Tag Archive: Brazil

FX Daily, June 14: Dollar Becalmed as Markets Wait for US Leadership

The short squeeze that lifted the US dollar ahead of the weekend has seen limited follow-through buying, and instead a consolidative tone emerged. Europe is searching for direction and perhaps waiting for US leadership after a quiet Asia Pacific session, with several centers closed for holiday today (China, Hong Kong, Taiwan, and Australia).

Read More »

Read More »

FX Daily, June 10: ECB Meeting and US CPI: Transitory Impact

The ECB meeting and the US May CPI report is at hand. The US dollar is consolidating at a higher level against most of the major currencies. Softer than expected, inflation readings are weighing on the Scandis, which are bearing the brunt. The US 10-year yield closed below 1.50% for the first time in three months yesterday, and this may have helped underpin the Japanese yen.

Read More »

Read More »

FX Daily, June 09: Without Yield Support, the Dollar Wilts

Falling US yields weigh on the US dollar. The 10-year Treasury yield is flirting with the 1.50% mark, and the greenback is trading heavily against all the major and most emerging market currencies. European and the Asia Pacific benchmark yields are lower as well.

Read More »

Read More »

FX Daily, June 04: US and Canada Report on Jobs as G7 Fin Mins Talk Taxes

Stronger than expected US employment data, ahead of today's monthly report and compromise proposal on corporate tax by the White House to help secure a deal on infrastructure sent US bond yields and the dollar high. Late dollar shorts were forced to cover.

Read More »

Read More »

FX Daily, May 31: China Raises Reserve Requirement for FX, Stemming the Yuan’s Rise

US and UK markets are closed for holidays today, contributing to the rather subdued price action today. The MSCI Asia Pacific Index rallied two percent last week, the most in three months, and most markets began off the week with modest gains. Japan, Australia, and Singapore, for notable exceptions.

Read More »

Read More »

FX Daily, May 25: Softer Yields Weigh on the Greenback

The decline in US 10-year rates to two-week lows below 1.59% is helping rebuild bullish enthusiasm for stocks and weighing on the US dollar. The NASDAQ reached two-week highs yesterday, and almost all the large markets in the Asia Pacific region rose, though India struggled.

Read More »

Read More »

FX Daily, May 12: The Dollar Stabilizes but Stocks, Not So Much

The markets remain on edge. Asia Pacific and US equities have yet to find stable footing, and inflation fears are elevated. The foreign exchange market has turned quiet as the dollar consolidates its recent losses.

Read More »

Read More »

FX Daily, May 11: Stocks Slide but Little Demand for Safe Havens

The sell-off in US shares yesterday has triggered sharp global losses today, and there is no flight into fixed income as benchmark yields are higher across the board. Nor is the dollar serving as much as a safe haven. It is mostly softer against the major currencies.

Read More »

Read More »

FX Daily, March 30: US Yields Push Higher, Lifting the Greenback Especially Against the Euro and Yen

The US 10-year yield is at new highs since January 2020, pressing above 1.77% and helping pull up global yields today. European benchmarks yields are up 4-5 bp, and the Antipodean yields jump 8-9 bp. The impact on equities has been minor, and the talk is still about the unwinding of Archegos Capital.

Read More »

Read More »

FX Daily, March 15: Big Week Begins Quietly

The capital markets are beginning a new and busy week in a non-committal fashion. Equities are mixed. Except for Japan, Hong Kong, and Australia, most markets in the Asia Pacific region were lower, led Chinese and Indian shares.

Read More »

Read More »

FX Daily, March 9: Turn Around Tuesday Strikes

It is not clear the trigger, but risk-taking appetites rebounded smartly today after the NASDAQ completed a more than 10% pullback from its highs yesterday. Ironically, the Dow Jones Industrials set new record highs yesterday too. Most equity markets in the Asia Pacific region rallied. The notable exceptions were South Korea and China.

Read More »

Read More »

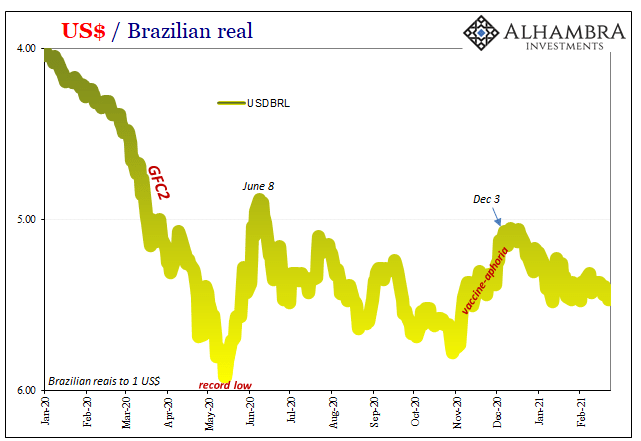

For The Dollar, Not How Much But How Long Therefore How Familiar

Brazil’s stock market was rocked yesterday by politics. The country’s “populist” President, Jair Bolsonaro, said he was going to name an army general who had served with Bolsomito (a nickname given to him by supporters) during that country’s prior military dictatorship as CEO of state-owned oil giant Petróleo Brasileiro SA. Gen. Joaquim Silva e Luna is being installed, allegedly, to facilitate more direct control of the company by the federal...

Read More »

Read More »

FX Daily, February 23: Dramatic Market Adjustment Continues

Overview: Rising rates continue to spur a rotation and retreat in stocks. Yesterday the NASDAQ sold-off by nearly 2.5% while the Dow Industrials eked out a minor gain. Equities are mostly higher in the Asia Pacific region while Japanese markets were on holiday.

Read More »

Read More »

FX Daily, January 26: Subdued Activity as New Incentives Awaited

Overview: After rallying strongly to start the year, Asia Pacific equities, led by the high-flying Hang Seng, sold-off, led by Tencent. Most markets in the region were off at least 1%. Australia and India escaped the profit-taking due to holidays. Europe's Dow Jones Stoxx 600 is faring better and looks poised to snap a two-day fall, led by materials, financials, information technology, and consumer staples.

Read More »

Read More »

FX Daily, January 19: Even When She Speaks Softly, She’s Yellen

Overview: The animal spirits are on the march today. Equities are mostly higher, peripheral European bonds are firm, and the dollar is mostly softer. After posting the first back-to-back decline this year, the MSCI Asia Pacific Index bounced back today, led by a 2.7% gain in Hong Kong (20-month high) and a 2.6% rise in South Korea's Kospi.

Read More »

Read More »

FX Daily, December 15: The Bulls are Emboldened

The S&P fell for the fourth consecutive session yesterday, the longest losing streak of the quarter, and this seemed to encourage profit-taking in the Asia Pacific region today. The MSCI Asia Pacific Index slipped for the second consecutive session, and even confirmation of the Chinese recovery failed to lift the Shanghai Composite.

Read More »

Read More »

FX Daily, December 9: Hope Burns Eternal

The market is hopeful today. The Johnson-von der Leyen dinner is seen as evidence that both sides see one more opportunity, and sterling is among the strongest currencies today. Hopes of a $900 bln+ fiscal stimulus package in the US helped stir animal spirits and lift US stocks to record highs yesterday.

Read More »

Read More »

FX Daily, November 30: Equities are Heavy and the Dollar Softer to Start New Week

Overview: Month-end profit-taking saw Asia Pacific shares tumble earlier today. Most markets are off 1-2.5% today after the MSCI Asia Pacific Index rose 2.25% last week. European shares are mixed, but little changed. US shares are also trading lower.

Read More »

Read More »

FX Daily, November 24: Diverging PMIs Fail to Give the Dollar Lasting Support

Overview: The contrast between the eurozone and US preliminary PMI readings caught the short-term market leaning the wrong way, and the dollar snapped back after extending its recent losses. However, today the US dollar is back on its heels and returning to yesterday's lows against most major currencies.

Read More »

Read More »

FX Daily, October 28: Animal Spirits Called in Sick

Sickened by the surging virus, animal spirits are bed-ridden today. Several European countries are experiencing the most fatalities and illnesses in several months, and policymakers are responded with national restrictions.

Read More »

Read More »