We examine the SNB monetary assessment statement of March 17 and the Swiss economy. We explain why negative rates may be a “toothless measure” if a central bank wants to weaken a currency. They have rather an inexpected consequence, they slow down GDP growth, in particular for banks and pension funds.

The following are the extracts from the monetary policy assessment of Swiss National Bank, 17 March 2016, and my comments.

All SNB statements appear in quotes, my comments without quotes.

Monetary policy remains expansionary

The Swiss National Bank (SNB) is maintaining its expansionary monetary policy.

The target range for the three-month Libor remains at between –1.25% and –0.25%, and interest on sight deposits at the SNB is unchanged at –0.75%.

The Swiss franc is still significantly overvalued.

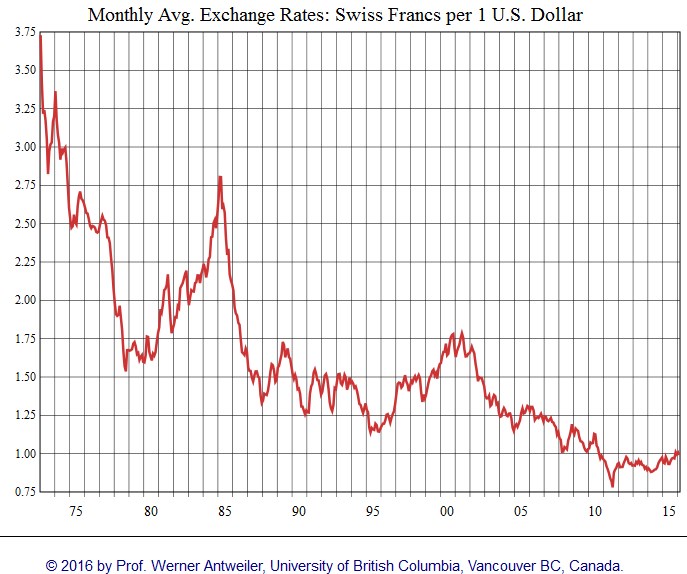

In the SNB view, the Swiss franc is overvalued, for me the franc is not overvalued. With expansionary monetary policy alone, the SNB cannot prevent that CHF strengthens further, like it did since the end of Bretton Woods. Like any other currency, CHF reacts according balance of payments mechanism, hence to a combination of trade balance and in- and outflows of capital.

In the SNB view, the Swiss franc is overvalued, for me the franc is not overvalued. With expansionary monetary policy alone, the SNB cannot prevent that CHF strengthens further, like it did since the end of Bretton Woods. Like any other currency, CHF reacts according balance of payments mechanism, hence to a combination of trade balance and in- and outflows of capital.

Negative interest rates

SNB: “Negative interest is making Swiss franc investments less attractive.”

This statement is simply wrong, the correction must be:

The important word is here cash. Cash investments in CHF are punished with negative rates, other types of investments in CHF are not. Prices of bonds, stocks or real estate even tend to go up, when rates go down. Therefore capital inflows in Swiss bonds, in Swiss stocks and in Swiss real estate may happen and a currency may appreciate despite negative rates. We must investigate the whole balance of payments, i.e outflows in cash compared with inflows in bonds, stocks and real estate.

See also “SNB introduces negative rates, a toothless measure“, a piece that I wrote shortly before the end of the peg.

FX interventions

SNB: “At the same time, the SNB will remain active in the foreign exchange market, in order to influence exchange rate developments where necessary.The global economic outlook has deteriorated slightly in recent months and the situation on international financial markets remains volatile. “

FX interventions are stronger than negative rates. FX interventions are able to counter both trade surplus and inflows in financial assets like stocks, bonds and real estate. But they come with the risk of central bank losses.

The SNB might continue do FX interventions until they must stop them, because central bank solvability is in danger.

Just like in June 2010 when they stopped intervening at EUR/CHF 1.40 (SNB abondons interventions in June 2010)

….. or in January 2015 at EUR/CHF 1.20….

Negative rates reduce GDP growth in the banking sector

SNB: “Against this background, the negative interest rate and the SNB’s willingness to intervene in the foreign exchange market serve to ease pressure on the Swiss franc. The SNB’s monetary policy is thus helping to stabilise price developments and support economic activity.”

This statement is mostly wrong.

Negative rates harm the profits of Swiss banks and pension funds. Therefore negative rates reduce GDP growth in these sectors. It is like taking money from one pocket – banks and pension funds – and putting into the other pocket – SNB and exporters.

True, exporters e.g. in the industrial sector are able reduce their competitiveness gap against Germany’s weak euro, some jobs are maintained, but others e.g. in banks are lost.

Other exporters like chemicals or pharmaceuticals already profit on the weak Swiss franc against the dollar.

Inflation Outlook: Will the SNB hike earlier than the ECB?

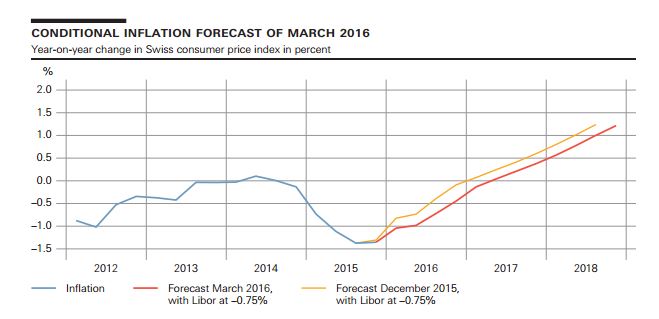

SNB” The new conditional inflation forecast has been revised downwards slightly compared to the previous quarter.

The further drop in oil prices is contributing to a decline in inflation in the short term. In the medium term, the main factors dampening inflation are the globally low inflation levels and the lacklustre outlook for the global economy.

The SNB continues to expect that inflation will re-enter positive territory in the coming year.

It is projecting an inflation rate of –0.8% for 2016, compared with –0.5% in the December forecast. For 2017, the inflation forecast is at 0.1%, which is 0.2 percentage points lower than in the previous quarter, while for 2018 it is 0.9%. The conditional inflation forecast is based on the assumption that the three-month Libor remains at –0.75% over the entire forecast period. Global economic performance at the beginning of the year was slightly weaker than had been anticipated at the quarterly assessment in December.”

In 2013/2014, I regularly presented evidence that the Swiss National Bank will hike rates earlier than the ECB. Unless the SNB allows a stronger franc, the Swiss CPI will overtake European inflation. The reason is that the Swiss real estate bubble will flow into the Swiss CPI and push inflation rates upwards. This has not happened yet, because of regulations on rent.

Manufacturing and trade weak globally

SNB: “Around the world, manufacturing and trade remained sluggish, contributing to a further sharp fall in oil prices. Against expectations, the low energy prices have had only a limited stimulatory effect on household consumer.

spending. By contrast, they have had a negative impact on the growth outlook in oilproducing countries, including the US. These factors will continue to hold back the global economy over the coming months. Accordingly, the SNB’s assessment of the global economic outlook is somewhat less favourable than in December. The recovery in the advanced economies is expected to continue at a moderate pace. Growth in China is likely to slow further. Moreover, the prevailing risks are still considerable. The complex structural changes taking place in China could have negative repercussions for global demand. In Europe, structural weaknesses and political uncertainty could hamper economic development.”

This statement explains why Swiss manufacturing, around 2% of GDP, currently struggles. Manufacturing and industrial output is weak everywhere in the world. Using the scape goat “Swiss Franc” is wrong.

GDP growth forecast

SNB: “Furthermore, renewed upheaval on global financial markets would impair financing conditions for households and companies. In Switzerland, annualised real GDP increased by 1.7% in the fourth quarter. Thus, for 2015 as a whole, the Swiss economy recorded growth of just under 1%. This confirms the SNB’s assessment at the time of the minimum exchange rate discontinuation. However, the economic momentum is not broad-based. Profit margins are still under pressure at many companies, and the willingness to invest and the demand for labour remain commensurately subdued.”

Now the central bank affirms that growth in Switzerland may pick up. The section focuses on the 1.7% growth in Q4. Then the question arises in which country profit margins are under pressure. Is it only Switzerland?

SNB: “Consequently, the unemployment rate has risen again slightly in recent months. Since the SNB assumes a more modest pace of global economic growth, it is also expecting a slower recovery in Switzerland. For this year, it is anticipating GDP growth of between 1% and 1.5%, instead of around 1.5% as hitherto. “

Some Swiss banks see a growth rate of only 1% for 2016 (e.g. Credit Suisse); the major reason for them is the unemployment rate that has risen from 3.2% to 3.4%. The SNB reduced her estimate, but she is more optimistic thant Credit Suisse. UBS see a 1.4% growth.

Swiss real estate prices

SNB: “Over the last few quarters, the downward trend in real estate price momentum has been confirmed. Mortgage volumes have also recorded slightly slower growth. Yet the imbalances on these markets persist, due to comparatively weak growth in fundamentals. The SNB will continue to monitor developments on the mortgage and real estate markets closely, and will regularly reassess the need for an adjustment of the countercyclical capital buffer.”

Real estate prices in centers are not growing any more. The reason is the overvaluation that got partially caused by capital flight from the European Union, from Russia and China.

But asrecent real estate reports shows, prices are rising outside of the centers, in particular the ones in reasonable distance from the centers.