Tag Archive: bond market

Weekly Market Pulse: Good News, Bad News

One thing I can tell you for certain about last week’s big rally on Thursday and Friday: there were a lot of people who desperately wanted a good excuse to buy stocks. And buy they did after a better-than-expected CPI report Thursday morning, pushing the S&P 500 up nearly 6% on the week with all of that coming on Thursday and Friday.

Read More »

Read More »

Weekly Market Pulse: Just A Little Volatility

Markets were rather volatile last week. That’s a wild understatement and what passes for sarcasm in the investment business. Stocks started the week waiting with bated (baited?) breath for the inflation reports of the week. It isn’t surprising that the market is focused firmly on the rear view mirror for clues about the future since Jerome Powell has made it plain that is his plan, goofy as it is.

Read More »

Read More »

The Real Tantrum Should Be Over The Disturbing Lack of Celebration (higher yields)

Bring on the tantrum. Forget this prevaricating, we should want and expect interest rates to get on with normalizing. It’s been a long time, verging to the insanity of a decade and a half already that keeps trending more downward through time. What’s the holdup?

Read More »

Read More »

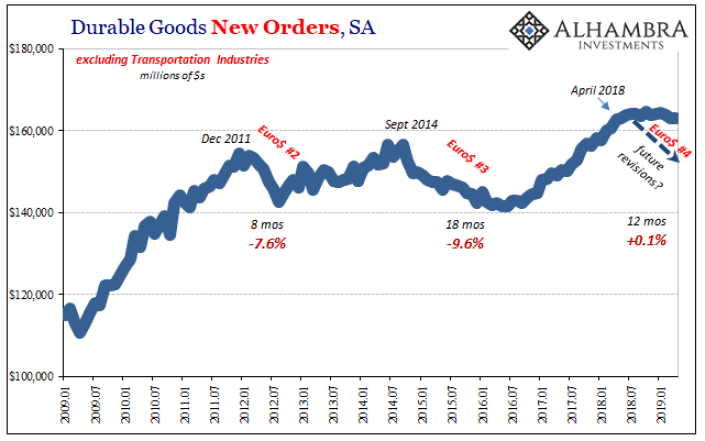

The Enormously Important Reasons To Revisit The Revisions Already Several Times Revisited

Extraordinary times call for extraordinary commitment. I never set out nor imagined that a quarter century after embarking on what I thought would be a career managing portfolios, researching markets, and picking investments, I’d instead have to spend a good amount of my time in the future taking apart how raw economic data is collected, tabulated, and then disseminated.

Read More »

Read More »

They’ve Gone Too Far (or have they?)

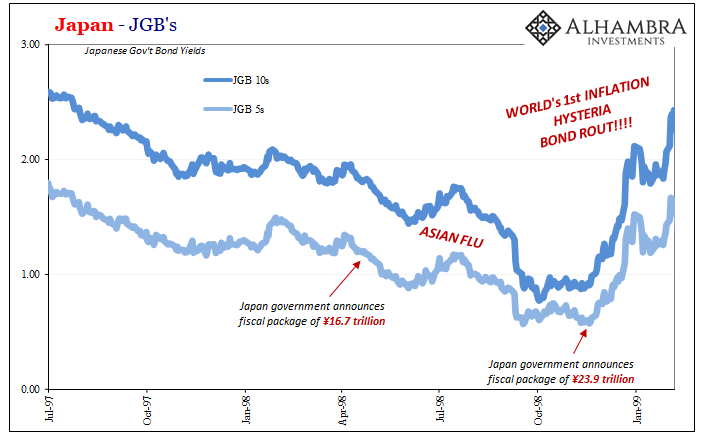

Between November 1998 and February 1999, Japan’s government bond (JGB) market was utterly decimated. You want to find an historical example of a real bond rout (no caps nor exclamations necessary), take a look at what happened during those three exhilarating (if you were a government official) months.

Read More »

Read More »

Re-recession Not Required

If we are going to see negative nominal Treasury rates, what would guide yields toward such a plunge? It seems like a recession is the ticket, the only way would have to be a major economic downturn. Since we’ve already experienced one in 2020, a big one no less, and are already on our way back up to recovery (some say), then have we seen the lows in rates?Not for nothing, every couple years when we do those (record low yields) that’s what “they”...

Read More »

Read More »

Macro Housing: Bargains and Discounts Appear

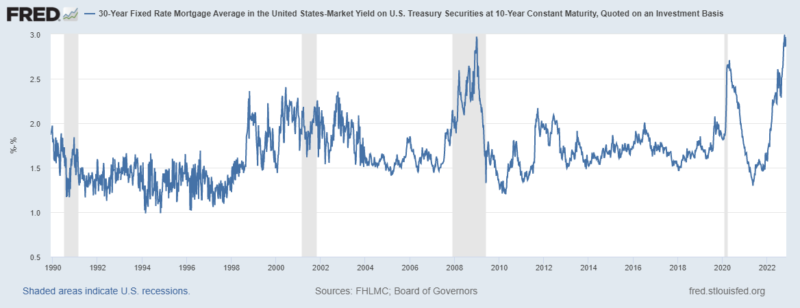

While things go wrong for Jay Powell in repo, they are going right in housing. Sort of. It’s more than cliché that the real estate sector is interest rate sensitive. It surely is, and much of the Fed’s monetary policy figuratively banks on it. When policymakers talk about interest rate stimulus, they largely mean the mortgage space.

Read More »

Read More »

Head Faking In The Empty Zoo: Powell Expands The Balance Sheet (Again)

They remain just as confused as Richard Fisher once was. Back in ’13 while QE3 was still relatively young and QE4 (yes, there were four) practically brand new, the former President of the Dallas Fed worried all those bank reserves had amounted to nothing more than a monetary head fake. In 2011, Ben Bernanke had admitted basically the same thing.

Read More »

Read More »

The Consequences Of ‘Transitory’

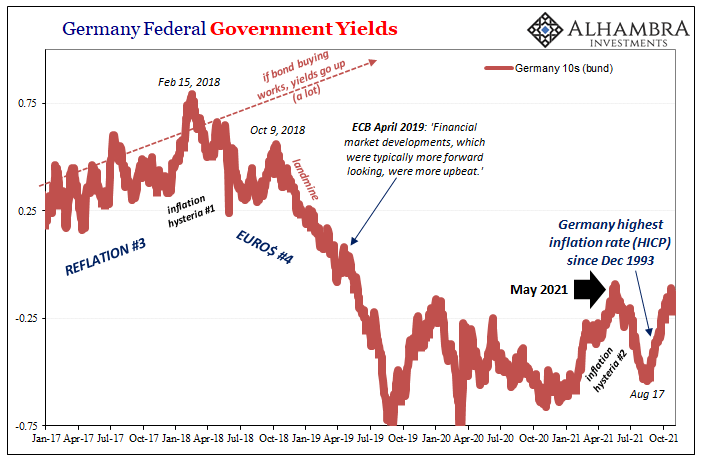

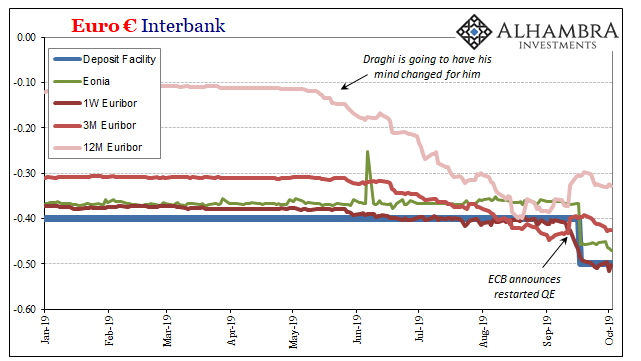

Europe’s QE, as noted this weekend, is off to a very rough start. In the bond market and in inflation expectations, the much-ballyhooed relaunch of “accommodation” is conspicuously absent. There was a minor back up in yields between when the ECB signaled its intentions back in August and the few weeks immediately following the actual announcement.

Read More »

Read More »

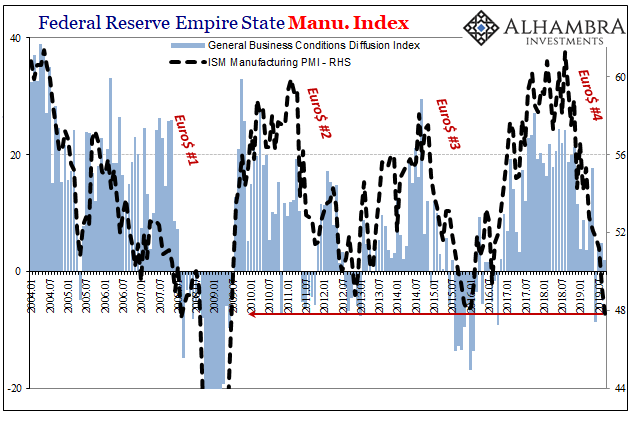

ISM Spoils The Bond Rout!!! Again

For the second time this week, the ISM managed to burst the bond bear bubble about there being a bond bubble. Who in their right mind would buy especially UST’s at such low yields when the fiscal situation is already a nightmare and becoming more so? Some will even reference falling bid-to-cover ratios which supposedly suggests an increasing dearth of buyers.

Read More »

Read More »

ISM Spoils The Bond Rout!!!

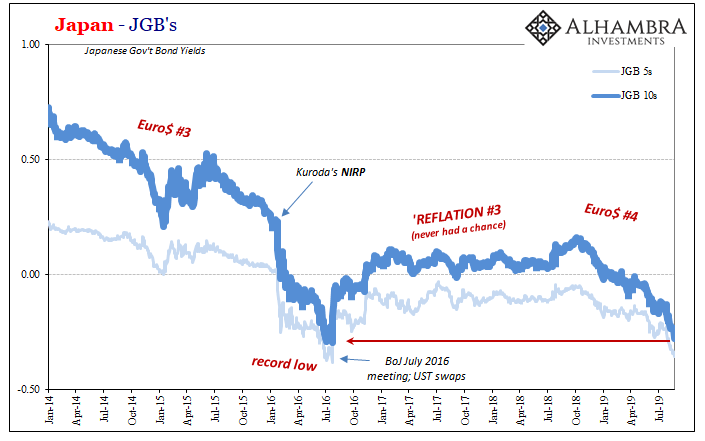

With China closed for its National Day Golden Week holiday, the stage was set for Japan to steal the market spotlight. If only briefly. The Bank of Japan announced last night that it had had enough of the JGB curve. The 2s10s very nearly inverted last month and BoJ officials released preliminary plans to steepen it back out.

Read More »

Read More »

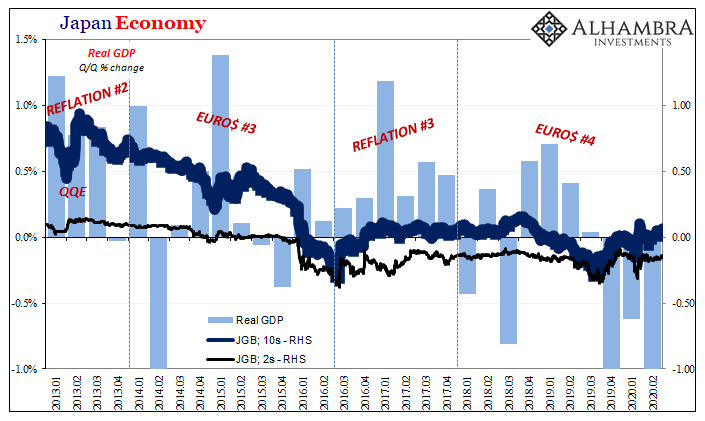

Japan: Fall Like Germany, Or Give Hope To The Rest of the World?

After trading overnight in Asia, Japan’s government bond market is within a hair’s breadth of setting new record lows. The 10-year JGB is within a basis point and a fraction of one while the 5-year JGB has only 2 bps to reach. It otherwise seems at odds with the mainstream narrative at least where Japan’s economy is concerned.

Read More »

Read More »

Germany’s Superstimulus; Or, The Familiar (Dollar) Disorder of Bumbling Failure

The Economics textbook says that when faced with a downturn, the central bank turns to easing and the central government starts borrowing and spending. This combined “stimulus” approach will fill in the troughs without shaving off the peaks; at least according to neo-Keynesian doctrine. The point is to raise what these Economists call aggregate demand.

Read More »

Read More »

Why You Should Care Germany More and More Looks Like 2009

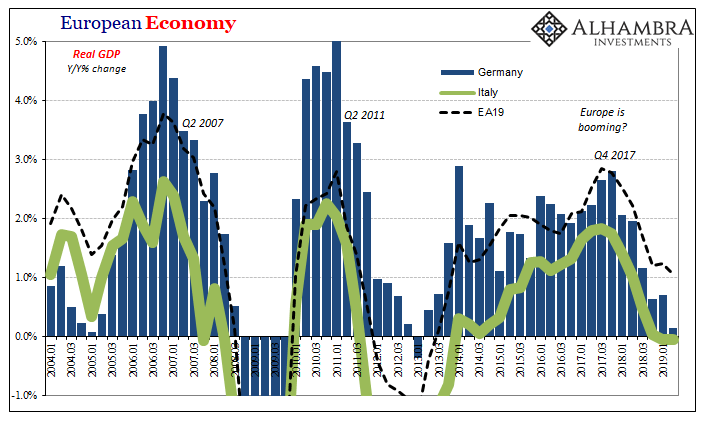

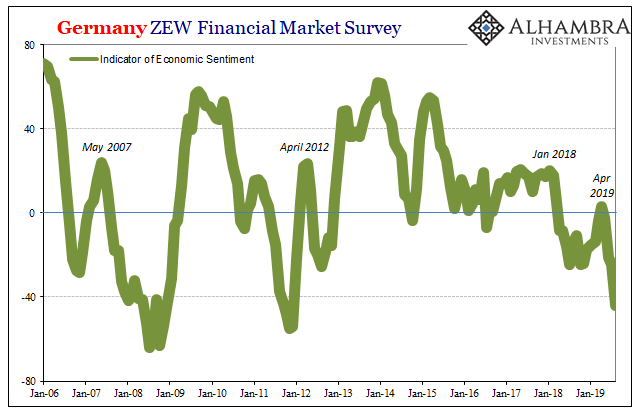

What if Germany’s economy falls into recession? Unlike, say, Argentina, you can’t so easily dismiss German struggles as an exclusive product of German factors. One of the most orderly and efficient systems in Europe and all the world, when Germany begins to struggle it raises immediate questions about everywhere else.

Read More »

Read More »

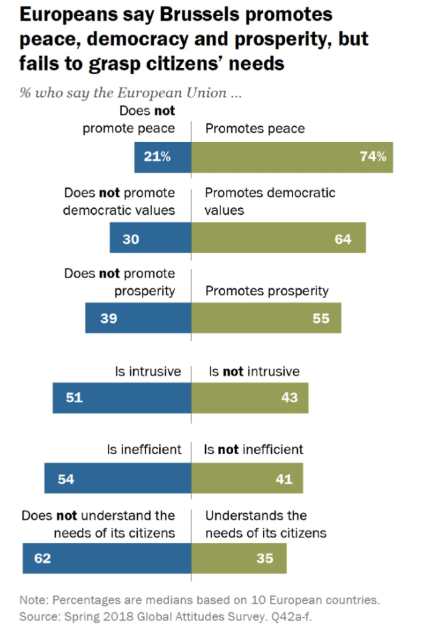

Europe Comes Apart, And That’s Before #4

In May 2018, the European Parliament found that it was incredibly popular. Commissioning what it calls the Eurobarameter survey, the EU’s governing body said that two-thirds of Europeans inside the bloc believed that membership had benefited their own countries. It was the highest showing since 1983. Voters in May 2019 don’t appear to have agreed with last year’s survey.

Read More »

Read More »

Not Buying The New Stimulus

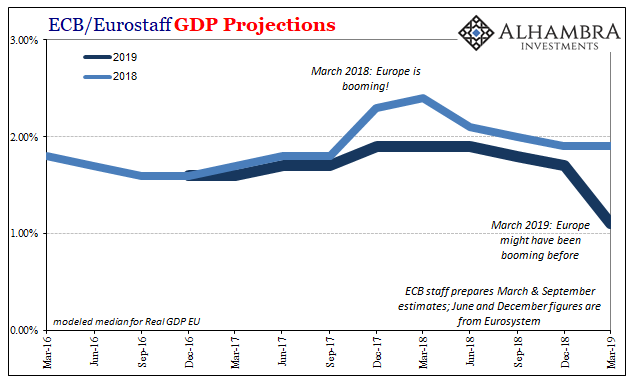

What just happened in Europe? The short answer is T-LTRO. The ECB is getting back to being “accommodative” again. This isn’t what was supposed to be happening at this point in time. Quite the contrary, Europe’s central bank had been expecting to end all its programs and begin normalizing interest rates.

Read More »

Read More »

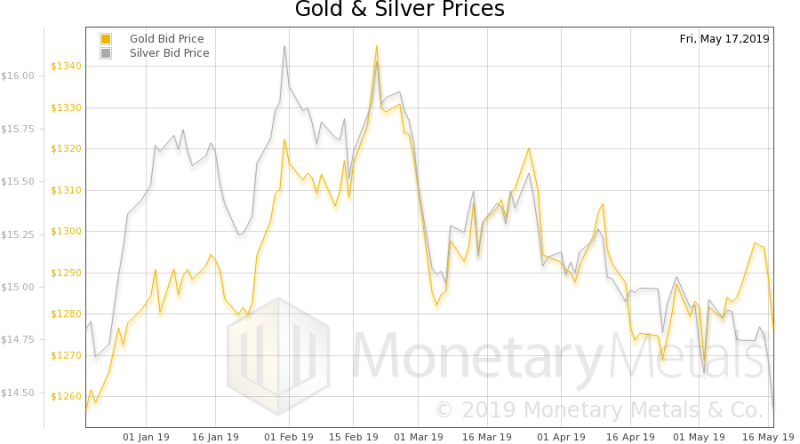

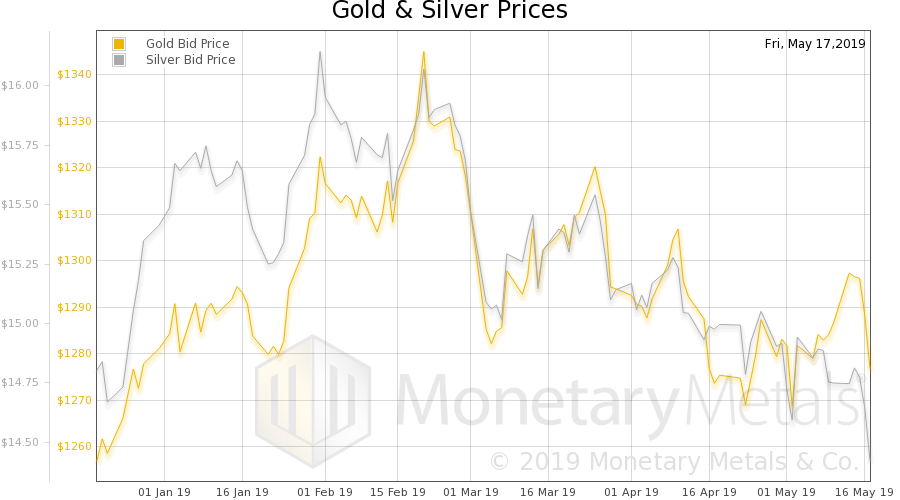

Inflation Protection Strategies You Need to Implement Now

2022-04-13

by Stephen Flood

2022-04-13

Read More »