Tag Archive: Bank of England

Central Banks Care about the Gold Price – Enough to Manipulate it!

In early March, RT.com, the Russian based media network, asked me for comments and opinion on the subject of central bank manipulation of gold prices. The comments and opinion that I supplied to RT became the article that RT then exclusively published on its website on 18 March under the title “Central banks manipulating & suppressing gold prices – industry expert to RT“. This article is now transcribed below, here on the BullionStar website.

Read More »

Read More »

FX Weekly Preview: The Fed and More

The most significant event in the coming week is the first FOMC meeting under the Chair Powell. At ECB President Draghi’s first meeting he cut interest rates. He cuts rates at his second meeting as well, underwinding the two hikes the ECB approved under Trichet. At BOJ Governor Kuroda’s first meeting, an aggressive monetary policy was announced that was notable not only in its size, but also in the range of assets to be purchased under the...

Read More »

Read More »

The Historical Warnings of Money

It’s interesting, to me anyway, that an image of the Roman goddess Juno remains to this day on the logo of the Bank of England. There are many stories about her role as it relates to money, but what cannot be denied is that the very word itself came to us from her temple. The Latin moneta was derived from the word monere, a verb meaning to warn. Moneta was Juno’s surname.

Read More »

Read More »

Russia, China and BRICS: A New Gold Trading Network

One of the most notable events in Russia’s precious metals market calendar is the annual “Russian Bullion Market” conference. Formerly known as the Russian Bullion Awards, this conference, now in its 10th year, took place this year on Friday 24 November in Moscow. Among the speakers lined up, the most notable inclusion was probably Sergey Shvetsov, First Deputy Chairman of Russia’s central bank, the Bank of Russia.

Read More »

Read More »

FX Weekly Preview: FOMC and ECB Highlight Central Banks’ Last Meetings of the Year

No fewer than thirteen central banks meet in the week ahead. The UK and the US report the latest inflation figures, and the US and eurozone report industrial production. The eurozone sees the flash PMI for December, and the Japan's latest Tankan business survey will be released.

Read More »

Read More »

Central Bank Chiefs and Currencies

Market opinion on the next Fed chief is very fluid. BOE Governor Carney sticks to view, but short-sterling curve flattens. New Bank of Italy Governor sought. A second term for Kuroda may be more likely after this weekend election.

Read More »

Read More »

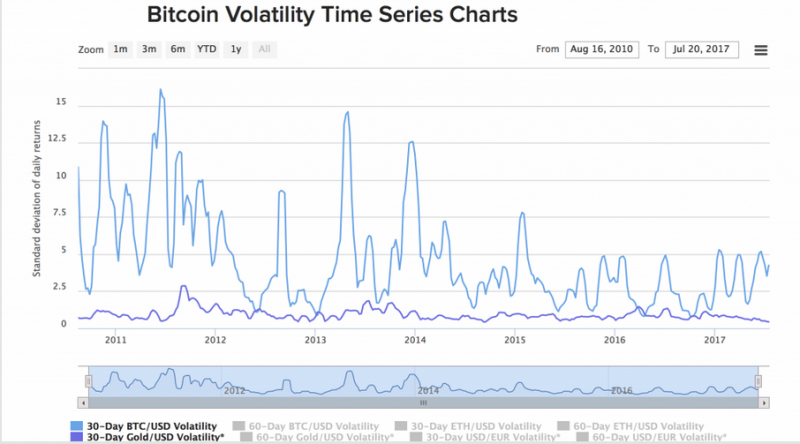

Bitcoin Fork, Hyped ICOs – Immutable Gold and Silver

Latest developments show risks in crypto currencies. Confusion as bitcoin may split tomorrow. SEC stepped into express concern over ICOs. ICOs have so far raised $1.2 billion in 2017. ICOs preying on lack of understanding from investors. Physical gold not vulnerable to technological risk. Beauty and safety in simplicity of gold and silver.

Read More »

Read More »

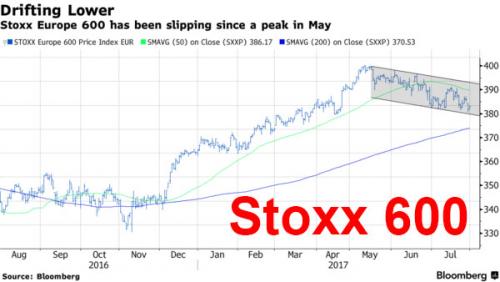

Bank of England Crushes Sterling

Sterling reached a new 11-month high against the dollar earlier today, but the dovish take away from the Bank of England has seen sterling reverse lower. It has now fallen below the previous day's low, and a close below there (~$1.3190) would confirm the bearish key reversal pattern. Support near the week's low just below $1.3100 is holding, and if that goes, the $1.30 level can be tested. A break of $1.2930, the low from the second half of July...

Read More »

Read More »

Cool Video: Dollar Drivers on Bloomberg

There were three talking points. First was the observation that while the President took credit for the record stock market, the strength of the economy, the low unemployment rate, and business confidence, there was no mention of the dollar, which poised to close lower for its seventh consecutive month.

Read More »

Read More »

Why Surging UK Household Debt Will Cause The Next Crisis

Easy credit offered by UK banks is endangering “everyone else in the economy”. UK banks are “dicing with the spiral of complacency” again. Bank of England official believes household debt is good in moderation. Household debt now equals 135% of household income. Now costs half of average income to raise a child. Real incomes not keeping up with real inflation. 41% of those in debt are in full-time work. £1.537 trillion owed by the end of May...

Read More »

Read More »

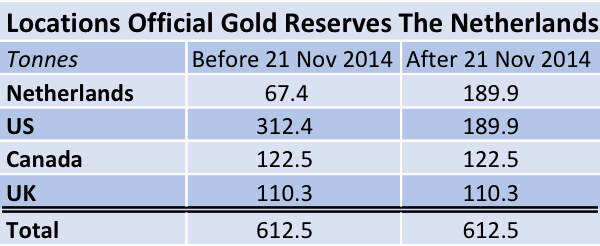

Did The Dutch Central Bank Lie About Its Gold Bar List?

Head of the Financial Markets Division of the Dutch central bank, Aerdt Houben, stated in an interview for newspaper Het Financieele Dagblad published in October 2016 that releasing a bar list of the Dutch official gold reserves “would cost hundreds of thousands of euros”. In this post we’ll expose this is virtually impossible – the costs to publish the bar list should be close to zero – and speculate about the far reaching implications of this...

Read More »

Read More »

Bank Of England Warns “Bigger Systemic Risk” Now Than 2008

Bank of England warn that “bigger systemic risk” now than in 2008. BOE, Prudential Regulation Authority (PRA) concerns re financial system. Banks accused of “balance sheet trickery” -undermining spirit of post-08 rules. EU & UK corporate bond markets may be bigger source of instability than ’08. Credit card debt and car loan surge could cause another financial crisis. PRA warn banks returning to similar practices to those that sparked 08 crisis....

Read More »

Read More »

Sterling, McCafferty, and BOE Policy

BOE hawk is arguing for a sooner unwind of QE. He did not favor the renewed asset purchases after the referendum. Sterling has been meeting resistance near $1.30 for past two months.

Read More »

Read More »