Tag Archive: Bank of England

Carney’s Tenure: Brief Thoughts

Not only is Carney not resigning, but he agreed to stay a year longer than initially agreed. He will stay for the two years that Brexit is negotiated. Sterling rallied, but did not challenge last week's highs.

Read More »

Read More »

FX Daily, November 03: Political Angst Drives Markets

GBP/CHF rates are trading below 1.20 on the exchange, providing those clients holding CHF with some of the best rates they’ve seen in the past six years. The Pounds woes have been well documented but with a key day of economic data releases ahead, is it all about to change?

Read More »

Read More »

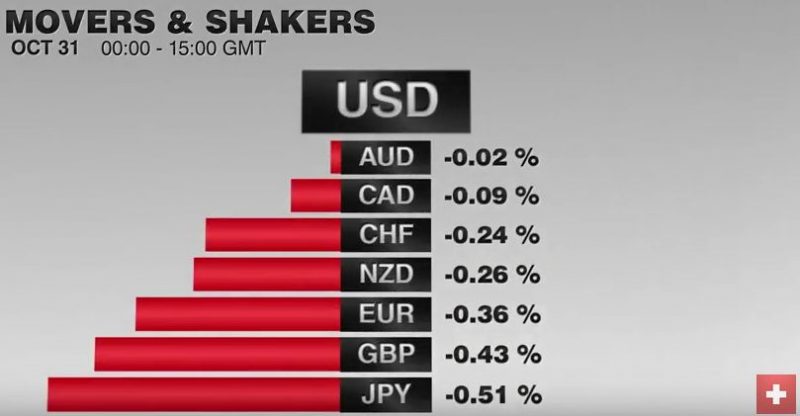

FX Daily, October 31: Respite for Market Nerves Lifts Peso, Rand, and US Dollar

he latest US political news before roiled thin pre-weekend markets, but cooler heads and more of them are prevailing today. Trump's fortune in the polls had bottomed prior to the re-opening of the investigation into Clinton's emails and the national polls have narrowed.

Read More »

Read More »

FX Weekly Preview: Six Thumbnail Sketches of This Week’s Dollar Drivers

Four central banks meet, but expectations for fresh action are low. The US latest election news does not appear to be altering the projected electoral college outcome. UK press are speculating about Carney possibly resigning. We are skeptical.

Read More »

Read More »

Jim Grant Puzzled by the actions of the SNB

James Grant, Wall Street expert and editor of the investment newsletter «Grant’s Interest Rate Observer», warns of a crash in sovereign debt, is puzzled over the actions of the Swiss National Bank and bets on gold.

Read More »

Read More »

Central Bank Austria Claims To Have Audited Gold at BOE. Refuses To Release Audit Report

After years of gradually securing its official gold reserves (unwinding leases) the central bank of Austria claims to have completed the audits of its 224 tonnes of gold stored at the BOE. However, it refuses to publish the audit reports and the gold bar list. What could possibly be so sensitive to hide from public eyes?

Read More »

Read More »

Cashless Society – Is The War On Cash Set To Benefit Gold?

Cash is the new “barbarous relic” according to many central banks, regulators, and some economists and there is a strong, concerted push for the ‘cashless society’. Developments in recent days and weeks have highlighted the risks posed by the war on cash and the cashless society.

Read More »

Read More »

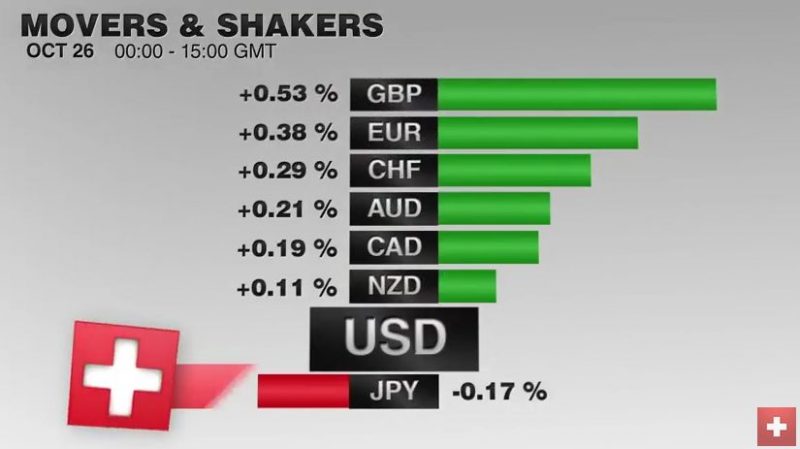

FX Daily, October 26: Euro and Yen Extend Recovery

After touching 1.08, which apparently the "new floor", the SNB moved the EUR/CHF upwards yesterday and Monday. Today's EUR recovery against USD, let also the EUR/CHF rise. The US dollar's upside momentum reversed in North America yesterday and has been sold in Asia and Europe. This seems like mostly position adjustments ahead of next week's FOMC, BOE and RBA meetings, in an otherwise subdued news period. The euro has at three-day highs. It has...

Read More »

Read More »

Seven Things I Learned while Looking for Other Things

Mainland demand for HK shares has dried up this month. EMU growth may accelerate in Q4, while the collective deficit continues to fall. German fertility rate increased last year.

Read More »

Read More »

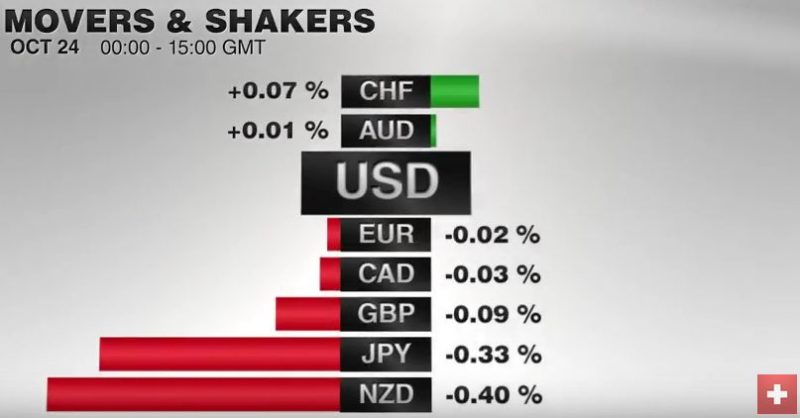

FX Daily, October 24: Dollar Begins Mostly Slightly Lower, and Risk is On to Start the Week

Sterling vs the Swiss Franc has remained close to its lowest level in history caused by the aftermath of the Brexit vote back in June and more recently the announcement that Article 50 will be triggered by March 2017. Confidence in Sterling exchange rates has plummeted recently and until we get some form of assurances as to how the talks may go with the European Union we could see Sterling fall even further against the Swiss Franc than its current...

Read More »

Read More »

Financial Repression Is Now “In Play”

A FALLING MARKET CANNOT BE ALLOWED – at any cost! The Central Bankers have clearly painted themselves into a corner as a result of their self-inflicted, extended period of “cheap money”. Their policies have fostered malinvestment, excessive leverage and a speculative casino approach to investments. Investors forced to take on excess risk for yield and scalp speculative investment returns, must operate in an unstable financial environment ripe for...

Read More »

Read More »

Switzerland’s central bank offers a glimpse behind the curtain

The Swiss National Bank is offering a rare look into how it sets monetary policy. A video of SNB President Thomas Jordan and fellow members of the governing board shows them beginning their quarterly policy assessment discussing the state of the economy with about 30 people.

Read More »

Read More »

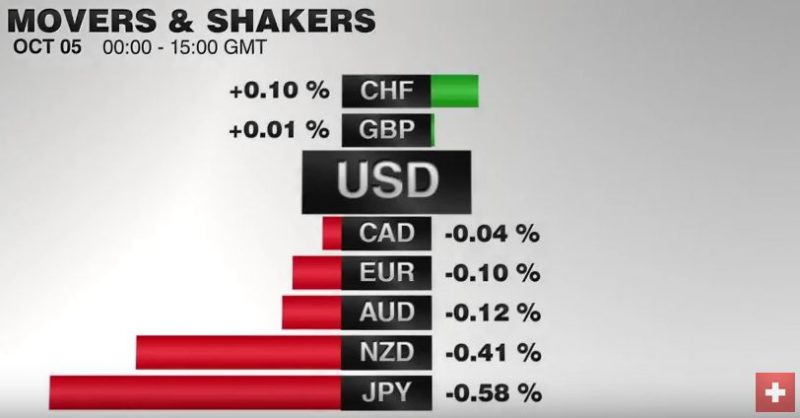

FX Daily, October 05: Euro Remains Firm Despite Dubious Tapering Story

After the sudden rise to 1.0973 the EUR/CHF is falling again. The volatiliy is related to the CHF speculative postion, that suddenly was Short CHF. Traders that moved with the SNB Window Dressing for Q3 are closing their shorts again.

Read More »

Read More »

Negative and the War On Cash, Part 2: “Closing The Escape Routes”

History teaches us that central authorities dislike escape routes, at least for the majority, and are therefore prone to closing them, so that control of a limited money supply can remain in the hands of the very few. In the 1930s, gold was the escape route, so gold was confiscated. As Alan Greenspan wrote in 1966:

Read More »

Read More »

Negative Rates and The War On Cash, Part 1: “There Is Nowhere To Go But Down”

As momentum builds in the developing deflationary spiral, we are seeing increasingly desperate measures to keep the global credit ponzi scheme from its inevitable conclusion. Credit bubbles are dynamic — they must grow continually or implode — hence they require ever more money to be lent into existence.

Read More »

Read More »

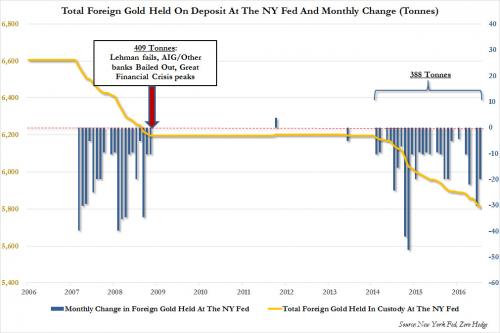

Gold Withdrawals From The NY Fed Accelerate, Hit 388 Tons Since 2014

First it was Germany who redeemed 120 tons of physical gold from the NY Fed in 2014; then it was the Netherlands who "secretly" redomiciled 122 tons of gold; then last May, we learned that Austria would be the third "core" European nation to repatriate most of its offshore gold, held primarily in the Bank of England, redepositing it in Vienna and Switzerland.

Read More »

Read More »

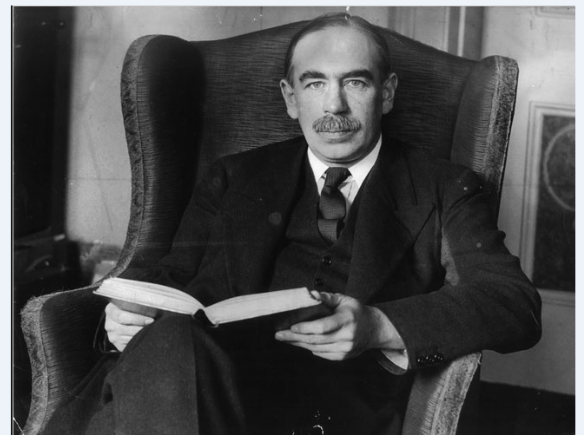

Does the UK Need Even More Stimulus?

“We are all Keynesians now, so let’s get fiscal.” This is one view according to Ambrose Evans-Pritchard from The Telegraph who believes the time is right for the UK government to loosen its fiscal stance. He suggests that the “Bank of England has done everything possible under the constraints of monetary orthodoxy to cushion the Brexit shock. It is now up to the British government to save the economy, and the sooner the better,” — argues the...

Read More »

Read More »

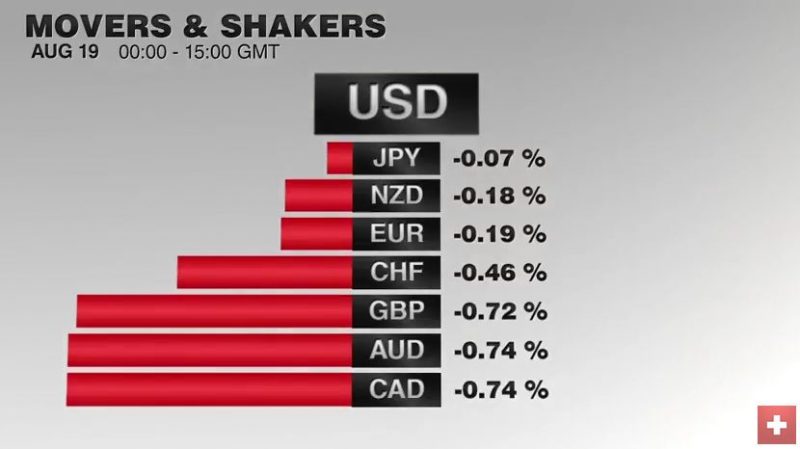

FX Daily, August 19: Dollar Recovers into the Weekend

The US dollar is trading firmly ahead of the weekend as part of this week's losses are recouped. The euro is trading within yesterday's range, holding to a little more than a half-cent above $1.13. However, as we have noted, the Asia and European participants appear more dollar-friendly than Americans

Read More »

Read More »