Tag Archive: Australia

Downside Risks to the US Employment Report?

Overview: The US dollar enjoys a firmer bias against

the major currencies ahead of the July employment data. Emerging market

currencies are mixed. Asian currencies are generally firm while central Europe is a bit softer. Some detect a relaxation in tensions around Taiwan, though

China’s aerial harassment continues. Taiwanese shares jumped 2.25% to lead the

region that saw China’s CSI 300 rally over 1%. Europe’s Stoxx 600 is giving

back yesterday’s...

Read More »

Read More »

Over to the BOE

Overview: Strong gains in US equities yesterday and

easing fears following Pelosi’s visit to Taiwan helped lift most Asia Pacific

equities, with Hong Kong leading the way with a 2% rally. Taiwan, Australia,

and India did not participate in the regional rally. The Stoxx 600 is edging higher

today. It was flat on the week through yesterday. US futures are a little

firmer. The greenback is offered against the major currencies led the Antipodeans.

The...

Read More »

Read More »

Attention Turns to US GDP, Ahead of Tomorrow’s EMU GDP and CPI

Overview: The Federal Reserve delivered its second consecutive 75 bp rate hike, and Chair Powell left the door open for another large hike at the next meeting in September. Yet, the market took away a dovish message and the dollar suffered, rates slipped, and equities rallied.

Read More »

Read More »

Dismal EMU Flash PMI on Heels of First ECB Rate Hike since 2011

Overview: The euro is over a cent lower from yesterday’s peak, pressured by

the drop in the flash PMI composite below 50 for the first time since early

last year. More generally, the flash PMIs have shown the global economic

momentum is waning, and the bond markets have responded accordingly. The US

10-year yield is flirting with 2.80%, its lowest level in more than two weeks. European

yields are 15-20 bp lower and the spread between Italian and...

Read More »

Read More »

Johnson Resigns, but Still not Clear if He Controls the Timing

Overview: The resignation of a UK prime minister makes for high political drama, but the markets hardly moved on it. Sterling, like most of the major currencies, are recovering against the dollar today.

Read More »

Read More »

Is a 0.3% Miss on Headline CPI Really Worth a 77 bp Rise in the December Fed Funds Yield?

Overview: Better than expected Chinese data and an unscheduled ECB meeting are the highlights ahead of the North American session that features the May US retail sales report and other high frequency data before the outcome of the FOMC meeting.

Read More »

Read More »

Dollar Gains Pared

Asia Pacific equities were mostly lower. China and India bucked the trend. Europe’s Stoxx 600 is steady with no follow through selling after yesterday reversal. US index futures are posting modest gains and are trying to snap a two-day drop.

Read More »

Read More »

Bank of Canada’s Turn

Overview: The recent equity rally is stalling. Asia Pacific equities were mixed, with Japan, South Korea, and Australia, among the major bourses posting gains. Europe’s Dow Jones Stoxx 500 is slipping lower for the second consecutive session, ending a four-day bounce. US equity futures are little changed.

Read More »

Read More »

Synchronizing Chinese Prices (and consequences)

It isn’t just the vast difference between Chinese consumer prices and those in the US or Europe, China’s CPI has been categorically distinct from China’s PPI, too. That distance hints at the real problem which the whole is just now beginning to confront, having been lulled into an inflationary illusion made up from all these things.

Read More »

Read More »

China’s Covid Sends Commodities Lower and helps the Dollar Extend Gains

Overview: Fears that the Chinese lockdowns to fight Covid, which have extended for four weeks in Shanghai, are not working, and may be extended to Beijing has whacked equity markets, arrested the increase in bond yields, and lifted the dollar.

Read More »

Read More »

Short Covering in the US Treasury Market Extends the Yield Pullback

Overview: What appears to be a powerful short-covering rally in the US debt market has helped steady equities and weighed on the dollar. Singapore and South Korea joined New Zealand and Canada in tightening monetary policy. Attention turns to the ECB now on the eve of a long-holiday weekend for many members. The tech-sector led the US equity recovery yesterday, snapping a three-day decline. Most of the major markets in Asia Pacific advanced but...

Read More »

Read More »

New Day, Same as the Old Day

Overview: It is a new day, but with the continued rise in interest rates and weaker equities, it feels like yesterday. Only China and Hong Kong among the major markets in Asia Pacific resisted the pull lower. Europe's Stoxx 600 is off by more than 0.5% led by health care and real estate. It is the fourth loss in five sessions and brings the benchmark to its lowest level since March 18. US futures are flattish.

Read More »

Read More »

Equities Finding a Bid in Europe After Sliding in Asia Pacific

Overview: The capital markets are calmer today. The market is digesting the FOMC minutes, where officials tipped an aggressive path to shrink the balance sheet and confirmed an "expeditious" campaign to lift the Fed funds rate to neutrality. Benchmark 10-year yields are softer, with the US off a couple basis points to 2.58%. European yields are 1-3 bp lower.

Read More »

Read More »

RBA Drops “patience” to Send the Aussie Higher

Overview: The Reserve Bank of Australia hinted that it was getting closer to a rate hike. The Australian dollar was bid to its best level since the middle of last year. Australian stocks advanced in a mixed regional session while China and Hong Kong markets were closed for the local holiday. BOJ Kuroda called the yen's recent moves "rapid." The yen is sidelined today as the dollar weakens against other major currencies, led by the...

Read More »

Read More »

Weekly Market Pulse: Oil Shock

Crude oil prices rose over 25% last week and as I sit down to write this evening the overnight futures are up another 8% to around $125. Almost every other commodity on the planet rose in prices last week too, as did the dollar. Those two factors – rising dollar and rising commodity prices – mean the likelihood of recession in the coming year has risen significantly in just the last week.

Read More »

Read More »

European Currencies Continue to Bear the Brunt

Overview: Russia's invasion of Ukraine and the global response is a game-changer, as Fed Chair Powell told Congress yesterday. The UK-based research group NISER estimated that world output will be cut by 1% next year or $1 trillion, and global inflation will be boosted by three percentage points this year and two next.

Read More »

Read More »

As The Fed Seeks To Justify Raising Rates, Global Growth Rates Have Been Falling Off Uniformly Around The World

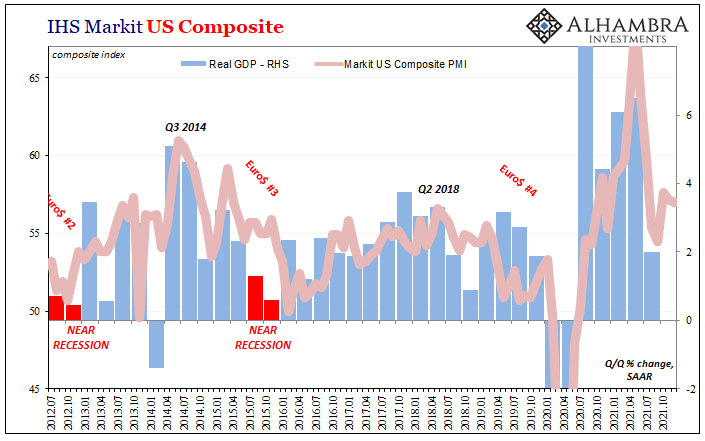

Sentiment indicators like PMI’s are nice and all, but they’re hardly top-tier data. It’s certainly not their fault, these things are made for very times than these (piggy-backing on the ISM Manufacturing’s long history without having the long history). Most of them have come out since 2008, if only because of the heightened professional interest in macroeconomics generated by a global macro economy that can never get itself going.

Read More »

Read More »

Fed Unleashes Animal Spirits

Overview: The Fed's hawkish pivot came a few weeks before yesterday's FOMC meeting, which confirmed more or less what the market had already largely anticipated. Buy the (dollar) on rumors (of tapering and more aggressive stance on rates) and sell the fact unfolded, and unleashed the risk-appetites which rippled through the capital markets. US stocks rallied yesterday, and the futures point to a gap higher opening today. Large Asia Pacific...

Read More »

Read More »

Dollar Starts the Week Bid ahead of the FOMC

Overview: Equities, bonds, and the dollar begin the new week on a firm note. Japanese, Chinese, Australian, and New Zealand equities advanced in the Asia Pacific region. Europe's Stoxx 600 is snapping a three-day decline, and US futures are 0.25%-0.35% higher. The US 10-year yield is a little softer at 1.48%. European benchmark yields are mostly 1-2 bp lower, and near 0.71%, the UK Gilt's yield is at a three-month low. The dollar is rising...

Read More »

Read More »

The Greenback Finds Traction ahead of the Jobs Report

Overview: The Omicron variant has been detected in more countries, but the capital markets are taking it in stride. Risk appetites appear to be stabilizing. The MSCI Asia Pacific Index rose for the third consecutive session, though Hong Kong and Taiwan markets did not participate in the advance today. Europe's Stoxx 600 is struggling to hold on to early gains, while US futures are narrowly mixed. The US 10-year yield is a little near 1.43%,...

Read More »

Read More »