Each week we will publish the best articles by Marc Meyer, one of the most critical voices against the SNB.

This post explains 3 points:

- That the SNB does not understand what assets and liabilities are – and due to this misunderstanding – it speculates with massive leverage.

- The difference between good and bad deflation, and that Switzerland has good deflation.

- That both the SNB and the Swiss government do what some Swiss exporters want. Therefore, the formerly admired central bank independence in Switzerland has become a farce.

The text originally appeared on Inside Paradeplatz in German in 2013. We have updated the article with the illustrations.

———————————————————————————————————————

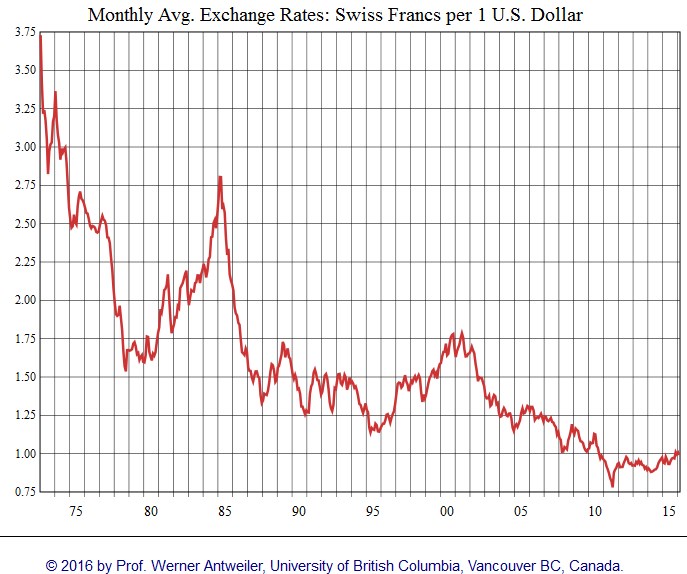

Since the collapse of the fixed exchange rate system of Bretton Woods (1973), the US dollar has lost about 80 percent against the Swiss franc. The euro has lost about 20 percent since its launch.

Since the collapse of the fixed exchange rate system of Bretton Woods (1973), the US dollar has lost about 80 percent against the Swiss franc. The euro has lost about 20 percent since its launch.

All currencies in Europe fell against the Swiss franc in the past decades: the D-Mark, the French franc, the Italian lira, the Spanish peseta, the Greek drachma and so on.

If a single stone drops into the water, a bunch of stones are falling as well. There is not one good reason to assume that the euro should rise in the long term against the Swiss franc (unless the SNB wrecks the Swiss economy).

Of course, there were always wave movements: also, here and there the dollar started off a high-altitude flight. Recall the time of Ronald Reagan, as the Greenback experienced a revival. In the long run, the Swiss franc tended to be more solid, and the export industry was living well with it.

Throughout the past decades, our National Bank has invested in foreign currencies. The accumulated foreign exchange losses of the SNB have approximately reached into the three-digit billions – at the expense of Switzerland. Quite apart from the value creation that has been lost to foreign countries.

SNB speculation with massive leverage

In the past, the SNB invested with a speculative leverage of approximately ten times the foreign exchange. Although the euro has become more solid again in recent days and weeks, it cannot be assumed that the upward trend of the Swiss franc, which has existed for decades, is now broken.

But our Swiss National Bank is asleep – and with it, the Federal Council (this is the Swiss government) bears a large share of responsibility for the excessive foreign exchange held by the SNB.

Swiss Constitution Article 99, paragraph 2 states:

“The Swiss National Bank conducts, as an independent central bank, a monetary- and currency policy that serves the general interest of the country; it is administered with the cooperation and supervision of the Confederation.”

Thus, the Swiss government has the right to participate in the management of the SNB. An active participation in the monetary policy, however, is forbidden by law. Nevertheless, the Federal Council significantly influences the monetary policy of the SNB.

Franc-Rütli: The secret meeting to weaken the franc

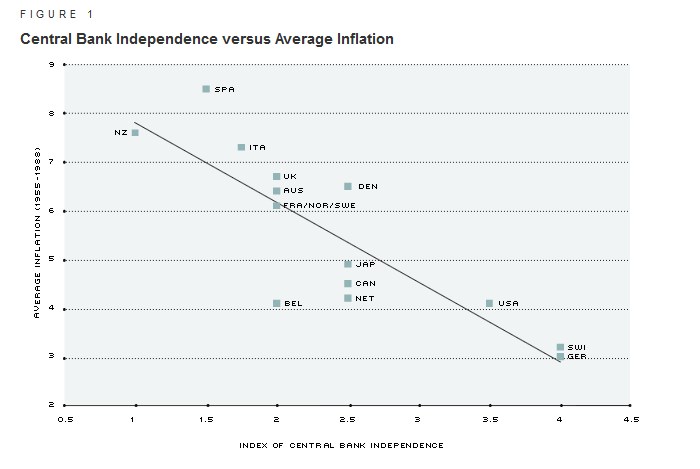

Source St. Louis Fed: When the Swiss still had the most independent central bank…

Let us recall, among others, the politically questionable “Franken-Rütli.” Following this dubious, secret meeting, the Swiss government expressed the “wish” that the SNB to intervene at the foreign exchange market, which was done by the SNB shortly thereafter (NZZ, 14.8.2011; Weltwoche 20.8.2011).

At that moment the formerly admired “independence of the Swiss National Bank” was finished (see left). The best protection for the independence of the SNB is solely a well-functioning democracy – never ever any secret meetings with “wishes.”

Often, the Swiss government takes a public position related to the decisions of the SNB by supporting them without exception. Thus, the Federal Council exerts a strong influence on the monetary policy.

Therefore, it is crucial that the Federal Council argues for the technically correct position and does not repeat the mistakes of the SNB.

Two examples:

In its response to the motion of the SVP “Introduction of a debt limit for the SNB,” the Federal Council replied: “(…) In contrast to commercial banks, the National Bank cannot become illiquid with Swiss francs (…).”

By definition, “liquidity” is an asset – it is wealth. In the short term it can be used to settle outstanding debts on the liabilities side, therefore “liquid.” There are only “liquid assets.” “Liquid debts” do not exist.

The Federal Council is missing the fact that the accounts of a bank are always balanced, it is a balance sheet. When a customer deposits money in a bank, it is an asset from the client´s perspective and debt from the point of view of the bank.

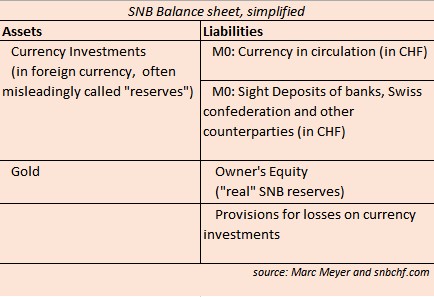

What are assets and liabilities in the SNB balance sheet?

The same is true for the SNB: bank notes, issued by the SNB, represent “liquid assets” from the perspective of the bank note´s holder.

From the perspective of the SNB, however, it is debt, which means: bank notes are debt certificates.

Secondly: the bank notes in circulation can never be called “liquid assets” of the central bank. They are not included in the “liquid assets” on the top at the left, but on the contrary, on the right at the side of the debt.

Most of the money supply (90 percent) consists of the monetary aggregates M1 – M3.

The central bank balance sheet and commercial bank balance sheets look the same

The sight deposits of a customer at a commercial bank belong to the money supply M1. It is “liquidity” or assets from the customer’s perspective, but not from the perspective of the bank. For the bank it is debt. Claiming that the sight deposits of customers would belong to the “liquid assets” of the commercial bank, would be nonsense.

Similarly, it is unreasonable when our Federal Council considers bank notes as “SNB liquidity” and asserts that the SNB could never become “illiquid,” because it could print bank notes itself. This is the misconception of monetary policy of this century.

Commercial banks cannot pay their own debt with the money of their clients. Likewise, the SNB cannot repay its debt with central bank money.

Expressions, such as “fiat money” – “money creation” – “unlimited” – “for eternity” and so on, which the SNB is demanding, belong to the “Genesis” of the Bible, but not to monetary theory and policy of our National Bank. To settle a debt, the debt has to be repaid. It requires “liquid assets” on the left side of the balance, which also applies to the SNB.

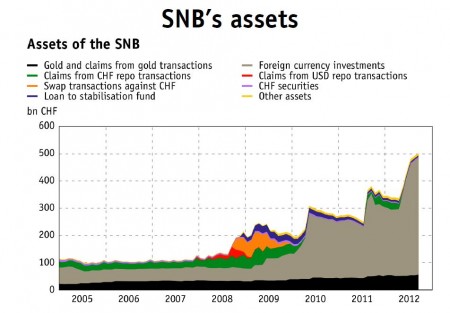

The assets of the SNB

The graph to the left shows that the grey-colored foreign currency investments – mostly euros and dollars – make up nearly 90% of the the SNB assets, gold has about 10%.

The graph to the left shows that the grey-colored foreign currency investments – mostly euros and dollars – make up nearly 90% of the the SNB assets, gold has about 10%.

The liabilities of the SNB consist mainly of loans to commercial banks in Swiss francs, the so-called “sight deposits of commercial banks at the SNB”, as well as emitted franc bank notes.

If the value of these assets falls below the value of its debt, and the SNB no longer has sufficient assets, or respectively “liquidity,” for paying off its own debts, then the SNB is “illiquid.”

In this very case, the SNB wants to simply transfer bank notes to the banks (SNB chief Jordan at the Statistical Society of Economics in Basel), but that would only be rescheduling of bank money into cash: the debt would remain.

If the SNB wanted to repay its debts, it would need “liquid assets.” With these, it could repay its outstanding “sight deposits” with commercial banks or withdraw its emitted bank notes from circulation.

However, the SNB does not have liquid assets in Switzerland anymore, such as Swiss CHF repos. In addition, it can neither print euros nor dollars, and it does not have its own gold mine.

If a private company wants to reduce debt, it could, for example, repurchase its own bonds at the end of maturity. That is to say: withdraw its own bonds from circulation. If it does not own sufficient “liquid assets” to transfer them in return to the creditors, they have to write off their investments accordingly.

Similarly, the SNB does not reduce its debt by printing bank notes – as asserted by the SNB and Federal Council. On the contrary, is has to collect its outstanding CHF bank notes (aka SNB debt certificates) and withdraw these CHF bank notes from circulation and destroy them. Then, the SNB must transfer the equivalent assets to the creditors (for example, gold, euros, dollars, repos).

If the SNB does not have enough liquid assets to transfer to its creditors, they have to write off their debt claim to the SNB accordingly.

For sight deposits of commercial banks held at the SNB, the banks will be the victims (up to their bankruptcy); for the bank notes it will be the consumers (with inflation or hyperinflation).

Central banks can go bankrupt like any commercial bank

The assertion of the SNB and the Federal Council is that the SNB could never become “illiquid” and it can “serve” all of its outstanding claims at any time is deceptive, misleading and extremely dangerous.

Central Banks can go bankrupt like any commercial bank, if assets are lower than the liabilities. In particular the Swiss National Bank can, as it is clearly established as a private company.

Good and bad deflation

The Federal Council asserts that the main reason for the intervention of the SNB would be a “threat of deflation.”

There is “good deflation” and bad, “harmful deflation.” In Switzerland, we currently have “good deflation,” which does not “harm” our economy, it is beneficial. Everyone might have heard of “supply” and “demand.” Perhaps the reader knows as well, that supply and demand can be depicted graphically.

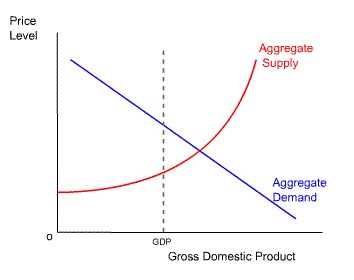

In a coordinate system, where the price is on the vertical and the quantity is on the horizontal, supply and demand curves are shown as follows: the demand curve runs from top left to bottom right and the supply curve inversely from bottom left to top right.

In a coordinate system, where the price is on the vertical and the quantity is on the horizontal, supply and demand curves are shown as follows: the demand curve runs from top left to bottom right and the supply curve inversely from bottom left to top right.

For example, when the demand curve is shifted to the right, prices and quantity are both increasing. However, when the supply curve is shifted to the right, quantity is increasing while prices are falling.

When the aggregated demand increases, the GDP and inflation are rising. If, on the contrary, aggregated supply rises, then GDP goes up and prices fall (deflation).

Switzerland has only good deflation

This last case applies to Switzerland today: thanks to improvements in productivity, favorable import prices, low interest rates and so on, the prices are falling, and the economy is booming with increasing employment.

Falling prices are not bad per se. Who would not be pleased if he or she can buy a commodity cheaper? Falling prices are only bad if they arise due to a reduced demand, coupled with a recession. But falling prices are fine when existing due to an improved supply combined with a boom.

In recent years, GDP and employment in Switzerland have increased steadily – partly even with falling prices (deflation), which verifies the theory above.

However, this very difference is unfortunately not understood by our National Bank. At a lecture in front of the “Club of Rome” the former SNB chief Philipp Hildebrand claimed, deflation is always due to a slump in aggregate demand, which is not true.

Based on this massive misunderstanding of monetary policy, the SNB had bought hundreds of billions of euros.

The government only repeats what the SNB claims

And the Federal Council? It is simply repeating what is claimed by the National Bank.

Conclusion:

The Federal Council interferes in matters of monetary policy without a link to the Parliament, and thus without the voters;

that is, without a legitimate democratic opinion forming process, for example, the politically dubious “Franken-Rütli.”

Independent monetary policy is just a farce.

The article was written in 2013. The end of the peg was a first step towards central bank independence, even if the market (and the ECB) forced the SNB to give it up and the central bank still today intervenes.

Until January 2015, Switzerland has effectively only good deflation. After the end of the peg, jobs in the industrial export sector were lost. The often negative Swiss press prevented that these jobs could be replaced by jobs in the internal economy (See Swiss GDP and Swiss Franc Shock Propaganda). This led to an increase of the unemployment rate (seasonal adjusted) from 3.2% before the end of the peg to 3.4%.

See more for