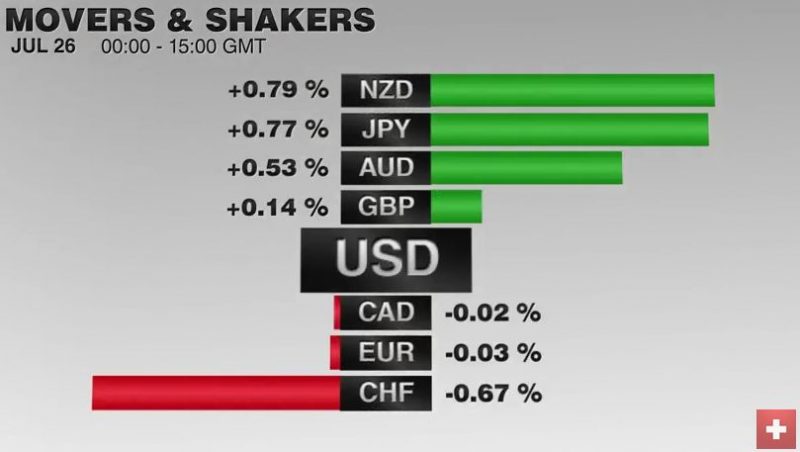

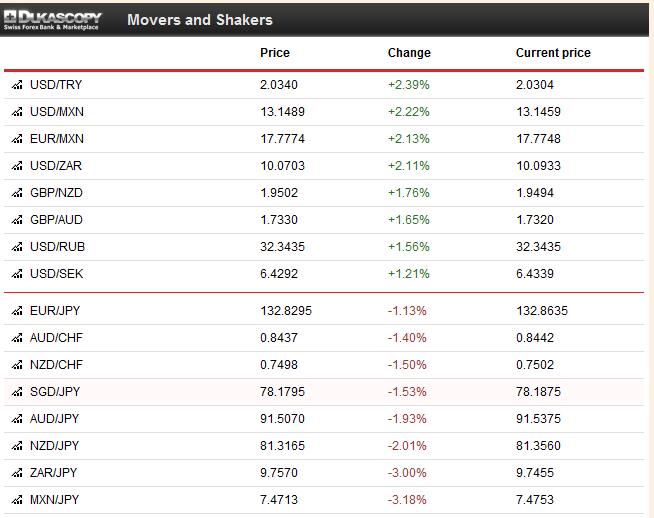

The Swiss Franc strangely depreciated on a day, when the other safe-haven, the yen strongly improved. The euro went up to 1.0899 by 0.54%. The reason seems to be technical.

Read More »

Tag Archive: 200-day moving average

Brexit Paranoia Creeps Into the Markets

European Stocks Look Really Bad… Late last week stock markets around the world weakened and it seemed as though recent “Brexit” polls showing that the “leave” campaign has obtained a slight lead provided the trigger. The idea was supported by a not...

Read More »

Read More »

Adjust Your Sales in today’s Choppy Market!

Dumping stocks is one of the hardest things to do. The best way to do this is to examine each stock’s earnings growth projections for significant damage. A planned 20% or 25% return might now no longer realistic, in particular when the sink even below their 200-day moving average

Read More »

Read More »

Fundamentals and FX Movements, Week September 23 to September 27

Weekly summary of fundamental news on FX with a focus on CHF and gold price movements. Weekly price movements The U.S. budget discussion and rather bad U.S. fundamental data made JPY and CHF the winners of the week. After weeks of improvements, the currencies of the Emerging Markets and carry trade currencies, like NZD, AUD …

Read More »

Read More »