Tag Archive: Silvio Berlusconi

Italian Euro Exit: Why it Might Come in some Years and Why it Will Help the Euro Zone and Italy

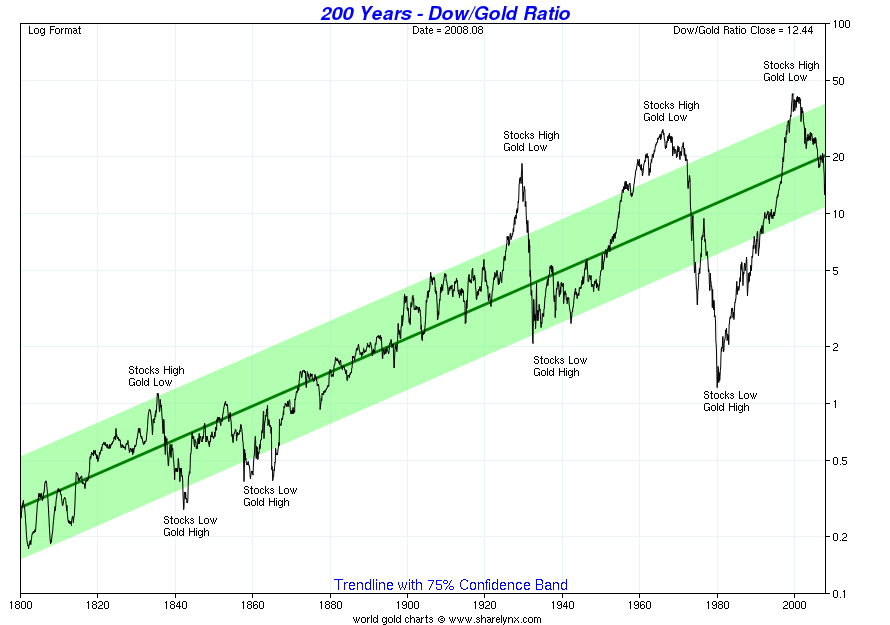

Italy has three options: 1. exit the euro zone and devalue the currency; 2. remain in the euro zone and devalue salaries. 3. go for Japan-like decades-long slow growth with stagnating wages, but also with falling inflation and (positive news!) falling bond yields.

Read More »

Read More »

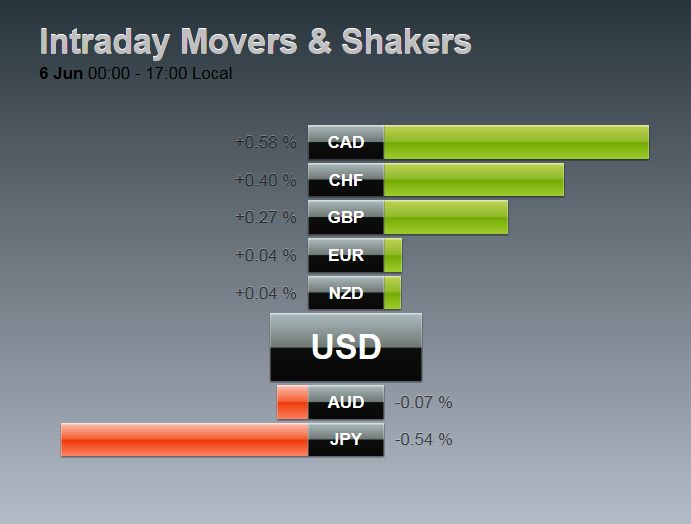

FX Daily, June 6: Shallow Bounce in Dollar, though Sterling Pressured by Brexit Polls

With the dismal jobs reports, speculators had to buy euro to cover their shorts (mostly against USD, but also against CHF). This led to a rising EUR/CHF on Friday. Today fundamental rules were valid again: In times of slow growth, the Swiss franc appreciates. Hence EUR/CHF was down by 49 bips. After the …

Read More »

Read More »

Three Political Events before the UK Referendum

“Every thinking person in America is going to vote for you Governor Stevenson,” said an enthusiastic voter. “I am afraid that won’t do. I need a majority,” reportedly quipped Stevenson (1952 or 1956). The UK referendum on June 23 is the most important political event of the first half of the year. A decision to …

Read More »

Read More »

8a) Italy and the Euro Exit

Italy, other peripheral economies and later France will follow Japan for a decade or more of balance sheet recession: stagnant wages, falling real estate prices and a reduction of private debt.

Read More »

Read More »

Das beeindruckende Comeback Berlusconis.

Wir sind beeindruckt von dem Leitartikel der Weltwoche, der doch ganz unserem Gedankengut entsprochen hat. Der deutsche Kanzlerkandidat Steinbrück hat der deutschen Demokratieverachtung und EU-treuen Überheblichkeit dann noch das i-Tüpfelchen hinzugefügt. “Zwei Clowns haben gewonnen.“ Von Roger Köppel, Die Weltwoche Demokratie ist, wenn es anders herauskommt, als Meinungsführer, Journalisten und tonangebende Politiker gedacht...

Read More »

Read More »

Italy: A Sustained US Recovery Will Make a Eurozone Split Up Possible

We reckon that a sustained US recovery will make it possible that the eurozone splits up. Today's Italian elections are maybe the start of an upcoming Italian euro exit.

Read More »

Read More »

Viva la Democrazia! The Reign of the Spread is Finished!

Claudio Messora, one of most well known critics during the "Reign of the spread" between Italian and German bonds.He happy about the return of democracy.

Read More »

Read More »

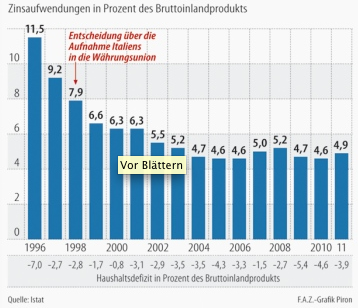

The Full List of Monti Reforms: Which Have Been Really Implemented?

Italian Prime Minister Mario Monti passed 30 billion euros ($40.3 billion) in tax hikes (17 billion), pension and spending cuts (13 billion).

Read More »

Read More »

Net Speculative Positions and Outlook, week of August 13

Currency Positioning and Outlook, week of August 13 Submitted by Marc Chandler from MarctoMarkets.com Market positioning in the week ending August 10 suggests that speculators in the futures market generally agree with our assessment that ECB President Draghi’s recent proposal was not a game changer. The recent pattern continued. Essentially what this entails is buying …

Read More »

Read More »

Guest Post: Six Reasons Why Italy May Exit the Euro Before Spain; Ultimate Occupy Movement

Six Reasons Why Italy May Exit Before Spain

1) Rise of the Five Star Movement

2) 44% of Italians view the euro negatively, only 30% favorably. That is biggest negative spread in the eurozone. In Spain more view the euro positively than negative, albeit by a small 4 percentage point spread.

Read More »

Read More »

Der italienische Euro-Austritt: Warum er in 2-3 Jahren kommen kann und warum er Italien helfen wird

Silvio Berlusconi ist “endlich” zurück und Kandidat seines “Polo della Liberia (PDL) für die Wahlen 2013. Premierminister Monti, der nicht vom Volk, sondern von den Finanzeliten gewählt wurde, soll bis zum Frühjahr 2013 regieren, könnte aber aber auch früher zurücktreten. Aufgrund einer Umfrage im Juni würde die Anti-Euro-Bewegung “5 Stelle” 20,6% in Wahlen erhalten, Berlusconi’s …

Read More »

Read More »

Italy: About the Hypocrisy of Politicians and the Blindness of the English-Speaking Financial Papers

Just a little wrap-up of two tweets read in 5 minutes, to which I finally added a bit more out of my recent Tweets. One Tweet: The British finance minister Osborne has emphasized that the euro zone needs to protect its peripheral economies. “The whole of Europe needs to become more competitive and productive. That …

Read More »

Read More »