Tag Archive: bubble

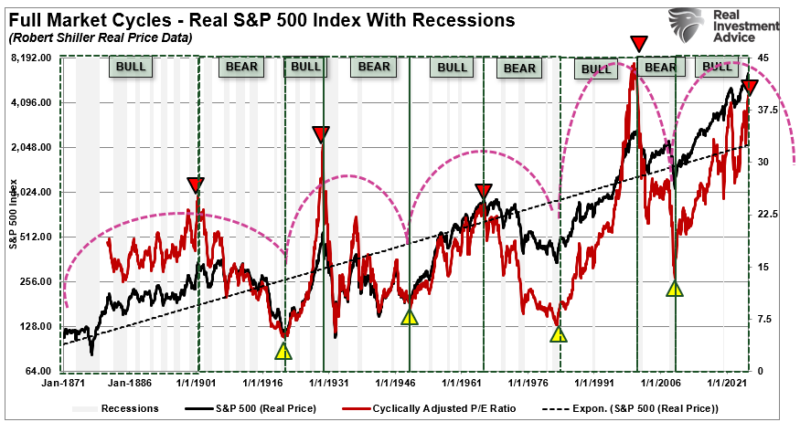

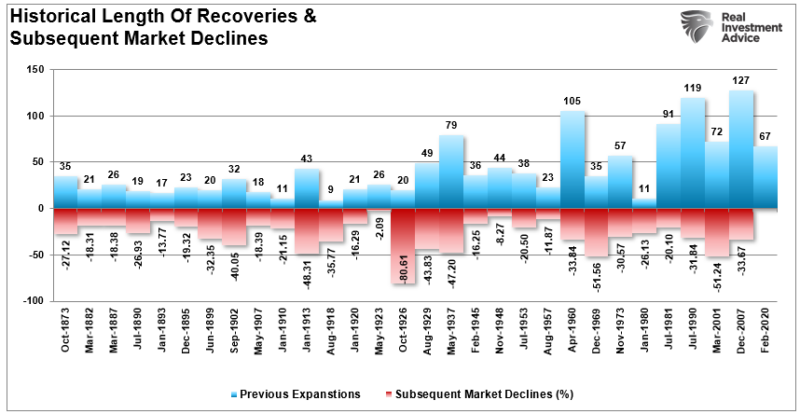

Full Market Cycles: Half Bull and Half Bear

Last week, we discussed the importance of "math" as it relates to valuations and noted the importance of understanding "full market cycles." To wit: "The math on forward return expectations, given current valuation levels, does not hold up. The assumption that valuations can fall without the price of the markets being negatively impacted is also grossly flawed. …

Read More »

Read More »

Forward Return And The Importance Of Math

During strongly trending bull markets, investors often overlook the importance of math in predicting forward returns. Such is easy to do when the market just seemingly continues to rise without regard to fundamentals. The current environment is also heavily influenced by the impact of "passive indexing," which has distorted market dynamics as well. However, none …

Read More »

Read More »

Three Years Ago QE, Last Year It Was China, Now It’s Taxes

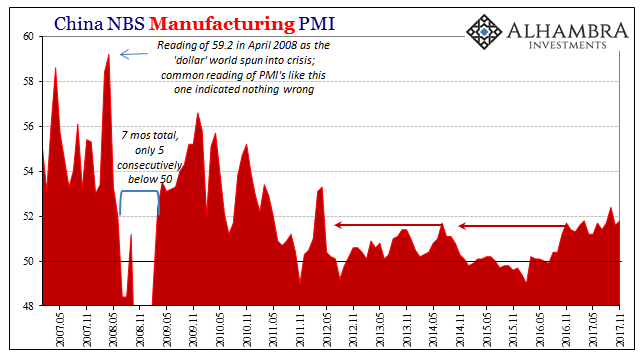

China’s National Bureau of Statistics reported last week that the official manufacturing PMI for that country rose from 51.6 in October to 51.8 in November. Since “analysts” were expecting 51.4 (Reuters poll of Economists) it was taken as a positive sign. The same was largely true for the official non-manufacturing PMI, rising like its counterpart here from 54.3 the month prior to 54.8 last month.

Read More »

Read More »

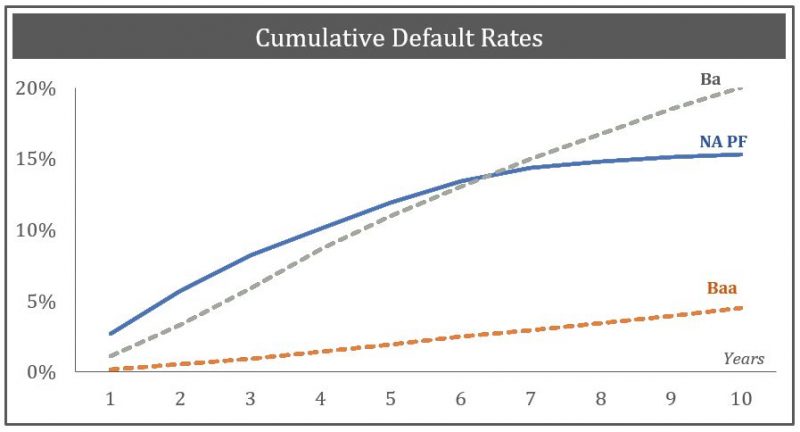

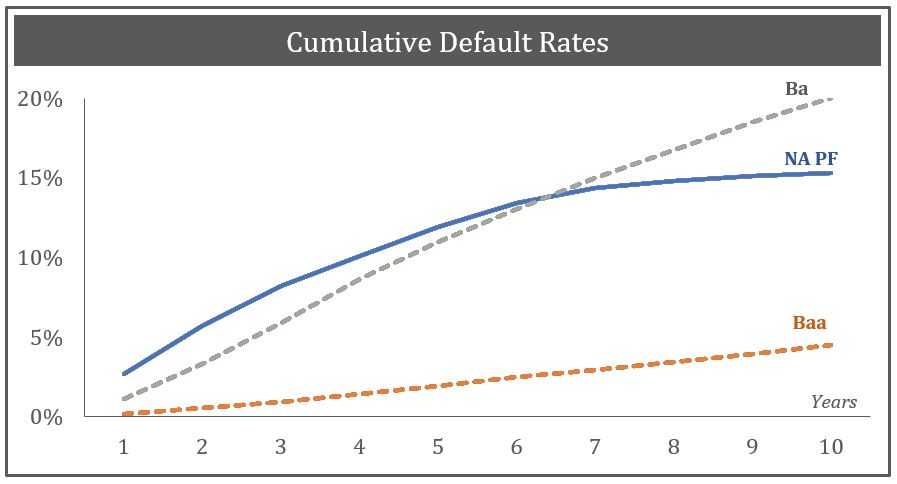

Necessity is the Mother of Invention – Retirees Desperate Reach for Yield

Ben Bernanke’s creativity inspired a generation of economists and central bankers. QE, ZIRP and NIRP established a new class of economics that is mathematically sound but practically disastrous. Billions of dollars were transferred from savers to investors to boost the economy, but the wizards of quant forgot that something has to give. In this case, it was the formation of a pension crisis that threatens the golden years of millions of retirees...

Read More »

Read More »

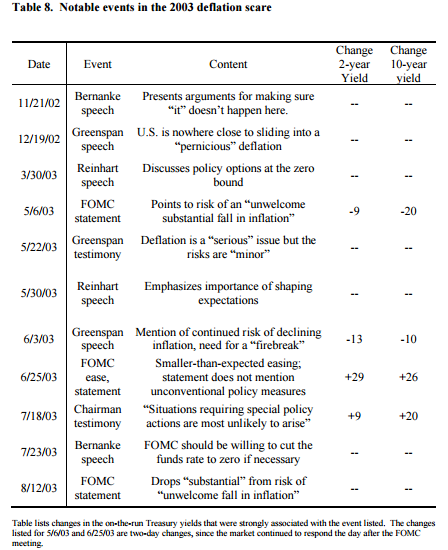

All In The Curves

If the mainstream is confused about exactly what rate hikes mean, then they are not alone. We know very well what they are supposed to, but the theoretical standards and assumptions of orthodox understanding haven’t worked out too well and for a very long time now. The benchmark 10-year US Treasury is today yielding less than it did when the FOMC announced their second rate hike in December.

Read More »

Read More »

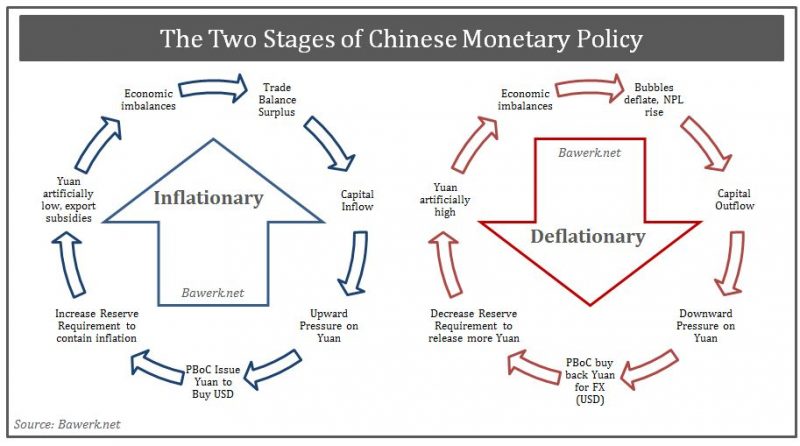

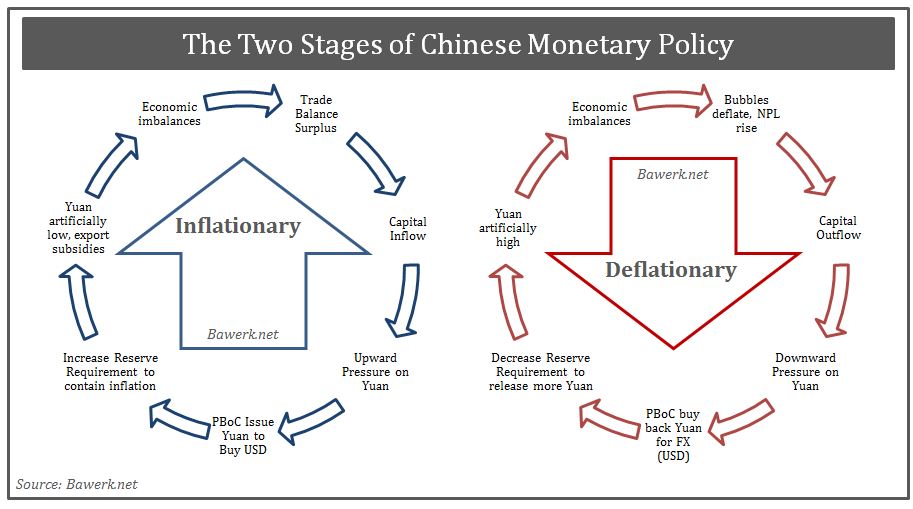

Chinese Philosopher Kings, Losing their Yuan FX Religion?

It took a while, but the world are slowly coming to grips with the simple fact that the red-suzerains in Beijing are not the infallible leaders en route to a new superior economic model as they thought they were. All the craze that emanated from the spurious work of Joshua Cooper Ramo, which eventually led to works like “How China’s Authoritarian Model Will Dominate the Twenty-First Century,” are slowly catching up to reality.

Read More »

Read More »

How to Invest in the New World Order

In our latest Toward a New World Order, Part III we ended by promising to look closer at investment implications from the political and economic shift we currently find ourselves in; and that story must begin with the dollar.

Read More »

Read More »

Toward A New World Order, part III

A new world order is coming of age and the transition is painful to accept for a Western middle class with a deep-seated sense of entitlement. We showed how the West feels threatened globally in Toward a New World Order and followed up explaining how this translate into domestic politics in Toward a New World Order Part II. We will now continue this series by showing how gross economic mismanagement have created the new political class that we...

Read More »

Read More »

Do our money managers really believe this will end well?

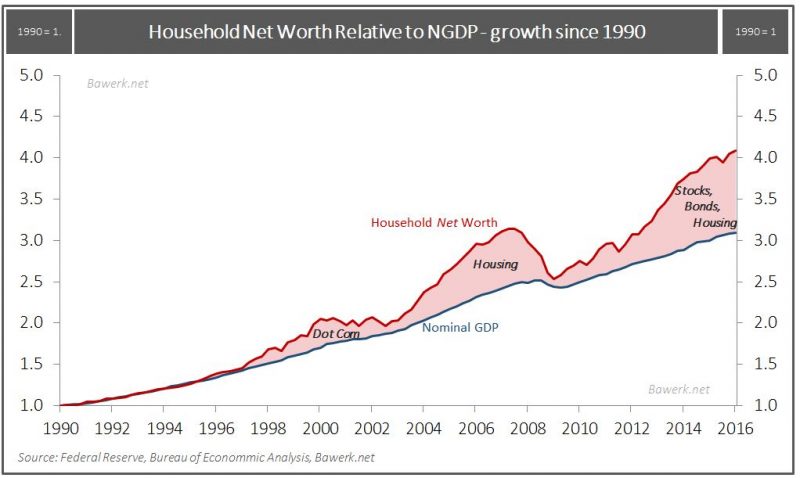

An economic bubble is essentially an economic activity that cannot sustain itself without a continuous influx of new money and credit to bid away real resources from self-funding endeavors. Financial bubbles are obviously closely related as financial...

Read More »

Read More »

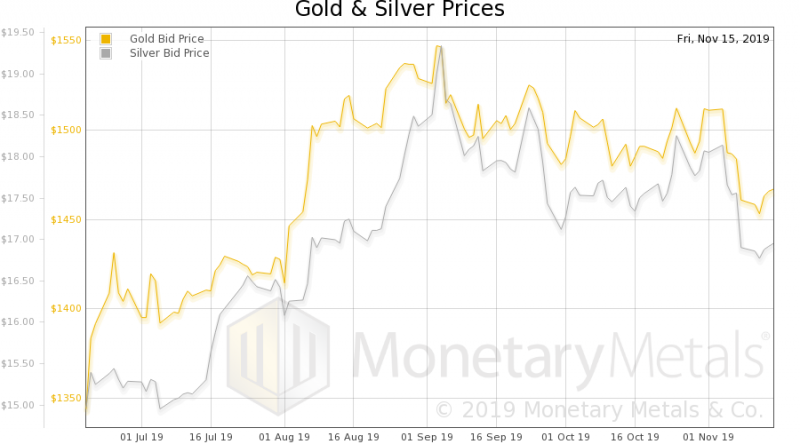

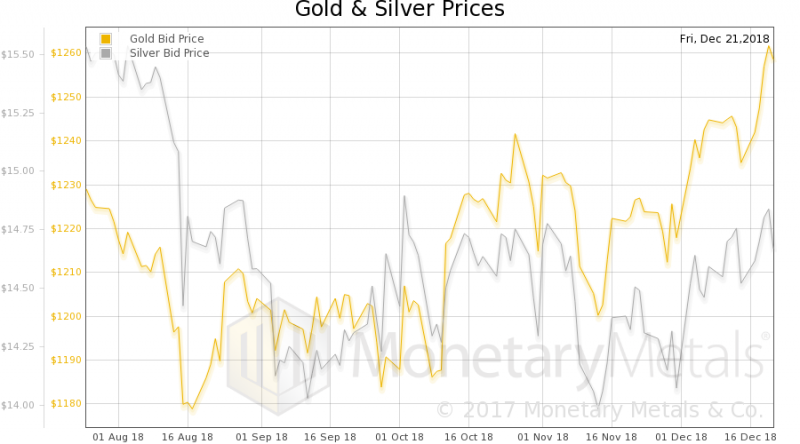

What Happens When Credit Is Mispriced?

Keith Weiner explains what happens when credit is mispriced. The rich are privileged because they can profit on the volatility and the bubbles the cheap credit createes.

Read More »

Read More »

Why Can’t The Fed Spot Bubbles?

The topic of whether the Federal Reserve can see bubbles in advance, and what they can do about them, is hotly debated. The price of an earning asset depends directly on the interest rate. This is because of time preference. It is better to have your cash today than tomorrow. The Fed’s problem is that the calculation depends on a rate of interest that it heavily influences. Its analysis is therefore circular and self-fulfilling. It’s like taking a...

Read More »

Read More »