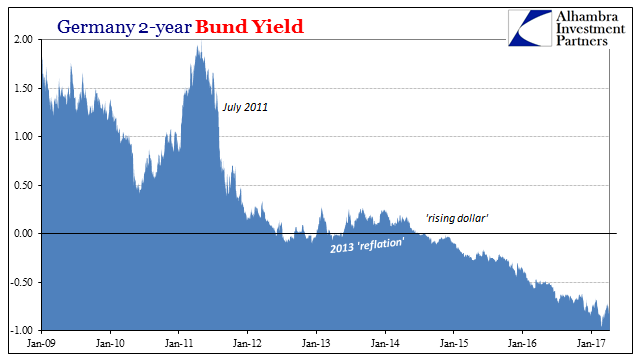

Why You Should Care Germany More and More Looks Like 2009

What if Germany’s economy falls into recession? Unlike, say, Argentina, you can’t so easily dismiss German struggles as an exclusive product of German factors. One of the most orderly and efficient systems in Europe and all the world, when Germany begins to struggle it raises immediate questions about everywhere else.

Read More »

Read More »

The Global Burden

Bundesrepublik Deutscheland Finanzagentur GmbH (German Finance Agency) was created on September 19, 2000, in order to manage the German government’s short run liquidity needs. GFA took over the task after three separate agencies (Federal Ministry of Finance, Federal Securities Administration, and Deutsche Bundesbank) had previously shared responsibility for it.

Read More »

Read More »

High German Pay Rises: The End of the German Bunds Bubble

Yesterday’s German CPI has given a first insights of what is coming these years: German inflation. For years excessive risk averseness put pressure on German yields. Most recently, energy prices helped to push down inflation and on German yields possibly for a last time. But many ignore that the main reason for inflation are rising …

Read More »

Read More »

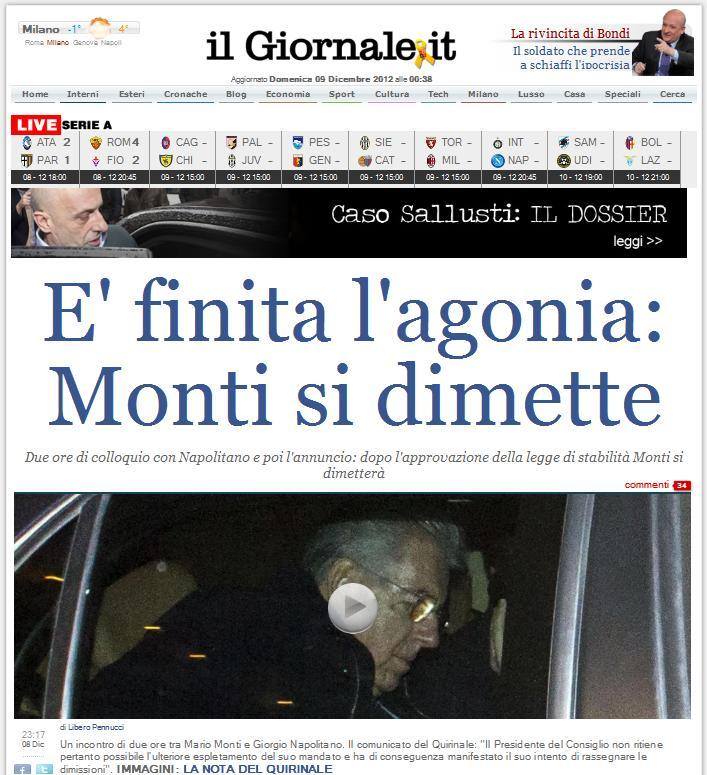

Viva la Democrazia! The Reign of the Spread is Finished!

Claudio Messora, one of most well known critics during the "Reign of the spread" between Italian and German bonds.He happy about the return of democracy.

Read More »

Read More »

Can The SNB Make Profit On Currency Reserves ?

Abstract We determine the main criteria with which markets evaluate currency prices. We focus on explaining the differences between the carry trade era (or like Ben Barnanke called it “The Great Moderation”) and the period after the financial crisis. Our research shows that each one of the following three main preconditions must be fulfilled, …

Read More »

Read More »

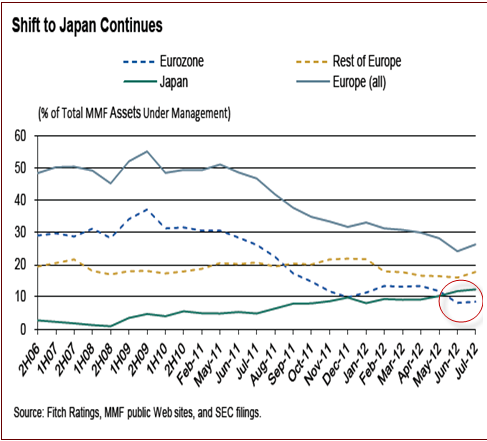

Are German Bunds finally heading for the big slide ?

Citibank judges that the Swiss National Bank (SNB) does not need a peg anymore. The EUR/CHF exchange rate would be now over 1.20 even if exposed to the free market. Yesterday we showed that the upward move in the EUR/CHF is just the behavior of some euphoric Forex traders. In the meantime we see a completely … Continue reading »

Read More »

Read More »

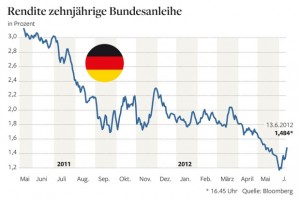

Spread Swiss Eidgenossen vs. German Bund to see further gains

The spread between the Swiss government Eidgenossen bond against the Germany 10yrs. Bund will see further gain in the future, after the Euro summit opened the door for ESM direct financing of banks. Differences between EFSF and ESM explained

Read More »

Read More »

The other risk for the SNB: Will German Bund yields double ?

In the latest post we started discussing the implications of a German euro exit for the Swiss National Bank, this time we will look on another risk: The rising German Bund yields.

Read More »

Read More »

Is the SNB prepared for the black swan ?

Will the SNB printing policy lead to inflation and a housing bust when Germany leaves the Euro ? Recently the voices for a German euro exit have become louder and louder. The most recent voice comes from Biderman , the FT says that the rise of German Bunds holds the secret how the eurozone crisis will … Continue reading...

Read More »

Read More »