Tag Archive: Bank of Canada

Commodity Weakness takes a Toll, Rand Fall Continues, US Retail Sales Awaited

The US dollar is confined to narrow ranges against the euro and sterling after pushing higher yesterday. The greenback is staging stronger upticks against the yen but is struggling to resurface above previous support in the JPY122.25 area. Weak commodity prices and the loss of upside momentum has seen profit-taking in the Australian and New …

Read More »

Read More »

After Gorging On News, Time To Digest

Last week lived up to the hype. It was indeed a momentous week. China joined the SDR, with a weight that puts it in third place behind the dollar and euro. The ECB did ease policy. It delivered a 10 bp cut in the deposit rate (now -30 bp), extended its asset purchase program for six … Continue reading »

Read More »

Read More »

The Wait is Nearly Over, and the Dollar Catches a Bid

The anticipation is nearly over. The softer than expected preliminary EMU inflation figures encourages expectations for the more aggressive range of actions by the ECB tomorrow. Draghi has claimed that movement toward the inflation target was to...

Read More »

Read More »

Great Graphic: Canadian Growth and Rate Expectations

Canada reported its monthly GDP estimate for September, and at the same time, provided its first estimate of Q3 GDP. The Great Graphic, created on Bloomberg, shows both time series.

The monthly GDP is depicted by the yellow line and the quart...

Read More »

Read More »

Dollar Trades Heavier, Key Events Awaited

The US dollar is trading with a heavier bias today amid some last minute position squaring ahead of the key events of the week, which are stacked in the second half. The ECB meeting and US jobs data are the two most important events in a jam pa...

Read More »

Read More »

Seven Events Next Week that will Shape the Investment Climate

The week ahead is among the most important of the year. Rarely is there such a confluence of events in a short period that will have far-reaching implications for investors that are known ahead of time and have been discussed so extensively. ?...

Read More »

Read More »

How Dangerous are Technical Conditions for Dollar Bulls?

Anticipating a yawning divergence of monetary policy between the world's largest central banks, market participants continued to drive the dollar higher over the past week. In fact, the greenback appreciated against all the major and emerging market currencies except the Malaysian ringgit and South Korean won. Next week is one of the most eventful …

Read More »

Read More »

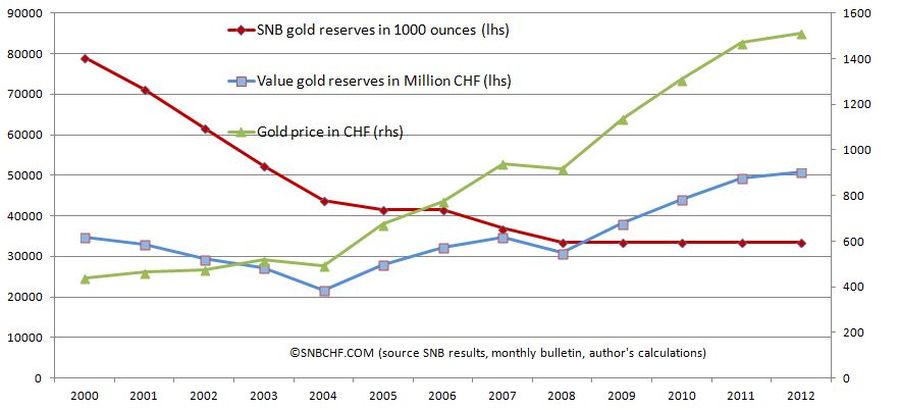

Swiss Franc History, 2000-2007: The sale of the Swiss gold reserves

A critical Swiss Franc History: Between 2000 and 2007, the SNB made the Swiss cantons happy and delivered some billions of francs to prop up their finances. The gains were unfortunately not caused by strong asset management capabilities, but mostly due to gold price improvements and gold sales at quite cheap prices.

Read More »

Read More »

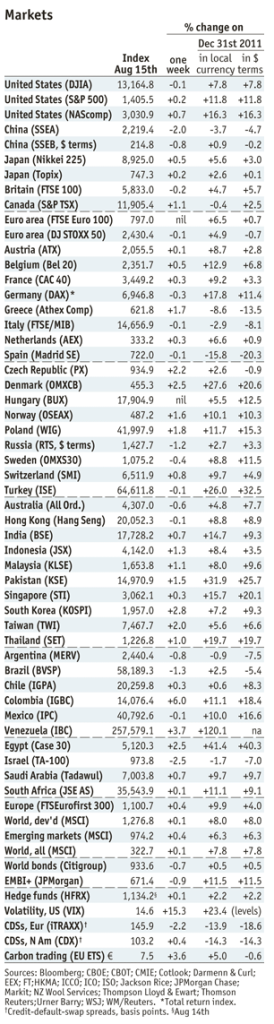

Net Speculative Positions, Global Stock Markets, Week October 29

Submitted by Mark Chandler, from marctomarkets.com The US Dollar Index reached its best level in more than six weeks on Friday. Yet it managed to only close a couple of ticks higher, as if warning short-term participants against ideas that a breakout is at hand. This also appears to be the message of the …

Read More »

Read More »

Net Speculative Positions, Global Stock Markets, Week October 22

Submitted by Mark Chandler, from marctomarkets.com Our big picture view is that the US dollar is carving out an important bottom, after selling off in Q3 as policy makers moved to reduce the extreme tail risks. The position adjustment that inspired among investors appears to have largely run its course.This bottoming of the dollar is …

Read More »

Read More »

Net Speculative Positions , Global Markets and Outlook, week from August 20

Currency Positioning and Outlook, week from August 20 Submitted by Mark Chandler, from marctomarkets.com The market is like expectant parents who don’t know the gender of the fetus. They know something big is around the corner, but they don’t have enough information to make some important decisions. They can contemplate the future, but there …

Read More »

Read More »

Net Speculative Positions and Outlook, week of August 13

Currency Positioning and Outlook, week of August 13 Submitted by Marc Chandler from MarctoMarkets.com Market positioning in the week ending August 10 suggests that speculators in the futures market generally agree with our assessment that ECB President Draghi’s recent proposal was not a game changer. The recent pattern continued. Essentially what this entails is buying …

Read More »

Read More »

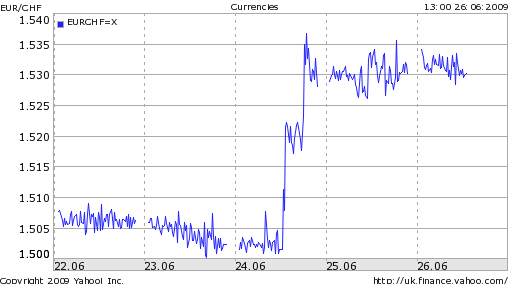

SNB Intervenes on Behalf of Franc (June 2009)

Jun. 26th 2009 Extracts from the history of the Swiss franc (June 2009) Back on March 12, the Swiss National Bank issued a stern promise that it would actively seek to hold down the value of the Swiss Franc (CHF) as a means of forestalling deflation. The currency immediately plummeted 5%, as traders made … Continue...

Read More »

Read More »