Tag Archive: Bank of Japan

FX Weekly Preview: Yellen at Jackson Hole

Lastly, a brief word about next week. I will not post my usual piece on macro considerations on Sunday. Here, though, is a brief thumbnail sketch of the top five things I will be watching: Yellen at Jackson Hole at the end of next week: To the extent that she shares her assessment of the economy, I would expect to largely echo the broad sentiment expressed by NY Fed President Dudley.

Read More »

Read More »

The Need for Higher Wages: Lots of Thunder, No Rain

Major central banks and many economists are calling for higher wages. However, they are reluctant to offer proposals to strengthen those institutions who's goal is to boost labor's share of national income. The advocates are more interested in boosting prices than in lifting aggregate demand or addressing the disparity of income and wealth.

Read More »

Read More »

Stupid is What Stupid Does – Secular Stagnation Redux

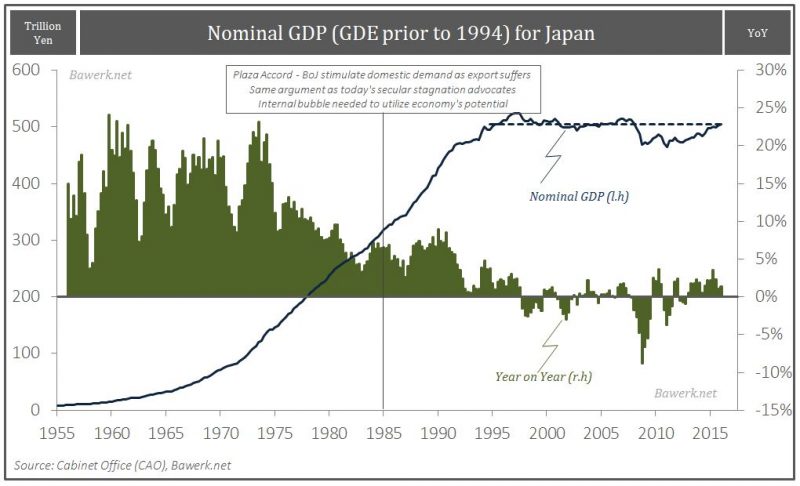

Which country, the United States or Japan, have had the fastest GDP growth rate since the financial crisis? Due to Japan’s bad reputation as a stagnant, debt ridden, central bank dependent, demographic basket case the question appears superfluous. The answer seemed so obvious to us that we haven’t really bothered looking into it until one day we started thinking about the demographic situation in the two countries.

Read More »

Read More »

FX Daily, August 15: Dollar Eases to Start the New Week

The US dollar closed the pre-weekend session well off its lows that were seen in response to the disappointing retail sales report. It has been unable to sustain the upside momentum, and as North American dealers prepare to return to their posts, it is trading lower against most of the major currencies. The notable exceptions are the Scandi-bloc, which are consolidating last week's gains, and sterling, which remains pinned near $1.29.

Read More »

Read More »

FX Weekly Preview: Thoughts on the Significance of Ten Developments

The GDP deflator may be just as important as overall growth for BOJ considerations and the possibility of fresh action next month. Falling UK rates and a weaker pound are desirable from a policy point of view.

Dudley's press conference may be more important than FOMC minutes.

Two German state elections that will be held next month comes as Merkel's popularity has waned.

Read More »

Read More »

Great Graphic: Bullish Emerging Market Equity Index

Liquidity rather than intrinsic value seems to be driving EM assets. MSCI EM equity index looks constructive technically. The chart pattern suggests scope for around 13% gains from here.

Read More »

Read More »

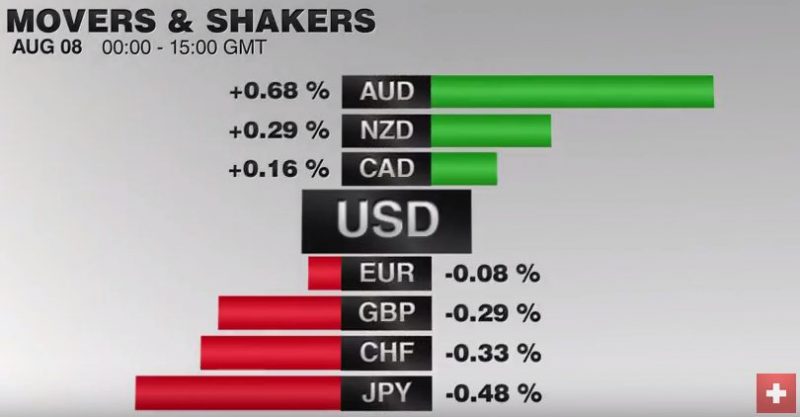

FX Daily, August 08: Stocks Up, Bonds Down, Dollar and Yen are Heavy

Investors favor risk assets today. Global stocks are moving higher in the wake of the pre-weekend US rally that saw the S&P 500 close at record levels. Bond yields are mostly firmer, again with US move in response to the robust employment report setting the tone in Asia.

Read More »

Read More »

FX Weekly Preview: Light Economic Calendar Week Allows New Thinking on Macro

Policy outlook is clear: ECB and BOJ review next month, FOMC still looking for opportunity. Inventory cycle making quarterly US GDP forecasting difficult, but it looks like re-acceleration still the more likely scenario than recessions.

Why didn't European bank stress tests results have more impact?

Read More »

Read More »

Negative Consumer Financing Rates in Germany, Soon More Negative in Switzerland?

Things are increasingly upside down in the brave new centrally planned world: thanks to negative deposit rates central banks have put an explicit cost on saving, while in various instances, such as taking out a mortgage in Denmark and the Netherlands, the bank actually pays the borrower, thus rewarding living beyond one's means.

Read More »

Read More »

666: The Number Of Rate Cuts Since Lehman

BofA's Michael Hartnett points out something amusing, not to mention diabolical: following the rate cuts by the BoE & RBA this week, "global central banks have now cut rates 666 times since Lehman."

Read More »

Read More »

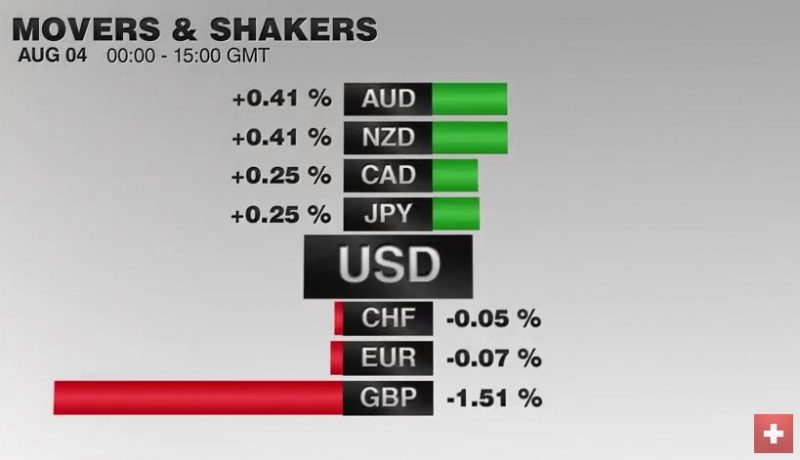

FX Daily, August 04: The BOE Owns Today, but Tomorrow is a Different Story

The Swiss Franc appreciated today against the euro. Given that the Bank of England started monetary easing, this slight appreciation is unexpectedly weak - reason was probably intervention. The SNB intervention level should be around 1 billion francs. Numbers revealed in next week's sight deposits.

Read More »

Read More »

FX Daily, August 03: Consolidation Featured

The US dollar is consolidating yesterday's losses. The greenback's upticks have thus far been shallow and unimpressive, except perhaps against the New Zealand dollar, which is off 0.8% ahead of next week's RBNZ meeting. Softer than expected labor cost increase reinforces the conviction that a 25 bp rate cut will be delivered next week.

Read More »

Read More »

Abe’s Fiscal Policy: More of the Same

Japan's fiscal stimulus if smaller than it appear and is unlikely to boost the economy as much as officials may think. The problem in Japan is not that interest rates are too high or that pubic investment is too weak. The risk is that the yen strengthens further, and we suggest the dollar may fall toward JPY94.60.

Read More »

Read More »

No Big Thoughts, but Several Smaller Observations

Notable that as the CRB Index moves lower, MSCI emerging market equities have done well. European banks are retreating after the stress test results. Tokyo elected its first women governor as this seem to be in part a sign of protest against Abe.

Read More »

Read More »

Fasten Your Seat Belts: Tomorrow Promises to be Tumultuous

Japan reports on labor, consumption, inflation and industrial output before the BOJ meeting. ECB reports inflation and Q2 GDP and the results of the stress test on banks. US reports first look at Q2 GDP.

Read More »

Read More »

Richard Koo: If Helicopter Money Succeeds, It Will Lead To 1,500 percent Inflation

After today's uneventful Fed announcement, all eyes turn to the BOJ where many anticipate some form of "helicopter money" is about to be unveiled in Japan by the world's most experimental central bank. However, as Nomura's Richard Koo warns, central banks may get much more than they bargained for, because helicopter money "probably marks the end of the road for believers in the omnipotence of monetary policy who have continued to press for further...

Read More »

Read More »

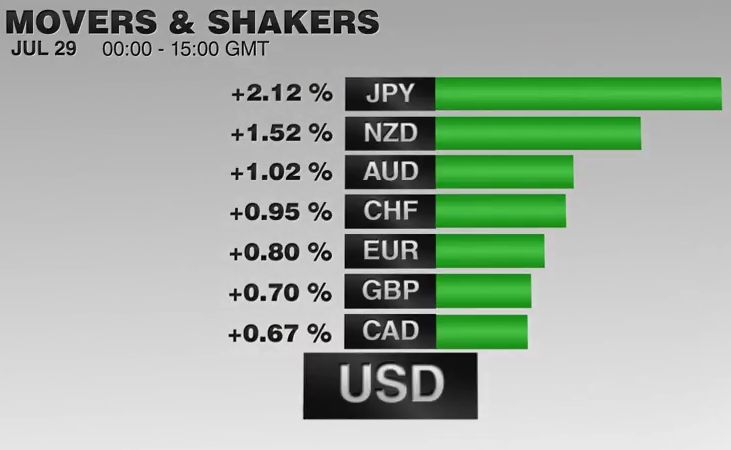

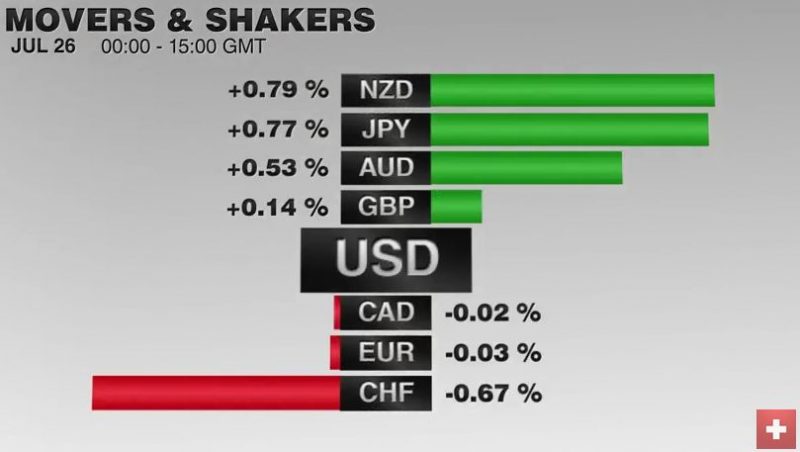

FX Daily, July 26: Strange Day: Yen Soars , Swissie Falls

The Swiss Franc strangely depreciated on a day, when the other safe-haven, the yen strongly improved. The euro went up to 1.0899 by 0.54%. The reason seems to be technical.

Read More »

Read More »

FX Weekly Preview: BOJ and FOMC Meetings Featured in the Last Week of July

A recent Reuters poll found about half of the 100 economists surveyed expect a hike in Q4, which really means December since the November meeting is too close to the national election. The other half is split between a Q3 rate hike (September) and some time in 2017. That said, two primary dealers anticipate no hike until the end of 2017.

Read More »

Read More »

The Central Planning Virus Mutates

Readers are probably aware of recent events in Japan, the global laboratory for interventionist experiments. The theories of assorted fiscal and monetary cranks have been implemented in spades for more than a quarter of a century in the country, to appropriately catastrophic effect.

Read More »

Read More »