Tag Archive: Bank of Canada

Will the Dollar Bloom like May Flowers after April Showers?

April was a cruel month for the US dollar. It fell against all the major currencies; even those whose central banks have negative yields. The greenback also fell against nearly all the emerging market currencies, but the Philippine peso and the Polish zloty. Through the first four months of the year, the dollar is lower …

Read More »

Read More »

Do You Believe Six Impossible Things before Breakfast?

The White Queen in Alice in Wonderland (Through the Looking Glass) confesses that when she was younger, she could believe six impossible things before breakfast. She encourages Alice to do the same. It appears many in the market are taking ...

Read More »

Read More »

What is the BOJ Going to Do?

Under Kuroda's leadership the BOJ has surprised the market a number of times, most recently with the move to negative rates at the end of January.

It is not that such a move, which has been tried by several European central banks, was without...

Read More »

Read More »

Dollar’s Technical Tone Improves

It is not that the US dollar had a particularly good week. It was mixed. The best performers were sterling and the Canadian dollar. The pound led with a 1.6% gain, followed closely by the Canadian dollar.

The latest polls suggest that tho...

Read More »

Read More »

FX Daily April 20: Markets Build on Yesterday’s Dramatic Recovery

Global capital markets staged an impressive recovery after the initial reaction to the failure to freeze oil output sent reverberations through the oil markets, commodities, and Asian equities. The sharp reversal begun in Europe and extended in N...

Read More »

Read More »

FX Daily, April 13: US Dollar Comes Back Bid

The US dollar is well bid in the Europe and is poised to start the North American session with the wind to its back. Despite firmer equity and industrial metal prices, most emerging market currencies are also succumbing to the rebounding greenback. The euro has yet to convincingly breakout of the range that has confined … Continue reading »

Read More »

Read More »

FX Daily, April12: Higher Inflation Lifts Sterling, Yen Stabilizes

There are three highlights to the foreign exchange market today. First, the yen is marginally softer. The yen's strength this month has been the main development. After making a marginal new high yesterday, some semblance of stability emerge...

Read More »

Read More »

Sterling Shines Temporarily in Choppy Start for Foreign Exchange

In an unusual development, sterling is outperforming today. It rose to a four-day high near $1.4230 on what appears to be mostly modest position adjustment in relatively subdued turnover. The $1.40 area held on repeated tests in the second ha...

Read More »

Read More »

FX Daily, April 10: Same Drivers, Different Direction

Over the past three months and the past month, the dollar has fallen against all the major currencies but the British pound. Sterling's underperformance can largely be explained by uncertainty created by the Tory government's sponsored referendum on continued EU membership. Most of the polls show those wanting to remain hold on to a slight …

Read More »

Read More »

FX Daily: Yen Pares Gains, Dollar-Bloc Firms

The surging yen has been the main feature in the foreign exchange market in recent days, but its advancing streak has been stopped with today's setback. The greenback traded briefly dipped below JPY107.70 in North America yesterday but has not ...

Read More »

Read More »

Great Graphic: Vulnerability of the Canadian Dollar

The Canadian dollar appears vulnerable. It remains firm while the US two-year premium over Canada has risen sharply. Like others, we do not expect the Bank of Canada to cut rates today and are looking past it. This Great Graphic was composed on Bloomberg. It shows the 2-year spread (white line) and the US dollar …

Read More »

Read More »

FX Daily, 03/09: Euro Pushes Lower Ahead of ECB

The euro has peeled off a cent from yesterday's high near $1.1060 as some short-term players move to the sidelines ahead of the ECB meeting. Recall that after peaking near $1.1375 on February 11 when the New Year's market angst peaked, the euro fell back to the lower end of its old range near $1.0825 … Continue reading »

Read More »

Read More »

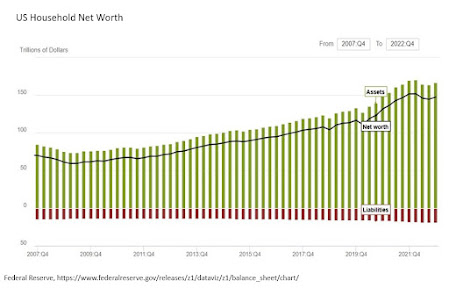

A Few Things on Our Mind

A few weeks ago investors were bemoaning a new bear market for equities, and there was much ink spilled drawing parallels between now and 2008-2009. Falling commodities, weakening growth, and prospects of Fed tightening saw the MSCI Emerging Market equity index fall 21.5% from early-November through the third week in January. Since then it has …

Read More »

Read More »

FX Daily, 03/07: Dollar and Yen Post Gains to Start the Week

The US dollar is retracing part of its pre-weekend losses against the European currencies and dollar-bloc today while falling equity prices are underpinning the yen. Brent is nearing $40 a barrel, and WTI is pushing through $36. Iron ore prices were limit up in China. US 10-year Treasury yield is three bp higher to poke … Continue...

Read More »

Read More »

Investment Climate Improves

Sometimes the news stream drives prices, and sometimes the price action drives the narratives. We argued that the sharp decline in equities at the start of the year was fanned the doom and gloom in the media and market commentary. Many had been taking about a new financial crisis and parallels were drawn between the … Continue...

Read More »

Read More »

FX Outlook: New Phase has Begun

The first two and a half weeks of the new year saw persistent selling of equities, commodities, and emerging markets. In the foreign exchange market, the dollar-bloc and sterling were crushed. The yen was the single biggest beneficiary, and spe...

Read More »

Read More »

Fragile Calm Ahead of ECB Meeting

The Asian equity markets failed to retain the early gains that had at least partially been fueled by the US equities recouping half of their losses. The MSCI Asia-Pacific Index lost about 1.7% and finished at new 3.5 year lows. European markets are posting minor gains, with the Dow Jones Stoxx 600 up about 0.25% … Continue reading »

Read More »

Read More »

Cool Video: Canadian Dollar Discussion on BNN

I had the privilege today to appear on Canada's Business News Network. It is a great source for information on the Canadian economy and markets. I was interviewed by Michael Hainsworth.

We discuss the Bank of Canada's decision not to cut rates...

Read More »

Read More »

Great Graphic: Canadian Dollar Resilience in Face of 7% Drop in Oil

This Great Graphic, composed on Bloomberg, shows two-time series. The white line is the premium the US government pays to borrow over the Canadian government for two years. The yellow line the US dollar against the Canadian dollar.

Even th...

Read More »

Read More »